Empirical analysis confirms that merger and acquisition methods (M&A), as represented by M&A index returns, are positively associated to the rate of interest and the change in rate of interest. This optimistic relationship between M&A index returns and rates of interest is pushed much less by the financial cycle, however by the distinctive nature of M&A deal danger.

Moreover, given M&A’s low correlation to the fairness and glued earnings markets, it might function a diversified supply of return and assist traders handle volatility in a rising charge market.

In 2015 the Federal Reserve (“the Fed”) started elevating rates of interest after reducing them to historic lows on account of the financial fallout of the 2008 Nice Monetary Disaster. From 2015 to 2019, the Fed Fund Goal Charge was raised 9 instances to as excessive as 2.5% till the onset of the COVID-19 Pandemic in 2020 compelled a reverse in course. Though the Fed has dedicated to supportive financial insurance policies as we navigate the restoration from the pandemic, we now have already seen inflation expectations selecting up and traders questioning when rates of interest will start to go up once more.

Traditionally, when rates of interest have climbed, fixed-income returns have typically fallen. With charges unlikely to stay low indefinitely, how ought to traders reply? Is there something they’ll do to mitigate the fixed-income losses which are prone to happen on this surroundings?

Capitalizing on deal danger

One doable technique is merger arbitrage. This various funding seeks to revenue from the worth enhance that usually happens within the inventory of an organization being acquired. When an acquisition is introduced, that inventory sometimes rallies however normally stays under the takeover bid. This “low cost” represents “deal danger,” the chance that the transaction will fail as a result of financing difficulties, regulatory points, issues acquiring shareholder approval, or different components. Because the deal strikes nearer to consummation, this unfold sometimes narrows as the danger dissipates.

One benefit of taking over this danger is its diversification profit. That’s, as a result of deal danger is modestly to negatively correlated to standard asset lessons, including a merger arbitrage technique to a portfolio might present added diversification of danger.

M&A and rates of interest

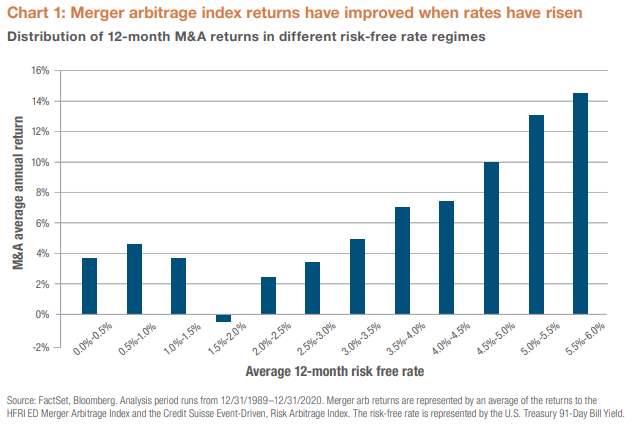

How have merger arbitrage methods carried out traditionally? Chart 1 reveals that merger arbitrage index returns have been higher when rates of interest have been greater. For instance, when the “risk-free” rate of interest was 3.5%-4.0%, the common 12-month index return on merger arb methods was 6.84%. That is consistent with the index returns these methods have sometimes sought, that’s, 3%-6% over the risk-free charge.

Chart 2 illustrates how merger arb index returns have, till not too long ago, tracked intently with the risk-free charge. Two options are instantly evident: 1) Previous to late 2008, the correlation between a rising, risk-free charge and merger arbitrage index returns was very tight, and a couple of) after 2008, that correlation weakened.

For instance, in late 2000, index returns started to say no and continued to take action as short-term rates of interest plummeted over the subsequent two years. Then again, merger arbitrage index returns improved as short-term rates of interest rose sharply between 2004 and 2007.

It’s additionally noteworthy that the hyperlink between the risk-free charge and the merger arb index returns was damaged starting in 2008. Little question, the terribly low-interest charges maintained by the Fed over the previous ten years have been a key driver behind decrease merger arb index returns, suggesting that when charges development towards regular ranges, index returns will development greater as properly.

