Gprevious elevated greater than 25% in 2020, its finest 12 months in a decade. Be certain you’re su

Gprevious elevated greater than 25% in 2020, its finest 12 months in a decade. Be certain you’re subscribed to the Investor Alert as a result of tomorrow I will likely be discussing commodities—how they fared final 12 months, and what my forecasts are for 2021. You’ll even be given an opportunity to obtain our up to date Periodic Desk of Commodity Returns.

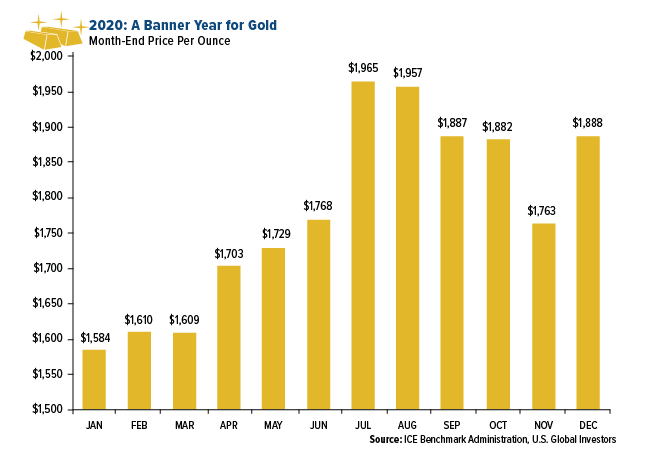

It was a banner 12 months for the yellow metallic, hitting a brand new file excessive of $2,070 an oz in August, as buyers sought a dependable retailer of worth within the face of unprecedented money-printing.

The worth of gold has now ended the 12 months up in 17 of the previous 20 years, for a formidable win price of 85%.

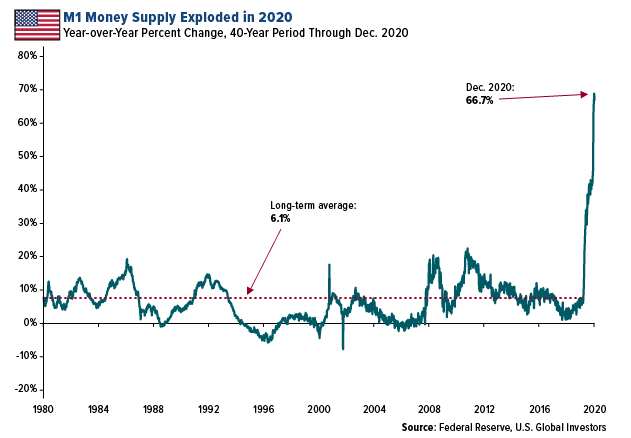

Beneath, you’ll be able to see the unbelievable surge in cash provide, which helped gas the rally in gold in addition to different commodities. The quantity of M1 cash sloshing across the U.S. financial system has skyrocketed an astounding 66% from simply final 12 months. That is effectively forward of the long-term common development price of round 6%. (M1, by the best way, contains essentially the most liquid types of cash equivalent to payments, cash, demand deposits and the like.)

Gold in 2020

Following are a number of the prime tales involving gold and treasured metals throughout 2020, by month.

January

Gold trades as much as a seven-year excessive on escalating tensions between the U.S. and Iran, following the killing of a prime Iranian army commander. In the meantime, palladium costs—already at file highs— surge 25% in as little as two weeks on world provide deficits.

February

The novel coronavirus was first detected in China on December 31, 2019, however world markets don’t begin reacting in earnest to the potential penalties till February. Gold climbs above $1,600 an oz on haven demand and because the yield on the 10-year Treasury plummets. The Silver Institute urges buyers to remain web consumers of silver and different treasured metals—a superb name, as silver elevated almost 48% by the tip of the 12 months.

March

Gold costs soar previous $1,700 and American Silver Eagle cash promote out because the S&P 500 falls into bear market territory and the Federal Reserve slashes rates of interest to near-zero. Palladium and platinum each soar on lockdowns in South Africa, one of many world’s main producers of the dear metals.

April

President Donald Trump indicators a $2.2 trillion aid package deal. It’s reported that central banks in Group of Seven international locations buy some $1.Four trillion in monetary belongings. Property underneath administration (AUM) in world gold-backed ETFs attain a brand new file excessive. Many analysts, together with myself, forecast increased asset costs on unprecedented money-printing. I additionally see sturdy earnings for treasured metallic miners within the first quarter, a prediction that seems to be correct.

