By Matthew J Bartolini, CFA, Head of SPDR Americas Analysis

By Matthew J Bartolini, CFA, Head of SPDR Americas Analysis

- Up and down the cap spectrum and past the shores of the US, worth has had a powerful begin to 2021

- Will this rally proceed?

The resurgence of worth shares has been a dominant theme over the previous few months, culminating within the largest month-to-month extra return over progress shares in February (9% and a two commonplace deviation occasion) since 2008[1]. And it hasn’t been simply large-cap worth that has produced robust above market returns. Up and down the cap spectrum and past the shores of the US, worth has had a powerful begin to 2021, in addition to over the previous 4 months as the twin headwinds of election and vaccine timeline uncertainty had been eliminated.

At this time’s query to the worth bulls which have performed the a part of Charlie Brown over the previous decade solely to have the market (Lucy) pull the ball away, is whether or not the rally will proceed. Let’s evaluate some information to gauge the power and pervasiveness of this worth rally.

Broad-based rally

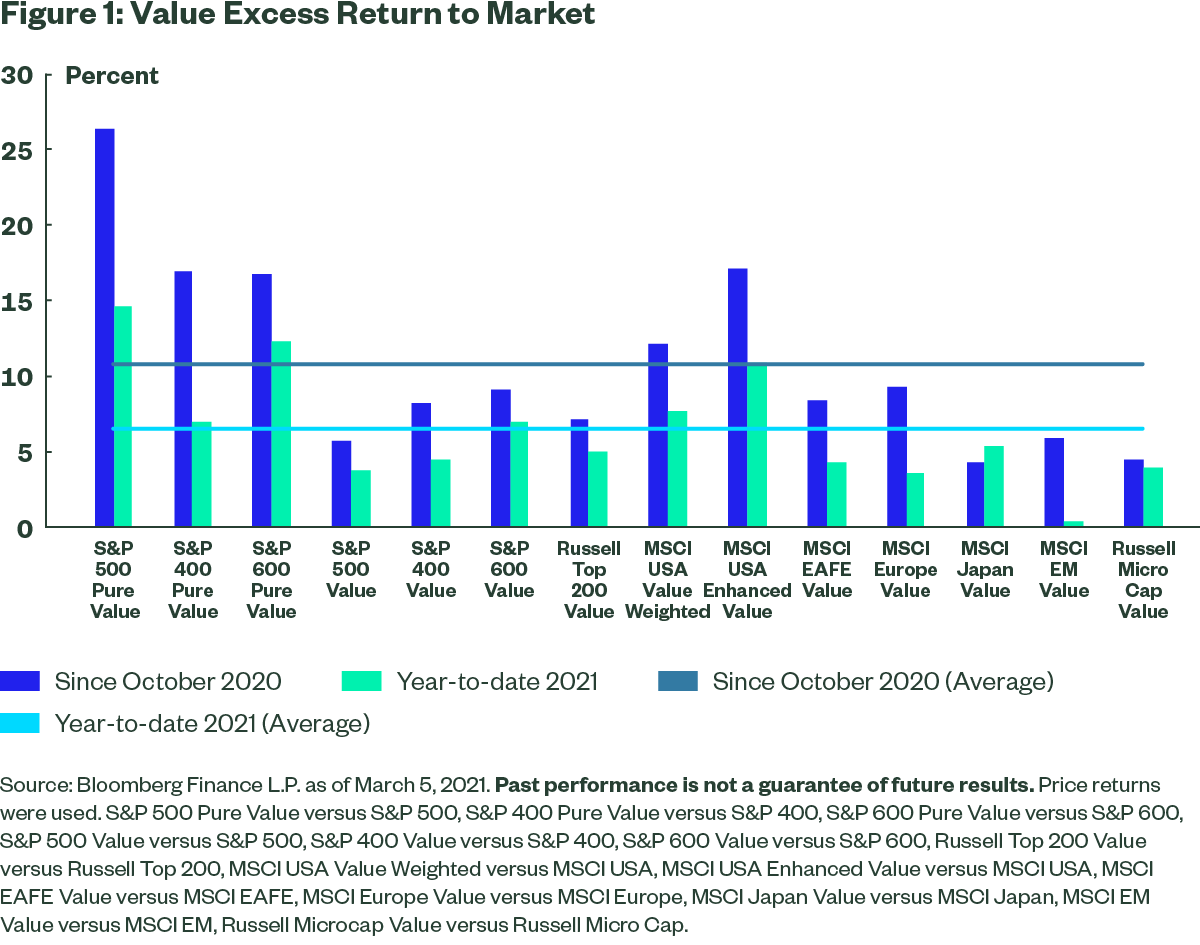

The run-up in worth has not been confined to one particular market, or building philosophy . As proven beneath, fourteen completely different worth approaches (starting from sector impartial to small cap to rising market) have outperformed their respective broad market segments each in 2021 and because the finish of October – with the common extra return of 6% and 10%, respectively.

