In 1905, the primary fuel pump appeared in St. Louis, Missouri, to fulfill the fueling calls for of a quickly rising variety of motorists. Earlier than this innovation, which resembled a handheld water pump, folks topped off their vehicles with gasoline they bought in cans on the pharmacy or ironmongery shop.

It wouldn’t be till 1913 that the primary purpose-built, drive-up fuel stations started popping up in cities everywhere in the U.S.

As of this 12 months, the nation has greater than 121,000 comfort shops that promote motor fuels. That determine doesn’t embody the tens of hundreds of supermarkets, kiosk fueling websites and different places that additionally promote gas.

However inner combustion engine (ICE) autos aren’t the one ones on the highway as we speak. By one estimate, there are some 26,000 electrical car (EV) charging stations open to the general public within the U.S. proper now, and if President Joe Biden will get his method, we’re going to wish an entire lot extra. 5 hundred thousand extra, to be extra exact.

Half of All Car Gross sales to Be Electrical by 2030?

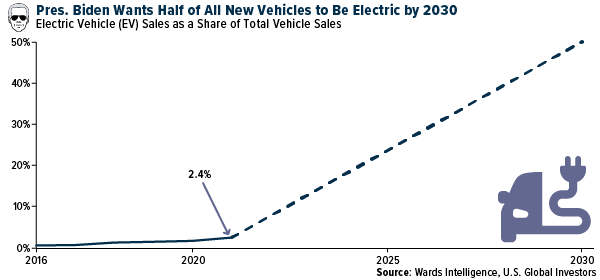

Final week, Biden set a aim for 50% of all autos bought within the U.S. to be “battery electrical, plug-in hybrid electrical or gas cell electrical” by the tip of the last decade.

That’s a tall order. Right this moment within the U.S., EV gross sales make up solely 2.4% of all car gross sales, in accordance with Wards Intelligence. Billions of funding {dollars} have flowed into EV producers—as a lot as $28 billion in 2020 alone—and plenty of billions extra will should be invested to fulfill Biden’s aim.

click on to enlarge

It’s not unimaginable, although. In a joint assertion following the president’s announcement, Normal Motors (GM) and Ford dedicated to attaining 40% to 50% of annual car gross sales to be EV by the tip of the last decade. GM believes it may attain a “zero-emissions, all electrical future” by 2035. Most carmakers, in actual fact, are making comparable pledges.

A Boon to Metals and Mining

The query buyers might need in mild of this information is find out how to place their portfolios. Investing in choose carmakers appears to be like engaging—we spend money on a number of ourselves, together with Tesla and Volkswagen—however my most popular strategy to get publicity is with the commodity producers supplying the metals and different supplies that might be required to ramp up EV manufacturing.

The metals that most individuals consider in terms of EVs are lithium or copper, the latter of which I’ve written about quite a few occasions. However it’s necessary to not overlook different key metals. Based on BloombergNEF, international nickel and aluminum demand may develop as a lot as 14 occasions between now and 2030, phosphorus and iron 13 occasions.

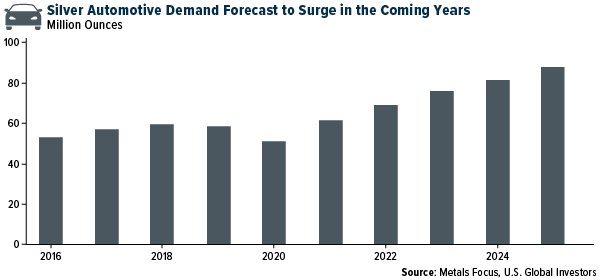

Silver demand also needs to profit over the approaching years. As essentially the most conductive metallic, silver might be more and more utilized in practically all parts of next-generation autos, together with switches, relays, breakers, fuses and extra.

click on to enlarge

Deciding on the best corporations to spend money on will be daunting. I’ve beneficial a number of prior to now 12 months. We like Nano One Supplies, which develops high-performance cathode supplies which might be utilized in extremely superior lithium-ion batteries. Customary Lithium, which has tasks in Arkansas and California, is up greater than 550% over the previous 12 months. For copper publicity, we proceed to wager on Ivanhoe Mines, which reported final week that its Kamoa-Kakula concentrator plant within the Democratic Republic of Congo reached business manufacturing on July 1.