Might

The yield on the two-year Treasury falls to a file low because the fed funds futures market costs in damaging rates of interest by early 2021, supporting treasured metals. The large three gold royalty corporations—Wheaton Valuable Metals, Franco-Nevada and Royal Gold—have a blowout first quarter, reporting a mixed $402 million in free money stream.

June

Valuable metals are the top-performing onerous asset of the primary half of 2020, with gold up greater than 17%, silver up 2%. The Fed broadcasts that it’ll start shopping for particular person company bonds on prime of the company debt ETFs it’s already begun buying. On account of all this shopping for, the central financial institution’s steadiness sheet skyrockets previous $7 trillion, representing almost a 3rd of the U.S. financial system.

July

Gold begins to look overdone, with the 14-day relative power index (RSI) exceeding 97.5, the very best studying since September 1999. Silver costs hit a seven-year excessive on each haven demand and future bets on huge world demand from the renewable vitality sector. July, the truth is, marks the very best month ever for silver, hovering 34%.

August

Gold hits its all-time excessive of just about $2,070 as gold-backed ETFs report holding extra bullion than any nation besides the U.S. The yellow metallic promptly corrects. Royalty corporations report one other standout second quarter, with Wheaton Valuable reporting file income of $503 million within the first half of the 12 months. In a stunning flip of occasions, perennial gold skeptic Warren Buffett’s Berkshire Hathaway buys shares of Barrick Gold, the world’s second-largest producer of the dear metallic. In the meantime, I forecast $4,000 gold within the subsequent three years.

September

The yellow metallic corrects, notching its worst week since March. Making the most of decrease costs, buyers add 1.2 million ounces to gold-backed ETFs in a single day, essentially the most in 2020. Wheaton Valuable CEO Randy Smallwood says that gold and silver are in “golden occasions” proper now with huge quantities of helicopter cash supporting costs.

October

ETFs backed by bodily gold climb to a brand new file quantity of 111.05 million ounces, having recorded their 10th straight month of inflows. For the primary time ever, such funds appeal to greater than 1,000 tonnes of gold at this level in a single 12 months, the equal of $55.7 billion. My pal Pierre Lassonde, co-founder of Franco-Nevada, says that “gold miners have by no means had it so good,” explaining that the “margins they’re producing are the fattest, the very best, absolutely the unbelievable margins they’ve ever had.”

November

Gold mining equities have change into money stream machines. Gold royalty corporations, together with Franco and Royal Gold, report file revenues within the third quarter, with Franco reporting near $280 million and Royal Gold reporting $147 million. Gold bullion suffers its greatest one-day drop in over seven years, plunging 5%, after Pfizer broadcasts it has developed an efficient vaccine towards COVID-19.

December

Silver stands as the very best commodity of the 12 months, up 48%, whereas gold notches its finest 12 months since 2010, up 25%. As for the opposite treasured metals, palladium ends the 12 months up 26%, platinum 11%. As of December 25, the mixed holdings of the Fed and European Central Financial institution (ECB) stand at a head-spinning $16 trillion, with Evercore ISI projecting this sum to rise to $18 trillion by the tip of 2021. President Trump indicators a package deal for a further $900 billion in COVID aid.

What could possibly be in retailer for treasured metals in 2021? Portfolio Supervisor Ralph Aldis shares his ideas with Streetwise Studies, alongside together with his prime inventory picks. Click on right here to learn.

Initially printed by US Funds, 1/7/21

All opinions expressed and knowledge supplied are topic to vary with out discover. A few of these opinions is probably not applicable to each investor.

M1 is the cash provide that’s composed of bodily foreign money and coin, demand deposits, vacationers’ checks, different checkable deposits, and negotiable order of withdrawal (NOW) accounts. The Relative Energy Index (RSI) is a momentum oscillator that measures the velocity and alter of value actions. The RSI oscillates between zero and 100. Historically the RSI is taken into account overbought when above 70 and oversold when under 30.

Holdings might change each day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. International Traders as of (12/31/2020): Wheaton Valuable Metals Corp., Franco-Nevada Corp., Royal Gold Inc.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.