In the midst of what seems to be a singular Q2 earnings season, with robust outcomes and unimpressive steering (particularly for the know-how sector), together with elevated fears surrounding the Delta Covid variant, we’re additional reminded of the variations between the markets and the financial system. Rewind to the beginning of 2020: most had been nervous the market was approaching the later phases of a progress cycle. The S&P 500 is up 39.6% in 19 months for the reason that starting of 2020. Covid apart, we’ve immense stimulus added to the financial system; 40% of all {dollars} in circulation had been printed since Covid. Perhaps the 40% S&P 500 run is smart? Innovation curve adoptions and developments in how and the place life and work, that won’t totally retrace in an opened, closed, or transitory financial system, needs to be performed. It’s fairly doable our financial system is most effective with all of us sitting at residence utilizing disposable earnings on investments and items as an alternative of companies, satirically. The long-lasting productiveness positive factors that may live on in a future, totally reopened world are a entrance and heart query that may decide if we’re within the midst of a brand new progress cycle, or on fumes constructing within the financial system pre-Covid. Paradoxically, our reply is each. In our final commentary, we wrote that the S&P 500 might finish the yr anyplace between up 30% and down 70%. Sadly, the potential outcomes, given the entire variables, are simply as large. Innovation in lots of fields is actual, and can proceed on a rampant tempo. Independently of that, there can be quite a few financial shocks alongside the best way, with the primary doubtlessly across the nook, given the unending rewritten US debt ceiling talks.

As a society we’re grappling at the advantages between most financial effectivity and the happiness of its individuals. We’re left with extra questions than solutions on who and what advantages from all of this quantitative easing, and for the way lengthy these results might final. What if prolonged recessions really profit the poor? What if prolonged recessions are wanted with a view to shake out the over-leveraged 1% and permit for redistribution of wealth primarily based on competitors? The 2020 recession formally lasted two months, ending April 2020. We had a 128- month fed induced enlargement, adopted by a 2-month recession. That was it. Threat takers of all kinds and in mainly any asset had been rewarded.

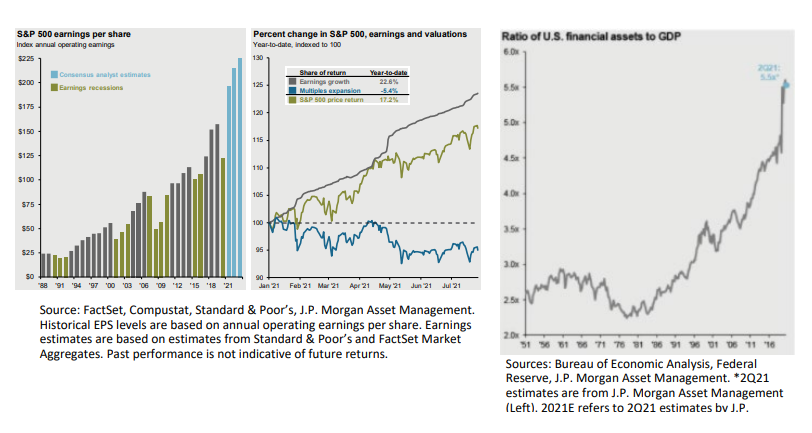

Earnings have come roaring again, and many of the returns in markets have really come from earnings progress over a number of expansions in 2021. S&P 500 earnings estimates for the second half of 2021 are anticipated to hit all-time highs, far past the place we had been pre-Covid. The chart above on the suitable exhibits the ratio of US monetary property to GDP. GDP is roaring again, earnings are increased than ever, and property are as costly in comparison with precise GDP as they ever have been. There’s potential for a really robust US inventory market in 2021, primarily because of the huge quantity of stimulus and comparatively robust vaccine rollout. There are various dangers that might throw a wrench on this. Regardless, one other robust second half in fairness markets is a possible end result for the remainder of 2021.

