By Stephen McBride

By Stephen McBride

Day-after-day, hundreds of traders accept mediocrity. It’s not their fault. They’ve been fed the identical, unsuitable recommendation for years: “Purchase the S&P 500.”

As you most likely know, the S&P is by far probably the most watched, talked about, and written about inventory benchmark on this planet. Research present tens of thousands and thousands of parents personal S&P 500 index funds of their 401(okay)s. In reality, many novice traders assume the S&P “is” the market!

On this essay, I’ll present you why these people are making an enormous mistake, and what it is best to do as a substitute.

The S&P Is The Epitome Of Mediocrity

The S&P tracks 500 of the most important firms in America. Inside its ranks are a handful of nice firms, a pair dozen respectable firms, and 400+ firms I wouldn’t make investments a greenback in.

If you personal the S&P 500, you personal all of them. Don’t get me unsuitable, I’m not saying it is best to blacklist the S&P fully. An enormous chunk of my private portfolio is invested in a handful of nice particular person shares inside the S&P.

I really like huge, dominant disruptors like Walmart (WMT), which has an internet enterprise rising at triple digits. Or fee duopoly Visa (V) and Mastercard (MA), leaders within the disruption of cash.

These are shares you purchase, and by no means promote. You sit again and watch these firms compound your cash over a long time.

However for those who’re after huge, fast beneficial properties, you’ll not often get them within the S&P. That’s proper: One of the best-performing shares are NEVER within the S&P 500. For instance pc chipmaker Superior Micro Gadgets (AMD) was the best-performing identify within the S&P in 2019, handing traders 150% beneficial properties.

However step exterior this “over picked” universe of shares, and you’ll earn far larger returns. Promoting software program pioneer Digital Turbine (APPS) is just too small for the “huge leagues.” However it shot up 240% final yr.

Ditto for Enphase Power (ENPH), which makes photo voltaic microinverters for rooftop panels. The inventory jumped 410% in 2019.

Longtime RiskHedge readers will know the identify Shopify (SHOP). It isn’t within the S&P both, but it soared 210% final yr. Be mindful, these aren’t tiny microcap shares. They’re huge, fast-growing, multi-billion greenback companies that the S&P committee has not admitted into the index.

I might reel off one other 30 shares that trounced the S&P’s finest performer. And I’ll even take it a step additional…

When A Inventory Will get “Promoted” To The S&P, It Will Typically Tread Water At Greatest

And fall off a cliff at worst. In reality, analysis from Goldman Sachs checked out each inventory included within the S&P 500 over the previous two years. They discovered that the inventory usually falls as soon as it will get added to the index.

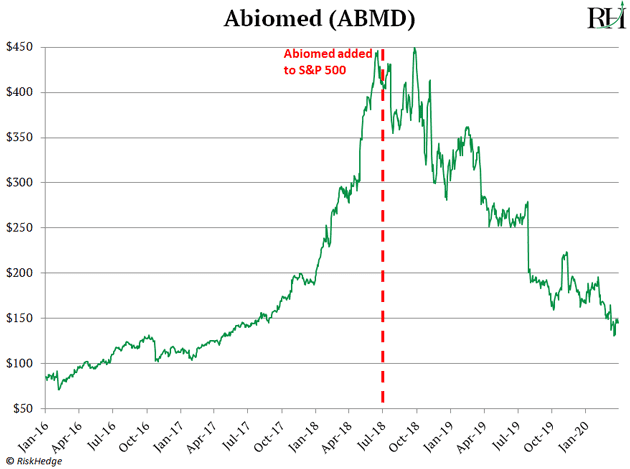

Take Abiomed (ABMD). It was added to the S&P 500 in Might 2018, then started its downward spiral:

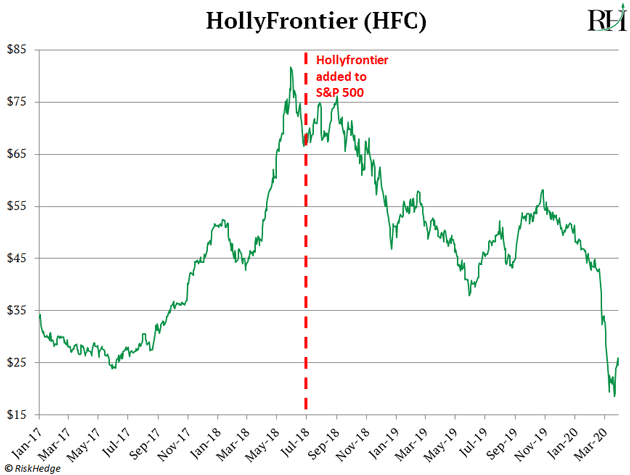

Or HollyFrontier (HFC):

Consider a sports activities celebrity like LeBron James or Tom Brady. The rise to superstardom is probably the most thrilling half. Shares are the identical. You need to search out the fast-growing rising stars earlier than they’re household-name superstars.

