By Joe Foster, Portfolio Supervisor, Gold Technique, VanEc

By Joe Foster, Portfolio Supervisor, Gold Technique, VanEck

Gold Correction

U.S. greenback power saved stress on gold all through September. The greenback, as measured by the U.S. Greenback Index (DXY),1 trended larger because the inventory market trended decrease from its all-time highs. The pandemic stimulus-driven bull market appears to be like to be in jeopardy because the S&P 5002 fell sharply initially of the month and the greenback responded to the risk-off sentiment. Gold might have seen extra stress as a supply of money from equity-related margin promoting. Gold had been consolidating above $1,900 per ounce since its $2,075 excessive on August 7. The consolidation now appears to be like extra like a correction as gold fell to a near-term low of $1,848 on September 28. For the month, the gold worth declined $81.98 (4.2%), ending at $1,885.82 per ounce. The underside of the present gold bull market pattern is round $1,800. We anticipate this correction to stay above this degree.

Gold miners retreated with gold, because the NYSE Arca Gold Miners Index (GDMNTR)3 fell 7.4% and the MVIS World Junior Gold Miners Index (MVGDXJTR)4 declined 7.6%.

Miners Stay On Level, Operationally

We attended the digital variations of the Valuable Metals Summit and Gold Discussion board Americas (a/okay/a The Denver Gold Discussion board). The Valuable Metals Summit options Junior corporations,5 most of that are cashed up from current fairness raises. In consequence there was an abundance of drilling outcomes, venture updates and plans for extra drilling. In our view, with new cash comes new discoveries. A number of of our corporations have just lately introduced discoveries that we imagine will assist advance their tasks towards manufacturing. For instance, De Gray Mining appears to be like to have a multi-million ounce discovery within the Pilbara area of Western Australia. Corvus Gold has made extra discoveries at its Southern Nevada venture which will flip it right into a district-scale play. Galway Metals’ drilling has turned some remoted gold occurrences right into a pattern which will host over 1,000,000 ounces in New Brunswick, Canada.

The Gold Discussion board Americas convention reiterated and enhanced the {industry} traits that we’ve been speaking about for a number of years. Massive gold producers tripped over one another to tell buyers of their cash-generating skill and dedication to return cash to shareholders by rising dividends and/or share buybacks. Stability sheets are pristine, as those that aren’t already in a net-cash place ought to get there by early 2021. Whereas there isn’t a lot progress amongst the big corporations, many emphasised sustainable manufacturing bases for ten years. Newmont (6.8% of web property) even went past, indicating it may well maintain present annual manufacturing ranges of round 6 million ounces into the 2040s. Previously we have been fortunate to get 5 years of steering. Most corporations proceed to make use of conservative pricing within the $1,200 to $1,300 per ounce vary to calculate reserves and venture economics. Firms additionally expressed a dedication to rising Environmental, Social and Governance (ESG) initiatives. All of this bodes properly for gold fairness buyers and demonstrates the sustainable monetary and working power of the {industry}.

Nonetheless, Room For Enchancment

In August, gold reached its all-time excessive of $2,075 per ounce. On the similar time the GDMNTR topped out at 1,271, far under its all-time excessive of 1,855 in September 2011 when gold reached its former excessive of $1,921. Because the present bull market started in December 2015, gold superior 98% to its August 2020 excessive, whereas GDMNTR gained 266% over the identical interval. If the GDMNTR had returned to its previous 2011 excessive of 1,855 in August of this yr, it might have superior 435% because the present bull market started. Right here we discover the explanations that gold miners haven’t reclaimed their all-time highs with gold.