One of the crucial mentioned fears is inflation. The irony is, simply as most scorching funding subjects, it’s virtually not possible to truly calculate what inflation is. Everybody really does have a singular inflation profile primarily based on their very own present life-style. Very like the Ok-shaped restoration, a Kshaped or in any other case skewed inflation might have an effect on simply the wealthy, simply the poor, or in the end find yourself transitory, doubtlessly stagflationary for some, and even deflationary for others. The patron worth index has been adjusted extra occasions than we will depend. It has hen as an alternative choice to many different issues, and no inclusion of an iPhone. Corporations are most actually feeling worth stress on inputs in items, provide chains, and even companies, because the financial system rebounds. This may very well be the primary stage of inflation, or really simply transitory, or might even result in a listing build-up subsequent summer season and add deflationary fears into the combo.

Some imagine the fed is not going to admit precise inflation till it’s too late, as they don’t seem to be effectively geared up to struggle it in any kind, with the debt at ranges seen right this moment. Any longer-standing inflation would inevitably hinder the revenue margin rebound we’re experiencing, at the same time as producers try to cross alongside elevated prices to shoppers, which might require wage progress to keep away from a stagflation surroundings. Transitory inflation, and even deflation (solely doable from continued innovation progress), are the most effective outcomes of the bunch, and we anticipate transitory inflation is most certainly. Nevertheless, we included the whole lot of the listing to painting how random and unpredictable the subsequent 12 months may very well be. Issues really look nice within the financial system on a macro foundation, and we’re doubtless about to proceed to climb an insane wall of fear for the subsequent few months. If financial savings charges drop too far and inflation fears don’t calm, our outlook might change.

[wce_code id=192]

Geopolitical Fears

The struggle for safe info and worry of huge tech is right here. The US has restricted Chinese language tech corporations within the US, and China has in flip put into query the viability of any listed US tech firm. Consider it as a case of prisoner’s dilemma, besides the listing of gamers and would-be collusions consists of democrats, republicans, the Chinese language nationwide occasion, the US tech giants, and the Chinese language tech giants, simply to call just a few. Whereas we battle one another economically, we’re additionally internally each uneasy with the extent of complete financial domination these tech corporations have inside every financial system. We nonetheless very a lot desire the Chinese language tech giants over the US FAANG names, however there may be potential for concern in each.

US Equities

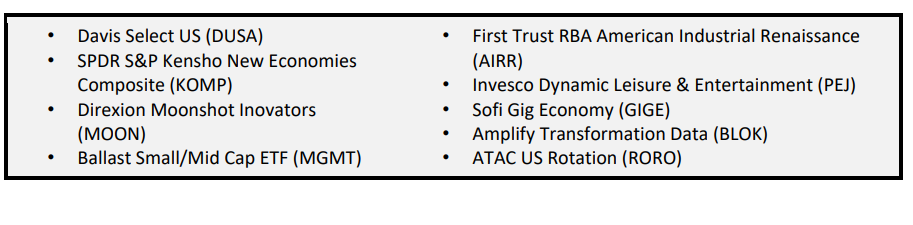

The iShares S&P 500 ETF (IVV) completed the primary half of the yr up 15.23%, up 17.95% by means of the tip of July. It was really a story of two halves this yr, as the primary quarter noticed enormous rallies in small caps and worth shares, whereas progress shares prevailed within the second quarter. By the tip of July, the iShares S&P 500 Development ETF (IVW) is now forward of the iShares S&P 500 Worth ETF (IVE), 18.51% vs 17.08% respectively. The reversal has correlated with treasuries, as worth outperformed and yields had been rising. Regardless of escalated fears in inflation, treasury yields have fallen and progress shares have as soon as once more prevailed. Small caps proceed on their robust tempo, up 26.85% for the yr including 3.42% in July. On an financial entrance, GDP barely disillusioned in Q2, up 6.5% vs an anticipated 8.5%. The tempo of consumption might sluggish, however nonetheless stay robust heading into Q3 with a much less elevated financial savings fee of 9.4%. In our final commentary, we talked about progress had room to run, and we anticipate it to proceed, albeit non-traditional non FAANG progress names that must be sourced uniquely. We’re cautious of all market cap indexes at this level. A lot of the Russell 2000 continues to exist with out income.

