By Doug Sandler, CFA

Abstract

- We imagine financial information clearly present that 2021 goes to be a banner yr for the US economic system.

- This may probably result in higher optimism amongst customers who now have the very best saving charge in additional than 45 years, in our view.

- Bear in mind that the sturdy returns over the past 12-months imply that buyers have probably anticipated a lot of this excellent news.

In the event you travelled on Spring Break you in all probability felt it…That feeling that financial exercise appears able to burst, like the discharge of water from a hose after a kink has been eliminated. This pent-up stress is a results of an financial trifecta, which we outline as three sturdy tailwinds triangulating on the US economic system at roughly the identical time.

-

- The re-opening of the economic system: Vaccine distribution within the US has shortly climbed the educational curve and in response to the CDC, we at the moment are vaccinating greater than Three million People on daily basis. In line with Youyang Gu, who makes use of machine-based studying for making COVID-19 associated projections, the US ought to return to regular (removing of all COVID-19 associated restrictions for almost all of US states) by Summer season 2021.

- Excessive financial savings charges: Financial savings charges are exceptionally excessive hovering close to 15%, the very best degree in over 45 years. We imagine that that is as a result of large financial uncertainty created by COVID-19. It’s our view that because the uncertainty recedes excessive financial savings charges create the wherewithal for future discretionary spending.

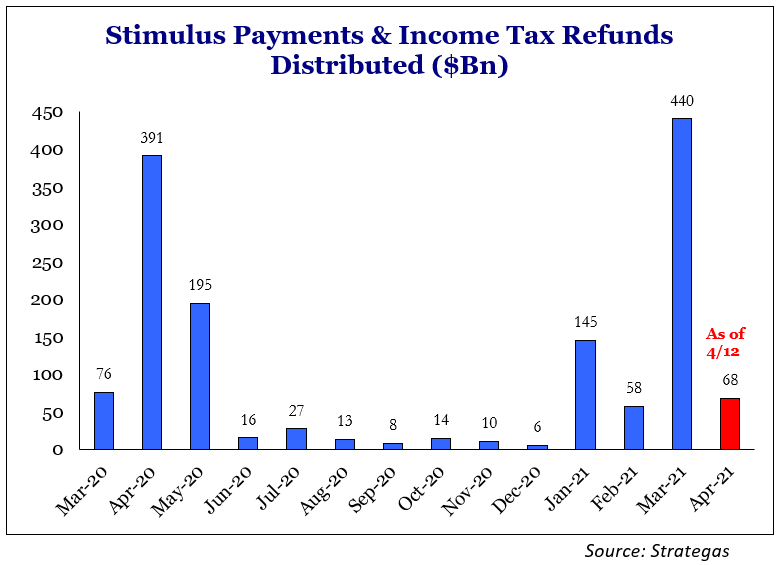

- Inflow of presidency funds: The third tailwind within the trifecta is the truth that a big chunk of the inhabitants simply acquired or are about to obtain a number of significant distributions from the federal authorities within the type of a stimulus examine and/or an earnings tax refund (Chart 1).

[wce_code id=192]

Chart 1: Federal Distributions More likely to Additional ‘Prime the Pump’ of Spending.

Disclosures: Previous efficiency is not any assure of future outcomes. Proven for illustrative functions.

This financial surge ought to be good for everybody, however it might be extra impactful to the typical American (‘Important Avenue’) than the typical investor (‘Wall Avenue’). We see three fundamental variations between Important Avenue and Wall Avenue. During the last 12-months these variations most benefitted Wall Avenue, over the following 12-months these identical variations may fit extra in Important Avenue’s favor.

Avenue. During the last 12-months these variations most benefitted Wall Avenue, over the following 12-months these identical variations may fit extra in Important Avenue’s favor.

