By Helios Quantitative Analysis As almost each market analy

By Helios Quantitative Analysis

As almost each market analyst and ETF strategists has famous, the political surroundings, particularly with a significant election across the nook, can often create short-term volatility. Final week was an instance of that kind of exercise when market volatility was attributed to a COVID reduction rollercoaster, the place President Trump introduced by way of Twitter that the following section of federal reduction was to return to a halt. On Tuesday October 6th, President Trump tweeted that he “…instructed [his] representatives to cease negotiation till after the election…” and as an alternative give attention to the vacant Supreme Court docket seat. Instantly following the tweet, markets reacted swiftly to the draw back, with the S&P 500 erasing features of 0.66% to shut the day down 1.40%.

[wce_code id=192]

Nonetheless, that very same night, Trump appeared to stroll again a part of the assertion, tweeting he supported stand-alone airline reduction, direct funds, and payroll safety. Wednesday was a day of relative confusion with the Chief of Employees confirming that negotiations have been useless, however additional tweets indicating Trump was prepared to signal sure stand-alone payments and Pelosi and Mnuchin having an extra name relating to a reduction invoice. Amid the confusion and partial stroll again, markets opened Wednesday up over 1% and settled +1.74%. The complete reversal on Thursday appeared in place with Trump claiming stimulus talks are again on and markets opening modestly larger and above the degrees simply earlier than the Tuesday tweet.

When these intervals of volatility hits, the delicate state of the financial system, can exacerbate the actions. We have now mentioned the potential for the election impacting short-term expectations, which can outcome within the markets adjusting (or making an attempt to regulate) to what the longer term financial state of affairs (e.g., COVID-related responses) could also be.

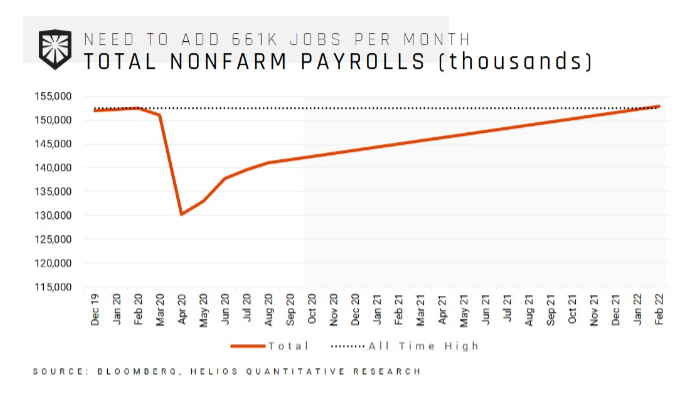

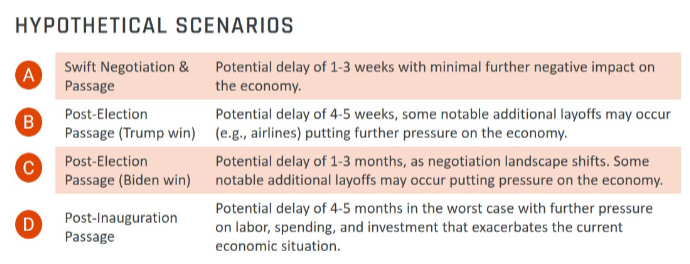

We will not make sure what the longer term holds within the subsequent twenty-odd days till the election. Nonetheless, there are just a few potential eventualities on the following web page that we’ve got performed out. The underside line is that extra delays relating to financial reduction will seemingly hamper enterprise confidence and funding within the short-term, put unfavourable stress on shopper spending, and push out the financial system’s skill to make up the roughly 11M jobs wanted to climb out of the COVID-induced jobs gap. On the opposite facet of the coin, if reduction is distributed to the general public, it might have the other influence.

The underside line: It’s by no means the perfect concept to speak about absolutes when discussing what might occur in D.C., and issues can at all times change, as we’ve got witnessed time and time once more. Markets dislike uncertainty, and this episode provides to that blend. Economically, the perfect case is distributing reduction sooner reasonably than later and passing a invoice earlier than the election. If a reduction invoice fails to materialize, we could also be trying till after the election for a invoice on the shorter finish. Nonetheless, if the elections materially change Congress’s make-up, negotiations will successfully have to restart and will take a while. Within the longest case, extra reduction may very well be delayed one other 4-5 months within the case of a Biden win plus a refusal from the present administration or Senate to cross a reduction invoice earlier than the incoming Congress’s inauguration and seating.

Initially printed by Helios Quantitative Analysis

This commentary is produced by Clear Creek Monetary Administration, LLC doing enterprise as “Helios Quantitative Analysis”. Helios Quantitative Analysis offers analysis providers to monetary advisors who’ve executed an settlement immediately with Helios Quantitative Analysis. Helios Quantitative Analysis’s analysis, evaluation, and views mirrored on this commentary are topic to alter at any time with out discover. Nothing on this commentary constitutes funding recommendation, efficiency knowledge, or any suggestion of a selected safety, portfolio of securities, or funding technique as appropriate for any particular individual. Any point out of a selected safety and associated efficiency knowledge is just not a suggestion to purchase or promote that safety. Monetary advisors are answerable for offering custom-made funding recommendation for every of their shoppers primarily based on their distinctive danger tolerance and monetary circumstances. Helios Quantitative Analysis is just not answerable for figuring out whether or not this commentary is relevant or appropriate for monetary advisor’s shoppers or for offering custom-made suggestions for any of monetary advisor’s shoppers. Investments in securities contain the chance of loss. Previous efficiency is not any assure of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.