By Solomon G. Teller, CFA, Chief Funding Strategist

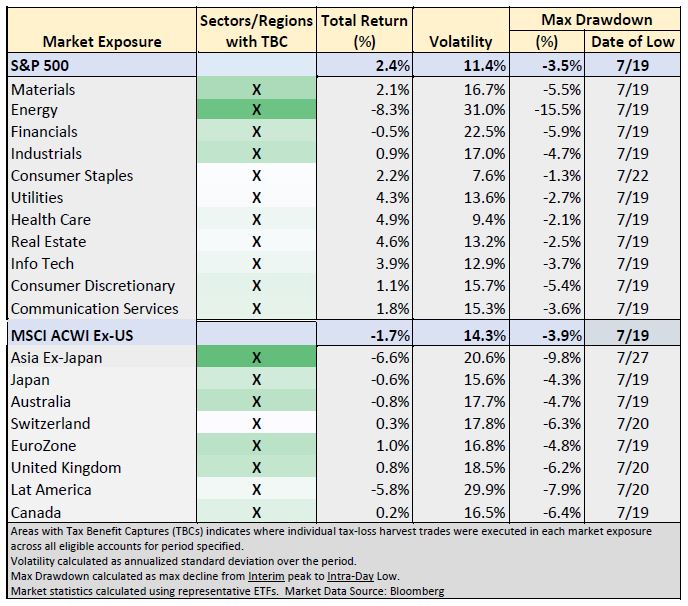

Markets retreated in July, offering alternatives for Tax Advantages Seize (TBC) or Tax Loss Harvesting. However then, within the latter half of the month, markets rebounded, ending within the inexperienced. General, the S&P 500 gained 2.3% in July – its sixth straight month of beneficial properties – culminating in 18.0% yr so far and doubling in worth since its March 23, 2020 backside. Listed here are highlights of Inexperienced Harvest Asset Administration’s TBC exercise final month together with accompanying statistics within the desk on web page 2:

- Whereas many shares dipped, one sector and one area every declined significantly greater than others, enabling focused and significant TBC.

- The Vitality sector fell over 15.5%, far and away the largest sufferer in July’s pullback. Vitality sector trades comprised totally 1/Three of all U.S. Fairness TBC associated buying and selling.

- Asian shares have been hit arduous final week amid information of tightening Chinese language laws. Asian shares rebounded after the information considerably, however not earlier than we have been capable of seize additional tax advantages.

- Accounts invested in Inexperienced Harvest’s flagship U.S. Fairness technique at first of July achieved a cumulative TBC of between 1.5% and a pair of.0%.1

- A lot of the TBC-related buying and selling occurred through the day on July 19th, when many sectors and areas have been bottoming.

- As positions with realized losses have been offered, related however not similar positions have been concurrently bought that stored purchasers invested within the subsequent rebound.

The markets’ continued skill to say no and rebound inside brief intervals is a reminder of the significance of a method that nimbly captures tax advantages – whereas additionally making certain that portfolios stay invested on daily basis.

[wce_code id=192]

Hoping you could have an awesome August.

1 Compared, the S&P 500’s most decline by means of mid-month was 0.85%. Cumulative TBC share displays cumulative realized losses as a share of beginning account values in money accounts solely; i.e., accounts with present legacy positions have been excluded.

Market Information and Inexperienced Harvest TBC Warmth Map Abstract for the month of July 2021:

Disclaimers:

Efficiency quoted represents previous efficiency, which isn’t any assure of future outcomes. Funding return and principal worth will fluctuate, so you might have a acquire or loss when the portfolio is liquidated. Present efficiency could also be greater or decrease than that quoted. Efficiency of an index is just not illustrative of any specific funding. It’s not potential to take a position instantly in an index.

GHAM doesn’t present tax recommendation. Though GHAM doesn’t make use of a Licensed Public Accountant on its workers, we have now, and proceed to work with outdoors accounting corporations and outdoors tax counsel that present ongoing steering and updates on all related tax legislation. Federal, state and native tax legal guidelines are topic to vary. GHAM is just not accountable for offering purchasers updates on any adjustments in tax legal guidelines, guidelines or statutes.