Worldwide Developed & Rising Markets

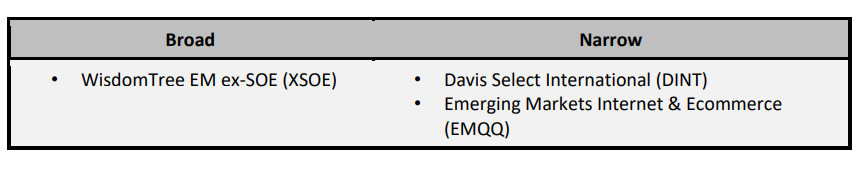

MSCI ACWI ex US, measured by the iShares MSCI ACWI ex US ETF (ACWX), was up 7.23% by means of July. iShares MSCI EAFE ETF (EFA) was up 9.86%, whereas the iShares MSCI EM ETF (EEM) erased all of its first quarter positive factors and is down -0.26% for the yr. Worldwide developed equities are the worth play of all worth performs, or a perpetual worth lure lead by an unhealthy banking system hooked on the ECB. They proceed to be additional behind the US in its vaccination rollout. The story in rising markets is China. The worry of data between the US and China has continued to harm the biggest tech gamers in each markets, and up to date actions out of China put into query the probability of additional Chinese language tech giants itemizing in US markets. Internally, China goes so far as to try to make training tech corporations exist with out income. You will need to observe that most of the largest state-owned enterprises have related mandates and proceed to supply income, however that is all troubling within the brief time period. Whether or not capital continues to circulate in direction of the Chinese language tech area or not, no matter the place these corporations are listed, will doubtless information their short-term destiny, however long term, we nonetheless see potential on this area.

Mounted Revenue

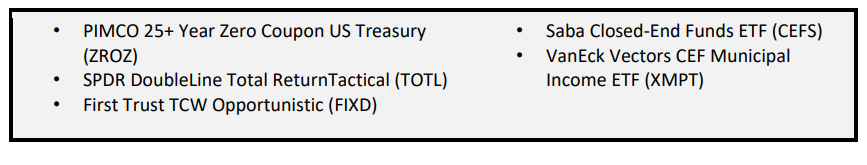

iShares Core US Mixture Bond ETF (AGG) bounced again within the second quarter and July, and is now solely down 0.54% for the yr. Comparable, however unrelated to the debt ranges, the period of AGG continues to climb as effectively, which means will increase in rates of interest sooner or later may have extra draw back than prior to now for every motion in yield. Lengthy-term treasuries measured by the iShares 20+ Yr Treasury Bond ETF (TLT) are nonetheless down -4.6% on the yr, however climbed 6.95% in Q1 and three.69 in July. We wouldn’t get too aggressive on the decrease credit score facet of the spectrum right here, given how tight credit score spreads are. Energetic is most popular right here as effectively. Broad indexes are extremely weighted in debt, rated simply above default, which can be an issue if the Fed-induced merry-go-round even exhibits slight indicators of stalling.

Alternate options

Invesco DB Commodity Index Monitoring ETF (DBC) is up 33.28% YTD, however has slowed down as of late, up only one.57% in July. Gold rebounded from a horrible first quarter, quietly up 7.8% since then, however nonetheless down -3.68% on the yr. It’s been a troublesome yr for alternate options, however in case you diligently rebalanced your longer-term treasuries with gold, bitcoin, and inflation safety, you’ve got carried out effectively on this bucket.

A hypothetical high-active-share reconstruction of a standard 60/40:

• 5% PIMCO 25+ Yr Zero Coupon US Treasury Index ETF (ZROZ)

• 7.5% Saba Closed-Finish Funds ETF (CEFS)

• 5% AGFiQ US Market Impartial Anti-Beta (BTAL)

• 5% Quadratic Curiosity Charge Volatility Infl (IVOL)

• 10 % SPDR Gold MiniShares Belief (GLDM)

• 7.5% Amplify Transformational Knowledge Sharing ETF (BLOK)

• 7.5% Sofi Gig Financial system ETF (GIGE)

• 7.5% SPDR S&P Kensho New Economies Comps (KOMP)

• 7.5% Davis Choose Worldwide ETF (DWLD)

• 7.5% Rising Markets Web & Ecommerce (EMQQ)

• 7.5% Ballast Small / Mid Cap ETF (MGMT)