[wce_code id=192]

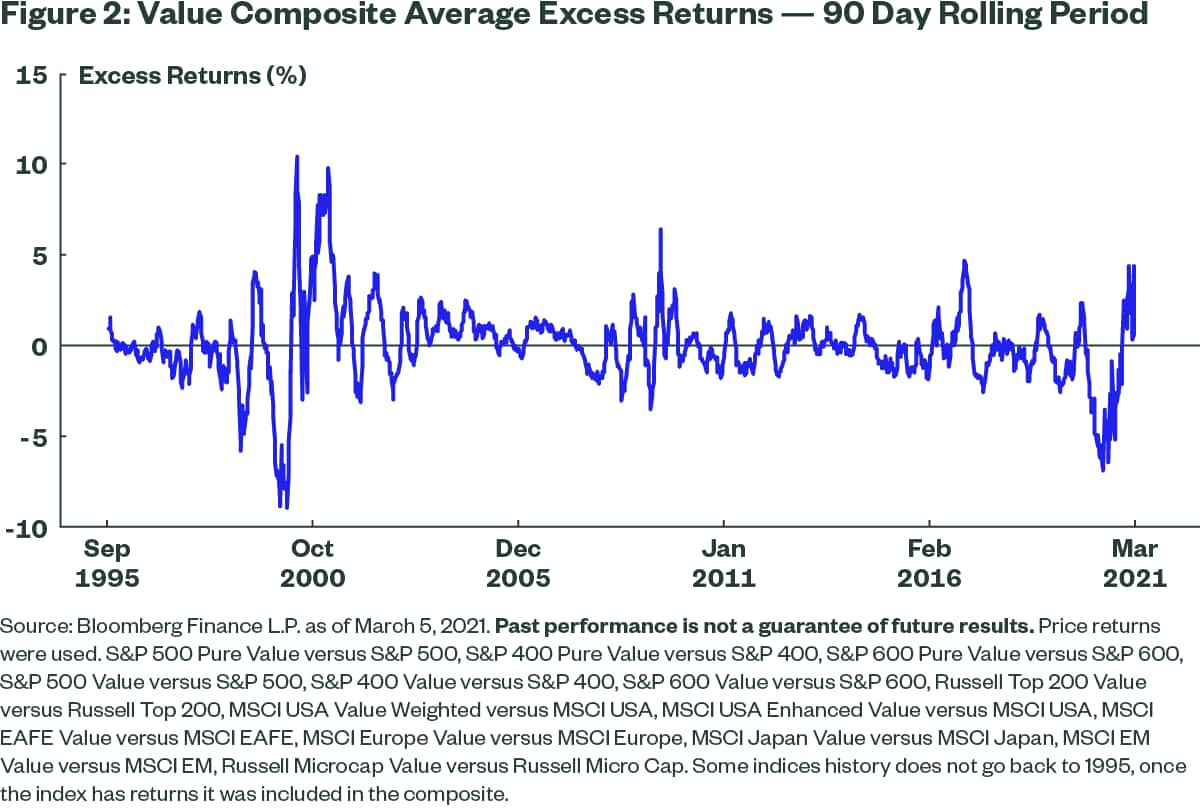

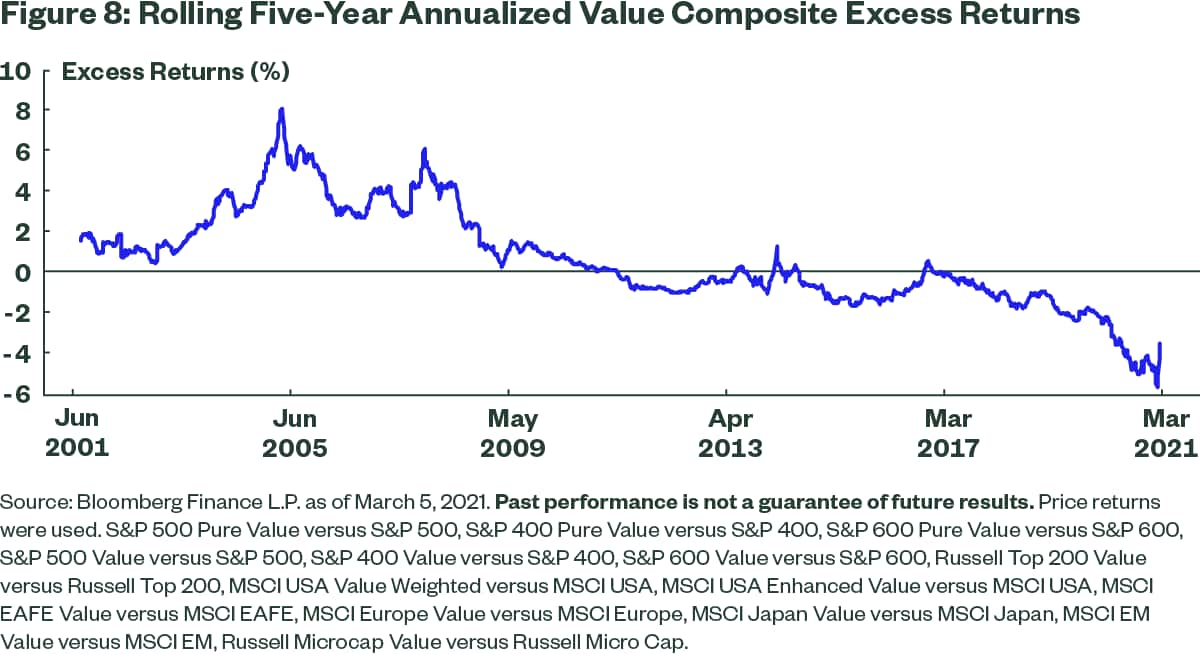

If we apply a composite method to those fourteen worth exposures (making a portfolio that holds every worth technique at equal weights, rebalanced weekly) and calculate the rolling 90-day common extra market return, the present 4% extra return could be within the historic 97th percentile. And a constructive extra return for 16 consecutive weeks underscores the breadth of this present worth rally.

