I hope you’re not renting a aut

I hope you’re not renting a automotive anytime quickly.

Vacationers flocking to sunny spots like Hawaii and Florida are being left stranded.

The common automotive rental in Hawaii used to value 50 bucks a day. Now a primary Toyota Camry will set you again $500+ a day.

Some determined vacationers are even turning to U-Haul vans as a result of rental automotive heaps are empty.

What the heck is occurring?

When COVID hit, automotive rental giants Avis and Hertz held fireplace gross sales.

The truth is, they dumped over half one million automobiles final 12 months. Now, they will’t purchase new automobiles.

For those who’ve been following alongside, you understand Ford began shutting the doorways on its factories again in February. Now it says a few of them might be closed till August!

GM… Volkswagen… Toyota… Honda… Volvo and different automakers had been compelled to idle their crops, too. Ford says it expects to provide 1.1 million fewer autos this 12 months than it had deliberate.

In keeping with prime consulting agency AlixPartners, automakers will lose $61 billion in gross sales this 12 months.

The rationale?

We’re shortly operating out of probably the most beneficial assets the world has ever identified…

I’m speaking about semiconductors.

On the flip of the century, most automobiles didn’t even have one microchip. Your common electrical automotive right now is full of roughly 3,000 of them.

These microchips usually value only a few {dollars}, however you may’t ship a $75,000 automotive with out them. Every little thing from energy steering to dashboards and automated brakes runs on semiconductor chips.

However this downside reaches far past automobiles…

Elon Musk known as the chip scarcity a “large downside.”

Apple simply introduced the drought may knock $Four billion off its gross sales subsequent quarter…

Even canine washing companies are struggling.

Illinois-based firm CCSI makes dog-washing cubicles that mechanically dispense shampoo, water, and even dry your canine. The machine is powered by pc chips, which CCSI can’t get their palms on proper now.

Longtime RiskHedge readers know the entire world runs on chips nowadays. Chips are basically the “brains” of recent electronics.

Temperature sensors in air conditioners are powered by tiny microchips. The chip inside pacemakers sends electrical pulses to the center to maintain it beating repeatedly.

Have you ever heard of a “show driver”? There’s a great probability you utilize it day by day and don’t even notice it.

This $1 machine is on the middle of the chip scarcity. In brief, it conveys primary directions for illuminating the display in your telephone, pc monitor, and even the navigation system in your automotive.

Now, you may’t seize a packet of microchips off the shelf at Walmart… so people are likely to underestimate their significance. However this chip scarcity is costing the world’s largest companies billions of {dollars}.

However it’s much more necessary than that:

Consider the chip scarcity just like the world operating out of concrete or metal 100 years in the past.

It will have stifled the world’s greatest tasks, proper?

For instance, there’s 60,000 tons of metal within the Empire State Constructing. And it took 4.Three million cubic yards of concrete to construct the Hoover Dam. That’s sufficient to pave a 16-foot-wide street from California to New York.

Lately, microchips—not heavy-duty supplies—make the world go spherical.

We’re going to want much more chips…

However the present scarcity highlights that chipmakers are already operating at full tilt.

Analysis from Wall Avenue agency AllianceBernstein exhibits each chip manufacturing unit is totally maxed out for the following couple of months. The hole between when a chip order is positioned and when it will get shipped has stretched to a document 4 months.

This could solely imply one factor: Chipmakers HAVE TO construct dozens of latest factories within the coming years.

The truth is, they’re already breaking floor.

The world’s largest chipmaker TSMC (TSM) introduced it might plough a document $100 billion into new crops over the following three years.

Rival Samsung mentioned it would make investments $116 billion in new factories by 2030. This features a $17 billion state-of-the-art chip plant in Austin, Texas.

Final month, chip pioneer Intel (INTC) introduced it would spend $20 billion on two new chipmaking fabrication crops in Phoenix. That is the most important funding within the firm’s 60-year historical past.

