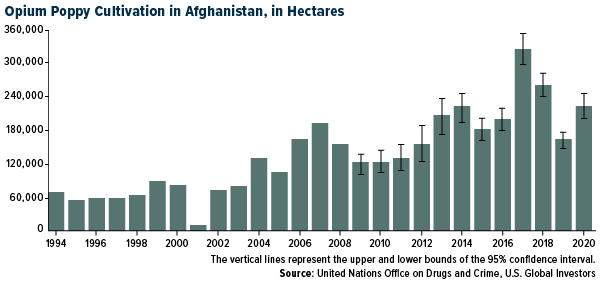

After 20 years, the longest conflict in U.S. historical past is lastly coming to a (clumsily dealt with) shut. The conflict on Afghanistan’s opium poppy manufacturing, alternatively, seems set to escalate, at a probably nice expense to taxpayers.

In case you don’t know, Afghanistan produces loads of the stuff. The United Nations Workplace on Medication and Crime (UNODC) estimates that the nation is accountable for a whopping 85% of worldwide poppy provide, a lot of which is used to make morphine, codeine and heroin.

The Taliban “formally” banned poppy cultivation in 2000—however quickly realized it couldn’t do with out the crop. Poppy is “a beautiful insurance coverage coverage,” a current inspector normal report says. It’s “light-weight, straightforward to move, profitable and it may be stockpiled to await extra favorable market or safety situations.”

Since 2002, the U.S. has spent some $9 billion combating the Taliban’s narcotics trafficking. However, cultivation has continued to ramp up. Final 12 months, the realm used to develop opium poppy in Afghanistan elevated 37% from 2019—even after U.S. air strikes destroyed 1 / 4 of Taliban-run poppy fields in 2018.

click on to enlarge

Now that the U.S. army is on its method out, do you suppose issues will enhance? I’m guessing no. Billions extra will possible should be spent to fight poppy cultivation and exporting, the Taliban’s primary supply of financing.

Gold and Bitcoin Have No Counterparty Danger

That is one more reminder that U.S. taxpayers and buyers want their very own “enticing insurance coverage coverage” in opposition to freewheeling authorities spending and forex debasement.

For my cash, gold is such an asset, because it has no counterparty threat. The more cash that’s printed to cowl authorities spending, the extra helpful I consider gold turns into.

The identical is true of Bitcoin, which many understand as “digital gold.” However as I instructed Michael Saylor throughout final week’s webcast, I don’t suppose Bitcoin ought to characterize greater than 2% to five% of your portfolio proper now. The crypto has unbelievable upside potential, however because it’s solely been round since 2009, it lacks gold’s centuries-long monitor report as a retailer of worth.

Danger is exactly the rationale why Palantir Applied sciences determined to make an funding in gold. The information analytics agency, based partially by billionaire Peter Thiel, introduced final week that it had stockpiled as a lot as $50 million value of gold bars in preparation for “a future with extra black swan occasions.” What’s extra, Palantir—named for the all-seeing crystal balls in Lord of the Rings—can also be permitting clients to pay for its software program in gold.

Palantir’s resolution “is just the start of what is going to quickly be many main firms diversifying their U.S. greenback money into gold,” the Nationwide Inflation Affiliation (NIA) wrote in a observe to subscribers.

Is Gold Being Manipulated?

That mentioned, Bitcoin is trending up—right now it jumped above $50,000 for the primary time since Might—whereas gold has continued to commerce in a really slender vary for the reason that final flash crash two weeks in the past, which noticed the yellow metallic plunge beneath $1,700 an oz..

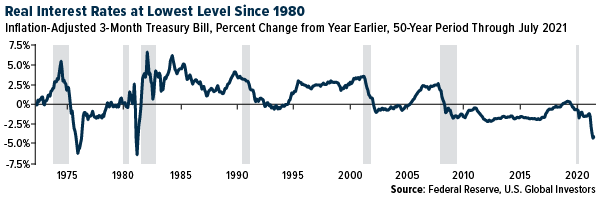

The stronger greenback bears loads of duty for gold’s woes. However one thing doesn’t add up when inflation is working at 5.4% year-over-year and actual charges stay deeply destructive. By one measure, charges are decrease now than they’ve been since 1980, the identical 12 months gold hit its all-time excessive when adjusted for inflation.

click on to enlarge

Are buyers betting that inflation will likely be “transitory,” as Federal Reserve Chair Jerome Powell insists?