• 7.5% Direxion Moonshot Innovators ETF (MOON)

• 5% First Belief Industrial Renaissance (AIRR)

• 5% Invesco Dynamic Leisure & Leisure ETF (MOON)

• 5% Distillate US Basic Stability & Worth ETF (DSTL)

Conclusion

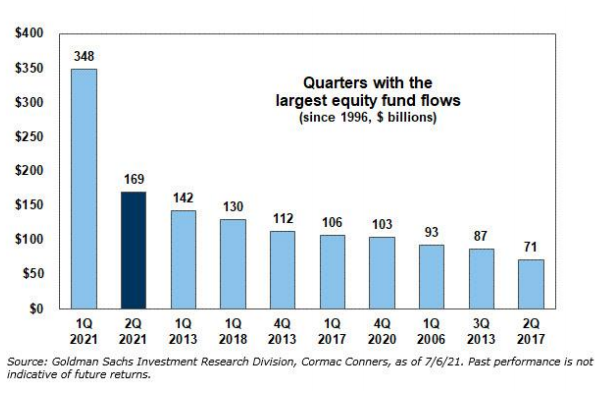

One factor to control is fairness flows. Whereas flows over this 13-year market run have been reasonably unimpressive, the identical can’t be mentioned for this yr. Fairness funds have seen over $500 billion in inflows in 2021. Q1 and Q2 2021 had been the 2 largest quarterly fairness flows, going all the best way again to 1996. This autumn 2020 can be on the highest 10 listing. Q1 2021 had a document influx of $348 billion {dollars}, 245% the earlier document in Q1 2013 (till Q2 2021 took second place with $169 billion). We’d not anticipate one other document quarter of flows in Q3.

Initially printed by Toroso

Disclosure

The data offered right here is for monetary professionals solely and shouldn’t be thought of an individualized advice or personalised funding recommendation. The funding methods talked about right here might not be appropriate for everybody. Every investor must assessment an funding technique for his or her personal specific scenario earlier than making any funding resolution.

All expressions of opinion are topic to vary with out discover in response to shifting market circumstances. Knowledge contained herein from third occasion suppliers is obtained from what are thought of dependable sources. Nevertheless, its accuracy, completeness or reliability can’t be assured.

Examples offered are for illustrative functions solely and never meant to be reflective of outcomes you possibly can count on to attain.

All investments contain threat, together with doable lack of principal.

The worth of investments and the earnings from them can go down in addition to up and traders might not get again the quantities initially invested, and might be affected by modifications in rates of interest, in change charges, normal market circumstances, political, social and financial developments and different variable components. Funding entails dangers together with however not restricted to, doable delays in funds and lack of earnings or capital. Neither Toroso nor any of its associates ensures any fee of return or the return of capital invested. This commentary materials is accessible for informational functions solely and nothing herein constitutes a suggestion to promote or a solicitation of a suggestion to purchase any safety and nothing herein needs to be construed as such. All funding methods and investments contain threat of loss, together with the doable lack of all quantities invested, and nothing herein needs to be construed as a assure of any particular end result or revenue. Whereas we’ve gathered the data introduced herein from sources that we imagine to be dependable, we can’t assure the accuracy or completeness of the data introduced and the data introduced shouldn’t be relied upon as such. Any opinions expressed herein are our opinions and are present solely as of the date of distribution, and are topic to vary with out discover. We disclaim any obligation to offer revised opinions within the occasion of modified circumstances.

The data on this materials is confidential and proprietary and might not be used apart from by the meant person. Neither Toroso or its associates or any of their officers or staff of Toroso accepts any legal responsibility by any means for any loss arising from any use of this materials or its contents. This materials might not be reproduced, distributed or printed with out prior written permission from Toroso. Distribution of this materials could also be restricted in sure jurisdictions. Any individuals coming into possession of this materials ought to search recommendation for particulars of and observe such restrictions (if any).