Causes to reap capital losses, sources of capital beneficial properties and the suggestion that mutual funds distribute capital beneficial properties are for instance functions solely and never meant to be tax, property planning or funding recommendation in any kind or for any particular shopper.

All efficiency and estimates of technique efficiency, after tax alpha, after tax alpha alternatives and different efficiency figures are derived from knowledge offered from a number of third-party sources. All estimates have been created with the good thing about hindsight and is probably not achieved in a stay account. The information acquired by GHAM is unaudited and its reliability and accuracy is just not assured.

The provision of tax alpha is extremely dependent upon the preliminary date and time of funding in addition to market route and safety volatility through the funding interval. Tax loss harvesting outcomes might fluctuate significantly for purchasers who make investments on totally different days, weeks, months and all different time intervals.

All estimates of previous returns of broad, slender, sector, nation, regional or different indices don’t embody the affect of advisor charges, until particularly indicated. Previous efficiency and volatility figures shouldn’t be relied upon as an indicator of future efficiency or volatility.

This materials is just not meant to be relied upon as authorized, funding or tax recommendation in any kind or for any particular shopper. The data offered doesn’t take note of the precise goals, monetary scenario or specific wants of any particular individual. All investments carry a sure diploma of danger, and there’s no assurance that an funding will carry out as anticipated over any time period.

As a comfort to our readers, this doc might include hyperlinks to data created and maintained by third get together websites. Please word that we don’t endorse any linked websites or their content material, and we’re not accountable for the accuracy, timeliness and even the continued availability or existence of this outdoors data. Whereas we endeavor to supply hyperlinks solely to these websites which might be respected and protected, we can’t be held accountable for the knowledge, services or products obtained from such different websites and won’t be accountable for any damages arising out of your entry to such websites.

Hedged Methods Danger

The Hedged Methods take “brief” positions by promoting an index ETF that the shopper portfolio doesn’t personal, which exposes the portfolio to prices and dangers that aren’t related to proudly owning securities lengthy. Sure of those prices and dangers are described within the margin disclosure assertion offered to you by the monetary establishment holding your account, and we encourage you to debate these dangers and prices along with your advisor. The next disclosure discusses the dangers associated to Inexperienced Harvest’s funding technique.

A brief place has an opposing or “inverse” relationship to an extended place on the identical asset. Usually, the brief index place will lose cash when the general lengthy portfolio is rising in worth, and the brief place will improve in worth when the lengthy portfolio is shedding cash. This relationship supplies the “hedging” facet of the Technique. Inexperienced Harvest seeks to brief an index ETF that’s anticipated to have a robust inverse relationship with the technique benchmark. If the index ETF underlying the brief place deviates from this inverse correlation to the benchmark efficiency, then the Technique is not going to carry out as desired, and you possibly can have restricted tax-loss harvesting outcomes in addition to low or detrimental portfolio returns. Though the brief place is meant as a hedge towards detrimental or low returns of the markets, the Technique’s return could also be detrimental. Any dividends paid by ETFs underlying the brief place have to be paid to the establishment lending the safety and thus is not going to generate revenue in your account.

Tax-loss harvesting alternatives exist when the lengthy portfolio has beneficial properties and when the brief place has losses. Portfolio losses might end in margin calls out of your monetary establishment, and if you instruct Inexperienced Harvest to promote portfolio belongings in response to margin calls, such gross sales might generate taxable capital beneficial properties. Alternatively, you may be required so as to add money to the account in response to margin calls.

Quick positions can result in extra risky efficiency of the underlying safety. As well as, the ETFs underlying brief positions might expertise intervals of low buying and selling quantity or lowered liquidity, which might limit the flexibility to enter brief positions. In these intervals, Inexperienced Harvest can search to enter brief positions by means of different obtainable transactions, which can have greater transaction prices. All investments are topic to liquidity danger, particularly when markets aren’t functioning usually. If Inexperienced Harvest is unable to amass or get rid of holdings rapidly or at costs that signify perceived market worth, then the Technique can be negatively impacted. Examples of occasions that may result in heightened liquidity danger embody home and international financial crises, pure disasters, political instability, and regulatory adjustments.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.