Fixed-income alternate traded fund traders are trying again into debt belongings overwhelmed down b

Fixed-income alternate traded fund traders are trying again into debt belongings overwhelmed down by the coronavirus pandemic, because the rollout of vaccines helps gas demand for riskier belongings.

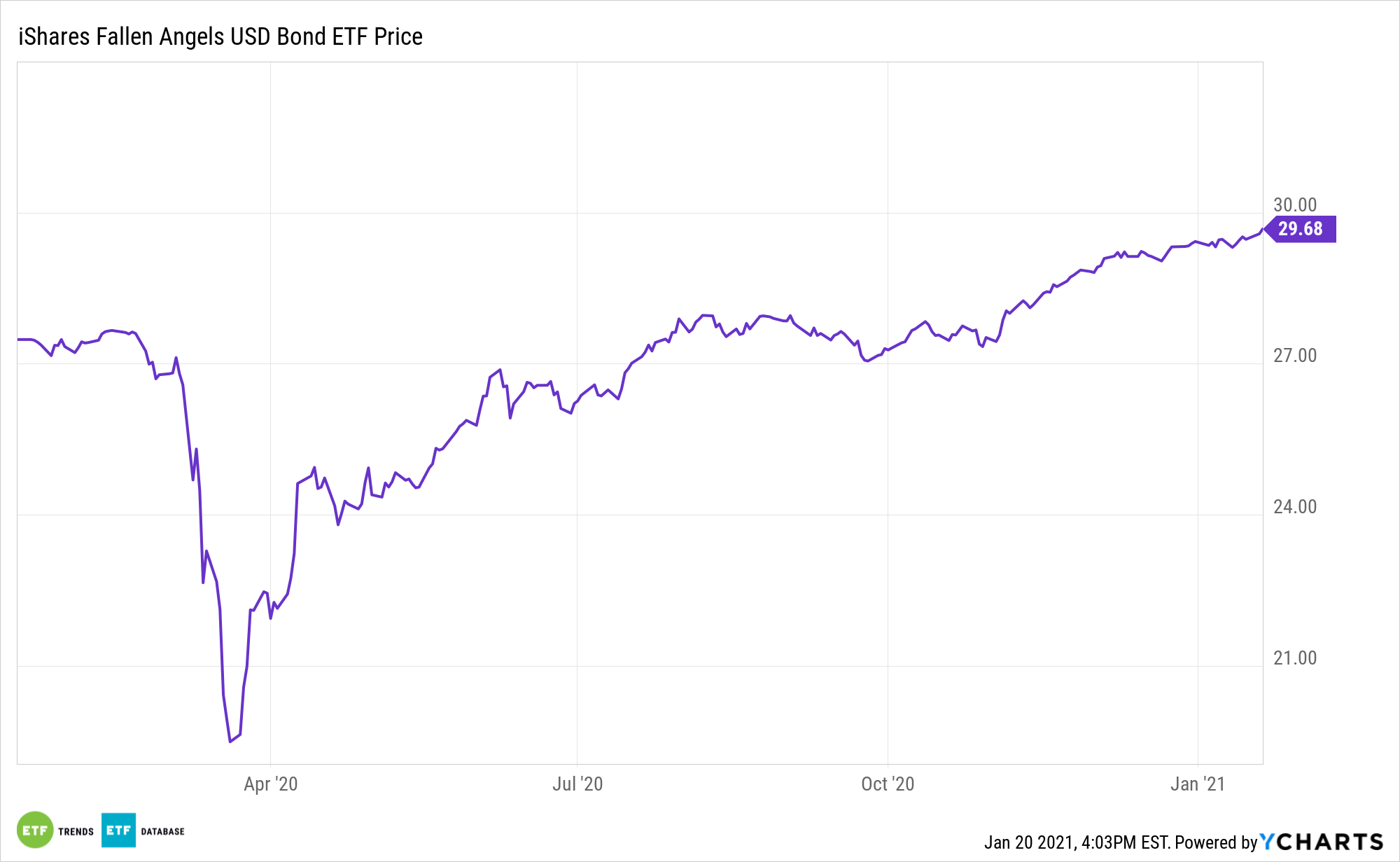

The iShares U.S. Fallen Angels USD Bond ETF (NASDAQ: FALN), which tracks the Bloomberg Barclays US Excessive Yield Fallen Angel 3% Capped Index composed of U.S. dollar-denominated excessive yield company bonds that have been beforehand rated funding grade, simply loved a weekly internet influx of $478 million and one other $93 million in inflows initially of this week, greater than doubling the fund’s belongings below administration to over $1 billion, in keeping with Bloomberg.

In 2020, there have been two occasions as many downgrades to American corporations than in 2019, after the the pandemic shut down broad swathes of the economic system.

Nevertheless, traders are returning again into areas of the market that suffered the brunt of final yr’s blow, which incorporates junk bonds and so-called fallen angels, which expertise mechanical promoting after being downgraded from high-grade indexes, in keeping with Peter Tchir of Academy Securities.

“Purchase something with a Covid low cost nonetheless inbuilt – that ought to dissipate over time. The fallen angel could cause pressured promoting initially primarily based on ranking, and there was some actual worry, so they’d lots of room to outperform,” Tchir advised Bloomberg, including that whereas the rally has been ‘spectacular’ up to now, there’s nonetheless room to go.

With the vaccine rollout selecting up, traders are returning to the reflation commerce and the hunt for extra engaging yields in a low-rate atmosphere. Wells Fargo Funding Institute argues that this has elevated the attraction of lately downgraded debt.

“The entire script flipped in early November,” Sameer Samana, senior world market strategist at Wells Fargo Funding Institute, advised Bloomberg. “Traders are betting {that a} re-opening of the worldwide economic system, together with the reflationary developments that we’re seeing, will result in unfold tightening and credit standing upgrades.”

For extra data on the fixed-income market, go to our bond ETFs class.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.