1. Wall Avenue displays the longer term, Important Avenue displays the current:

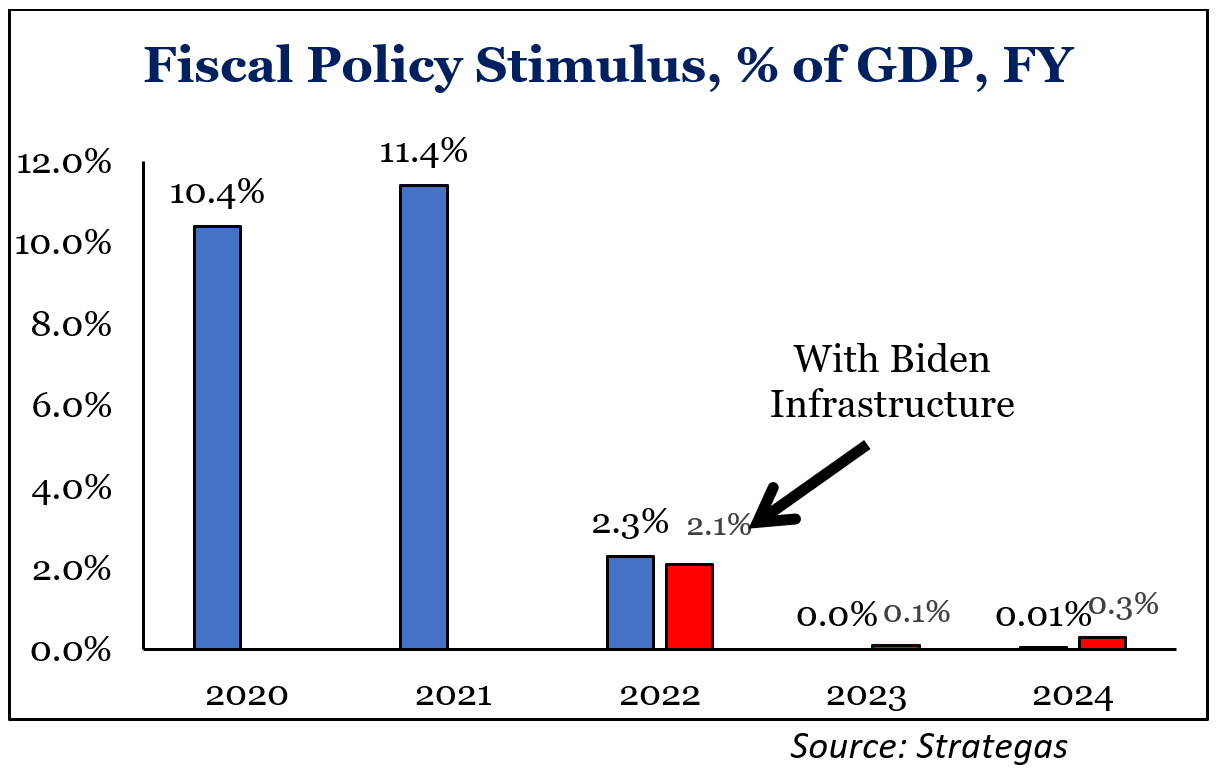

Inventory market buyers usually appears 6 to 12 months into the longer term. Subsequently, we imagine {that a} vital proportion of the inventory market’s energy over the previous 12 months will be accredited to it foreseeing the sturdy financial interval we’re about to enter. Extraordinary development, falling unemployment, and rising wages have been anticipated by Wall Avenue and thus could already be mirrored in inventory costs to some extent. The market is starting to look past 2021 and can begin reflecting what it sees in 2022. Sadly, 2022 is unlikely to be as universally optimistic as 2021. In truth, 2022 is already harboring its share of bogeymen. Greater taxes, fading stimulus (Chart 2), fears of inflation, shifting Fed coverage, and mid-term elections are just some of these issues on the horizon we’re figuring out.

Chart 2: Fiscal Stimulus Fades in 2022

Disclosures: Previous efficiency is not any assure of future outcomes. Proven for illustrative functions.

2. Wall Avenue represents a minority of US corporations, Important Avenue represents the bulk:

The prospects for giant and small corporations can differ considerably, particularly throughout troublesome instances. Since COVID-19 first impacted the economic system over a yr in the past, the enterprise local weather has been much more favorable to corporations listed on Wall Avenue. Wall Avenue is comprised of enormous public corporations, who’ve stronger technological platforms and higher entry to capital. These massive corporations have been additionally extra prone to make use of the ‘specialists’ essential to benefit from advanced authorities support packages. Not surprisingly, the typical valuation of public corporations has risen considerably as buyers acknowledged these benefits.

