There is a tug-of-war taking place within the power patch as we speak. Conventional fossil fuels producers are seen as local weather offenders, whereas purveyors of photo voltaic, wind, and sensible grid applied sciences, amongst others, are seen as constructive disruptive forces.

Caught within the center are midstream power firms and pipeline operators. Whereas midstream power firms sometimes rely oil and gasoline producers as their main shoppers, many are pivoting towards elevated renewable power publicity, and that brings alternatives for buyers contemplating alternate traded funds such because the ProShares DJ Brookfield International Infrastructure ETF (NYSEArca: TOLZ).

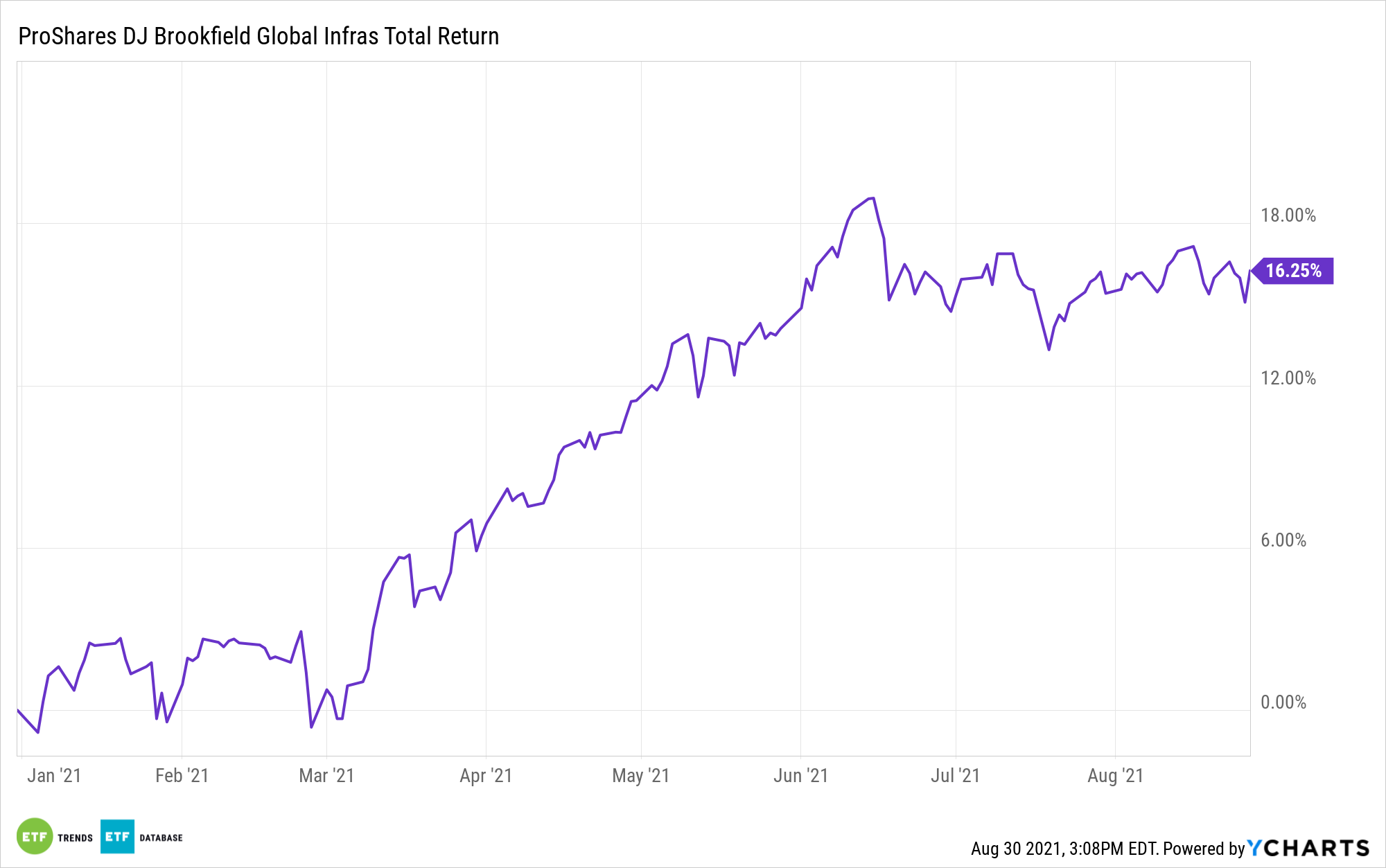

TOLZ tracks the Dow Jones Brookfield International Infrastructure Composite Index and, as is the case with different midstream belongings, is a tempting revenue concept with a dividend yield of three.48%. It is potential that TOLZ is on the heart of some seismic shifts within the power business.

“The latest give attention to infrastructure and cleaner power has ignited questions concerning the future function of the world’s present power infrastructure system,” says Kieran Kirwan, ProShares director of funding technique. “In spite of everything, our present community of pipelines shops and transports largely power created from carbon-based sources like oil and pure gasoline, and far of our electrical energy continues to be generated from carbon-based sources.”

TOLZ is a various infrastructure fund, offering publicity to an assortment of belongings, together with airports, toll roads, ports, communications, electrical energy distribution, oil and gasoline storage, transport, and water. Whereas it is not a devoted midstream power fund, its publicity to that group is greater than ample, giving it leverage with modifications within the power distribution and era landscapes.

TOLZ’s power infrastructure publicity is related as a result of it positions the fund’s long-term success as extra governments goal web zero emissions and carbon impartial agendas. It additionally positions the fund to stay sturdy because the transition to renewables unfolds as a result of fossil fuels cannot be deserted in a single day.

“Within the meantime, low-emission, carbon-based fuels like pure gasoline will play a big function within the international power combine for many years to come back,” says Kirwan. “Pure gasoline, together with liquefied pure gasoline (LNG), is a key enabler of a decrease carbon future and can steadily substitute a lot dirtier sources, like coal, as a dependable and cost-effective power supply. Pure gasoline allows financial development with out sacrificing environmental goals.”

It is also price noting that many pipeline operators will transport the fuels of the long run.

“Lots of as we speak’s main pipeline operators—like Williams and Kinder Morgan—are already pursuing and investing in cleaner various fuels of the long run. Low-emission gasoline sources like hydrogen, and renewable fuels like biodiesel and renewable pure gasoline, might be transported, saved, and utilized in the identical pipelines as pure gasoline with little to no modification,” provides Kirwan.

Kinder Morgan (NYSE:KMI) and Williams (NYSE:WMB) mix for 4.34% of the TOLZ roster.

For extra information, data, and technique, go to the Dividend Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com