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

July 2021 Market Commentary | Nasdaq

In the midst of wha

In the midst of what seems to be a singular Q2 earnings season, with robust outcomes and unimpressive steering (particularly for the know-how sector), together with elevated fears surrounding the Delta Covid variant, we’re additional reminded of the variations between the markets and the financial system. Rewind to the beginning of 2020: most had been nervous the market was approaching the later phases of a progress cycle. The S&P 500 is up 39.6% in 19 months for the reason that starting of 2020. Covid apart, we’ve immense stimulus added to the financial system; 40% of all {dollars} in circulation had been printed since Covid. Perhaps the 40% S&P 500 run is smart? Innovation curve adoptions and developments in how and the place life and work, that won’t totally retrace in an opened, closed, or transitory financial system, needs to be performed. It’s fairly doable our financial system is most effective with all of us sitting at residence utilizing disposable earnings on investments and items as an alternative of companies, satirically. The long-lasting productiveness positive factors that may live on in a future, totally reopened world are a entrance and heart query that may decide if we’re within the midst of a brand new progress cycle, or on fumes constructing within the financial system pre-Covid. Paradoxically, our reply is each. In our final commentary, we wrote that the S&P 500 might finish the yr anyplace between up 30% and down 70%. Sadly, the potential outcomes, given the entire variables, are simply as large. Innovation in lots of fields is actual, and can proceed on a rampant tempo. Independently of that, there can be quite a few financial shocks alongside the best way, with the primary doubtlessly across the nook, given the unending rewritten US debt ceiling talks.

As a society we’re grappling at the advantages between most financial effectivity and the happiness of its individuals. We’re left with extra questions than solutions on who and what advantages from all of this quantitative easing, and for the way lengthy these results might final. What if prolonged recessions really profit the poor? What if prolonged recessions are wanted with a view to shake out the over-leveraged 1% and permit for redistribution of wealth primarily based on competitors? The 2020 recession formally lasted two months, ending April 2020. We had a 128- month fed induced enlargement, adopted by a 2-month recession. That was it. Threat takers of all kinds and in mainly any asset had been rewarded.

Earnings have come roaring again, and many of the returns in markets have really come from earnings progress over a number of expansions in 2021. S&P 500 earnings estimates for the second half of 2021 are anticipated to hit all-time highs, far past the place we had been pre-Covid. The chart above on the suitable exhibits the ratio of US monetary property to GDP. GDP is roaring again, earnings are increased than ever, and property are as costly in comparison with precise GDP as they ever have been. There’s potential for a really robust US inventory market in 2021, primarily because of the huge quantity of stimulus and comparatively robust vaccine rollout. There are various dangers that might throw a wrench on this. Regardless, one other robust second half in fairness markets is a possible end result for the remainder of 2021.

One of the crucial mentioned fears is inflation. The irony is, simply as most scorching funding subjects, it’s virtually not possible to truly calculate what inflation is. Everybody really does have a singular inflation profile primarily based on their very own present life-style. Very like the Ok-shaped restoration, a Kshaped or in any other case skewed inflation might have an effect on simply the wealthy, simply the poor, or in the end find yourself transitory, doubtlessly stagflationary for some, and even deflationary for others. The patron worth index has been adjusted extra occasions than we will depend. It has hen as an alternative choice to many different issues, and no inclusion of an iPhone. Corporations are most actually feeling worth stress on inputs in items, provide chains, and even companies, because the financial system rebounds. This may very well be the primary stage of inflation, or really simply transitory, or might even result in a listing build-up subsequent summer season and add deflationary fears into the combo.

Some imagine the fed is not going to admit precise inflation till it’s too late, as they don’t seem to be effectively geared up to struggle it in any kind, with the debt at ranges seen right this moment. Any longer-standing inflation would inevitably hinder the revenue margin rebound we’re experiencing, at the same time as producers try to cross alongside elevated prices to shoppers, which might require wage progress to keep away from a stagflation surroundings. Transitory inflation, and even deflation (solely doable from continued innovation progress), are the most effective outcomes of the bunch, and we anticipate transitory inflation is most certainly. Nevertheless, we included the whole lot of the listing to painting how random and unpredictable the subsequent 12 months may very well be. Issues really look nice within the financial system on a macro foundation, and we’re doubtless about to proceed to climb an insane wall of fear for the subsequent few months. If financial savings charges drop too far and inflation fears don’t calm, our outlook might change.