In line with information from the US Census Bureau and Wilshire Associates, public corporations symbolize lower than 1% of all US corporations. The Nationwide Bureau for Financial Analysis additionally notes that publicly traded corporations account for roughly one-third of US non-farm employment. Subsequently, the opposite 99%+ of US corporations and two-thirds of employment come Important Avenue. Important Avenue corporations are sometimes smaller (many could also be sole proprietors), extra poorly capitalized, and fewer technologically superior. Thus, Important Avenue corporations have disproportionately been impacted by state-mandated shutdowns and fewer capable of shift to ‘earn a living from home’. Nevertheless, because the economic system begins to surge from pent-up demand, we imagine that the aggressive benefits of Wall Avenue corporations will grow to be much less compelling, notably in mild of their increased inventory costs.

3. Wall Avenue focuses on earnings and inventory costs, Important Avenue focuses on wages and residential costs:

Important Avenue will recognize tightening labor markets since they contribute to rising wages. Important Avenue also needs to love the truth that the housing market is extraordinarily sturdy, benefitting from an increase in residence possession and ultra-low rates of interest. Wall Avenue, however, doesn’t essentially like rising wages since they negatively affect revenue margins and earnings. The potential for increased company taxes and a stricter regulatory setting additionally threatens to stress earnings sooner or later. We imagine these pressures could also be sturdy sufficient to offset among the advantages of a strengthening economic system.

Conclusion:

Our view is that each Wall Avenue and Important Avenue will probably be smiling all through 2021. Because of this, we’re modestly chubby shares in our balanced Benefit portfolios. Nevertheless, over the following 12-months, Important Avenue’s smile could also be barely wider than Wall Avenue’s, which we expect will probably be a superb factor for America.

Going ahead, we expect buyers could wish to put together for decrease returns over the following 5-7 years and doubtlessly increased volatility because the inventory market could sooner or later begin to look past the sturdy financial interval we’re getting into.

Essential Disclosure Info

The feedback above refer typically to monetary markets and never RiverFront portfolios or any associated efficiency. Opinions expressed are present as of the date proven and are topic to alter. Previous efficiency just isn’t indicative of future outcomes and diversification doesn’t guarantee a revenue or shield towards loss. All investments carry some degree of danger, together with lack of principal. An funding can’t be made instantly in an index.

Chartered Monetary Analyst is an expert designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of economic analysts. Candidates are required to move three ranges of exams overlaying areas similar to accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can grow to be a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Info or information proven or used on this materials was acquired from sources believed to be dependable, however accuracy just isn’t assured.

This report doesn’t present recipients with info or recommendation that’s enough on which to base an funding resolution. This report doesn’t bear in mind the particular funding aims, monetary scenario or want of any explicit consumer and is probably not appropriate for all sorts of buyers. Recipients ought to take into account the contents of this report as a single consider investing resolution. Extra basic and different analyses could be required to make an funding resolution about any particular person safety recognized on this report.

In a rising rate of interest setting, the worth of fixed-income securities typically declines.

When referring to being “chubby” or “underweight” relative to a market or asset class, RiverFront is referring to our present portfolios’ weightings in comparison with the composite benchmarks for every portfolio. Asset class weighting dialogue refers to our Benefit portfolios. For extra info on our different portfolios, please go to www.riverfrontig.com or contact your Monetary Advisor.

Shares symbolize partial possession of a company. If the company does nicely, its worth will increase, and buyers share within the appreciation. Nevertheless, if it goes bankrupt, or performs poorly, buyers can lose their total preliminary funding (i.e., the inventory value can go to zero). Bonds symbolize a mortgage made by an investor to a company or authorities. As such, the investor will get a assured rate of interest for a selected time period and expects to get their unique funding again on the finish of that point interval, together with the curiosity earned. Funding danger is compensation of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Buyers ought to concentrate on these variations previous to investing.

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Alternate Fee. Registration as an funding adviser doesn’t suggest any degree of ability or experience. Any dialogue of particular securities is supplied for informational functions solely and shouldn’t be deemed as funding recommendation or a suggestion to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Integrated (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its workers by means of RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and subsequently an oblique proprietor of RiverFront. BFC is the mother or father firm of Robert W. Baird & Co. Integrated, a registered dealer/seller and funding adviser.

To assessment different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Type ADV, Half 2A. Copyright ©2021 RiverFront Funding Group. All Rights Reserved. ID 1610891

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.