Tlisted below are 2,755 billion

Tlisted below are 2,755 billionaires on earth, in response to Forbes.

However solely 4 are wealthy sufficient to qualify as “centi-billionaires”—price $100 billion or extra.

Amazon founder Jeff Bezos is #2.

Tesla’s Elon Musk sits within the 3rd spot…

Microsoft founder Invoice Gates is #4.

However #1 will most likely shock you.

It’s not super-investor Warren Buffett. It’s not Fb CEO, Mark Zuckerberg.

It’s not a hedge fund supervisor, a banker, or a Russian oligarch.

The richest particular person on earth is a French man who sells girls’s purses…

On Monday, Bernard Arnault’s private fortune grew to $186 billion.

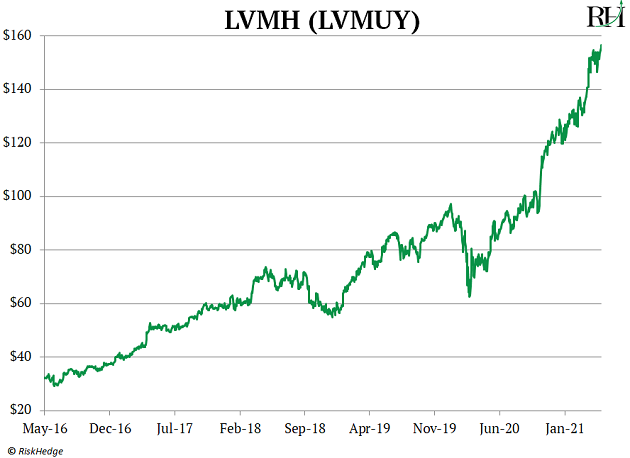

In case you don’t know the title, Arnault is CEO of luxurious empire LVMH (LVMUY)—greatest referred to as the mother or father firm of Louis Vuitton. He additionally owns $116 billion trend large Christian Dior.

Bezos and Gates made their fortunes “the common manner”—by creating game-changing merchandise that a whole lot of hundreds of thousands of individuals use each day. Eight in each ten computer systems run on Microsoft’s software program. Over 100 million People subscribe to Amazon’s Prime supply service.

Elon Musk is following this path by pioneering high-performance electrical automobiles.

Arnault bought wealthy in an entire totally different manner. He constructed tremendous luxurious manufacturers like Louis Vuitton, Givenchy, Hublot, and Dom Perignon.

A prestigious model is a robust factor. A no-name purse from Goal may cost a little $100—tops. However girls line up across the block handy over $5,000 for a Louis Vuitton.

LVMH’s enterprise is booming. Gross sales have surged 50% previously 4 years, and its inventory has shot up 380% since 2016, vaulting Arnault into the centi-billionaire membership.

Gucci is booming too…

Like Louis Vuitton, Gucci is a super-luxury model. In order for you a pair of Gucci sneakers, put together to drop a minimum of a thousand bucks.

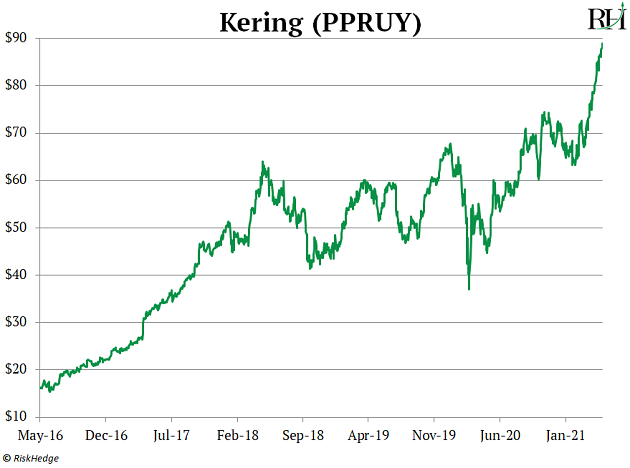

It’d sound ludicrous to spend the equal of a small mortgage fee on footwear, however Gucci’s are flying off the cabinets. Earnings at its mother or father firm, Kering (PPRUY), have greater than doubled over the previous 4 years.