[wce_code id=192]

Geopolitical Fears

The struggle for safe info and worry of huge tech is right here. The US has restricted Chinese language tech corporations within the US, and China has in flip put into query the viability of any listed US tech firm. Consider it as a case of prisoner’s dilemma, besides the listing of gamers and would-be collusions consists of democrats, republicans, the Chinese language nationwide occasion, the US tech giants, and the Chinese language tech giants, simply to call just a few. Whereas we battle one another economically, we’re additionally internally each uneasy with the extent of complete financial domination these tech corporations have inside every financial system. We nonetheless very a lot desire the Chinese language tech giants over the US FAANG names, however there may be potential for concern in each.

US Equities

The iShares S&P 500 ETF (IVV) completed the primary half of the yr up 15.23%, up 17.95% by means of the tip of July. It was really a story of two halves this yr, as the primary quarter noticed enormous rallies in small caps and worth shares, whereas progress shares prevailed within the second quarter. By the tip of July, the iShares S&P 500 Development ETF (IVW) is now forward of the iShares S&P 500 Worth ETF (IVE), 18.51% vs 17.08% respectively. The reversal has correlated with treasuries, as worth outperformed and yields had been rising. Regardless of escalated fears in inflation, treasury yields have fallen and progress shares have as soon as once more prevailed. Small caps proceed on their robust tempo, up 26.85% for the yr including 3.42% in July. On an financial entrance, GDP barely disillusioned in Q2, up 6.5% vs an anticipated 8.5%. The tempo of consumption might sluggish, however nonetheless stay robust heading into Q3 with a much less elevated financial savings fee of 9.4%. In our final commentary, we talked about progress had room to run, and we anticipate it to proceed, albeit non-traditional non FAANG progress names that must be sourced uniquely. We’re cautious of all market cap indexes at this level. A lot of the Russell 2000 continues to exist with out income.

Worldwide Developed & Rising Markets

MSCI ACWI ex US, measured by the iShares MSCI ACWI ex US ETF (ACWX), was up 7.23% by means of July. iShares MSCI EAFE ETF (EFA) was up 9.86%, whereas the iShares MSCI EM ETF (EEM) erased all of its first quarter positive factors and is down -0.26% for the yr. Worldwide developed equities are the worth play of all worth performs, or a perpetual worth lure lead by an unhealthy banking system hooked on the ECB. They proceed to be additional behind the US in its vaccination rollout. The story in rising markets is China. The worry of data between the US and China has continued to harm the biggest tech gamers in each markets, and up to date actions out of China put into query the probability of additional Chinese language tech giants itemizing in US markets. Internally, China goes so far as to try to make training tech corporations exist with out income. You will need to observe that most of the largest state-owned enterprises have related mandates and proceed to supply income, however that is all troubling within the brief time period. Whether or not capital continues to circulate in direction of the Chinese language tech area or not, no matter the place these corporations are listed, will doubtless information their short-term destiny, however long term, we nonetheless see potential on this area.

Mounted Revenue

iShares Core US Mixture Bond ETF (AGG) bounced again within the second quarter and July, and is now solely down 0.54% for the yr. Comparable, however unrelated to the debt ranges, the period of AGG continues to climb as effectively, which means will increase in rates of interest sooner or later may have extra draw back than prior to now for every motion in yield. Lengthy-term treasuries measured by the iShares 20+ Yr Treasury Bond ETF (TLT) are nonetheless down -4.6% on the yr, however climbed 6.95% in Q1 and three.69 in July. We wouldn’t get too aggressive on the decrease credit score facet of the spectrum right here, given how tight credit score spreads are. Energetic is most popular right here as effectively. Broad indexes are extremely weighted in debt, rated simply above default, which can be an issue if the Fed-induced merry-go-round even exhibits slight indicators of stalling.

Alternate options

Invesco DB Commodity Index Monitoring ETF (DBC) is up 33.28% YTD, however has slowed down as of late, up only one.57% in July. Gold rebounded from a horrible first quarter, quietly up 7.8% since then, however nonetheless down -3.68% on the yr. It’s been a troublesome yr for alternate options, however in case you diligently rebalanced your longer-term treasuries with gold, bitcoin, and inflation safety, you’ve got carried out effectively on this bucket.