Sector results on the worth rally

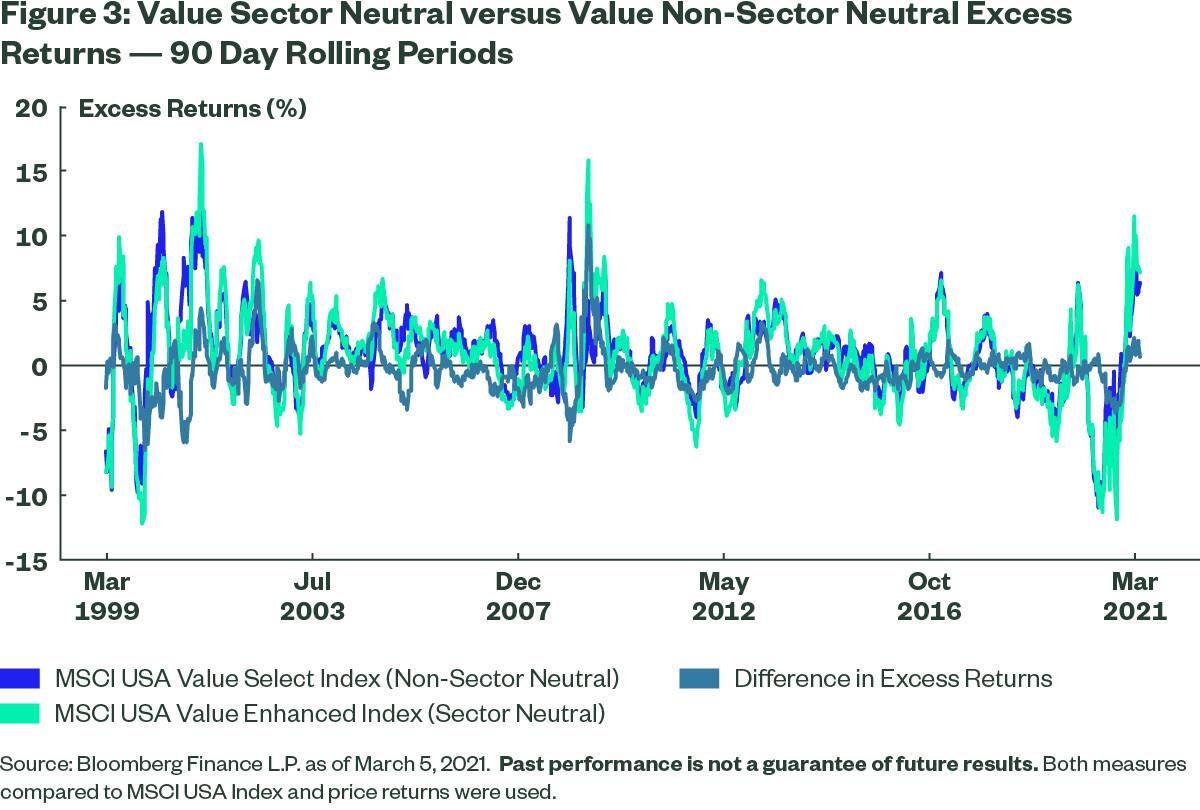

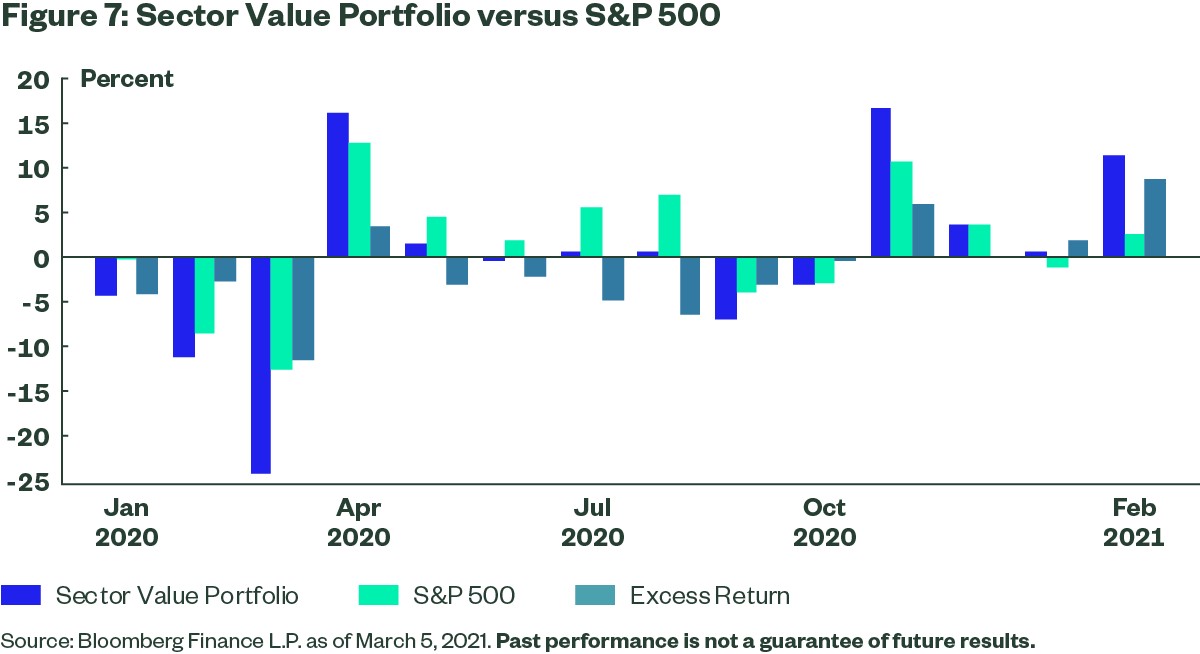

To find out if this worth rally relies on sector allocations, we will showcase the return of a sector impartial worth technique versus a equally constructed however non-sector impartial technique[2]. Each have had robust constructive extra returns thus far this yr, up versus the market by 11% and seven.7%, respectively[3]. Just like the evaluation on the composite method, the rolling 90-day returns plotted beneath present each worth building sorts have had outsized outperformance as of late, with the sector impartial publicity main. And the sector impartial publicity’s outperformance over the non-neutral benchmark signifies cheaper shares are outperforming costly shares regardless of the sector they reside in.

