Asian markets ended final week up, buoyed partially by a rally in healthcare corporations, based on Reuters.

The blue-chip CSI300 Index, which tracks the highest 300 shares traded on the Shenzhen Inventory Change and the Shanghai Inventory Change, closed out the week 2.3% larger.

Particularly, the CSI300 financials index rose by 3.3% and the CSI300 healthcare index jumped by 2.4%.

Play Chinese language Healthcare Shares

The Chinese language healthcare market is among the quickest rising on this planet, based on KraneShares, rising at a 5-year compounded annual fee of 11%, in comparison with a 4% rise in america and a 4% decline in Japan.

China’s healthcare sector is primed for continued progress, when considering the getting old inhabitants, rising incomes, and rising urbanization in China.

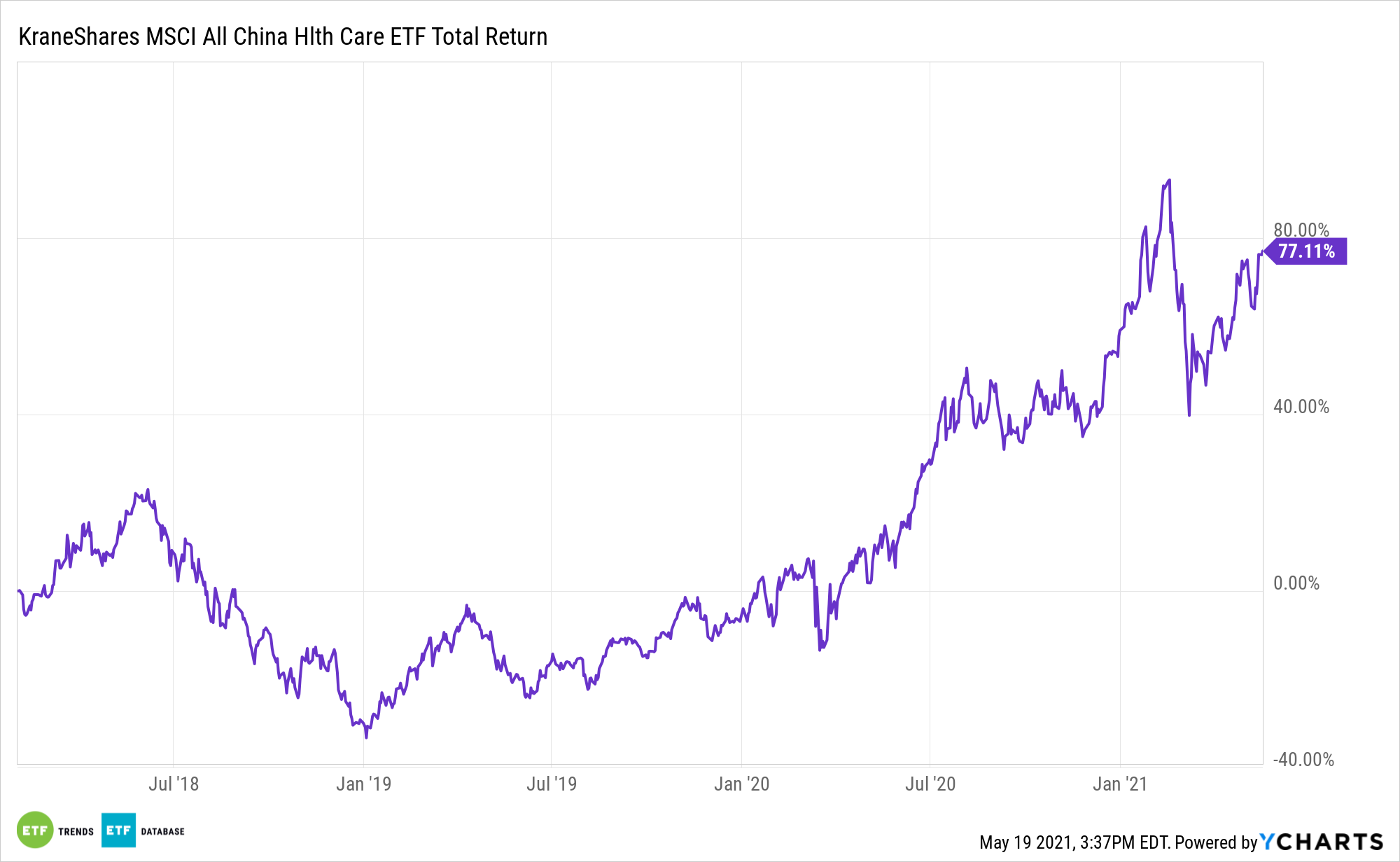

The KraneShares MSCI All China Well being Care Index ETF (NYSE:KURE) gives traders entry to the Chinese language healthcare sector. KURE invests 100% in Chinese language healthcare equities..

The fund measures the efficiency of the MSCI All China Well being Care 10/40 Index and captures large- and mid-cap illustration in China A-shares, B-shares, H-shares, red-chips, P-chips, and international listings, per the index methodology.

The “10/40” index applies limits to the weights and holdings, such that the burden of every group entity within the index is capped at 10%, whereas the cumulative weight of all group entities with a weight that’s higher than 5% doesn’t exceed 40% of all the index.

KURE’s index at the moment allocates 34% of its weighting to pharmaceutical firms, 21% to biotechnology corporations, and 17% to life sciences instruments & companies firms.

58% of the ETF’s shares are listed in mainland China, whereas 35% of them are listed in Hong Kong. The remaining 7% are listed within the U.S.

At the moment, KURE’s high three portfolio holdings embody Wuxi Biologics, at 8.6%; Shenzhen Mindray Bio-Medical Digital Co, at 5.5%; and Jiangsu Hengrui Medication, at 5.0%.

All three firms are up considerably year-over-year. Wuxi Biologics, which gives open-access tech platforms for biologic drug growth, is at the moment up 69% over the previous 12 months; Shenzhen Mindray Bio-Medical Digital Co is up 31%; and Jiangsu Hengrui Medication is up 25%.

For extra information, data, and technique, go to the China Insights Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.