By John Welling, Director, Fairness Indices, S&P Dow Jones Indices

By John Welling, Director, Fairness Indices, S&P Dow Jones Indices

Key to evaluating core worldwide fairness benchmarks is an understanding of the nation exposures supplied. Developed and rising market nation classification variations between index suppliers might result in notable geographic publicity variations throughout market segments. One of the vital significant cases of this includes South Korea, which S&P DJI has categorised as a developed market since 2001, whereas MSCI continues to categorise the nation as an rising market.[1]

In our newest weblog in a sequence highlighting key options of the worldwide fairness benchmark panorama, we discover South Korea’s classification as a developed market and the affect of its inclusion throughout the MSCI Rising Market indices.

South Korea’s Match within the Developed Market Universe

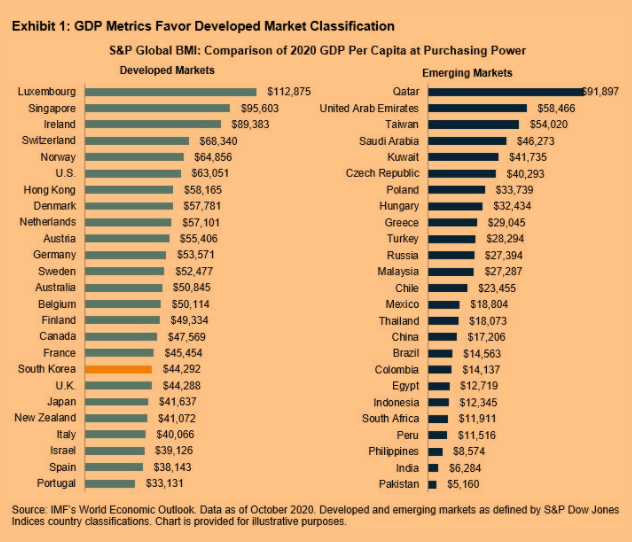

S&P DJI yearly conducts an entire evaluation of all nations included in its international fairness benchmarks. Just like different index suppliers, this course of includes an analysis of markets by numerous financial and market accessibility standards. S&P DJI has categorised South Korea as a developed market since 2001 due to its excessive stage of financial improvement, appreciable measurement and liquidity, absence of serious international funding restrictions, and GDP per capita alignment with developed economies (see Exhibit 1). Through the years, S&P DJI has confirmed this classification by means of its annual nation classification session course of, which includes suggestions from a variety of market individuals.

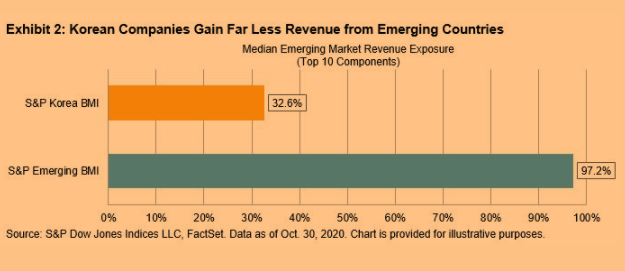

Considered by means of the lens of firm revenues on a geographic foundation, the biggest South Korean corporations overwhelmingly achieve revenues from developed economies. Compared, the biggest corporations primarily based in less-developed nations achieve practically all their revenues from different rising economies. Due to this fact, the inclusion of South Korea in an rising markets index results in much less underlying financial publicity to usually faster-growing rising economies. A notable instance of this phenomenon is Samsung Electronics, which is predicated in South Korea and derives roughly 59% of its income from developed markets and is the fourth largest place in MSCI Rising Markets.

Crowding Out Much less-Developed International locations

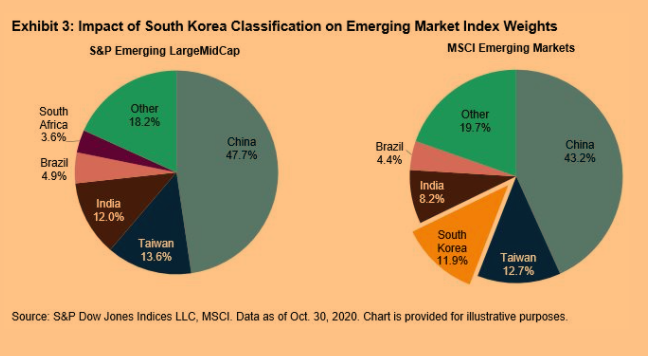

Whereas excluded from the S&P Rising LargeMidCap, South Korea represents an outsized weight of 11.9% in MSCI Rising Markets, probably crowding out less-developed markets from the benchmark.

Since nation publicity is a key driver of the danger and return of rising market equities, it’s crucial to completely perceive your benchmark to make sure the publicity is per the anticipated traits of rising markets.

To be taught extra in regards to the complete protection of the S&P World BMI Index Sequence, see The S&P World BMI: Offering Constant Insights into World Fairness Markets since 1989.

Initially printed by Indexology, 11/23/20

1 FTSE promoted South Korea’s standing in 2009.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.