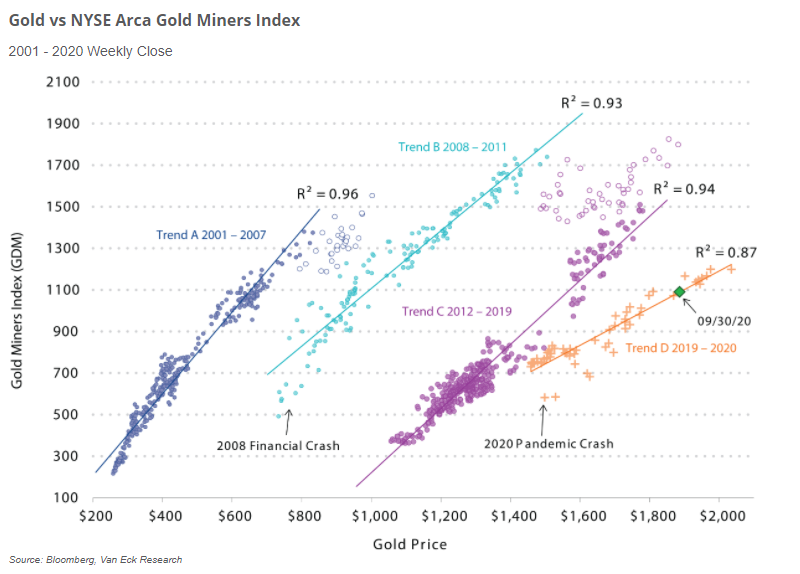

This chart under plots gold versus gold miners (as measured by GDMNTR). Discover that gold and gold miners commerce alongside 4 discreet traits which have shifted to the suitable over time. Inside every pattern, the extent to which gold miners’ worth actions could be defined by gold worth actions (as measured right here by the coefficient of willpower, or “R-squared”6) may be very excessive—close to 1.0, or almost 100% of the time in some circumstances. Alternatively, pattern shifts to the suitable point out {that a} given gold worth motion corresponds to a decrease gold miner worth motion than in a previous pattern. In different phrases, gold miners have been de-rated relative to gold. Additionally, flatter pattern traces signifies decrease gold miners’ worth beta7 to gold (beta being the efficiency leverage gold miners naturally carry to gold).

The chart exhibits that gold miners have suffered three de-ratings8 since 2007, with their beta to gold declining as properly. The primary two de-ratings occurred in late 2007/early 2008 and late 2011/early 2012 (traits A-B-C). These have been brought on by poor working and monetary efficiency on many fronts. Price inflation eroded the working leverage that buyers anticipated. Rising prices additionally prompted capital tasks to fall in need of anticipated returns. Firms made a behavior of lacking their manufacturing and price steering. When charges fell after the monetary disaster, the Seniors loaded up on debt and lots of corporations overpaid for acquisitions that didn’t carry out as promised. In consequence, high managements of all the big gold producers misplaced their jobs. New managements have realized the laborious classes of the previous and the {industry} has utterly turned itself round by instilling the suitable incentive construction from the board to the mines. That is proven by current monetary and working outcomes and the methods we’ve highlighted from the Gold Discussion board Americas.

Sadly, regardless of all the enhancements, the sector nonetheless suffered one other de-rating in 2019 (traits C-D). We imagine there are two causes for this:

- Many generalist buyers deserted gold equities within the final cycle on account of poor administration. We now have but to see many of those buyers return. Up to now on this cycle, most buyers are utilizing bullion ETFs for publicity to the gold market. Bullion ETF inflows have shattered data in 2020. In the meantime web inflows to each lively and passive fairness funds have been anemic.

- There’s a lack of progress amongst the big gold corporations. Traditionally, a rising gold worth introduced exploration pleasure, prime quality discoveries and increasing manufacturing. Whereas this pleasure remains to be driving Junior gold miners, it’s lacking amongst the big corporations. Multi-million ounce gold deposits have grow to be very troublesome to seek out and international manufacturing might be previous its peak. The massive corporations at the moment are targeted on sustaining present manufacturing ranges in the long run.

Up to now in 2020 gold has superior 24%, whereas the GDMNTR is up 34%. If Pattern D stays in place by the present cycle, the GDMNTR might attain its historic 2011 excessive if/when gold reaches $2,755 per ounce. Typically talking, from present ranges, this might translate to a 46% enhance for gold and a 70% enhance for gold miners. We imagine gold miners can do higher.

