Financial institution of America accomplished the opening

Financial institution of America accomplished the opening salvo of fourth quarter earnings releases from the biggest banks yesterday morning and, like JPMorgan, Citigroup, and Wells Fargo late final week, issued outcomes forward of consensus expectations thanks largely to a drawdown of mortgage loss reserves. Particularly, BAC decreased provisions for credit score losses by $828 billion in This autumn, bringing the whole launch among the many 4 largest banks to almost $6 billion. Credit score reserves might be considered probably the most tangible type of company steering, so this development ought to be taken as a powerful trace that expectations for the yr forward are quickly bettering.

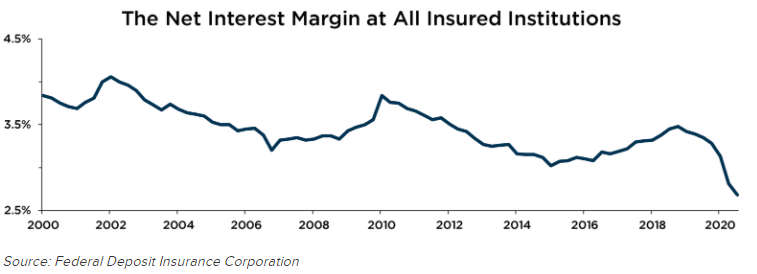

Extra broadly alongside these traces, the banks also needs to be seen as a bellwether for the economic system at giant on condition that they symbolize the first transmission mechanism between financial coverage and the enterprise cycle. Maybe probably the most encouraging information right here, then, is that BAC’s internet curiosity revenue was up for the primary time in eight quarters in This autumn and is predicted to proceed to climb in 2021 (the online curiosity numbers for the opposite massive banks had been combined during the last three months, however the outlook for the quarters forward has been universally constructive). Rising internet curiosity margins feed instantly into lending and consumption, with knock-on results for employment and incomes. Earnings season remains to be simply getting out of the gate, however it’s already bringing additional validation of the more and more constructive outlook for the yr to come back.

Chinese language progress tops expectations

China’s actual GDP grew by 6.5 p.c year-over-year within the fourth quarter, forward of each consensus expectations and the pre-COVID development. Nonetheless, it continues to be a gradual restoration in consumption, as tertiary GDP stays a laggard relative to the agricultural and industrial sectors whereas retail gross sales progress is beginning to slip once more after rebounding strongly earlier final yr. This can be a operate in a part of the federal government’s ongoing vigilance in opposition to new outbreaks – be aware the extreme lockdowns in Hebei province after the brand new day by day case rely crept into the triple-digits this month – in addition to some lingering impacts from the downturn final yr. On the identical time, it additionally hints that the scope for a post-pandemic increase is international in nature, as there’s a substantial amount of pent-up demand in nearly each main economic system.

Day by day Trivia

What metropolis is residence to every of the three most cited establishments in tutorial financial analysis?

Earlier Query

The technical sample marked by a pointy rise, a spiky high, and a speedy decline, which is most prevalent in cryptocurrencies, is known as for what iconic character?

Reply:

Bart Simpson

Initially printed by Nationwide

Disclaimers

-

This info is basic in nature and isn’t supposed to be tax, authorized, accounting or different skilled recommendation. The knowledge offered is predicated on present legal guidelines, that are topic to vary at any time, and has not been endorsed by any authorities company.

Neither Nationwide nor its representatives give authorized or tax recommendation. Please have your shoppers seek the advice of with their lawyer or tax advisor for solutions to their particular tax questions.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.