By Stephen McBride I’m going to start out off at present by

By Stephen McBride

I’m going to start out off at present by saying one thing controversial. It’s not that arduous to make huge beneficial properties of 200%, 300%, 400%, or extra within the inventory market. In truth, it’s fairly simple, in case you’ve obtained nothing however time.

You should purchase huge, protected dividend paying shares like Berkshire Hathaway (BRK.B) or Johnson & Johnson (JNJ), and maintain them for years. BRK has climbed 170% prior to now decade. JNJ is up 120%.

When you’ve obtained nothing however time, you don’t even should hassle selecting particular person shares to double your cash. You may merely purchase and maintain the S&P 500. US shares, on common, have doubled each eight years for the final 140 years.

So, in case you’ve obtained nothing however time to construct wealth, be happy to discard this essay. As a result of I’m going to indicate you a easy, dependable strategy to make investments that skyrockets your odds of doubling or tripling your cash in months, as a substitute of years or many years.

The “catch” is you could solely use this technique each few years. Thankfully, we simply entered one in every of these golden home windows. Let me clarify.

To double or triple your cash in months, all you need to do is apply these three magic phrases

Establish one thing BIG and NEW. And spend money on it EARLY. Right here’s an instance: bear in mind again in 2018 when the US authorities successfully legalized marijuana? This was an enormous deal: A complete new trade was born virtually in a single day!

It allowed abnormal people to spend money on marijuana firms for the primary time ever. Immediately, “pot shares” jumped to the moon. In the course of the 18-month window when these shares had been “new,” earnings had been being handed out on a silver platter.

CV Sciences soared 598%, MariMed gained 371%, and Modern Industrial Properties shot up 188%.

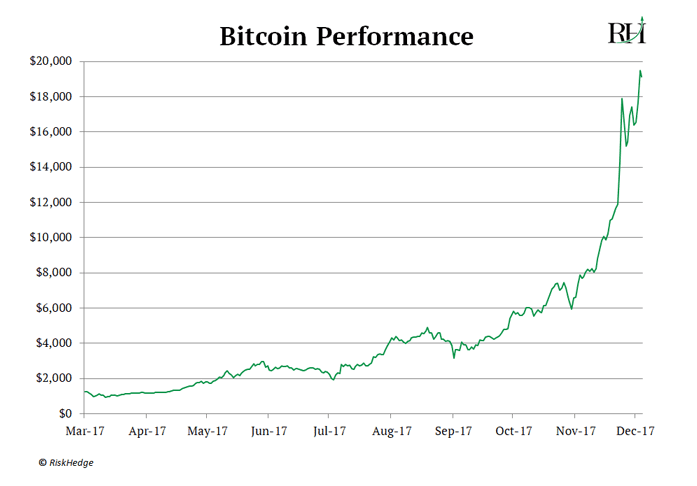

Do you bear in mind when cryptocurrencies had been crimson sizzling a few years in the past? In 2017, Bitcoin took markets by storm. I had dinner with a widely known Dallas hedge fund supervisor early that yr. Bitcoin’s worth had doubled over the earlier six months, surging to $1,200. However he seemed me within the eye and stated: “This can be a completely new phenomenon, I assure we’re solely getting began.”

Bitcoin went on to soar 1,500% to $19,000 over the subsequent 9 months:

Bitcoin actually handed out many years value of beneficial properties in just some months! And the important thing was that crypto was new. The overwhelming majority of American traders had been listening to about it for the primary time.

It’s very uncommon that a wholly new alternative opens as much as abnormal traders

Earlier than marijuana and cryptos, you need to return a decade to search out the final time a brand new class of shares hit the market. That’s when Salesforce (CRM) discovered software program might be offered over the web as a subscription. This was a “eureka” second for a lot of American companies. They found you may make much more cash charging subscriptions to software program as a substitute of a one-time price.

Software program as a service (SaaS) shares had been born, and so they rocketed in a flash. Splunk (SPLK) shot up 245% in somewhat over a yr. Twilio (TWLO) handed early traders triple digit beneficial properties in lower than seven months. AppFolio (APPF) jumped 118% in lower than six months.

At the moment, in October 2020, there’s a brand new kind of inventory handing out huge, quick beneficial properties: I’m speaking about hypergrowth shares.

These new shares are rising even sooner than the pot inventory, crypto, and SaaS booms earlier than them. In truth, revered Silicon Valley CEO Aaron Levie not too long ago stated: “There may be actually no playbook for these sorts of numbers at this scale.”

However whenever you discover a hypergrowth inventory that’s doing one thing totally NEW, you’ve discovered one thing very particular: a inventory with blue-sky potential to rise a lot sooner than any abnormal inventory may.

Keep in mind, “new issues” in investing solely come round as soon as each 5 years or so. When you seize the second, and pinpoint the appropriate hypergrowth shares, you possibly can accumulate a decade value of beneficial properties in lower than a yr or two.

Get my report “The Nice Disruptors: three Breakthrough Shares Set to Double Your Cash”. These shares will hand you 100% beneficial properties as they disrupt entire industries. Get your free copy right here.

Initially revealed by Mauldin Economics

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.