By John Patrick Lee, CFA, Product Supervisor, VanEck Who ma

By John Patrick Lee, CFA, Product Supervisor, VanEck

Who may have predicted {that a} free recreation would earn more money than every other online game in a single 12 months? That’s precisely what Fortnite did in 2018, when it introduced in about $2.4B. It’s a distinguished instance of how in-game spending has revolutionized the online game ecosystem.

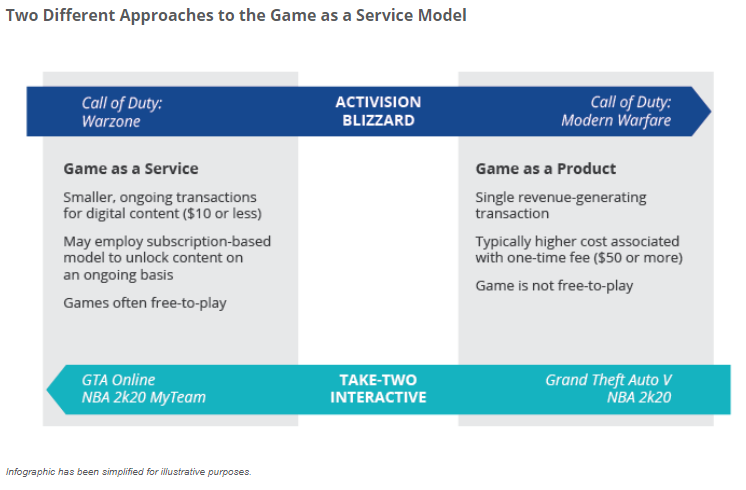

Within the conventional enterprise mannequin, referred to as “recreation as a product”, a recreation writer develops a recreation after which sells it to the buyer for a single, revenue-generating price. After the buyer buys the sport, the online game writer has to develop one other online game or add-on to generate further revenues from that shopper.

Within the mid-2000s, online game publishers started testing the “recreation as a service” mannequin. On this mannequin, the buyer might bypass the preliminary price of buying the sport, after which pay ongoing charges to proceed taking part in the sport and accessing content material. There are a variety of various methods the sport writer can generate revenues beneath this mannequin, together with recreation subscriptions, microtransactions and season passes. Whereas transactions within the service mannequin might entail smaller quantities, the writer opens the door to an indefinite buying lifespan from every shopper, which might enhance the entire revenues generated from a single recreation.

This enterprise mannequin serves three key functions from the writer’s perspective. It extends the lifecycle of video games being performed by customers, will increase the utmost income potential from a single shopper and lowers the hurdle for brand spanking new potential paying clients to attempt the sport earlier than deciding to spend. Publishers are embracing this new mannequin as a approach to drive income progress. Nonetheless, totally different publishers are tailoring their in-game spending technique relying on their particular product lineup. Activision Blizzard and Take-Two Interactive have every adopted very totally different approaches to implementing this enterprise mannequin.

Activision Blizzard: From Free to Premium

Blizzard Leisure (now a division of Activision Blizzard) was one of many pioneers of this new income mannequin. It launched World of Warcraft in 2004, an MMORPG that allowed gamers the choice to purchase a month-to-month, ongoing subscription to entry the complete, unlocked recreation. Presently, Activision Blizzard is using the in-game income mannequin throughout plenty of totally different video games and platforms.

Name of Responsibility: Warzone is a free-to-play recreation that has been downloaded and performed by no less than 75 million folks world wide since its launch in Q1 2020.

- Warzone serves as a standalone income supply by way of its Battle Cross subscription and digital merchandise choices (resembling skins and weapons).

- Warzone additionally serves as a kind of free trial for gamers, who might then go on to purchase the complete Name of Responsibility: Trendy Warfare recreation, beneath the normal “recreation as product” mannequin.

- In Activision’s Q2 2020 earnings report, the corporate famous that Trendy Warfare (the paid model) “added extra gamers outdoors of a launch quarter to the premium Name of Responsibility expertise than ever earlier than, with the bulk coming by way of upgrades from Warzone.”1

- On this instance, Activision Blizzard has efficiently used a free to play recreation (Warzone) to draw hundreds of thousands of latest gamers, which in flip elevated gross sales of their premium recreation (Trendy Warfare) beneath the normal recreation as a product paradigm.

Take-Two Interactive: From Product to Service

Take-Two Interactive coined the phrase “recurrent shopper spending” and defines it as income generated from ongoing shopper engagement, together with digital foreign money, add-on content material and in-game purchases. These income streams are particularly grouped to exclude the preliminary recreation buy.

In line with Take-Two, recurrent shopper spending elevated 52% and accounted for 58% of complete GAAP web income as of the fiscal Q1 2021 quarterly earnings report.2 “The most important contributors to GAAP web income in fiscal first quarter 2021 had been Grand Theft Auto® On-line and Grand Theft Auto V; NBA® 2K20; Pink Lifeless Redemption 2 and Pink Lifeless On-line.”3

- Recurrent shopper spending now represents nearly all of web revenues for Take-Two, suggesting that the corporate will proceed to launch content material and video games that facilitate in-game spending.

- Grand Theft Auto V was launched in 2013, however remains to be the highest income supply for the corporate. On this case, customers initially bought the sport (recreation as a product) earlier than having an opportunity to make additional in-game purchases (recreation as a service).

Video Gaming and Esports: Taking Media and Leisure to the Subsequent Degree

Activision and Take-Two have basically adopted reverse approaches to the sport as a service mannequin. Activision’s launch of a free-to-play recreation helps drive customers to buy a standard recreation, whereas Take-Two requires an upfront recreation buy earlier than customers are capable of spending extra on in-game gadgets.

Recurrent in-game spending is among the many developments which are driving the expansion of the video gaming trade and making this house, in our view, a compelling funding alternative. The whitepaper, Video Gaming and Esports: Taking Media and Leisure to the Subsequent Degree, gives an in-depth take a look at what’s driving the long-term potential of this house, in addition to how traders can incorporate it into their portfolio.

Initially revealed by VanEck, 11/4/20

DISCLOSURES

1 Supply: Activision Blizzard Q2 2020 Earnings Report

2 Take-Two Interactive Software program, Q1 2021 Earnings Report

3 Ibid.

Please word that Van Eck Securities Company (an affiliated broker-dealer of Van Eck Associates Company) might provide investments merchandise that spend money on the asset class(es) or industries included on this weblog.

This isn’t a proposal to purchase or promote, or a advice to purchase or promote any of the securities/monetary devices talked about herein. The knowledge offered doesn’t contain the rendering of personalised funding, monetary, authorized, or tax recommendation. Sure statements contained herein might represent projections, forecasts and different ahead wanting statements, which don’t replicate precise outcomes, are legitimate as of the date of this communication and topic to vary with out discover. Info offered by third social gathering sources are believed to be dependable and haven’t been independently verified for accuracy or completeness and can’t be assured. The knowledge herein represents the opinion of the creator(s), however not essentially these of VanEck.

All investing is topic to danger, together with the attainable lack of the cash you make investments. As with every funding technique, there isn’t any assure that funding aims might be met and traders might lose cash. Diversification doesn’t guarantee a revenue or defend in opposition to a loss in a declining market. Previous efficiency is not any assure of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.