By Doug Sandler, CFA There are

By Doug Sandler, CFA

There are few issues extra necessary to the American psyche and the American economic system than a wholesome housing market. We consider a wholesome housing market signifies client confidence, catalyzes financial development, and creates high-paying jobs. Right here is why:

- Client Confidence: In our view, a house buy is the final word signal of client confidence. We consider homebuyers solely purchase properties after they really feel that their job is safe, their prospects for the long run are optimistic, their private stability sheets are comparatively sturdy, and banks are keen to lend.

- Catalyst: A house buy is commonly an financial accelerator. The acquisition of a house is usually adopted by further purchases corresponding to furnishings, ground coverings, dwelling items, and garden and backyard tools.

- Creator: Residence building and residential reworking create jobs and may also help bridge the revenue divide. In keeping with the Bureau of Labor Statistics (BLS), there are roughly 7.Four million construction-related jobs within the US and plenty of of those jobs are high-paying. As of January 2021, the typical hourly price for a building employee is over $32, which equates to roughly $60,000 to $65,000 per 12 months (assuming a 40-hour workweek). Wages will be larger within the quickest rising areas of the nation and for the extra expert positions corresponding to carpentry, electrical, mission administration, and tools operation. This makes dwelling building one of many few industries the place staff can earn an above common revenue and not using a faculty diploma.

[wce_code id=192]

The Alternative: Pent-up Demand for Properties

Over the long-term, the demand for housing is pushed by components together with demographics (family formation), rates of interest, the state of the economic system, and different exogenous components. The demand for properties has not too long ago accelerated, and we consider that demand will stay sturdy for the foreseeable future for the next causes.

Previous efficiency is not any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency.

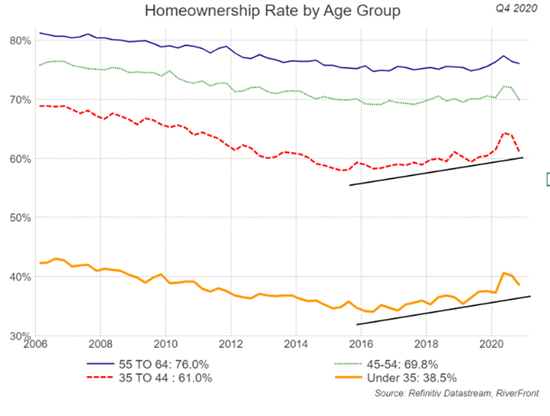

Demographics: A brand new technology of homebuyers is descending on the housing market in drive: The Millennials. Nielsen Media Analysis defines Millennials as these born between 1981 and 1996, which means they’re someplace between 24 and 40 years of age. From the chart on the suitable, one can see dwelling possession starting to extend within the Beneath 35 class (backside strong line) and the 35 to 44 class (dotted line). From this information it will seem that the Millennials will not be everlasting renters, however homebuyers that have been delayed by excessive ranges of pupil debt and the next recession that adopted the Monetary Disaster. This will likely clarify why dwelling possession has declined since 2005 from 69% to 66% (US Census Bureau). Curiously, the technology following the Millennials (Gen Z) could also be much more obsessed with dwelling possession than the Millennials. A current ballot by Freddie Mac discovered that 86% of these aged 14-23 supposed to buy a house sometime. These optimistic demographics will trigger homeownership ranges to extend in coming years even perhaps eclipsing the 2005 highs, in our view.

Financial system and Curiosity Charges: We consider that the economic system and rates of interest are supportive of continued housing power. In our opinion, the economic system can solely get higher from right here as vaccines get distributed and companies re-open. Rates of interest additionally stay comparatively low and though charges have risen not too long ago, nationwide mortgage charges for a 30-year conforming mortgage are round three to three.5%, well-below historic averages.

Exogenous Elements: With many individuals prone to proceed to work at home, the will to reside in as good an surroundings as attainable will proceed to develop nicely past COVID-19, supporting each housing demand and reworking. Thus, whereas a few of these exogenous components like COVID-19 itself could fade, we consider that many will stay and create enduring demand for housing.

The Downside: Housing is in Brief Provide

Previous efficiency is not any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency.