Or is gold being manipulated?

Should you discuss to Chris Powell (no relation to Jay), secretary and treasurer on the Gold Anti-Belief Motion Committee (GATA), the reply to the latter query is an emphatic sure.

Again in 2019, Chris instructed me that gold is basically manipulated by way of the futures markets and the London over-the-counter (OTC) market. “The mechanisms are gold swaps and leases between central banks and bullion banks, and thru the sale of futures contracts,” he mentioned.

After I requested him the place he thought gold could be had been it not for the sort of institutional manipulation he’s noticed, Chris correctly mentioned that the “true worth of gold is no matter our free market needs it to be.”

If gold is being suppressed, as Chris and others consider, with G7 nations and central bankers persevering with their fashionable financial idea (MMT) experiment, the spring impact has the potential to be even higher. We may see gold at $2,000 to $2,400 an oz..

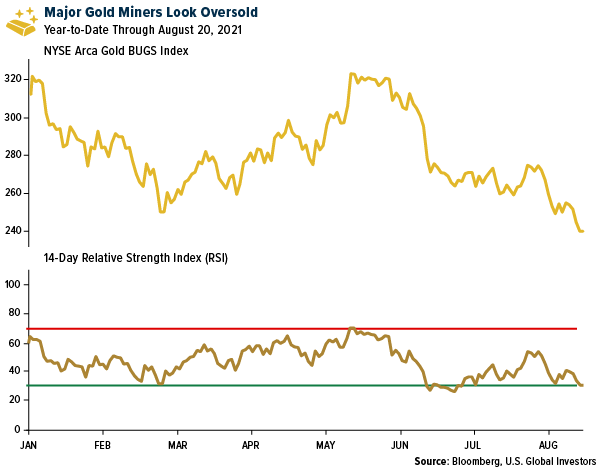

Gold Miners May Be a Purchase

No shock, however gold miners are additionally down, as a lot as 20% for the 12 months to date. Primarily based on the 14-day relative power index (RSI), the NYSE Arca Gold BUGS Index exhibits that producers are oversold proper now, which means they could possibly be a purchase in anticipation of upper metallic costs.

click on to enlarge

If I had been investing, I might give attention to the royalty and streaming firms resembling Franco-Nevada, Wheaton Treasured Metals and Royal Gold. As I’ve defined a number of instances earlier than, these firms present lots of the advantages of the gold mining trade with out loads of the dangers.

Current earnings are proof of that. Take Franco-Nevada. Regardless of decrease gold costs, the Toronto-based firm reported report gross sales of $347 million in the course of the second quarter, a rise of 78% from the identical quarter a 12 months earlier. Adjusted internet revenue got here in at $182 million, nearly double the revenue from a 12 months in the past.

This units Franco up for a report 12 months, says Paul Brink, president and CEO, including that the corporate’s royalty enterprise mannequin “is especially enticing in periods of trade value inflation.”

Initially revealed by US Funds, 8/23/21

All opinions expressed and knowledge supplied are topic to vary with out discover. A few of these opinions might not be acceptable to each investor. By clicking the hyperlink(s) above, you may be directed to a third-party web site(s). U.S. International Traders doesn’t endorse all data provided by this/these web site(s) and isn’t accountable for its/their content material.

The relative power index (RSI) is a momentum indicator utilized in technical evaluation that measures the magnitude of current value adjustments to guage overbought or oversold situations within the value of a inventory or different asset. The NYSE Arca Gold Bugs Index is a rules-based, modified equal weighted fairness benchmark designed to trace the efficiency of firms concerned within the mining of gold ore that don’t hedge their manufacturing past 1.5 years. Holdings might change day by day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. International Traders as of (06/30/2021): Franco-Nevada Corp., Wheaton Treasured Metals Corp., Royal Gold Inc.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com