You’re most likely questioning why chip crops are so costly? The truth is, it prices extra to construct a cutting-edge chip plant than a nuclear reactor… or a large US navy plane provider.

CBS’ 60 Minutes dug into the chip scarcity on Sunday.

Host Lesley Stahl flew all the way down to Intel’s headquarters in Phoenix.

And he or she quizzed CEO Pat Gelsinger on why factories value a lot.

Lesley Stahl: How a lot does this fab value?

Pat Gelsinger: $10 billion.

Lesley Stahl: Billion?

Pat Gelsinger: $10 billion… every one among these items of apparatus is perhaps $5 million.

Right here’s what the within of Intel’s plant appears to be like like:

Supply: 60 Minutes

Chipmakers use essentially the most superior machines on earth.

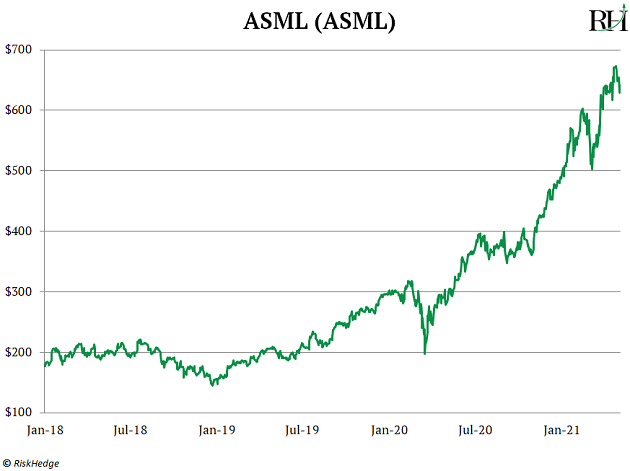

RiskHedge readers know ASML (ASML) is a key participant in chipmaking.

ASML’s excessive ultraviolet lithography (EUV) machine “burns” a blueprint of transistors onto a silicon wafer. And it does it with the precision equal to taking pictures an arrow from Earth and hitting an apple positioned on the moon.

ASML’s instruments permit chipmakers to push the boundaries of what’s potential. In brief, they’re important to crafting modern chips. And get this… these machines are so heavy it takes three Boeing 747 cargo planes simply to ship one

As Intel’s CEO informed 60 Minutes, the most costly a part of these fabs is the machines. For instance, ASML’s machines include a $160 million price ticket—and modern factories may need 20 or extra.

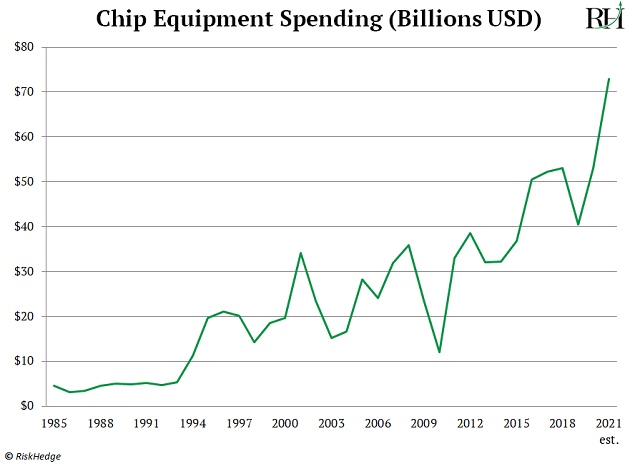

As chipmakers rush to construct new factories, they may spend boatloads of cash on these instruments over the following few years.

Intel, TSMC, and others are on observe to splash out $70 billion on chipmaking instruments this 12 months alone. This smashes earlier information, as you may see:

ASML is already raking in boatloads of money. The disruptor achieved document earnings in late April, which despatched the inventory surging to all-time highs:

ASML has greater than tripled since I first wrote about it within the RiskHedge Report again in 2018. I see this all-time nice disruptor heading a lot greater over the approaching years.

Initially printed by Mauldin Economics, 5/10/21

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.