Airline shares are on monitor to document their third straight month of positive aspects on hopes t

Airline shares are on monitor to document their third straight month of positive aspects on hopes that the coronavirus vaccine will assist normalize industrial air journey sooner somewhat than later. Buyers are additionally betting that U.S. carriers could also be in line to obtain further aid within the stimulus package deal presently being negotiated in Congress.

As of December 16, the NYSE Arca Airline Index was up almost 4.5% for the month. This follows a spectacular 41.9% enhance in November—airline shares’ greatest month-to-month leap on document—and 1.6% enhance in October.

A Congressional aid package deal has seen delay after delay, however a invoice could also be headed for President Donald Trump’s desk as quickly as this week, based on reporting by Politico.

Such a invoice would “in all probability” embrace between $17 billion and $25 billion for home airways, write Bloomberg analysts Nathan Dean and Eric Kazatsky. Even when the present spending package deal doesn’t embrace airline aid, Dean and Kazatsky say they anticipate support to return as early as the primary quarter of subsequent yr, after President-elect Joe Biden takes workplace.

Billionaire investor Warren Buffett believes one other spherical of fiscal stimulus is essential to assist U.S. companies get to the top of the pandemic.

“We want one other injection to finish the job,” the Berkshire Hathaway chief informed CNBC this week. “Congress is debating that proper now, and I hope very a lot that they prolong the PPP (paycheck safety program).”

Buffett Nonetheless Incorrect to Have Exited Airways

In the event you recall, Buffett introduced in early Could that he had dumped his whole place within the large 4 home airways, following a collapse in share costs as a result of pandemic.

Inside three weeks, the choice value him a cool $2.7 billion, based on Investor’s Enterprise Day by day (IBD). That quantity has solely elevated since then. For the yr, class A shares of Berkshire are down 1.6%, considerably underperforming the S&P 500, up 16.5%.

After information got here out of his airline departure, the Oracle of Omaha was roundly criticized, and not simply by me.

Invoice Miller, the previous chief funding officer at Legg Mason, stated that in case you don’t personal airways, “you’re betting towards the vaccine.” Then, in June, day-trader Dave Portnoy posted a collection of movies on Twitter whereby he took jabs at Buffett for lacking a no brainer alternative.

“Warren Buffett is previous his prime,” the Barstool Sports activities founder stated in one of many movies. “He misinterpret the market dramatically when he stated get out of airways.”

I feel it’s protected to say that Miller, Portnoy and others have been vindicated. Solely six months after Buffett made his exit, Pfizer introduced that it had developed a protected, efficient vaccine towards COVID-19. A month after that, the vaccine was being administered to frontline medical employees.

Though it is going to possible be months earlier than everybody within the U.S. has been inoculated—even longer for the remainder of the world—I consider the airline trade may even see quick advantages.

Don’t consider me? Take a look at Australia.

Home Air Journey Demand in Australia to Exceed Pre-COVID Ranges

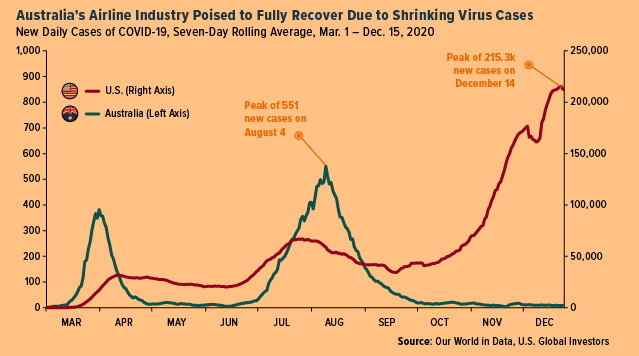

Due to its aggressive measures towards the pandemic, Australia has skilled decrease an infection and dying charges than many different high-income nations. On December 17, the nation of 25 million reported solely three new circumstances of COVID-19.

Because of this, its home airline trade is near full restoration and, by March, demand is anticipated to exceed pre-COVID ranges.

That’s based on Jetstar, the low-cost provider owned by Australia’s flagship Qantas Airways.

In a press launch dated December 15, Jetstar says that it plans to function greater than 850 weekly flights throughout 55 routes by March 2021, or 110% of its schedule earlier than the pandemic. By comparability, the U.S. is presently working at about 42% capability in comparison with the identical time a yr in the past, based on U.Ok.-based OAG Aviation Worldwide.

Australia’s worldwide borders stay closed—one among quite a few actions the nation took to include the unfold of the virus—which means many residents with wanderlust “are set to discover locations across the nation they’ve by no means visited, which is nice for native hospitality and tourism operators,” commented Jetstar CEO Gareth Evans.

Can the identical factor occur right here? I’m optimistic. Between the rollout of the vaccine and potential aid from Congress, I consider the airline trade is in a very good place to rebound a lot sooner than many individuals initially thought.

Questioning how one can take part? Watch my video under. Remember to like and subscribe!

Initially printed by US Funds, 12/16/20

All opinions expressed and information supplied are topic to alter with out discover. A few of these opinions will not be applicable to each investor. By clicking the hyperlink(s) above, you’ll be directed to a third-party web site(s). U.S. World Buyers doesn’t endorse all info equipped by this/these web site(s) and isn’t chargeable for its/their content material.

The S&P 500 Inventory Index is a widely known capitalization-weighted index of 500 frequent inventory costs in U.S. corporations. The NYSE Arca Airline Index is designed to measure the efficiency of extremely capitalized and liquid U.S. and worldwide passenger airline corporations recognized as being within the airline trade and listed on developed and rising international market exchanges.

Holdings could change every day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. World Buyers as of 9/30/2020: Qantas Airways Ltd.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.