Legendary world investor John Templeton as soon as mentioned that the most effective time to purchase was when there was “most pessimism,” and the most effective time to promote was when there was “most optimism.”

This kind of contrarian investing takes nice conviction and nerves of metal, however its practitioners—Templeton included—will be rewarded handsomely. The trick is to seek out the alternatives.

Proper now I see gold as the last word contrarian funding. The yellow metallic is basically unloved in the intervening time. It’s set to notch its worst month-to-month stoop since November 2016, and the 50-day transferring common is threatening to fall under the 200-day transferring common.

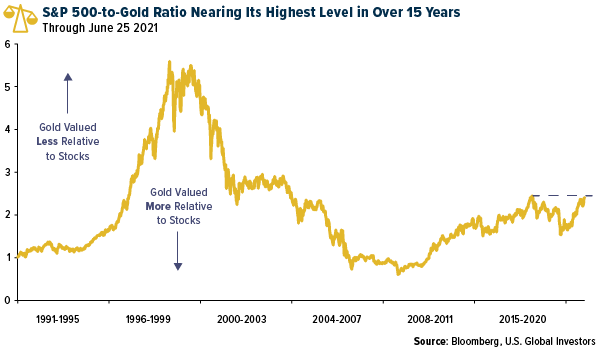

Bloomberg stories that the S&P 500-to-gold ratio is nearing its highest degree in over 15 years. As of this week, it takes shut to 2 and a half ounces of gold to purchase one “share” of the S&P 500. That’s up considerably from September 2011 when two thirds of an oz of gold was sufficient to get you entry.

click on to enlarge

All of this factors to the truth that gold is extraordinarily undervalued proper now, and nobody appears to be paying a lot consideration. I don’t know if this implies we’re at “most pessimism.” What I do know is that the entire conventional drivers of the gold value are firmly in place, making the yellow metallic very engaging, I consider. I’ll spotlight two of these drivers under.

File Cash-Printing Favors Gold

Over the previous 18 months, central banks have taken unprecedented measures to prop up their economies. That features printing cash at a file tempo, which has the direct impact of diluting the buying energy of the native forex.

Just lately I shared with you that just about 1 / 4 of all U.S. {dollars} in circulation has been created since January 2020. What meaning, basically, is that the dollar has misplaced 1 / 4 of its worth because of the actions of Powell & Firm.

Such money-printing has rightfully triggered large curiosity in Bitcoin, which (not like the greenback) is totally decentralized and has no third-party threat. The speed of recent Bitcoin issuance is minimize in half roughly each 4 years. No central banker, then, can push a button and create tens of millions extra Bitcoin out of skinny air.

The identical will be mentioned of bodily gold. Gold’s provide progress is of course restricted by an absence of recent massive discoveries and corporations’ reluctance to spend extra to develop harder-to-mine deposits.

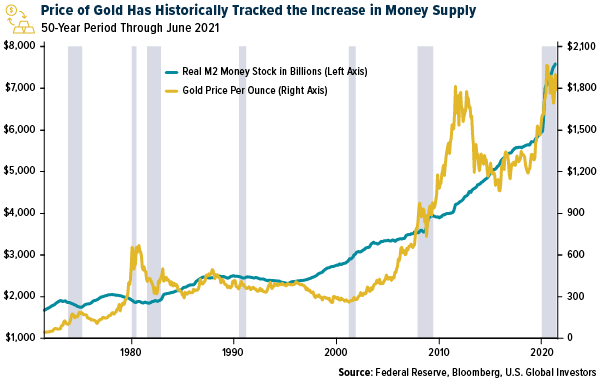

One benefit that gold has over Bitcoin is that there’s a long time’ price of information illustrating the near-perfect constructive correlation between the sum of money circulating within the U.S. financial system and the worth of gold. As the worth of the U.S. greenback has decreased as a result of better charges of money-printing, gold has surged to new file highs.

The implication, after all, is that gold might proceed to profit from the Fed’s easy-money insurance policies.

click on to enlarge

Inflation to Stay Elevated

The second issue is one thing I’ve been writing quite a bit about these days—inflation. Might’s client value index (CPI) rose 5% over the identical month final yr. That’s the best price we’ve seen since August 2008.

The actual inflation, although, may very well be a lot increased. The value of used vehicles and vans are up greater than 36% from final yr, in keeping with automobile public sale firm Manheim, with some pre-owned autos promoting for greater than their authentic sticker value.

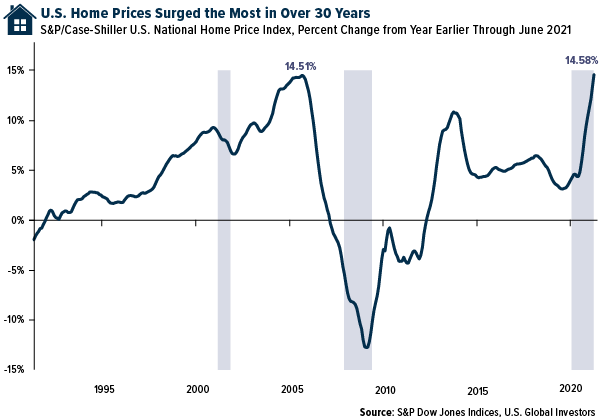

Or think about dwelling costs. They climbed at their quickest price on file in April, rising 14.5% year-over-year, surpassing the earlier file price set in September 2005.

click on to enlarge

Regardless of the Fed’s insistence that this present spate of inflation is “transitory,” analysts at Financial institution of America consider costs might stay elevated for 2 to 4 years. In need of a serious monetary disaster, central banks are unlikely to boost charges within the subsequent six months to tame inflation, in keeping with the financial institution. The CME Group’s FedWatch Software reveals there’s a 100% likelihood of charges staying close to zero till at the very least the tip of 2021.

Everybody’s heard at one level or one other that gold is a superb inflation hedge. That hasn’t been true in each cycle, and it’s not true now: The CPI is up 5% whereas gold is successfully flat in comparison with a yr in the past.

However that could be as a result of we’re at “most pessimism,” as Templeton referred to as it. Gold is presently out of favor as shares chart new all-time highs. If Templeton have been alive in the present day, he may say now could be the time to purchase.

Plus, with bond yields buying and selling under zero on an actual foundation proper now, buyers might have little various than to contemplate gold and gold mining shares in an effort to fight inflation’s affect on their portfolios.

Initially revealed by US Funds, 6/30/21

All opinions expressed and knowledge supplied are topic to vary with out discover. A few of these opinions will not be acceptable to each investor. By clicking the hyperlink(s) above, you can be directed to a third-party web site(s). U.S. World Buyers doesn’t endorse all data equipped by this/these web site(s) and isn’t accountable for its/their content material.

The Client Value Index (CPI) is a measure of the typical change extra time within the costs paid by city customers for a market basket of client items and companies. M2 is a measure of the U.S. cash inventory that features M1 (forex and cash held by the non-bank public, checkable deposits, and vacationers’ checks) plus financial savings deposits (together with cash market deposit accounts), small time deposits underneath $100,000, and shares in retail cash market mutual funds. The S&P 500 is a inventory market index that tracks the shares of 500 large-cap U.S. firms. The S&P CoreLogic Case-Shiller U.S. Nationwide Dwelling Value NSA Index is a composite of single-family dwelling value indices for the 9 U.S. Census divisions and is calculated month-to-month. It’s included within the S&P CoreLogic Case-Shiller Dwelling Value Index Collection which seeks to measure adjustments within the complete worth of all current single-family housing inventory.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.