Lumber costs proceed to climb, bolstering sawmill homeowners and timber sector-related change traded funds.

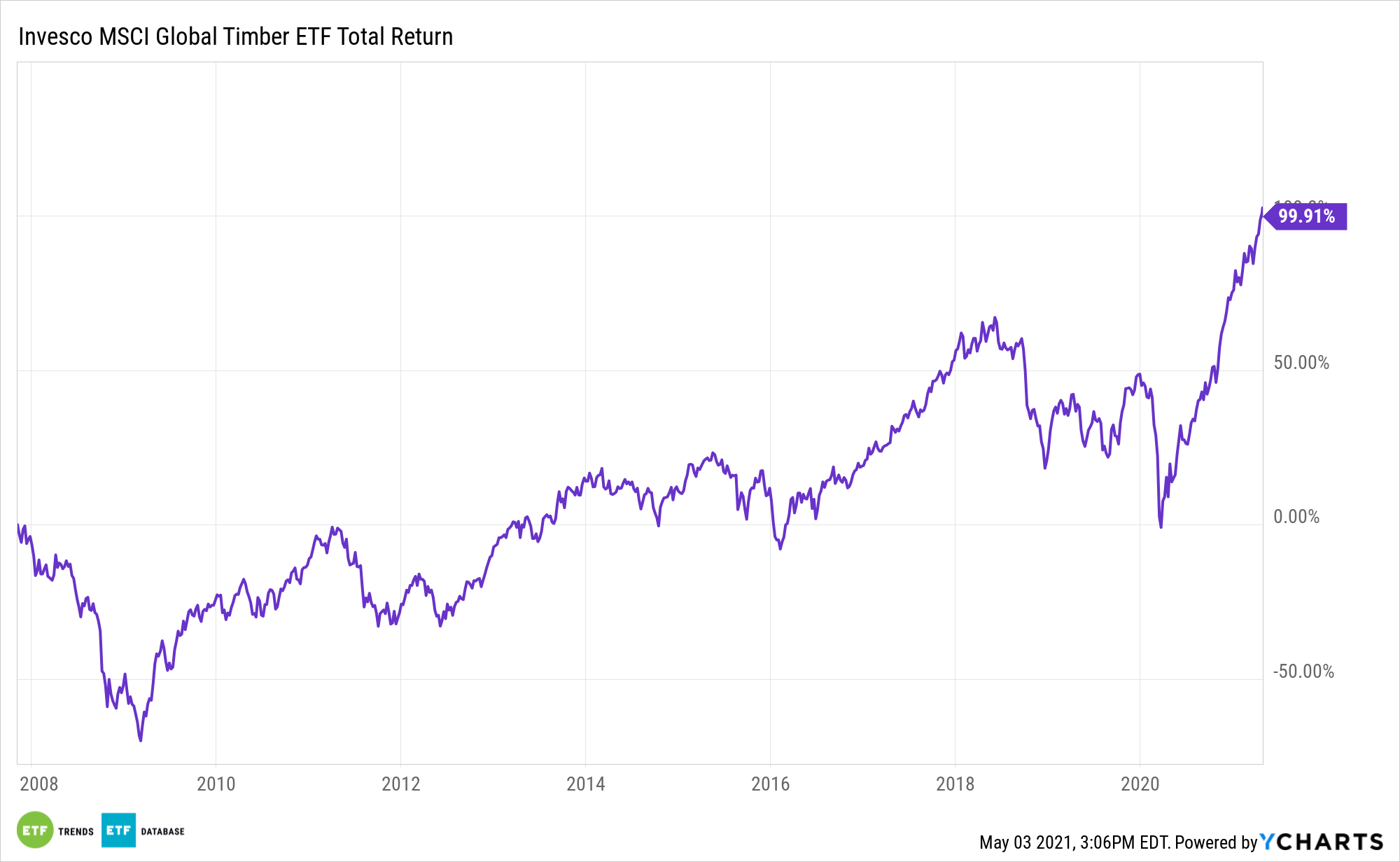

Yr-to-date, the iShares International Timber & Forestry ETF (WOOD) has elevated 15.3%, whereas the Invesco MSCI International Timber ETF (CUT) has gained 13.8%.

Whereas wooden costs grew into report territory final week, sawmill homeowners within the timber business like Weyerhaeuser Co. and Canfor Corp. are anticipated to generate even bigger earnings than the report earnings they’ve been reporting for the primary three months of 2021, the Wall Avenue Journal reviews.

Sawmills have turn out to be the largest beneficiaries of the wooden market rally. The businesses are capitalizing on a glut of low cost pine bushes within the U.S. South. In the meantime, demand for completed merchandise like lumber and plywood has surged amid the current increase within the housing market and refurbishing enterprise.

“Builders are reporting report house gross sales, and so they’re going to wish that wooden to construct these properties,” Eric Cremers, chief govt of PotlatchDeltic Corp., stated.

Lumber futures for Could supply at the moment are hovering round an all-time excessive and about 4 occasions the standard worth for this era of the 12 months. Moreover, lumber futures have hit their every day most allowed worth change by the Chicago Mercantile Trade for 9 of the final 17 buying and selling periods.

“Nervousness on the a part of many merchants was palpable, as they thought of what the draw back of the run would possibly seem like,” Random Lengths stated in its weekly report.

Random Lengths famous that costs for two-by-fours and different wooden merchandise have hit report highs as properly. With none options, merchants gave into the sky excessive costs. Mill homeowners have pointed to their backed up orders that stretch out to June.

“Absent a major enhance in mortgage charges or a Covid resurgence, it’s arduous to think about what may trigger lumber demand to drop and costs to reasonable within the foreseeable future,” Cremers stated.

For extra information, data, and technique, go to ETF Developments.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.