At the moment, October 13, may belong to Amazon Prime Day,

At the moment, October 13, may belong to Amazon Prime Day, however it’s been prime time for bond ETFs since March. The Federal Reserve’s resolution to shore up the bond market has since sparked a heightened curiosity in bonds of all varieties, leading to $170 billion in inflows.

“Issues have been trying fairly bleak again in March for bond exchange-traded funds,” a Bloomberg article printed on Yahoo Finance famous. “The Covid-19 selloff created a liquidity crunch that drove their costs to commerce at deep reductions to the worth of the underlying belongings. Skeptics questioned whether or not these merchandise might ever be trusted once more.”

“Then the Federal Reserve stepped in. On March 23, it introduced that that it could start shopping for company debt ETFs,” the article added. “This ignited a wave of front-running investments and served as a stamp of approval for the market sector.”

As such, Federal Reserve chairman Jerome Powell is on the record of individuals to thank this Thanksgiving for bond traders.

“A thank-you be aware to Jerome Powell could also be so as,” the article stated. “Flows into U.S. fixed-income merchandise this yr have surpassed the entire for all of final yr. New funds are coming down the pipeline. And traders are more and more utilizing company bond ETFs to guess on an financial restoration and hedge in opposition to what might be a unstable post-election season.

“The occasions from the onset of the pandemic have solely accelerated the expansion of fixed-income ETFs,” stated Matthew Bartolini, head of SPDR Americas Analysis at State Road World Advisors.

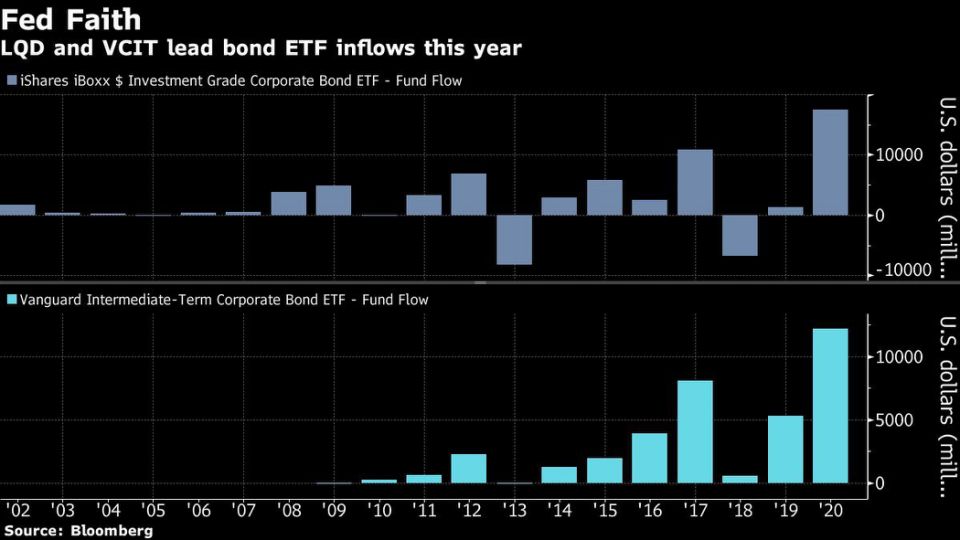

Topping the record of inflows in 2020 are the iShares iBoxx $ Invmt Grade Corp Bd ETF (LQD) and the Vanguard Interm-Time period Corp Bd ETF (VCIT).

“Up to now this yr, inflows to bond funds whole $170 billion, in contrast with $154 billion in all of 2019, in keeping with information compiled by Bloomberg,” the article added.

A Twist on Excessive Yield Publicity

Fastened earnings traders could wish to get publicity to debt with a twist through funds just like the VanEck Vectors Fallen Angel Excessive Yield Bond ETF (BATS: ANGL). ANGL seeks to copy as intently as doable the worth and yield efficiency of the ICE BofAML US Fallen Angel Excessive Yield Index, which is comprised of beneath funding grade company bonds denominated in U.S. {dollars} that have been rated funding grade on the time of issuance.

ANGL basically focuses on debt that has fallen out of investment-grade favor and is now repurposed for top yield returns with the downgraded-to-junk standing. Shopping for family company bond ETFs was to be anticipated by the Fed once they carried out their bond buying program earlier this yr, however they combined up their strikes properly with excessive yield debt purchases like ANGL.

For extra market traits, go to ETF Developments.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.