By BCM Funding Staf

By BCM Funding Staff

The Nationwide Bureau of Financial Analysis’s choice to set the COVID recession at two months was shocking since greater than a 12 months and a half later, “normalization” is ongoing. And though longer-dated inflation expectations have been moderating (accepting the “transient” theme), 7 million People are nonetheless out of labor regardless of many industries—notably the service and manufacturing industries—proceed to report hiring struggles. Seeking to rising markets, inflation charges in EM Asia seem subdued—nicely under their goal midpoint—and are anticipated to recede additional. In the meantime, traders search draw back safety because the Skew index continues to climb and market management between progress and worth continues to toggle. Bond yields across the globe have been transferring decrease however this might simply be the seasonal impact we see yearly because the 10-year Treasury yield has traditionally declined through the summer time months. Will we see it rise throughout the subsequent 6-months, following a 20% drop, or will the Covid issue power completely different outcomes?

[wce_code id=192]

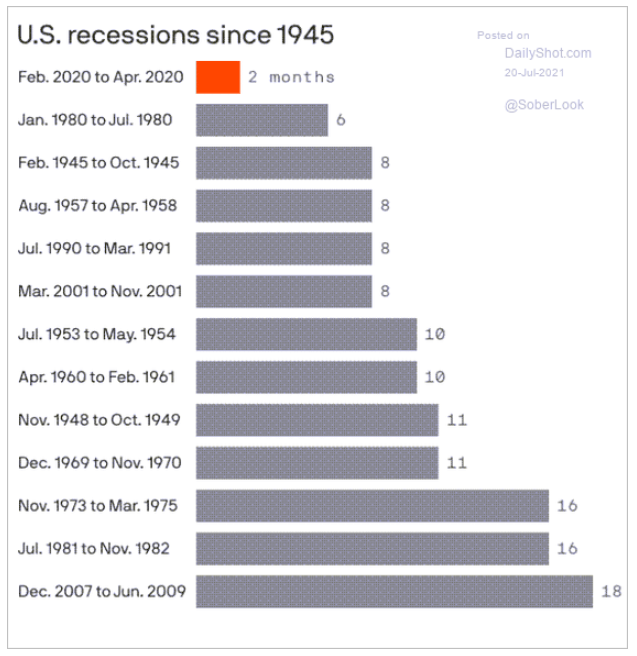

1. As a complete, it was decided the recession lasted solely two months, the shortest in historical past. I suppose it relies upon who you ask…

Supply: NBER, from 7/20/21

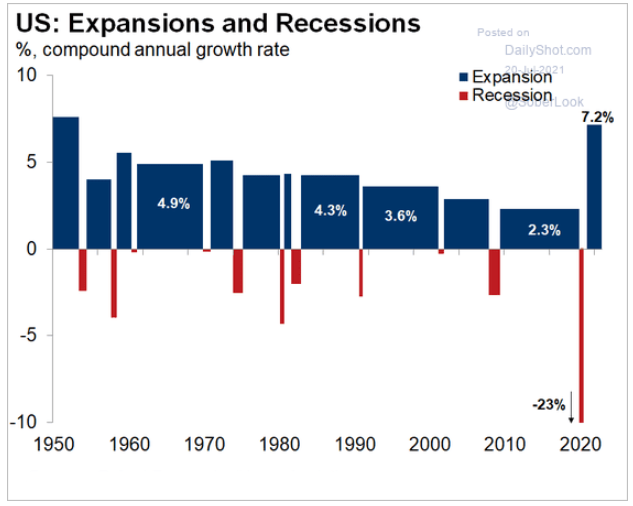

2. Normalization remains to be ongoing, but up to now the restoration is on par with submit WWII:

Supply: Oxford Economics, Haver Analytics, from 7/20/21

3. US CPI doesn’t all the time seize “true” inflation. The biggest element, housing, is decided by “equal rents” which is predicated on a survey asking owners how a lot they assume they may lease their home for. That is the most effective we will do?

