By Brie Williams, Head of Apply Administration, State Road

By Brie Williams, Head of Apply Administration, State Road

Adoption of ESG investing and asset progress has accelerated. You’ll be able to assist shoppers pursue their objectives by successfully integrating ESG ideas into portfolios.

Environmental social and governance (ESG) investing tends to land within the highlight throughout excessive occasions like the worldwide pandemic. Nevertheless, the pattern line is unmistakable: ESG investing has been rising for some time. Between 2017 and 2019, ESG investing grew by greater than a 3rd, to $30+ trillion, over 1 / 4 of the world’s professionally managed property.1 Some estimates say it might attain $50 trillion over the subsequent 20 years.2

However precisely what’s ESG investing? Some assume it’s all about investing for impression. Others assume it’s about imposing a sure set of values on corporations.

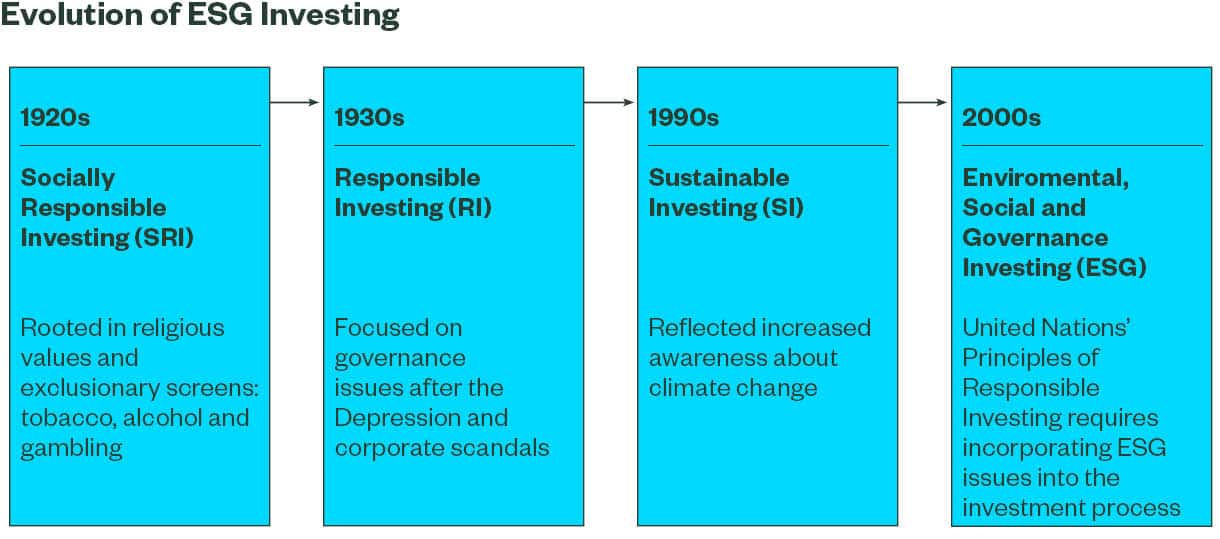

ESG is about informing higher decision-making by including the evaluation of fabric, environmental, social and governance points to the funding course of. It enriches conventional analysis like analyzing monetary statements, trade traits and firm progress methods.

What started as a automobile for expressing one’s values has advanced into a method of including worth to a portfolio. As State Road International Advisors President and CEO Cyrus Taraporevala observes, “Addressing materials ESG points is nice enterprise observe and important to an organization’s long-term monetary efficiency—a matter of worth, not values.”