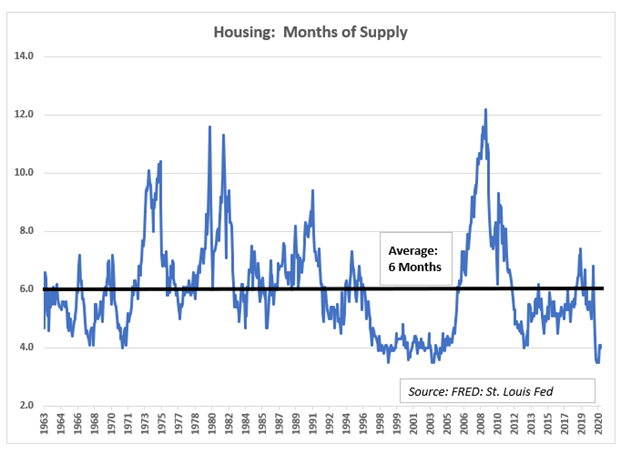

At this time, there’s solely a 4-month provide of properties accessible, which is close to the all-time lows within the late 1990s/early 2000s (proper chart). This degree of stock is nicely under the long-term common of 6 months. Provide signifies how lengthy present stock would final if no new properties have been constructed.

At present, there’s a mixture of decreased availability from present properties and an absence of availability for brand new building. In keeping with Realtor.com, 2012-2019 skilled sustained ranges of underbuilding leaving a spot of three.84 million new properties.

A 2018 Freddie Mac report estimated that the demand for brand new properties within the US was roughly 1.6 million per 12 months. That is comprised of about 300,000 properties to interchange properties which have deteriorated, 1.1 million properties wanted by new households, 100,000 as second properties and 120,000 to be in stock.

Conclusion

The housing market will be an necessary precursor of future financial exercise. At this time, the US housing market is wholesome. January new dwelling gross sales have been up 19% 12 months/12 months (US Census Bureau), January present dwelling gross sales have been up almost 24% 12 months/12 months (Nationwide Affiliation of Realtors) and residential costs have been up 10% in 2020 (S&P CoreLogic Case-Shiller). We anticipate the housing market to stay wholesome as demand stays sturdy and provide stays tight.

In our opinion, a wholesome housing market is supportive of elevated earnings, a stronger economic system and better inventory costs. This is without doubt one of the causes we at present favor shares over bonds in our Benefit portfolios. Sectors and industries that we consider will profit probably the most from housing power embrace client discretionary, banking, engineering and building, dwelling enchancment, and constructing supplies.

Vital Disclosure Info

The feedback above refer typically to monetary markets and never RiverFront portfolios or any associated efficiency. Opinions expressed are present as of the date proven and are topic to vary. Previous efficiency shouldn’t be indicative of future outcomes and diversification doesn’t guarantee a revenue or defend in opposition to loss. All investments carry some degree of danger, together with lack of principal. An funding can’t be made immediately in an index.

Chartered Monetary Analyst is knowledgeable designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of monetary analysts. Candidates are required to cross three ranges of exams masking areas corresponding to accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can grow to be a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Info or information proven or used on this materials was acquired from sources believed to be dependable, however accuracy shouldn’t be assured.

This report doesn’t present recipients with data or recommendation that’s adequate on which to base an funding choice. This report doesn’t keep in mind the precise funding aims, monetary scenario or want of any specific consumer and will not be appropriate for every type of traders. Recipients ought to take into account the contents of this report as a single think about investing choice. Extra elementary and different analyses can be required to make an funding choice about any particular person safety recognized on this report.

In a rising rate of interest surroundings, the worth of fixed-income securities typically declines.

When referring to being “obese” or “underweight” relative to a market or asset class, RiverFront is referring to our present portfolios’ weightings in comparison with the composite benchmarks for every portfolio. Asset class weighting dialogue refers to our Benefit portfolios. For extra data on our different portfolios, please go to www.riverfrontig.com or contact your Monetary Advisor.

Shares signify partial possession of a company. If the company does nicely, its worth will increase, and traders share within the appreciation. Nonetheless, if it goes bankrupt, or performs poorly, traders can lose their total preliminary funding (i.e., the inventory value can go to zero). Bonds signify a mortgage made by an investor to a company or authorities. As such, the investor will get a assured rate of interest for a particular time period and expects to get their unique funding again on the finish of that point interval, together with the curiosity earned. Funding danger is reimbursement of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Buyers ought to pay attention to these variations previous to investing.

The Benefit portfolios could also be invested in shares, bonds and exchange-traded merchandise (exchange-traded funds (ETFs) and exchange-traded notes (ETNs)). Benefit is obtainable by means of individually managed accounts or on mannequin supply platforms, relying on the Sponsor Agency.

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Trade Fee. Registration as an funding adviser doesn’t indicate any degree of talent or experience. Any dialogue of particular securities is supplied for informational functions solely and shouldn’t be deemed as funding recommendation or a suggestion to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Included (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its workers by means of RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and due to this fact an oblique proprietor of RiverFront. BFC is the dad or mum firm of Robert W. Baird & Co. Included, a registered dealer/seller and funding adviser.

To assessment different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Kind ADV, Half 2A. Copyright ©2021 RiverFront Funding Group. All Rights Reserved. ID 1554966

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.