Supply: Bloomberg, from 7/21/21

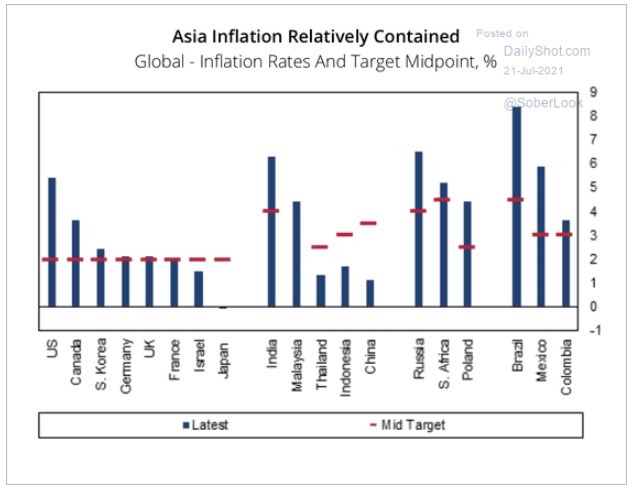

4. Inflation charges across the globe:

Supply: Nationwide Central Banks, from 7/21/21

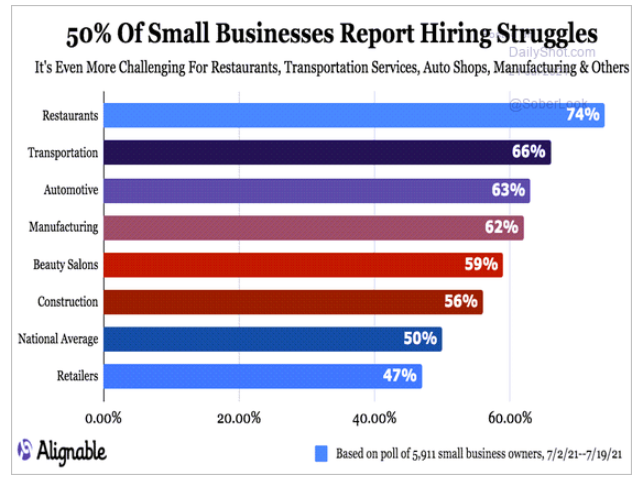

5. ~7 million People are nonetheless unemployed from the Covid recession, but:

Supply: The Day by day Shot, from 7/21/21

6. Is one other blow to crypto on the way in which?

Supply: The Day by day Shot, from 7/21/21

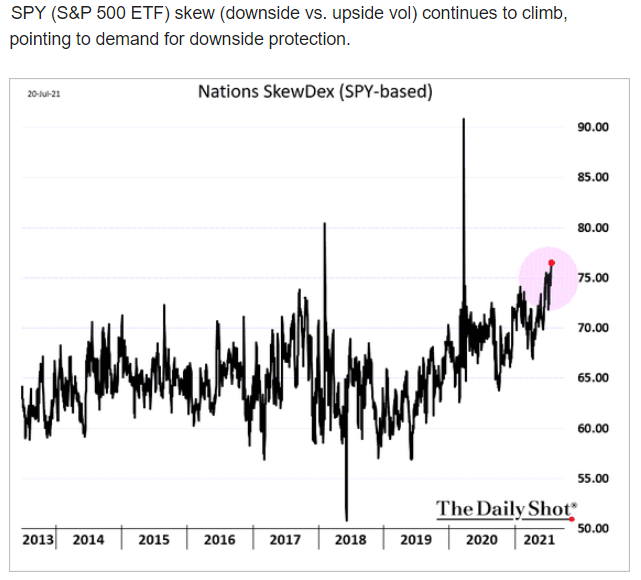

7. Most traders search for draw back safety after it’s too late (see spikes). We provide extra everlasting alternate options:

Supply: The Day by day Shot, from 7/21/21

8. Market management has been on a rollercoaster this 12 months. This chart reveals a worth ETF/a progress ETF:

Supply: The Day by day Shot, from 7/21/21

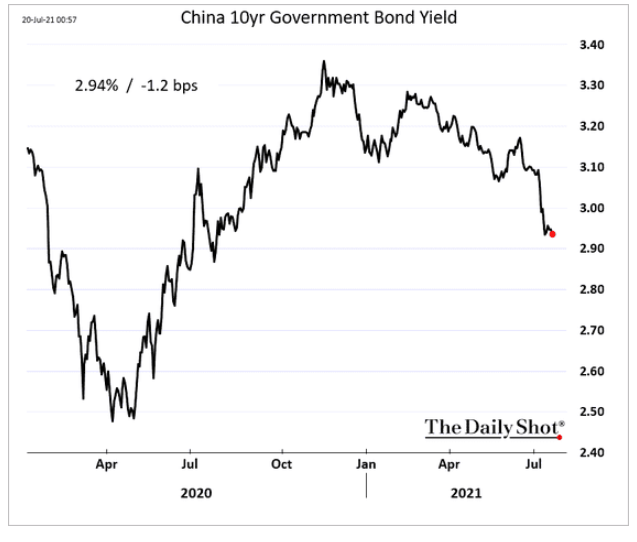

9. Falling bond yields has typically been a worldwide phenomenon. Are the bond markets telling us the expansion will average sooner/greater than anticipated?

