Shares and index ETFs are blended to increased once more o

Shares and index ETFs are blended to increased once more on Thursday, constructing momentum following a decline in sentiment that was associated to a probably smaller coronavirus help bundle.

After a pullback earlier within the session from over 155 factors, the Dow Jones Industrial Common is now simply 0.27% increased. The S&P 500 superior by 0.63%, whereas the Nasdaq Composite restricted its positive aspects so as to add 0.6%.

The main inventory index ETFs are additionally trying a run increased Thursday together with their underlying benchmarks, because the SPDR Dow Jones Industrial Common ETF (DIA) improved barely, whereas the SPDR S&P 500 ETF Belief (SPY), and Invesco QQQ Belief (QQQ) are each climbing as of 1215PM EST. The iShares Core S&P 500 ETF (IVV) gained over 0.5% Thursday as nicely.

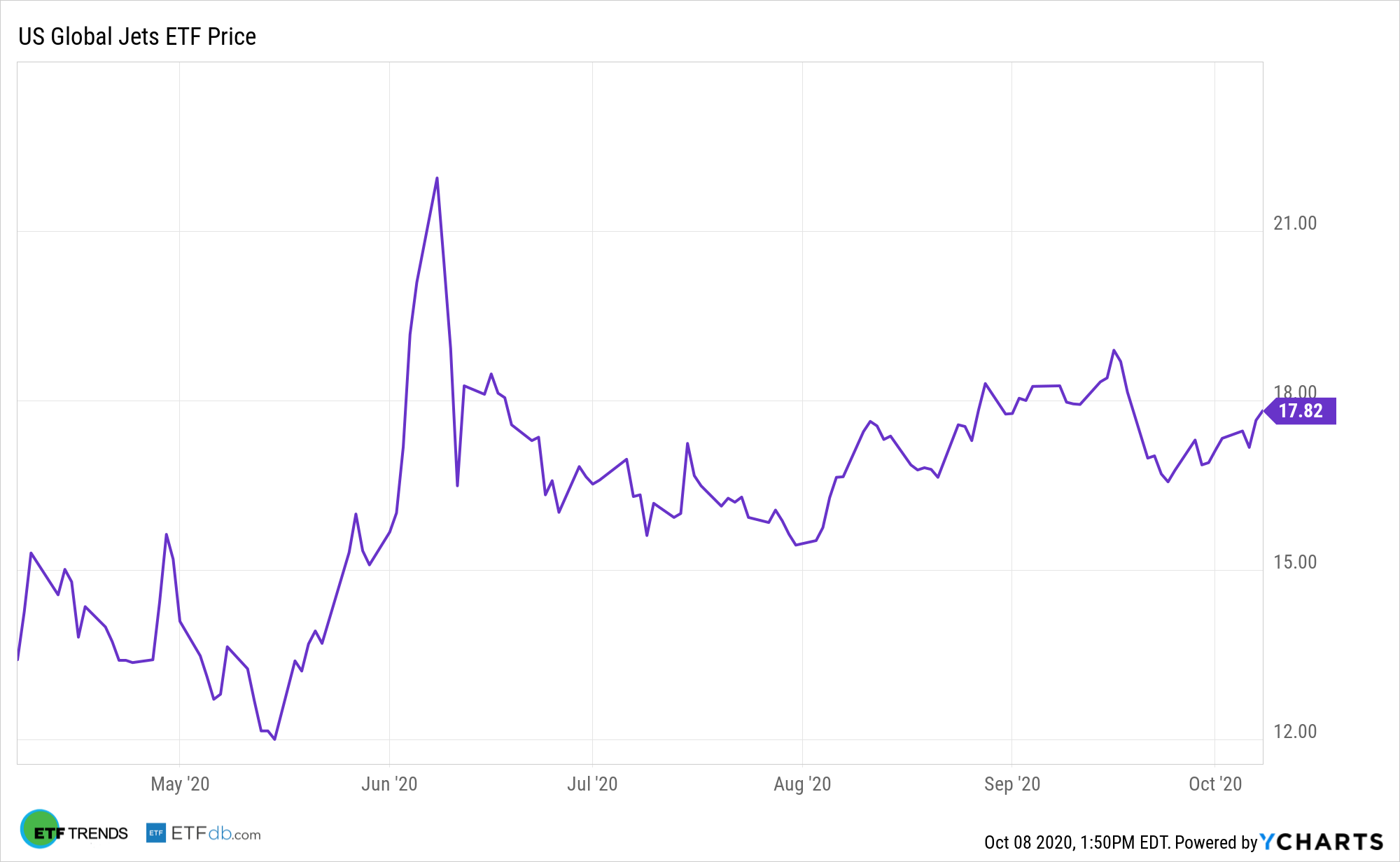

Nancy Pelosi informed reporters there won’t be a a lot anticipated impartial stimulus invoice for airways with no extra substantial help bundle, driving airline shares decrease on the day, even the U.S. World Jets ETF (JETS) has managed to maintain a slight acquire of 0.45%.

The blended market follows a strong efficiency by shares on Wednesday, the place the Dow had its greatest day since mid July, gaining over 1%., whereas the S&P 500 and Nasdaq have been added 1% in the course of the earlier session as nicely.

Stimulus Possible, However Nonetheless Unsure

Most analysts now appear assured that additional coronavirus stimulus will finally happen, however advise traders to guard portfolios by acceptable diversification measures.

“Though there’s uncertainty now in regards to the fiscal stimulus negotiations, no matter who wins the election, we’re more likely to have extra fiscal stimulus,” mentioned Nancy Davis, founder and portfolio supervisor at Quadratic Capital.

“With the uncertainty, I feel it’s vital for traders to have a diversified portfolio, with investments which are uncorrelated to one another. We must always anticipate extra uncertainty going ahead,” she added.

Regardless of disappointing claims information Thursday, which revealed that 840,000 extra Individuals filed for unemployment advantages for the primary time, versus the complete 825,000 first-time claims that Dow Jones predicted for the week ending Oct. 3, markets appear to be attaining some traction because the sizable drop in September.

Nevertheless, numerous dangers are nonetheless current for traders, together with growing international coronavirus circumstances and a sluggish price of financial restoration. This makes it doubtless that traders might encounter heightened volatility in the meanwhile.

“The dangers we at the moment are dealing with—medical, financial, and political—have waxed and waned over the yr, so a troublesome quarter will probably be nothing new,” famous Brad McMillan, Chief Funding Officer for Commonwealth Monetary Community. “In reality, after the election, there’s a good probability subsequent yr will look significantly better. We must wait and see, however for the second, be ready for volatility — however bear in mind that it’s going to go,” he added

For extra market traits, go to ETF Traits.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.