By Frank Holmes With two weeks remaining till the November

By Frank Holmes

With two weeks remaining till the November Three election, nationwide polls present that former Vice President Joe Biden maintains a lead over President Donald Trump.

You’d be excused for not placing any religion in such polls, as they solely misled voters 4 years in the past. What’s extra, although Trump has a traditionally low approval score heading into the election, the percentages are stacked towards Biden. Since 1900, solely 5 incumbents (Taft, Hoover, Ford, Carter and H. W. Bush) have misplaced to their presidential challengers.

And but, it could be time to face the true risk that Biden shall be sworn in come this January. We might additionally see a so-called “blue wave,” whereby the Democrats choose up management of not simply the White Home but additionally each chambers of Congress.

This improvement would absolutely have a huge effect on markets, and I anticipate there to be some rotation out of Republican-friendly industries (fossil fuels, as an illustration) and into these poised to profit from potential insurance policies enacted by a President Biden and Democratic-controlled Congress.

Earlier than persevering with, I ought to level out that right here at U.S. International Traders, we’re politically agnostic and don’t have any specific choice as to which celebration is in energy. It’s the insurance policies that matter above all else, and we select to see alternatives the place different companies and buyers may even see solely roadblocks.

New Fiscal Stimulus May Assist Renewables Proceed to Outperform

Wanting simply at pure assets, we consider the place to be in anticipation of a “blue wave” is renewable power. That features not simply wind and photo voltaic producers but additionally the mineral producers that offer these firms. We notably like copper and nickel since they’re among the many metals that would see a rise in international demand alongside the electrification of every thing from our vehicles and buses to your complete energy grid.

The case for renewables ought to be obvious, however simply in case, let’s take a look at what Biden has proposed. In mid-July, the candidate unveiled an bold clear power plan value $2 trillion, or 2.Four p.c of U.S. gross home product (GDP). The long-term objective is for the U.S. to be carbon-free no later than 2050, however earlier than then, Democrats are eyeing 2035 because the 12 months when 100 p.c of all electrical energy within the U.S. is generated with out fossil fuels.

Immediately, solely 18 p.c of U.S. electrical energy comes from renewables. As I mentioned, the plan is bold.

Demand for oil and different fossil fuels is predicted to proceed rising on an annual foundation for a while longer, however the pandemic has uncovered severe vulnerabilities. The Group of Petroleum Exporting International locations (OPEC) estimated in its September report that the worldwide recession has diminished 2020’s oil demand by an unbelievable 9.5 million barrels a day.

Even earlier than the pandemic, conventional power markets had been struggling regardless of Trump’s steps to decontrol the trade. From his inauguration in January 2017 to the tip of 2019, power was the one S&P 500 sector to ship a destructive return, down 16.6 p.c. Yr-to-date by October 13, power is one in all 5 sectors with a destructive return, and but it’s down probably the most at destructive 48.9 p.c.

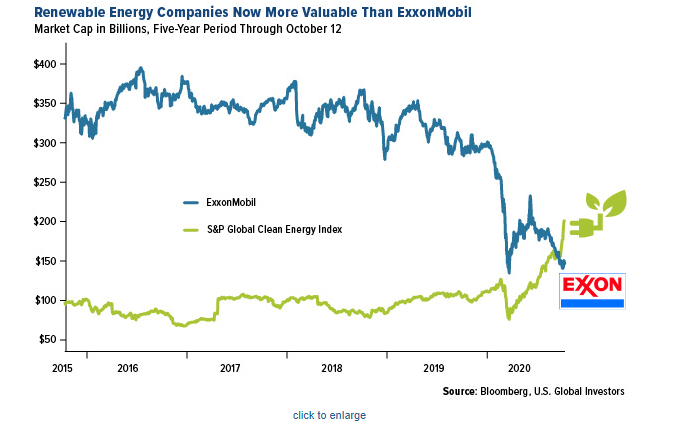

The S&P International Clear Vitality Index, however, is up 80.Zero p.c year-to-date by October 13, with half of these positive aspects made within the final 30 days alone. This implies to me that buyers could also be positioning for a possible Biden victory.

A major shift in investor sentiment towards renewables already passed off earlier this 12 months when the collective market cap of unpolluted power shares surpassed that of oil big ExxonMobil. The clear power group—which incorporates firms like Vestas Wind Programs, Plug Energy, Sunrun and Siemens Gamesa Renewable Vitality (SGRE)—is now valued at slightly below $200 billion, in comparison with Exxon at $145 billion. That’s down considerably from a market cap of half a trillion {dollars} in 2007.

