It is troublesome to get rising markets

It is troublesome to get rising markets (EM) publicity sans the native forex threat that comes with it. One solution to decrease these challenges is the Vanguard Rising Markets Authorities Bond Index Fund ETF Shares (VWOB).

VWOB seeks to trace the efficiency of a benchmark index that measures the funding return of U.S. dollar-denominated bonds issued by governments and government-related issuers in rising market nations. The fund employs an indexing funding method designed to trace the efficiency of the Bloomberg Barclays USD Rising Markets Authorities RIC Capped Index.

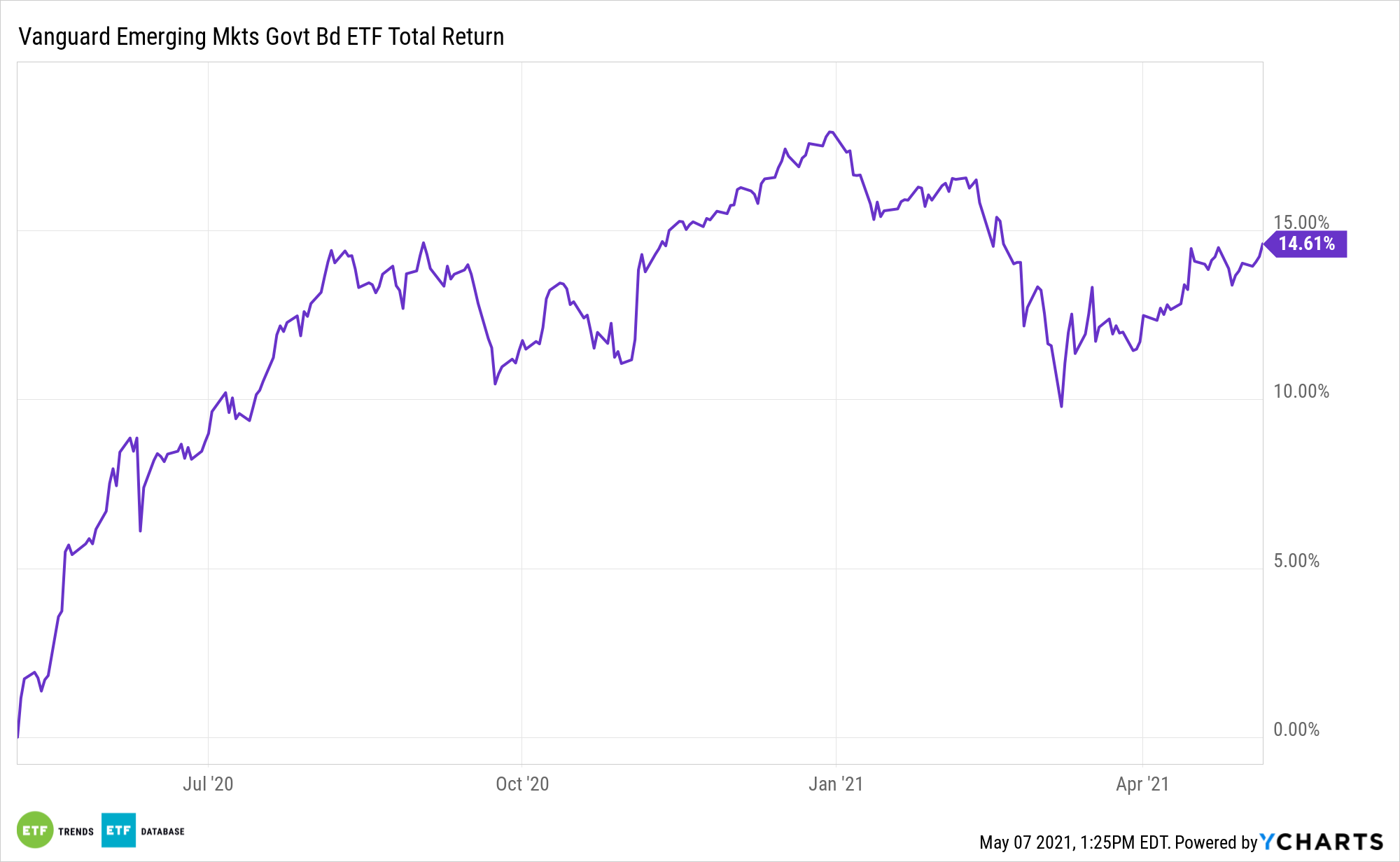

All the fund’s investments shall be chosen by way of the sampling course of, and below regular circumstances no less than 80% of the fund’s property shall be invested in bonds included within the index. The fund has risen over 14% throughout the previous 12 months.