Excessive and rising rates of interest drive merger arb index returns

To raised perceive the efficiency of merger arb methods, we examined index returns between December 1994 and December 2020, analyzing them in relation to 3 components:

- the risk-free charge firstly of the 12 months,

- the change within the risk-free charge over one 12 months, and

- financial situations firstly of the 12 months, represented by the Convention Board’s Coincident Index

of Financial Indicators, which tracks non-farm payrolls, private earnings, industrial manufacturing, and

gross sales by the manufacturing, wholesale, and retail sectors.

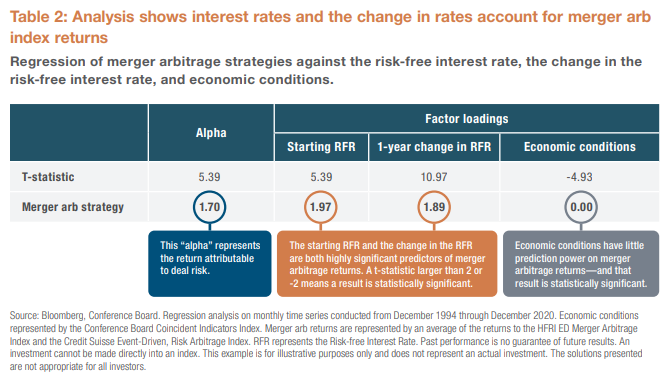

We discovered that each excessive charges and rising charges helped to account for a good portion of the variability of index returns over this era. Broader macroeconomic situations, then again, didn’t.

To be extra particular, a one-percentage-point enhance within the beginning risk-free charge was related to an increase of 1.97 proportion factors in merger arb index returns (see Desk 2). Equally, a one-percentage-point enhance within the charge of change within the risk-free charge was related to an enchancment of 1.89 proportion factors. Then again, normal financial situations had little impact on index returns. Though the impact of this issue was statistically important, it was so small as to be meaningless.

Furthermore, our evaluation confirmed that, on common, merger arb methods produced an alpha of 1.70% per 12 months relative to those components. One technique to interpret that is that it represents the deal danger we famous earlier, or the index return captured when the goal firm’s inventory rallies throughout the interval between the deal announcement and the closing.

This discovering, that merger arb efficiency tracks with short-term rates of interest and modifications in these charges, could appear counterintuitive. Low charges, in truth, are sometimes cited as extra conducive to merger and acquisition exercise.

How rates of interest account for merger arbitrage efficiency

So, why are excessive and rising charges related to stronger merger arb index returns? We imagine there are 4 causes:

- Deal premium — With mergers and acquisitions, there’s at all times a danger {that a} deal will fall by.

The anticipated return on merger arbitrage incorporates a premium above the risk-free charge that displays

this danger. Subsequently, including this premium to the risk-free charge when that charge is rising ends in a better

anticipated return. - Alternative value — Merger arb methods should supply enticing returns, or traders will go for different

investments with comparable returns however much less danger. With rates of interest at excessive ranges, investments

providing enticing returns with decrease danger could also be extra plentiful. If merger arb returns fail to compensate

for deal danger sufficiently, traders will pull their cash from arb funds and go for these different investments. - Borrowing value — As rates of interest rise, the buying firm requires an even bigger deal premium

as a result of whether it is financing the cope with debt, its borrowing prices will likely be greater. The buying firm

will seize this premium through a decrease buy value, producing greater returns for merger-arb traders. - Larger return on collateral — Most arbitrage methods make use of some sort of a brief place to

assist handle draw back danger. Whether or not the brief is on the market or sector stage or is a brief on the

inventory of the acquirer, the lender would require that money be put apart as collateral on the brief. As

charges rise, the money return on the collateral can even rise, offering a optimistic return potential when

rates of interest rise.

The underside line for traders? As we get well from the pandemic, rates of interest wouldn’t keep at these historic lows endlessly. And if historical past is any information, greater charges might end in enticing return potential for merger arbitrage methods, making this various funding a well timed complement to a fixed-income portfolio. Furthermore, as a result of this technique is uncorrelated with conventional asset lessons, it could additionally present extra diversification advantages.

Initially revealed by New York Life Investments

Alpha, a measure of efficiency, is the surplus return of an funding relative to the return of a benchmark index.

