Alibaba (NYSE:BABA) not too long ago drew the ire of Beijing, reminding traders that political threat is a vital difficulty to think about in rising markets. Nonetheless, the WisdomTree China ex-State-Owned Enterprises Fund (NasdaqGM: CXSE) deserves consideration on this surroundings.

CXSE tracks Chinese language firms that aren’t state-controlled. State-owned enterprises are outlined as authorities possession of greater than 20% of excellent shares of firms, in keeping with WisdomTree.

With Beijing more and more scrutinizing Chinese language tech firms, traders have to do their homework.

“Chinese language know-how firms have been within the highlight recently, and some under-reported particulars stand out,” notes Liqian Ren, WisdomTree director of Trendy Alpha. “When the Ant Monetary IPO was delayed, hypothesis grew about how Chinese language regulators would prohibit the corporate. As anticipated, its monetary providers are going to be structured below the regulation of a monetary holding firm. One element that went unanswered is, what to do with Ant’s know-how arm? For my part, it could be spun right into a separate tech firm that will enhance its valuation.”

A Shopping for Alternative for ‘CXSE’?

The Alibaba and Ant Group hoopla took a toll on CXSE, sending the alternate traded fund down nearly 19% from its 52-week excessive.

“The most important query for Ant and Alibaba within the subsequent 5 years is whether or not they can compete, develop and earn cash in a really aggressive house for Chinese language know-how,” provides Ren. “The 34 firms on this record (going through regulatory scrutiny) present the challenges and alternatives, as Ant continues to be the highest non-state-owned monetary entity with the least competitors from different non-state-owned enterprises, whereas Alibaba’s different major companies have loads of sturdy rivals.”

Nevertheless, current weak point in CXSE may show to be a shopping for alternative for long-term traders. Over longer holding durations, CXSE typically tops conventional China benchmarks. Prior to now yr, the WisdomTree ETF is larger by 60.71%, in comparison with a acquire of 37.65% for the general MSCI China Index.

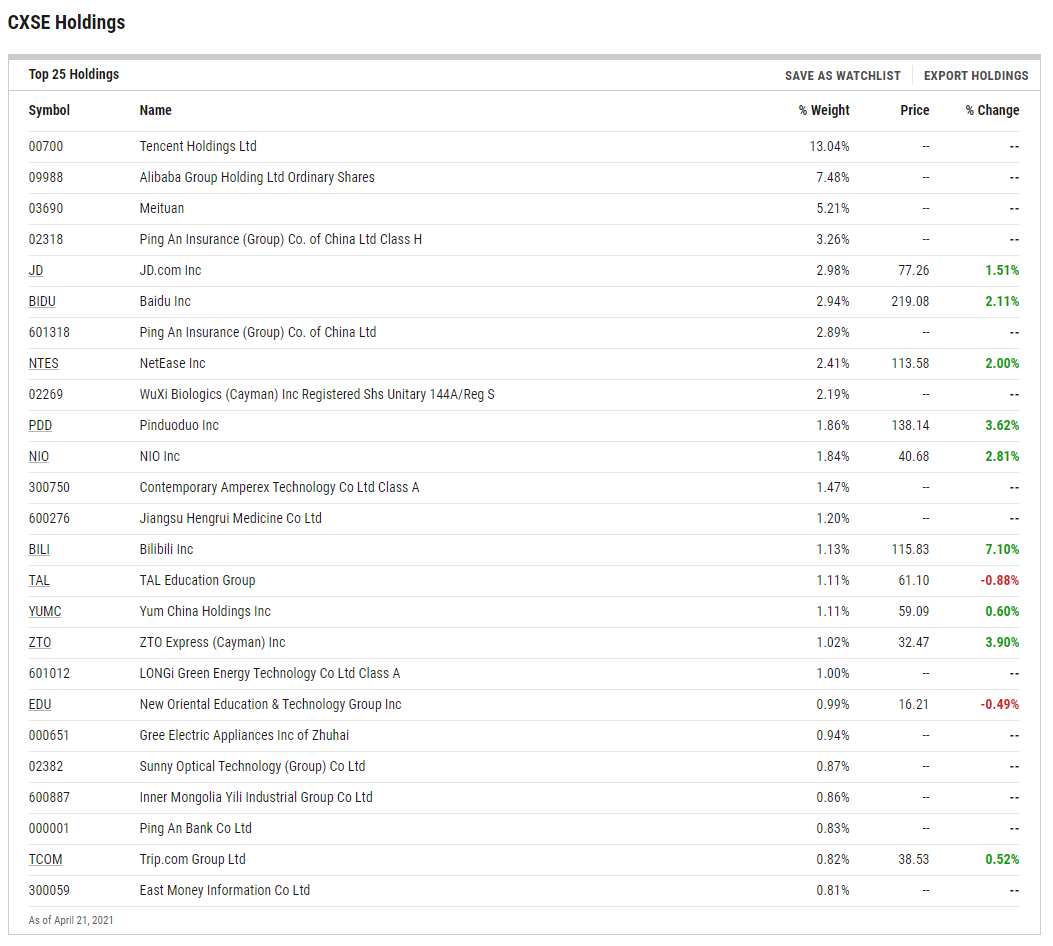

House to almost $970 million in belongings below administration, CXSE allocates 54% of its mixed weight to client discretionary and communication providers shares. The fund prices 0.32% per yr, or $32 on a $10,000 stake.

For extra on find out how to implement mannequin portfolios, go to our Mannequin Portfolio Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.