Incorporate new views on worth and efficiency

Latest analysis highlighting long-term risk-adjusted returns and decrease draw back has challenged the notion that ESG investing might imply sacrificing returns.3 Moreover, State Road International Advisors’ personal analysis finds that 69% of ESG adopters say that pursuing an ESG technique has helped with managing volatility. Seventy-five % anticipate the identical returns from these investments as they do from others.4

But, whereas the potential advantages of ESG investing have gotten extra clear, generally the trail for shoppers to take isn’t as apparent. The rising variety of ESG choices displays the variety of investor goals, together with:

- Managing dangers

- Aligning investments with values

- Pursuing sustainable efficiency

Some of those goals span completely different ESG methods to various levels. And they don’t seem to be mutually unique—a number of ESG methods could be mixed in a single funding automobile to attain the investor’s particular objectives. Regardless of the consumer’s goal, monetary advisors might want to optimize ESG funding alternatives throughout a vary of asset lessons and the chance spectrum.

Combine ESG ideas successfully

Efficient integration of ESG ideas right into a portfolio begins with a client-focused course of, not a product-focused course of. Utilizing a client-centric method requires advisors to establish appropriate ESG methods, supply helpful training, and observe shoppers’ progress towards longer-term goals. Our three-step framework can assist advisors focus consumer conversations on key issues:

1. Evaluation all of the angles to establish a transparent entry level

- Decide if and the way integrating ESG investing matches into the consumer’s long-term plan.

- Educate as a part of the invention course of. Make clear the motivation to tell the journey, slender the main focus and form priorities.

- Goal alternatives to establish assets and ESG funding technique choice.

Be mindful: What are the consumer’s funding goals? What are the consumer’s ESG priorities? The place are the market alternatives?

2. Hold danger in perspective

- Choose the diploma of ESG integration.

- Assess the broader asset allocation to maintain the funding plan correctly balanced. Keep away from introducing sector or fashion biases.

- Evaluation private values and danger framework with shoppers to assist them perceive ESG investing issues.

Be mindful: What are the consumer’s desired consequence priorities? Is ESG all or simply a part of a consumer’s portfolio allocation?

3. Take the lengthy view

- Perceive the consumer’s perspective and align expectations on non-financial outcomes and reporting.

- Outline success as a part of the funding plan.

- Modify ongoing reporting to deal with consumer’s priorities. Adapt portfolio as motivations shift.

Be mindful: What’s the consumer’s time horizon and meant impression? How is the consumer defining and measuring success?

Wanting forward

ESG permits shoppers to take a position with higher precision—to use a broader lens to extra deeply analyze investments. Whether or not they wish to match investments with their mission or pursue enhancing long-term efficiency, ESG can assist meet their objectives. It’s a brand new approach of valuing the long run.

For extra on advising shoppers about ESG investing, you possibly can learn “Goal Larger: Serving to Traders Transfer from Ambition to Motion with ESG Funding Approaches.”

Initially revealed by State Road International Advisors, 8/12/20

1 State Road International Advisors. “Into the Mainstream: ESG on the Tipping Level.” November 2019.

2 www.cnbc.com. “Your full information to investing with a conscience, a $30 trillion market simply getting began.” December 14, 2019.

3 Gunnar Friede, Timo Busch & Alexander Bassen, “ESG and monetary efficiency: aggregated proof from greater than 2000 empirical research”, Journal of Sustainable Finance & Funding, Quantity 5, Concern 4, p. 210-233, 2015. Benice Napach, “ESG-Centered Funds Are Outperforming Throughout Pandemic, Assume Advisor, Could 21, 2020. Morningstar, “How Did ESG Indexes Fare In the course of the First Quarter Promote-off?” April 8, 2020.

4 State Road International Advisors. “Performing for the Future.” 2017 Survey.

The returns on a portfolio of securities which exclude corporations that don’t meet the portfolio’s specified ESG standards might path the returns on a portfolio of securities which embody such corporations. A portfolio’s ESG standards might consequence within the portfolio investing in trade sectors or securities which underperform the market as an entire.

Investing entails danger together with the chance of lack of principal.

The entire or any a part of this work is probably not reproduced, copied or transmitted or any of its contents disclosed to 3rd events with out State Road International Advisors’ specific written consent.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.