T-stat, is a measure of how excessive a statistical estimate is. It’s calculated by subtracting the hypothesized worth from the statistical estimate after which dividing by the estimated normal error. In lots of, however not all conditions, the hypothesized worth could be zero.

The Bloomberg Barclays U.S. Combination Bond Index is a broad-based index that measures the investment-grade, U.S. dollar-denominated, fixed-rate, taxable bond market, together with Treasuries, government-related and company securities, mortgage-backed securities (company fixed-rate and hybrid, adjustable-rate, mortgage pass-throughs), asset-backed securities, and business mortgage-backed securities, with maturities of at the very least one 12 months.

The Credit score Suisse Occasion-Pushed Threat Arbitrage Index is a subset of the Credit score Suisse Hedge Fund Index that measures the mixture efficiency of danger arbitrage funds. Threat arbitrage, event-driven hedge funds sometimes try and seize the spreads in merger or acquisition transactions involving public firms after the phrases of the transaction have been introduced.

The HFRI ED: Merger Arbitrage Index focuses on alternatives in fairness and fairness associated devices of firms that are at present engaged in a company transaction.

The S&P 500 Index is an American inventory market index, primarily based in the marketplace capitalization of 500 giant firms having widespread inventory listed on the NYSE or NASDAQ.

Previous efficiency is not any assure of future outcomes, which is able to fluctuate. All investments are topic to market danger and can fluctuate in worth.

Merger arbitrage danger is the principal danger related to the Fund’s investments, in that sure of the proposed takeover transactions through which the Fund invests could also be renegotiated, terminated, or contain an extended timeframe than initially contemplated, for enterprise causes or as a result of regulatory oversight or for different causes, which, in every case, might negatively impression the Fund’s returns.

Brief positions, together with brief publicity to securities indexes, introduce extra danger to the Fund than lengthy positions (purchases) as a result of the utmost sustainable loss on a safety bought (held lengthy) is restricted to the quantity paid for the safety plus the transaction prices, whereas there is no such thing as a most attainable value of the shorted safety. Subsequently, in concept, securities offered brief, have limitless draw back potential.

This materials represents an evaluation of the market surroundings as of a selected date; is topic to alter; and isn’t supposed to be a forecast of future occasions or a assure of future outcomes. This data shouldn’t be relied upon by the reader as analysis or funding recommendation concerning the funds or any issuer or safety specifically.

The methods mentioned are strictly for illustrative and academic functions and will not be a advice, supply, or solicitation to purchase or promote any securities or to undertake any funding technique. There is no such thing as a assure that any methods mentioned will likely be efficient.

This materials accommodates normal data solely and doesn’t take into consideration a person’s monetary circumstances. This data shouldn’t be relied upon as a major foundation for an funding resolution. Reasonably, an evaluation ought to be made as as to if the data is suitable in particular person circumstances, and consideration ought to be given to speaking to a monetary advisor earlier than investing resolution.

Think about the Fund’s funding aims, dangers, and fees and bills fastidiously earlier than investing. The prospectus and the assertion of extra data, together with this and different related details about the Fund, can be found by visiting nylinvestments.com/etfs or calling 888-474-7725. Learn the prospectus fastidiously earlier than investing.

For extra data, name 888-474-7725 or go to nylinvestments.com/etfs.

New York Life Investments is a service mark and title underneath which New York Life Funding Administration LLC does enterprise. New York Life Investments, an oblique subsidiary of New York Life Insurance coverage Firm, positioned at 51 Madison Avenue, New York, NY 10010, offers funding advisory services. IndexIQ® is an oblique wholly owned subsidiary of New York Life Funding Administration Holdings LLC and serves because the

advisor to the IndexIQ ETFs. ALPS Distributors, Inc. (ALPS) is the principal underwriter of the ETFs. NYLIFE Distributors LLC is a distributor of the ETFs. NYLIFE Distributors LLC is positioned at 30 Hudson Avenue, Jersey Metropolis, NJ 07302. ALPS Distributors, Inc. shouldn’t be affiliated with NYLIFE Distributors LLC. NYLIFE Distributors LLC is a Member FINRA/SIPC.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.