Rising COVID-19 circumstances have pushed many buyers again right into a defensive stance in opposition to volatility, to the advantage of the Invesco S&P 500 Low Volatility ETF (SPLV).

Volatility, as outlined, is a statistical measurement of the magnitude of up-and-down asset value fluctuations over time.

The fund and the index are re-balanced and reconstituted quarterly in February, Could, August, and November.

“SPLV has gathered belongings up to now month in distinction to see USMV,” a CFRA Funds in Focus report famous. “Invesco’s portfolio of the least volatility 100 shares within the S&P 500 Index amassed $1.four billion of recent cash within the one-month interval ended August 20, erasing prior redemptions and pushing the year-to-date internet inflows complete to roughly $320 million, in keeping with CFRA’s ETF information.”

“SPLV climbed 3.3% up to now month, forward of 1.8% acquire for SPDR S&P 500 ETF (SPY 443 ***) because the extra defensive method added worth,” the report added.

The fund relies on the S&P 500® Low Volatility Index and seeks to take a position a minimum of 90% of its complete belongings in frequent shares that comprise the Index. The index is compiled, maintained, and calculated by Normal and Poor’s and consists of the 100 shares from the SP 500 Index with the bottom realized volatility over the previous 12 months.

A Shift Towards Protection

A shift towards extra defensive sectors came about this month for SPLV. Sectors that lack the panache of huge tech like utilities and client staples are again in favor for the fund.

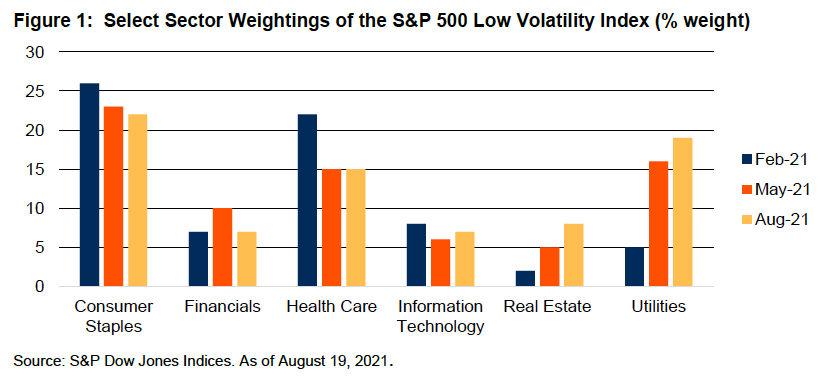

“SPLV elevated its publicity to sure defensive sectors throughout its August rebalance,” the CFRA report mentioned. “The S&P index behind SPLV is rebalanced on a quarterly foundation, with the newest modifications occurring final week. Publicity to higher-dividend yielding sectors similar to actual property and utilities continued to climb from the February and Could ranges, as proven in Determine 1.”

“Utilities now represents 19% of belongings, up from 16% and 5% in Could and February, respectively, whereas actual property is 8%, up from 5% and a couple of%,” the report added. “In the meantime, stakes client staples and well being care have been 22% and 15% of the portfolio, down from the 26% and 22% weights in February, although little modified from Could. The financials sector shrunk probably the most in August, with the burden falling again to the 7% February degree, after initially climbing to 10% in Could.”

For extra information and data, go to the Revolutionary ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com