Report Renewable Demand in Europe

Demand for renewable power isn’t restricted to the U.S., in fact. Europe is residence to among the greatest wind power companies, together with Vestas (Denmark) and SGRE (Spain)—we personal each in our International Assets Fund (PSPFX)—and over the previous decade we’ve seen demand for renewables develop at an uninterrupted tempo.

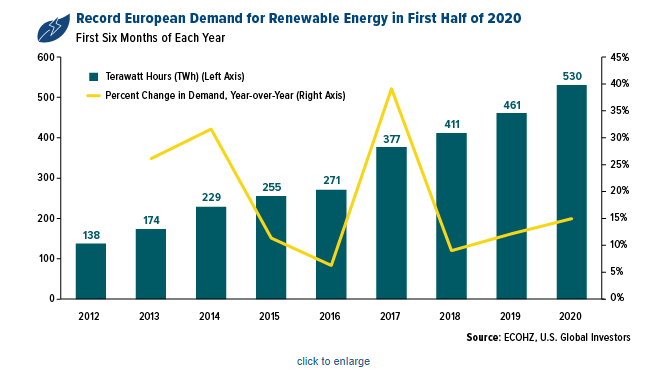

In response to an October eight report, the Norwegian power agency ECOHZ introduced that European demand for renewable power hit a brand new all-time excessive within the first half of 2020, regardless of the pandemic. Demand hit 530 terawatt hours (TWh) within the first six months of the 12 months, a rise of 15 p.c over 2019. The determine isn’t solely increased than any previous first half to a 12 months, nevertheless it’s additionally increased than most full years, 2019 being the one exception.

Vestas is scheduled to report third-quarter earnings on November 4, and we’re anticipating to see increased revenues and margins on robust orders. What makes Vestas notably engaging is its fast-growing service enterprise. It has round 105 gigawatts (GW) of wind generators underneath service, with a mean service length of round 9 years per turbine. This helps guarantee a dependable income stream over a great time period.

Infrastructure May Additionally Be a Beneficiary

Let’s return to the U.S. One other beneficiary of the Democrats’ spending objectives, ought to they arrive into energy, is infrastructure, with potential windfalls accessible to firms concerned in building and constructing supplies, mass transit, air transportation, broadband and extra.

Traders can get a good suggestion of the place lawmakers may allocate spending within the $1.5 trillion “Shifting Ahead Act,” handed in July by the Democrat-controlled Home however by no means taken up by the Republican-controlled Senate. Amongst different issues, the invoice contains $494 billion for highways, mass transit and rail; $300 billion for current roads and bridges; and $70 billion for renewable power.

Biden has mentioned he hopes to offer high quality transportation to all People in municipalities of over 100,000 individuals by 2030. That entails bettering current bus strains in addition to putting in light-rail networks.

It ought to be famous that Trump has additionally been in favor of spending extra on infrastructure for your complete length of his presidency up to now, and may he win reelection, it’s attainable he could ask Congress for a invoice in some unspecified time in the future in his second time period. In June, it was being reported that the Trump administration would quickly be releasing its personal infrastructure plan, rumored to be valued at $1 trillion, however as of at the moment no particulars have emerged.

Overweighting Renewables, Underweighting Fossil Fuels

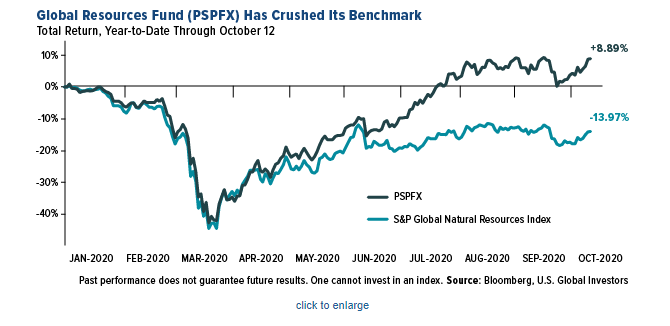

In case you recall from one in all my posts again in February of this 12 months, we started taking steps to pivot away from fossil fuels and into renewable power in our International Assets Fund (PSPFX). Moreover Vestas and SGRE, we preserve positions in Canadian Photo voltaic, Atlantica Sustainable Infrastructure and Plug Energy, whereas underweighting our publicity to grease and gasoline explorers and producers. As of September 30, our largest oil place, at 1.40 p.c, was Russia’s Lukoil, which we like for its beneficiant dividend yield and progress charge (12.68 p.c and 116.80 p.c, respectively, for the 12-month interval by October).

That is in stark distinction to the fund’s benchmark, the S&P International Pure Assets Index, which has completely no publicity to wind, photo voltaic or hydro as of September 30.

What’s extra, the pure assets index has restricted publicity to producers of sure metals, together with copper, which may be in increased demand within the years to return as renewables’ share of power technology will increase.