Kering’s inventory is on hearth. It’s surged 445% previously 5 years, outpacing Amazon and Microsoft over the identical interval.

However Stephen, what in regards to the “demise of retail?”

You realize all about how on-line disruptors like Amazon are placing common shops out of enterprise.

In keeping with main retail analysis agency Nielsen, greater than 30,000 shops have shut their doorways previously few years.

But on-line disruption hasn’t damage luxurious sellers one bit. Tremendous luxurious corporations have confirmed completely resistant to the web wrecking ball. A current examine from “Huge 4” accounting agency Deloitte discovered gross sales for luxurious retailers have greater than doubled previously 5 years!

As a substitute, it’s the middle-of-the-road retailers which might be getting crushed.

Toys “R” Us… Sears… J.C. Penney… Borders… Circuit Metropolis… and RadioShack are all bankrupt.

In the meantime, many different middling retailers are barely clinging to life. Regardless of its current run, Macy’s (M) inventory has been minimize in half over the previous 5 years. Mall proprietor Simon Property Group (SPG) has collapsed 40% over the identical timeframe.

These disrupted shops made one mistake there’s no getting back from…

They tried to be every thing to everybody.

The “division retailer” enterprise mannequin used to work okay. Open a giant retailer, promote every thing from blouses to outside grills to video video games. So long as the shop was situated in a spot with sufficient folks coming by way of—like a metropolis or a shopping center—it might do good enterprise.

These days are lengthy gone. Web buying has blown up unspecialized, “center of the street” shops.

In the meantime, low-end low cost shops are doing simply fantastic…

In keeping with Deloitte, low cost retailer gross sales have surged 60% previously 5 years.

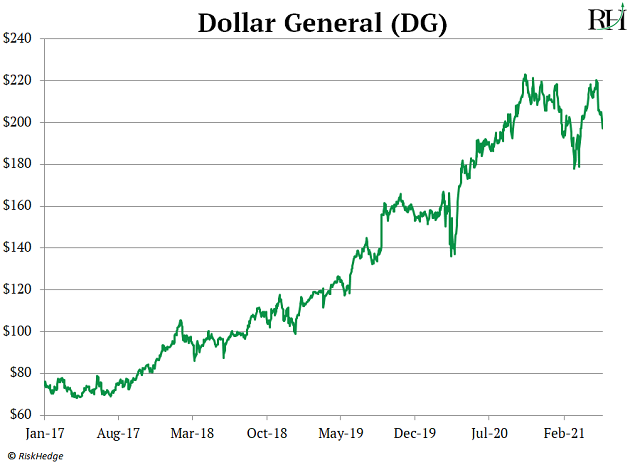

Greenback Normal (DG), for instance, is America’s largest greenback chain. You possibly can have tripled your cash on its inventory previously 4 years:

Greenback Normal is now the most important US retail chain by retailer depend. It operates virtually 17,000 shops—greater than McDonald’s, Starbucks, or Walmart.

Income has shot up 150% previously decade. And it’s not simply low-income people buying there. In keeping with JP Morgan, households incomes between $50,000 and $75,000 per yr are Greenback Normal’s fastest-growing clients.

The hollowing out of the “center” is a disruptive theme rippling throughout many industries…

The place will it strike subsequent?

Longtime RiskHedge readers know robotaxis are going to disrupt the auto trade. Actually, automakers have been among the many worst-performing shares for years.

Regardless of a giant bounce this yr, Ford (F) remains to be 65% beneath its 1999 peak. German automaker Volkswagen (VWAGY) is buying and selling on the similar worth it was in 2008.

Tremendous luxurious carmakers are doing simply fantastic, although. Sportscar maker Ferrari’s (RACE) inventory has handed buyers 280% features since going public in 2015!

So what ought to a disruption investor do with this data?

Avoid “common” shares. Keep away from mediocre, typical, or “ok” companies.

For higher or worse, the center is dying as its lunch is eaten from above and beneath.

Initially revealed by Mauldin Economics, 5/31/21

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.