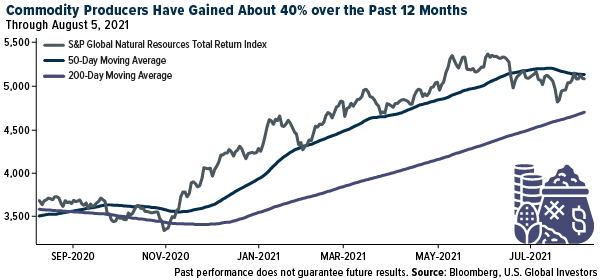

A doable answer could merely be to spend money on an actively-managed pure sources fund that tracks a diversified group of corporations concerned in metals and mining. Take the S&P International Pure Sources Index, which tracks 90 corporations. It’s up practically 40% over the previous 12 months, and the 50-day shifting common has remained above the 200-day since final September.

click on to enlarge

U.S. Manufacturing and Providers PMIs at Report Ranges

Contributing to my bullishness are the speed at which S&P 500 corporations are beating earnings expectations and final month’s stunningly optimistic manufacturing and providers PMI readings.

Up to now, 87% of corporations within the S&P 500 have reported outcomes for the second quarter, and of these, 87% have crushed Wall Avenue projections. If 87% had been the ultimate price for the quarter, it will mark the very best such proportion since FactSet started monitoring this information again in 2008.

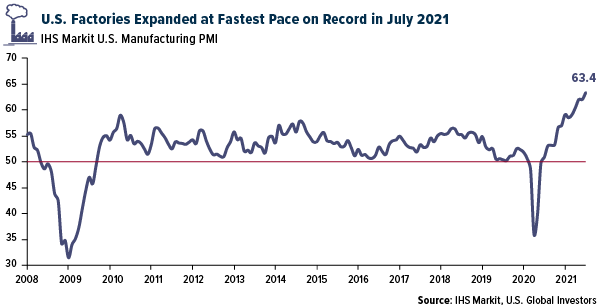

July’s IHS Markit Manufacturing PMI got here in at 63.4, essentially the most important enchancment in U.S. manufacturing unit working circumstances since information started in 2007. That is maybe “the strongest sellers’ market that we’ve seen… with suppliers climbing costs for inputs into factories on the steepest price but recorded and producers capable of elevate their promoting costs to an unprecedented extent,” says IHS Markit’s Chris Williamson.

click on to enlarge

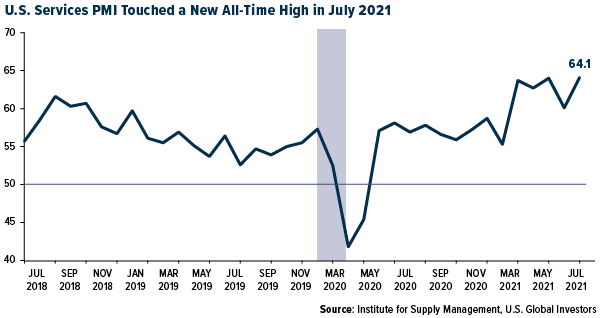

Service suppliers additionally had a blowout month. The Providers PMI registered a 64.1, additionally an all-time excessive and the 14th straight month of growth for the providers sector.

click on to enlarge

It’s necessary to do not forget that the PMI, or buying supervisor’s index, is forward-looking. It measures factories and repair suppliers’ expectations for development within the subsequent a number of months not less than. Once they’re extra optimistic, as they’re now, they’re extra prone to enhance orders for uncooked supplies (in producers’ case) and completed items (in service suppliers’ case).

And with the U.S. financial system having added near 1 million jobs for 2 months straight, I count on demand to stay sturdy.

For extra information, info, and technique, go to the ESG Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.