Constructing Mass Attraction Over Constructing Mines

We imagine, the important thing to attaining a optimistic re-rating, higher efficiency and better valuations is attracting generalists again to the sector. Scotia Capital Markets estimates that the typical dividend yield of the big gold producers will rise to the typical of the S&P 500 someday in 2021 at 1.5%. Scotia additionally reckons that if gold costs grow to be sustainable across the $2,000 per ounce degree, money flows ought to allow yields within the 3% to 4% vary. Managements are targeted on the duty and doing every part of their energy to make the gold {industry} attraction to a broader investor base with their skill to generate returns and mitigate dangers.

GDMNTR and MVGDXJTR are dominated by Senior and Mid-Tier gold corporations respectively, lots of which we maintain in our lively gold funds. Whereas the big corporations are doing an excellent job, the actual fact stays that the easiest way to create worth is to make a discovery and switch a barren piece of actual property right into a gold mine. That is the kind of worth creation we discover within the Juniors and a number of the Mid-Tiers in our lively portfolio. That is additionally how we anticipate to ship the leverage to gold seen in previous cycles.

Obtain Commentary PDF with Fund particular data and efficiency.

Initially printed by VanEck, 10/9/20

IMPORTANT DISCLOSURES

*All firm, sector, and sub-industry weightings as of September 30, 2020 until in any other case famous. Supply: VanEck, FactSet.

Nothing on this content material must be thought of a solicitation to purchase or a suggestion to promote shares of any funding in any jurisdiction the place the provide or solicitation could be illegal underneath the securities legal guidelines of such jurisdiction, neither is it meant as funding, tax, monetary, or authorized recommendation. Traders ought to search such skilled recommendation for his or her explicit state of affairs and jurisdiction.

1U.S. Greenback Index (DXY) signifies the final worldwide worth of the U.S. greenback by averaging the alternate charges between the U.S. greenback and 6 main world currencies. 2S&P 500® is a capitalization-weighted index of 500 U.S. shares from a broad vary of industries. 3NYSE Arca Gold Miners Index (GDMNTR) is a modified market capitalization-weighted index comprised of publicly traded corporations concerned primarily within the mining for gold. 4MVIS World Junior Gold Miners Index (MVGDXJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of a world universe of publicly traded small- and medium-capitalization corporations that generate no less than 50% of their revenues from gold and/or silver mining, maintain actual property that has the potential to provide no less than 50% of the corporate’s income from gold or silver mining when developed, or primarily spend money on gold or silver. 5“Juniors” are gold mining corporations that usually produce lower than 0.Three million ounces of gold per yr whereas Seniors” and “Mid-Tiers” are gold mining corporations that produce, roughly,1.5-6.Zero and 0.3-1.5 million ounces of gold per yr, respectively. 6R-squared is a statistical measure typically interpreted because the extent to which the variance of 1 issue can clarify the variance of a second issue (for instance, the share of a fund or safety’s actions that may be defined by actions in a benchmark index). 7Beta is a measure of sensitivity to market actions. 8A change in ranking typically happens when the market’s view of an organization or {industry} modifications considerably sufficient—both positively or negatively—to the place an organization’s or {industry}’s valuation is impacted consequently.

Any indices listed are unmanaged indices and embrace the reinvestment of all dividends, however don’t replicate the cost of transaction prices, advisory charges or bills which can be related to an funding in a Fund. Sure indices might have in mind withholding taxes. An index’s efficiency is just not illustrative of a Fund’s efficiency. Indices are usually not securities through which investments could be made.

NYSE Arca Gold Miners Index is a service mark of ICE Information Indices, LLC or its associates (“ICE Information”) and has been licensed to be used by VanEck Vectors ETF Belief (the “Belief”) in reference to VanEck Vectors Gold Miners ETF (the “Fund”). Neither the Belief nor the Fund is sponsored, endorsed, bought or promoted by ICE Information. ICE Information makes no representations or warranties relating to the Belief or the Fund or the power of the NYSE Arca Gold Miners Index to trace normal inventory market efficiency.

ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

MVIS World Junior Gold Miners Index (the “Index”) is the unique property of MV Index Options GmbH (an entirely owned subsidiary of Van Eck Associates Company), which has contracted with Solactive AG to take care of and calculate the Index. Solactive AG makes use of its greatest efforts to make sure that the Index is calculated appropriately. Regardless of its obligations in direction of MV Index Options GmbH, Solactive AG has no obligation to level out errors within the Index to 3rd events. The VanEck Vectors Junior Gold Miners ETF (the “Fund”) is just not sponsored, endorsed, bought or promoted by MV Index Options GmbH and MV Index Options GmbH makes no illustration relating to the advisability of investing within the Fund.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC and/or its associates and has been licensed to be used by Van Eck Associates Company. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P World, Inc., and/or its associates. All rights reserved. Redistribution or copy in complete or partially are prohibited with out written permission of S&P Dow Jones Indices LLC. For extra data on any of S&P Dow Jones Indices LLC’s indices please go to www.spdji.com. S&P® is a registered trademark of S&P World and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their associates nor their third celebration licensors make any illustration or guarantee, specific or implied, as to the power of any index to precisely signify the asset class or market sector that it purports to signify and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their associates nor their third celebration licensors shall have any legal responsibility for any errors, omissions, or interruptions of any index or the information included therein.

Please observe that the knowledge herein represents the opinion of the creator, however not essentially these of VanEck, and this opinion might change at any time and every so often. Non-VanEck proprietary data contained herein has been obtained from sources believed to be dependable, however not assured. Not meant to be a forecast of future occasions, a assure of future outcomes or funding recommendation. Historic efficiency is just not indicative of future outcomes. Present knowledge might differ from knowledge quoted. Any graphs proven herein are for illustrative functions solely. No a part of this materials could also be reproduced in any kind, or referred to in another publication, with out specific written permission of VanEck.

About VanEck Worldwide Traders Gold Fund: You may lose cash by investing within the Fund. Any funding within the Fund must be a part of an general funding program, not a whole program. The Fund is topic to the dangers related to concentrating its property within the gold {industry}, which could be considerably affected by worldwide financial, financial and political developments. The Fund’s general portfolio might decline in worth on account of developments particular to the gold {industry}. The Fund’s investments in international securities contain dangers associated to adversarial political and financial developments distinctive to a rustic or a area, foreign money fluctuations or controls, and the potential for arbitrary motion by international governments, or political, financial or social instability. The Fund is topic to dangers related to investments in Canadian issuers, commodities and commodity-linked derivatives, commodities and commodity-linked derivatives tax, gold-mining {industry}, derivatives, rising market securities, international foreign money transactions, international securities, different funding corporations, administration, market, non-diversification, operational, regulatory, small- and medium-capitalization corporations and subsidiary dangers.

About VanEck Vectors® Gold Miners ETF (GDX®) and VanEck Vectors® Junior Gold Miners ETF (GDXJ®): An funding within the Funds could also be topic to dangers which embrace, amongst others, investing in gold and silver mining corporations, Canadian issuers, international securities, international foreign money, depositary receipts, small- and medium-capitalization corporations, fairness securities, market, operational, index monitoring, approved participant focus, no assure of lively buying and selling market, buying and selling points, passive administration threat, fund shares buying and selling, premium/low cost threat and liquidity of fund shares, non-diversified and focus dangers, all of which can adversely have an effect on the Funds. Overseas investments are topic to dangers, which embrace modifications in financial and political circumstances, international foreign money fluctuations, modifications in international rules, and modifications in foreign money alternate charges which can negatively influence the Funds’ return. Small- and medium-capitalization corporations could also be topic to elevated dangers. The Funds’ property could also be concentrated in a selected sector and could also be topic to extra threat than investments in a various group of sectors.

Diversification doesn’t guarantee a revenue or shield towards loss.

Please name 800.826.2333 or go to vaneck.com for efficiency data present to the newest month finish and for a free prospectus and abstract prospectus. An investor ought to think about a Fund’s funding goal, dangers, fees and bills fastidiously earlier than investing. The prospectus and abstract prospectus include this in addition to different data. Please learn them fastidiously earlier than investing.

© 2020 VanEck

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.