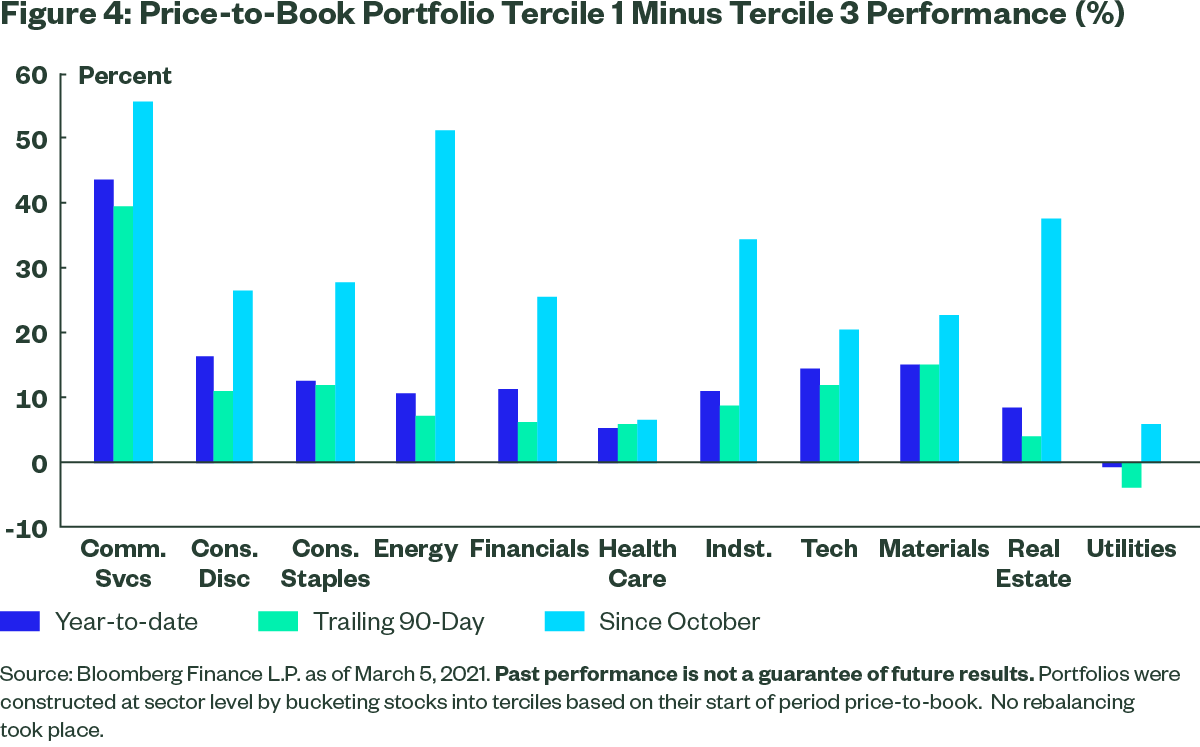

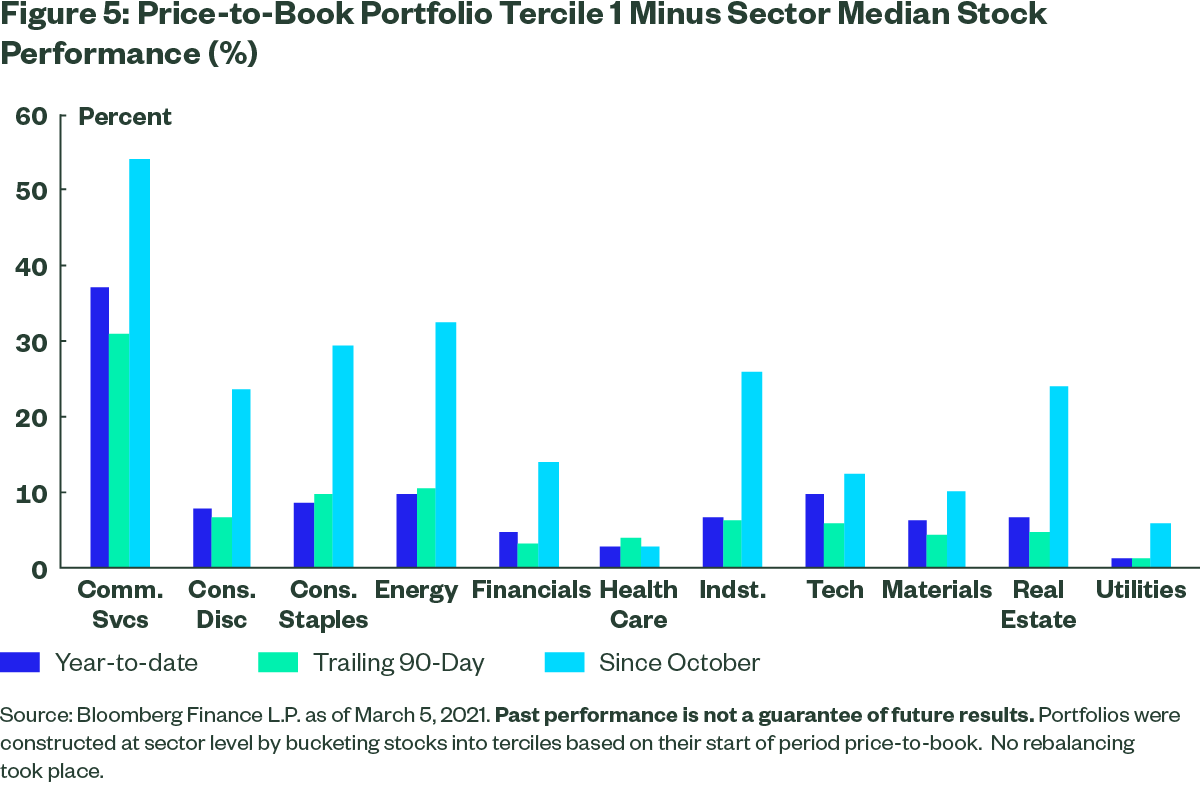

One other solution to showcase that is to separate every sector into terciles based mostly on a valuation measure. For this instance, I used price-to-book. Though this isn’t the proper measure, it matches tutorial analysis and controls for corporations with detrimental earnings – however is impacted by intangibles. With the Russell 1000 Index as the bottom universe, the highest tercile contains the most cost effective shares with the bottom price-to-book (P/B) and the underside tercile has the costliest shares. (Notice that these aren’t progress shares. Progress just isn’t absolutely the inverse of worth. These are simply high-priced shares).

Inside every tercile, the shares had been equally weighted. The efficiency of the sector tercile portfolios over the beforehand talked about time intervals (year-to-date, rolling 90 days, and because the finish of October 2020) is proven beneath. Relative to the median inventory return and the high-priced tercile, the “low cost” worth shares in each sector have outperformed because the finish of October. Solely low P/B shares within the Utilities sector have lately underperformed the median and high-priced third tercile. Total, nevertheless, the efficiency favors tercile one (low P/B or “low cost” shares), additional reinforcing how pervasive the worth rally has been.