Supply: The Day by day Shot, from 7/20/21

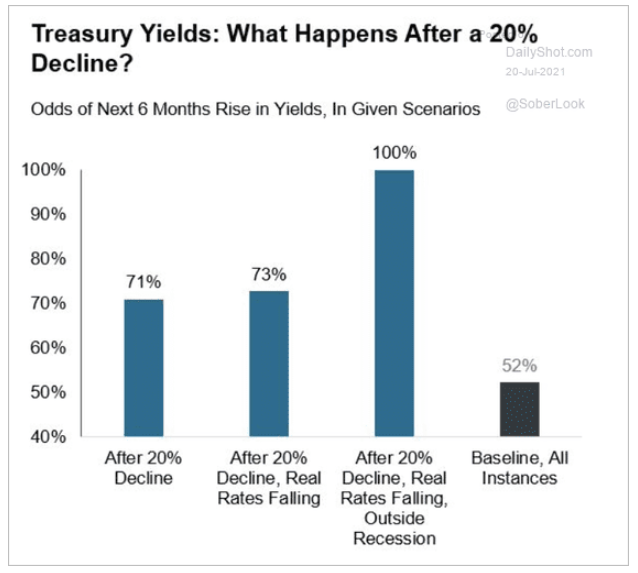

10. Attention-grabbing, however the yield drops seem like greater than seasonal, particularly within the face of rising inflation considerations:

Supply: The Day by day Shot, from 7/21/21

11. However Covid by no means occurred earlier than…

Supply: The Day by day Shot, from 7/21/21

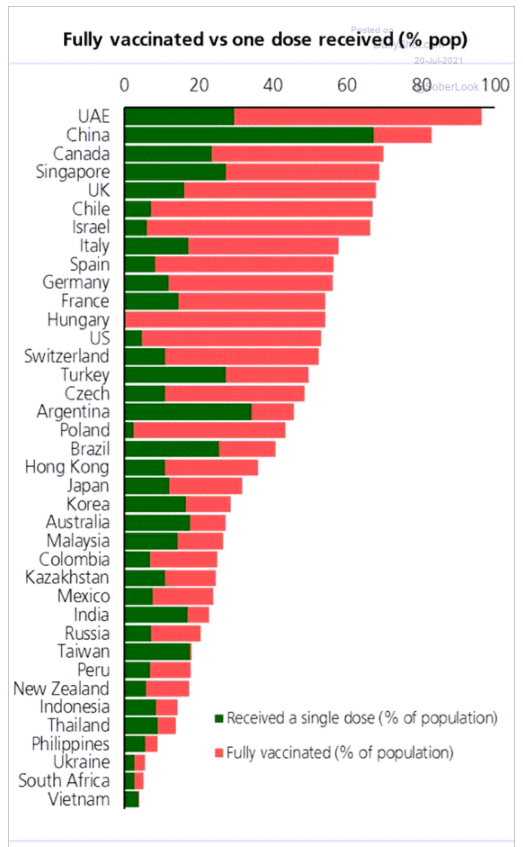

12. If herd immunity requires 70% or extra (figures fluctuate), then the planet remains to be woefully uncovered to the delta variant:

Supply: The Day by day Shot, from 7/21/21

This text was contributed by Beaumont Capital Administration Funding Staff, a participant within the ETF Strategist Channel.

For extra insights like these, go to BCM’s weblog at weblog.investbcm.com.

Disclosure: The charts and info-graphics contained on this weblog are usually primarily based on knowledge obtained from third events and are believed to be correct. The commentary included is the opinion of the writer and topic to vary at any time. Any reference to particular securities or investments are for illustrative functions solely and will not be supposed as funding recommendation nor are they a advice to take any motion. Particular person securities talked about could also be held in consumer accounts. Previous efficiency is not any assure of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.