A Hedge Towards a Rising Greenback

The energy of rising markets is often tied to the efficiency of their native currencies. A stronger greenback amid a vaccine deployment and the potential of rising U.S. rates of interest may give EM traders complications.

The capital markets are not shopping for Federal Reserve claims of continued accommodative help. In line with a Monetary Instances article, “When French funding financial institution Natixis polled its shoppers in December about their key expectations for the 12 months forward, their survey discovered that 52 per cent of them anticipated rising markets to outperform main economies.”

“It’s not shaping up that approach,” the article mentioned additional. “Within the first quarter of the 12 months, rising markets equities rose round 5 per cent, lower than half the 9 per cent surge within the S&P 500. The currencies of creating economies have additionally fared much less properly than anticipated, whereas the greenback has gained almost three per cent in opposition to a basket of its friends in that interval.”

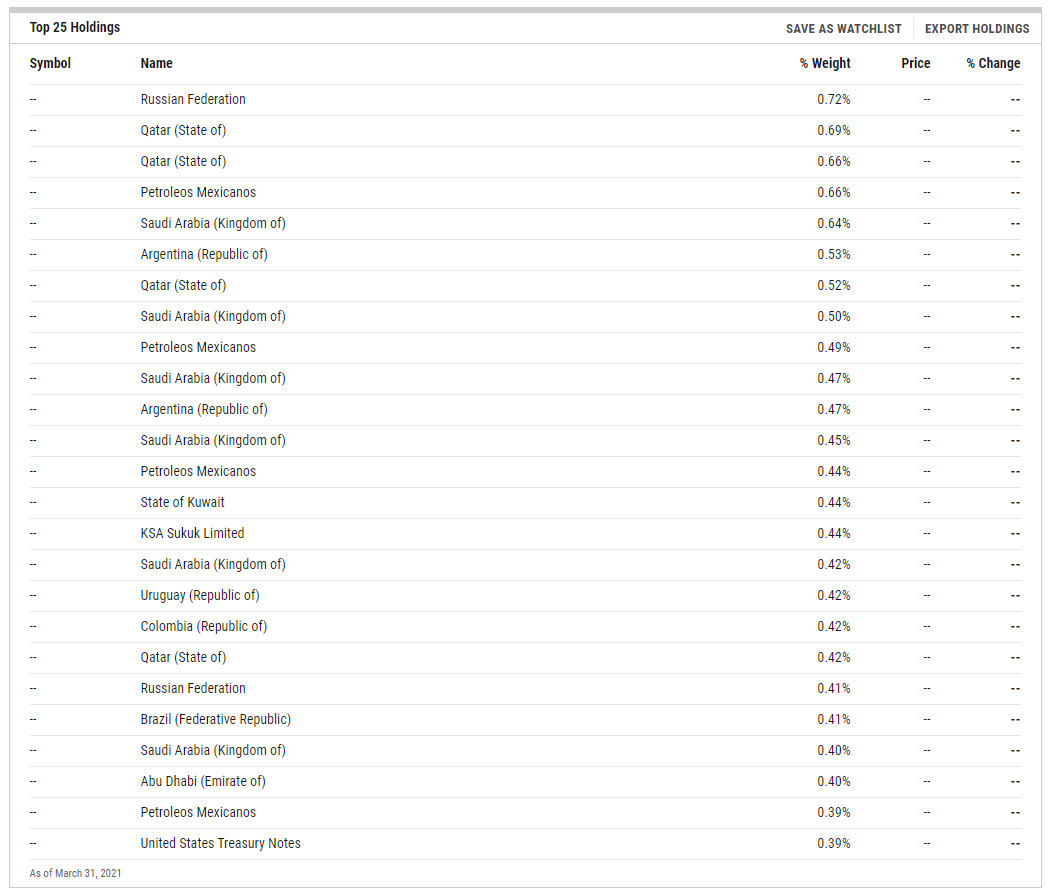

That mentioned, VWOB can get publicity to worldwide markets with out the direct forex threat by way of bonds. Moreover, traders get diversification within the fund, which gives publicity to nations like Mexico, Saudi Arabia, and Indonesia.

Moreover, VWOB comes with a low expense ratio of simply 0.25%. That is 19 foundation factors decrease in comparison with its categorical common.

“This ETF delivers publicity to an asset class that may improve present returns and ship geographic diversification, with out subjecting traders to forex fluctuations,” an ETF Database evaluation famous. “VWOB is among the least costly choices accessible within the class and has vital property and each day liquidity.”

or extra information, info, and technique, go to the Mounted Earnings Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.