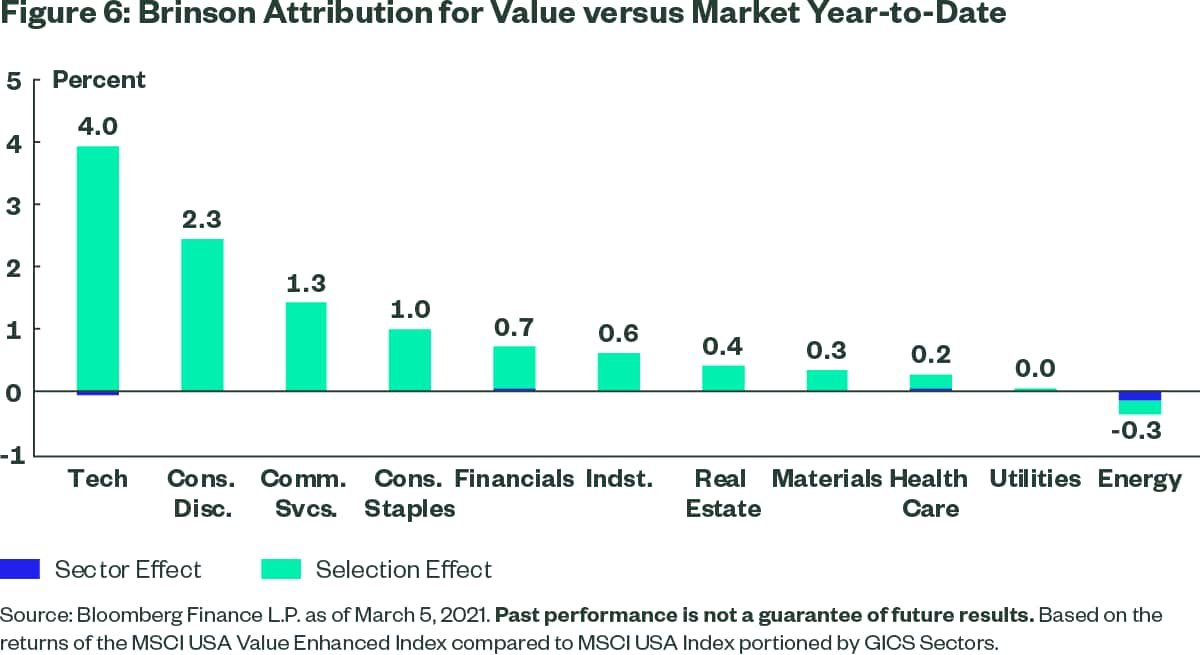

Performing Brinson attribution[4] of a price publicity to the broader market also can present whether or not sector results or choice results drove returns. The attribution for a sector impartial worth versus the broader market is proven beneath, and greater than 100% of the 11% outperformance by worth thus far this yr is pushed by choice impact – indicating the portfolio that targets low cost shares and weights them accordingly drove the returns.

This isn’t to say, nevertheless, that sector results should not enjoying a task. Fairly, the returns illustrate a depth to the worth rally that isn’t confined to the robust efficiency of sector XYZ. But, proudly owning simply low cost sectors has additionally produced robust returns. If we had been to create a price sector portfolio by rating every sector throughout 4[5] valuation metrics[6] – as we spotlight in our month-to-month chart pack – and equal weight the most cost effective three sectors to create a single portfolio (rebalanced month-to-month)[7] , this portfolio would additionally present robust extra returns relative to the market. It could have outperformed the market in every of the previous 4 months. This additional strengthens the notion that low cost stuff has actually rallied as of late, irrespective of the worth building method.

Okay however why now?

Worth buyers have performed the roles of Vladimir and Estragon over the previous decade, ready for worth (Godot) to return. In reality, on a rolling five-year foundation for the composite of all fourteen worth exposures mentioned earlier, the composite had constructive rolling return in solely 9% of the time interval observations over the previous decade – and none since 2016, as proven beneath. It has been a troublesome trip to say the least.

Worth’s continued resurgence relies upon two primary variables:

- A reflating of the financial system, benefiting price delicate equites – correlation and beta profile (55%/ 0.30) to charges is increased than each the market and progress disciplines (34%/0.12 and 27%/0.11, respectively)[8]

- Above market progress, plus enticing valuations at a time of stretched metrics elsewhere – Earnings-per-share progress (25%) is above that of progress kinds (20%) and the market (24%). And relative valuations for S&P 500 worth shares are within the backside decile throughout Worth-to-Subsequent-Twelve-Month-Earnings Ratio, Worth-to-Ebook Ratio, and Worth-to-Gross sales Ratio in comparison with high decile for S&P 500 progress shares.[9]

With each macro variables more likely to persist amid this renewed increased reflationary price regime, the worth rally could have extra room to run. To not point out, worth shares are beginning to exhibit robust value return momentum. A easy type of the highest 100 S&P 500 shares based mostly on 12-1 momentum[10] display screen now has 9% overlap on the finish of February to the extremely concentrated S&P 500 Pure Worth Index,[11] up from 3% at first of the yr. A extra intermediate momentum rating of 6-1 results in increased overlap, at the moment 40% versus 18% at first of the yr.

Total the worth rally has been robust and broad-based, irrespective of the definition. If this rally does proceed, investor positioning towards these extra price delicate equities could present robust above market returns whereas on the similar time mitigating the consequences of the speed reflationary regime shift on broadly allotted portfolios.