The Shares I’m Speaking About All Share One Factor In Widespread

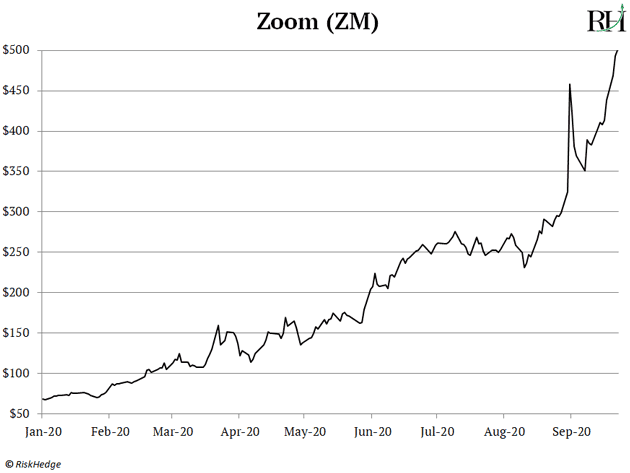

They’re rising at supersonic speeds. For instance, digital assembly sensation Zoom (ZM) isn’t within the S&P, and it’s handed traders 500% beneficial properties this yr.

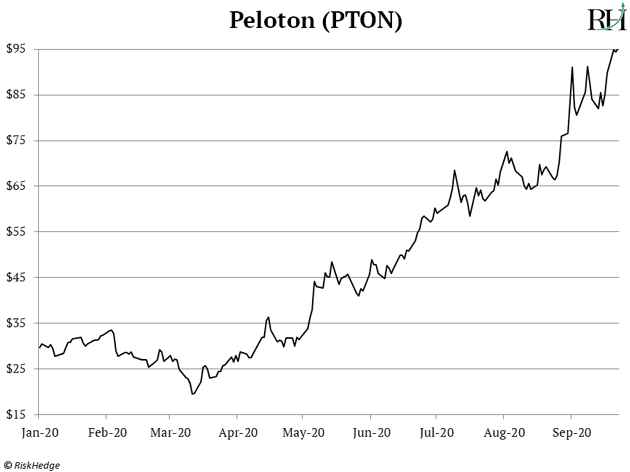

Linked health pioneer Peloton (PTON) has tripled since January.

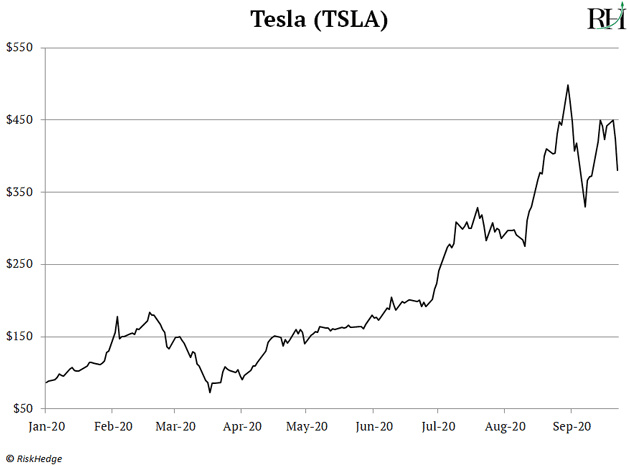

Electrical automobile pioneer Tesla (TSLA) was simply rejected for S&P inclusion. But its inventory jumped 400% over the previous 9 months!

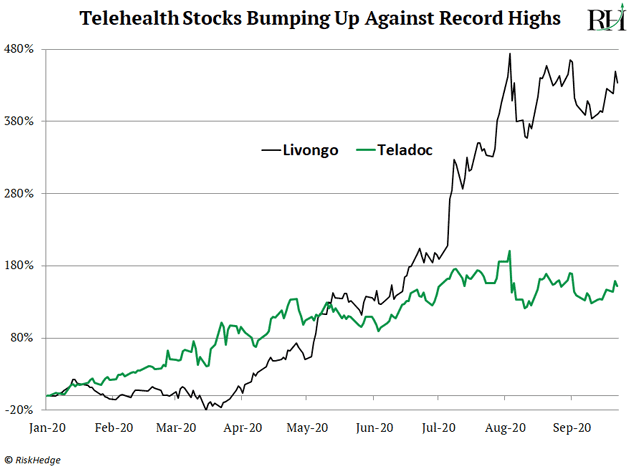

Take telehealth pioneers Livongo (LVGO) and Teladoc (TDOC) for instance. Seeing a health care provider on the pc was unheard of some years in the past. However as common RiskHedge readers know, thousands and thousands of People are actually firing up their laptops and “visiting” medical doctors nearly. They’ve rocketed 390% and 140% since January.

Once more, none of those shares are within the S&P 500.

If You Need A Piece Of America’s Quickest Rising Shares, Look Exterior The S&P

The fact is the S&P is filled with stodgy dinosaurs that may eke out slightly progress every year. Over the previous decade, the typical S&P 500 firm has grown gross sales a smidge below 5%/yr.

In the meantime new sectors like telehealth, edge-computing, and artificial biology are rising at a 50%+ clip. Each disruption investor must be studying every little thing they will about these new, fast-growing firms.

The Nice Disruptors: three Breakthrough Shares Set to Double Your Cash”

Get my newest report the place I reveal my three favourite shares that can hand you 100% beneficial properties as they disrupt entire industries. Get your free copy right here.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.