A hypothetical high-active-share reconstruction of a standard 60/40:

• 5% PIMCO 25+ Yr Zero Coupon US Treasury Index ETF (ZROZ)

• 7.5% Saba Closed-Finish Funds ETF (CEFS)

• 5% AGFiQ US Market Impartial Anti-Beta (BTAL)

• 5% Quadratic Curiosity Charge Volatility Infl (IVOL)

• 10 % SPDR Gold MiniShares Belief (GLDM)

• 7.5% Amplify Transformational Knowledge Sharing ETF (BLOK)

• 7.5% Sofi Gig Financial system ETF (GIGE)

• 7.5% SPDR S&P Kensho New Economies Comps (KOMP)

• 7.5% Davis Choose Worldwide ETF (DWLD)

• 7.5% Rising Markets Web & Ecommerce (EMQQ)

• 7.5% Ballast Small / Mid Cap ETF (MGMT)

• 7.5% Direxion Moonshot Innovators ETF (MOON)

• 5% First Belief Industrial Renaissance (AIRR)

• 5% Invesco Dynamic Leisure & Leisure ETF (MOON)

• 5% Distillate US Basic Stability & Worth ETF (DSTL)

Conclusion

One factor to control is fairness flows. Whereas flows over this 13-year market run have been reasonably unimpressive, the identical can’t be mentioned for this yr. Fairness funds have seen over $500 billion in inflows in 2021. Q1 and Q2 2021 had been the 2 largest quarterly fairness flows, going all the best way again to 1996. This autumn 2020 can be on the highest 10 listing. Q1 2021 had a document influx of $348 billion {dollars}, 245% the earlier document in Q1 2013 (till Q2 2021 took second place with $169 billion). We’d not anticipate one other document quarter of flows in Q3.

Initially printed by Toroso

Disclosure

The data offered right here is for monetary professionals solely and shouldn’t be thought of an individualized advice or personalised funding recommendation. The funding methods talked about right here might not be appropriate for everybody. Every investor must assessment an funding technique for his or her personal specific scenario earlier than making any funding resolution.

All expressions of opinion are topic to vary with out discover in response to shifting market circumstances. Knowledge contained herein from third occasion suppliers is obtained from what are thought of dependable sources. Nevertheless, its accuracy, completeness or reliability can’t be assured.

Examples offered are for illustrative functions solely and never meant to be reflective of outcomes you possibly can count on to attain.

All investments contain threat, together with doable lack of principal.

The worth of investments and the earnings from them can go down in addition to up and traders might not get again the quantities initially invested, and might be affected by modifications in rates of interest, in change charges, normal market circumstances, political, social and financial developments and different variable components. Funding entails dangers together with however not restricted to, doable delays in funds and lack of earnings or capital. Neither Toroso nor any of its associates ensures any fee of return or the return of capital invested. This commentary materials is accessible for informational functions solely and nothing herein constitutes a suggestion to promote or a solicitation of a suggestion to purchase any safety and nothing herein needs to be construed as such. All funding methods and investments contain threat of loss, together with the doable lack of all quantities invested, and nothing herein needs to be construed as a assure of any particular end result or revenue. Whereas we’ve gathered the data introduced herein from sources that we imagine to be dependable, we can’t assure the accuracy or completeness of the data introduced and the data introduced shouldn’t be relied upon as such. Any opinions expressed herein are our opinions and are present solely as of the date of distribution, and are topic to vary with out discover. We disclaim any obligation to offer revised opinions within the occasion of modified circumstances.

The data on this materials is confidential and proprietary and might not be used apart from by the meant person. Neither Toroso or its associates or any of their officers or staff of Toroso accepts any legal responsibility by any means for any loss arising from any use of this materials or its contents. This materials might not be reproduced, distributed or printed with out prior written permission from Toroso. Distribution of this materials could also be restricted in sure jurisdictions. Any individuals coming into possession of this materials ought to search recommendation for particulars of and observe such restrictions (if any).

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com

RECOMMENDED FOR YOU