As of September 30, the primary place in PSPFX was copper explorer Ivanhoe Mines. Different copper-focused companies embody Chakana Copper and CopperBank Assets. These firms can’t be discovered within the S&P International Pure Assets Index.

I feel the outcomes communicate for themselves. Under you’ll be able to see the efficiency of PSPFX in comparison with the benchmark year-to-date by October 12. Following March’s market backside as a result of pandemic, PSPFX started to decouple from the benchmark. It was up almost 9 p.c, whereas the benchmark was down 14 p.c over the identical interval.

Even in the event you missed the run-up up to now this 12 months, I don’t consider it’s too late to begin taking part. Quite a lot of the buying and selling since March has been sentiment-driven, however ought to there be a “blue wave” subsequent month, and if insurance policies are enacted that favor renewables, I might anticipate there may be potential to see even additional positive aspects.

I invite you to think about PSPFX as your entry to renewable power. Discover the fund at the moment by clicking right here.

Initially revealed by U.S. Funds, 10/21/20

Please click on right here to see the PSPFX prospectus.

Foreside Fund Providers, LLC, Distributor. U.S. International Traders is the funding adviser.

| Fund | One-Yr | 5-Yr | Ten-Yr | Gross Expense Ratio |

|---|

| International Assets Fund (PSPFX) | 12.81% | 3.61% | -4.14% | 1.58% |

| S&P International Pure Assets Index | -10.20% | 6.00% | -0.43% | n/a |

Expense ratios as acknowledged in the latest prospectus. The Adviser of the International Assets Fund has voluntarily restricted whole fund working bills (unique of acquired fund charges and bills of 0.02%, extraordinary bills, taxes, brokerage commissions and curiosity, and advisory payment efficiency changes) to not exceed 1.90%. Complete annual bills after reimbursement had been 1.58%. Efficiency knowledge quoted above is historic. Previous efficiency isn’t any assure of future outcomes. Outcomes replicate the reinvestment of dividends and different earnings. For a portion of intervals, the fund had expense limitations, with out which returns would have been decrease. Present efficiency could also be increased or decrease than the efficiency knowledge quoted. The principal worth and funding return of an funding will fluctuate in order that your shares, when redeemed, could also be value roughly than their unique price. Efficiency doesn’t embody the impact of any direct charges described within the fund’s prospectus which, if relevant, would decrease your whole returns. Efficiency quoted for intervals of 1 12 months or much less is cumulative and never annualized. Get hold of efficiency knowledge present to the latest month-end at www.usfunds.com or 1-800-US-FUNDS.

Investing entails danger. Principal loss is feasible. International and rising market investing entails particular dangers equivalent to forex fluctuation and fewer public disclosure, in addition to financial and political danger. As a result of the International Assets Fund concentrates its investments in particular industries, the fund could also be topic to larger dangers and fluctuations than a portfolio representing a broader vary of industries.

The S&P 500 Index is extensively considered the perfect single gauge of large-cap U.S. equities and serves as the muse for a variety of funding merchandise. The index contains 500 main firms and captures roughly 80% protection of accessible market capitalization. The S&P International Pure Assets Index contains 90 of the biggest publicly-traded firms in pure assets and commodities companies that meet particular investability necessities, providing buyers diversified, liquid and investable fairness publicity throughout Three main commodity-related sectors: agribusiness, power and metals & mining. The S&P International Clear Vitality Index offers liquid and tradable publicity to 30 firms from world wide which can be concerned in clear power associated companies. The index is comprised of a diversified mixture of Clear Vitality Manufacturing and Clear Vitality Know-how and Gear Suppliers firms. It’s not attainable to put money into an index.

There isn’t any assure that the issuers of any securities will declare dividends sooner or later or that, if declared, will stay at present ranges or improve over time. The dividend yield is the annual dividends per share divided by the value per share, expressed as a proportion.

Fund portfolios are actively managed, and holdings could change every day. Holdings will not be suggestions to purchase or promote a safety and are reported as of the latest quarter-end. Holdings within the International Assets Fund as a proportion of internet property as of 9/30/2020: Ivanhoe Mines Ltd. 3.99%, Vestas Wind Programs A/S 3.33%, Canadian Photo voltaic Inc. 2.45%, Siemens Gamesa Renewable Vitality S.A. 1.96%, Atlantica Sustainable Infrastructure PLC 1.71%, Lukoil PJSC 1.40%, Plug Energy Inc. 1.34%, Chankana Copper Corp. 1.00%, CopperBank Assets Corp. 0.99%, Exxon Mobil Corp. 0.00%, Sunrun Inc. 0.00%.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.