Initially revealed by State Road, 3/10/21

1 Primarily based on the returns of the S&P 500 Pure Worth Index and the S&P 500 Index based mostly on information from 1995 per Bloomberg Finance L.P. as of February 28, 2021

2 There are different variations in building when it comes to the descriptors used that may result in deviations past sector results, however sectors do have a significant impression on the variations in lively danger

3 Primarily based on the returns of the MSCI USA Worth Choose Index (non-sector impartial) and the MSCI USA Worth Enhanced Index

4 Brinson attribution refers to efficiency attribution based mostly on lively weights. There are completely different variations, however the results often embody allocation, safety choice, foreign money, and doubtlessly others.

5 Worth-to-Ebook, Worth-to-Gross sales, Worth-to-Earnings, and Worth-to-Subsequent-Twelve-Month Earnings

6 In earlier evaluation we used one metric as we’re evaluating intra-sector so we’re evaluating in opposition to like shares that could be impacted by among the valuation metrics shortcomings in an analogous approach (i.e. P/B to tech shares would understate intangibles of tech corporations, however it’s completed equally). For evaluating throughout sectors the place sure valuation metrics could present nook outcomes as a consequence of biases (e.g., intangibles) a composite method is extra sturdy.

7 For simplicity used finish of month rebalancing despite the fact that that introduces timing luck.

8 Bloomberg Finance L.P. as of February 26, 2021 based mostly on the month-to-month returns of the S&P 500 Pure Worth Index, S&P 500 Pure Progress Index, and S&P 500 Index versus the US 10 Yr Yield from 2/2016 to 2/2021

9 FactSet as of February 26, 2021 Worth-to-Subsequent-Twelve-Month-Earnings Ratio, Worth-to-Ebook Ratio, and Worth-to-Gross sales Ratio for S&P 500 Worth Shares are beneath the 10th percentile relative to the S&P 500 over the previous 15 years

11 Most up-to-date 12 months return minus the newest month

12 Roughly 120 holdings

13 Most up-to-date six month return minus the newest month

The views expressed on this materials are the views of SPDR Americas Analysis Crew and are topic to alter based mostly on market and different situations. This doc accommodates sure statements that could be deemed forward-looking statements. Please word that any such statements should not ensures of any future efficiency and precise outcomes or developments could differ materially from these projected.

The data offered doesn’t represent funding recommendation and it shouldn’t be relied on as such. It shouldn’t be thought of a solicitation to purchase or a proposal to promote a safety. It doesn’t take into consideration any investor’s explicit funding goals, methods, tax standing or funding horizon. It is best to seek the advice of your tax and monetary advisor.

All materials has been obtained from sources believed to be dependable. There is no such thing as a illustration or guarantee as to the accuracy of the data and State Road shall don’t have any legal responsibility for choices based mostly on such info.

All of the index efficiency outcomes referred to are offered completely for comparability functions solely. It shouldn’t be assumed that they symbolize the efficiency of any explicit funding.

Passively managed funds maintain a variety of securities that, within the mixture, approximates the complete Index when it comes to key danger elements and different traits. Passively managed funds make investments by sampling the index, holding a variety of securities that, within the mixture, approximates the complete Index when it comes to key danger elements and different traits. This may occasionally trigger the fund to expertise monitoring errors relative to efficiency of the index.

Actively managed funds don’t search to copy the efficiency of a specified index. The technique is actively managed and should underperform its benchmarks. An funding within the technique just isn’t acceptable for all buyers and isn’t supposed to be an entire funding program. Investing within the technique includes dangers, together with the danger that buyers could obtain little or no return on the funding or that buyers could lose half and even the entire funding.

Fairness securities could fluctuate in worth in response to the actions of particular person corporations and normal market and financial situations.

Volatility administration strategies could end in intervals of loss and underperformance could restrict the Fund’s potential to take part in rising markets and should improve transaction prices.

A momentum type of investing emphasizes securities which have had increased latest value efficiency in comparison with different securities, which is topic to the danger that these securities could also be extra unstable and might flip shortly and trigger important variation from different sorts of investments.

Investments in small-sized corporations could contain larger dangers than in these of bigger, higher identified corporations.

Corporations with massive market capitalizations go out and in of favor based mostly on market and financial situations. Bigger corporations are usually much less unstable than corporations with smaller market capitalizations. In trade for this doubtlessly decrease danger, the worth of the safety could not rise as a lot as corporations with smaller market capitalizations.

Worth shares can carry out in another way from the market as a complete. They will stay undervalued by the marketplace for lengthy intervals of time.

Due to their slim focus, sector funds are usually extra unstable.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.