By Stephen McBride If it weren’t for my spouse, I nonethele

By Stephen McBride

If it weren’t for my spouse, I nonetheless wouldn’t learn about that pile of cash.

My good friend John not too long ago advised me a loopy story over espresso. One which’s 100X extra highly effective than any “scorching inventory tip.”

“It was 1996,” he stated. “I used to be managing residence buildings and buying at Dwelling Depot 2–Three days per week. Each time I walked in there, the place was PACKED. I used to be simply getting began investing… however I knew I wanted a chunk of this enterprise.”

John enrolled of their direct inventory buy plan (DSPP), which robotically buys a set greenback quantity of shares frequently. “I put an preliminary $2,500 in, and set it as much as purchase $75 extra each month.”

For the primary couple months, John rigorously watched his account develop. Then the novelty wore off, and he forgot about it. John moved to Costa Rica and turned his consideration to actual property. After a profitable profession there, he and his household moved to Delray Seashore, Florida, in 2015.

“Right here we had been 20 years later, going over our funds. That’s when my spouse appeared up and requested: Honey, what ever occurred to these Dwelling Depot shares?”

John didn’t even know his password to log into his account. However when he lastly figured it out, he was shocked on the quantity. “It was $128,000.”

This Is The #1 Trait of Profitable Buyers

Just a few years in the past, brokerage agency Constancy performed a examine. The outcomes had been hilarious. They discovered that traders who carried out one of the best had one factor in frequent: They forgot they’d an account! These traders weren’t buying and selling out and in of positions. They weren’t attempting to catch the subsequent “high-flying” inventory. They weren’t attempting to “time” the market.

They weren’t doing something! But their portfolios had been blowing everybody else’s out of the water. This, and John’s story, reveals a vital investing fact. Proudly owning world-class companies—and holding them for the lengthy haul—is among the most dependable methods to construct lasting wealth.

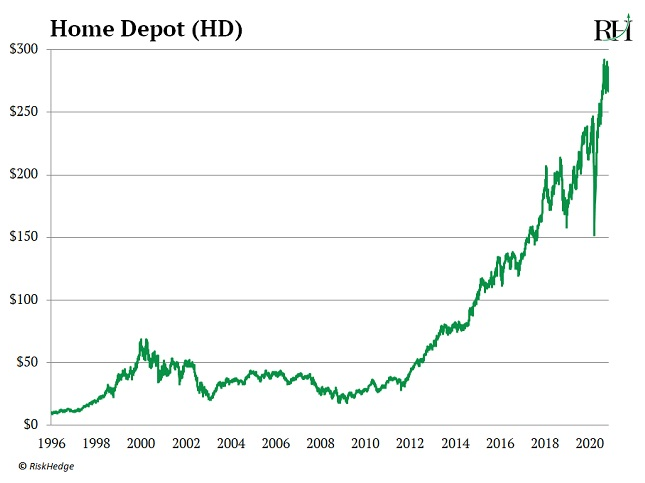

Now, John’s $128,000 nest egg didn’t seem in a single day. In reality, it took 20 years. But it surely was the least disturbing $100Okay he ever made. And the inventory’s nonetheless booming in the present day:

The factor with world-class companies is you don’t must log into your account day-after-day and monitor them. They’re easy. They resolve issues. And also you by no means have to fret about them “going out of favor.”

Proper now, persons are shopping for and renovating properties in droves now. And other people will proceed to purchase properties—and renovate them—for the subsequent hundred years. Bear in mind, John didn’t overthink his choice to leap on Dwelling Depot (HD). He noticed all the things he wanted the minute he set foot in that retailer 20 years in the past.

When It Involves These Companies, the Greatest Time to Promote Is “By no means”

The #1 mistake traders make when attempting to take a position this fashion is dumping world-class companies the minute they unload. We’re not speaking about penny shares right here. We’re speaking about proudly owning essentially the most dominant companies on the planet. You’re not going to get rich attempting to “time” your entry and exit factors completely.

After all, the problem is determining which dominators will stay dominant, and which of them are sitting geese to be disrupted. For each Dwelling Depot there’s an ExxonMobil (XOM).

Exxon reigned as one of many world’s most dominant firms for 40 years. From 1974 to 2014, anybody who invested a giant a part of their life financial savings in Exxon inventory appeared like a genius. However then all the things modified. Oil as our main supply of gasoline is on its method out. Exxon inventory has been a complete catastrophe, torching traders’ cash to the tune of -67% over the previous 6 years.

Disruption comes at you quick. So how do you inform the distinction between a real dominator and a sitting duck? I concentrate on the world dominators doing the disrupting, not those getting disrupted.

Two of my favorites proper now are on the coronary heart of one of the unstoppable traits on earth: the tip of the normal banks. And the rise of “new cash” disruptors. Particularly, I’m betting on Mastercard (MA) and Visa (V).

These guys don’t get practically as a lot consideration as scorching shares like Tesla or Netflix. However Visa and Mastercard have handed traders large positive aspects over the previous decade. I anticipate that to proceed for the subsequent decade and past.

If you happen to’re like the typical American, you carry 4 bank cards in your pockets. Whereas all of the playing cards are from completely different banks—and so they all have their very own particular privileges, prestigious names, and coloration schemes—most have one factor in frequent: “Visa” or “Mastercard” stamped on the underside proper.

It hardly issues what financial institution you utilize. Your card probably makes use of one in all these fee networks to perform. In reality, there are 3.four billion Visa and a couple of.6 billion Mastercard playing cards in circulation!

These are two of essentially the most persistently spectacular companies I’ve ever analyzed. They completely dominate the marketplace for shifting cash round, and can proceed to for a very long time.

Visa and Mastercard’s place on the core of the worldwide funds system makes them one of many most secure bets for the lengthy haul. In contrast to Exxon, they’re what I name “undisruptible.” And one of the best half? You should buy them, neglect about them, and get on together with your life. (And in case your partner asks about them years from now, chances are you’ll be shocked on the quantity in your account, too.)

The Nice Disruptors: Three Breakthrough Shares Set to Double Your Cash”

Get my newest report the place I reveal my three favourite shares that may hand you 100% positive aspects as they disrupt entire industries. Get your free copy right here.

Initially revealed by Mauldin Economics

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.