Today I’m spilling the beans on

Today I’m spilling the beans on one thing essential.

It’s a “fact” about investing nearly no person understands.

This fact explains why most traders battle to make any actual cash within the inventory market… whereas a number of obtain life-changing beneficial properties.

The reality is… most shares suck.

Forgive me for the crude language.

There’s merely no different phrase that so precisely sums up my ideas on the overwhelming majority of shares:

They suck.

Let me present you what I imply… and how one can flip this fact into an edge that’ll allow you to beat 99% of traders.

This fact has been fooling traders for hundreds of years…

About 150 years in the past, whaling was certainly one of America’s most vital industries.

Electrical energy hadn’t been invented. To gentle up streets and houses at evening, of us burned extremely flammable whale oil.

By 1850, whaling was America’s fifth-largest sector, and it paid extraordinarily effectively. Just some thousand whalers earned the modern-day equal of $27 billion in a single yr.

However most voyages by no means made a dime.

A couple of years in the past, Chicago College researchers wrote a guide in regards to the US whaling growth: In Pursuit of Leviathan. They analyzed 4,000+ voyages and located one-third of whalers really misplaced cash. And get this… the highest 1.7% of whalers generated nearly all of the returns.

What if I instructed you a similar is true in modern-day investing?

Have a look at the enterprise capital (VC) trade, for instance. Most venture-backed startups fail. A small portion do okay. However solely a handful flip into multibillion-dollar winners.

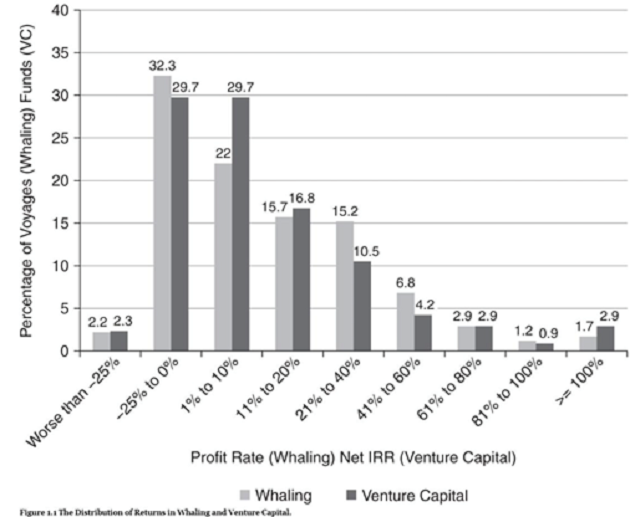

Within the guide VC: An American Historical past, Tom Nicholas in contrast VC returns over the previous few a long time to whalers 150 years in the past. And so they look eerily comparable.

Roughly one-third of funds misplaced cash, and solely a tiny fraction hit it out of the park—as you’ll be able to see right here:

Supply: VC: An American Historical past.

Tons of losers… a number of huge winners.

The US inventory market follows the identical sample.

JP Morgan Asset Administration not too long ago revealed an amazing paper known as Agony & Ecstasy.

It’s a deep dive into the efficiency of the US inventory market over the previous 40 years. And it confirmed an vital investing fact: most shares suck.

JPMorgan discovered nearly half of shares suffered a “catastrophic loss” from 1980 to 2020. Which means they plunged 70%+ and by no means recovered.

One other 26% of shares handed out returns decrease than the general market.

In different phrases, roughly eight in 10 shares had been complete duds that price traders’ cash.

However you certainly know the US inventory market is quite a bit greater than it was forty years in the past.

How is that attainable when eight in 10 shares are losers?

Seems, all the market’s returns got here from simply 10% of shares, which JPMorgan known as “megawinners.” In brief, this elite group of shares carried out so effectively, they pulled the complete market up with them.

Whether or not you’re measuring 19th-century whaling… early stage startups… or massive shares, you’ll be able to’t escape this investing fact. A number of losers… a number of huge winners.

In brief, the chances are stacked in opposition to traders from the beginning. It’s no marvel most inventory market traders battle to even sustain with inflation.

Because of this selecting particular person shares isn’t for everybody. In reality, many of us are higher off proudly owning a broad basket of US shares or shopping for indexes.

By merely proudly owning the S&P 500 ETF (SPY), you’d have doubled your cash over the previous 5 years. That’s , stress-free possibility.

However traders who actually need to get wealthy should hunt for “megawinners.”

“Stephen… how do I discover these elite shares?”

It’s quite a bit simpler as soon as you recognize what to search for.

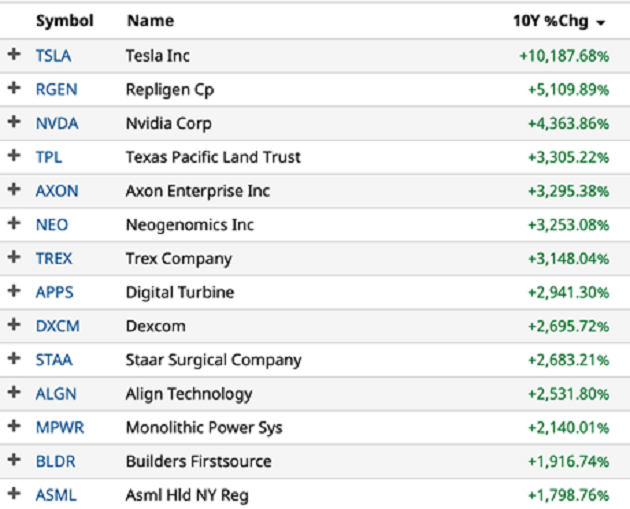

Listed here are the highest performing massive US shares over the previous ten years:

These megawinners aren’t all family names. However most of them share one key trait: They’re disruptors.

Longtime RiskHedge readers know disruptors are firms that change the world and invent the longer term. Take a fast take a look at the highest three megawinners.

Tesla rocketed to the highest of the record by pioneering inexpensive electrical automobiles.

Repligen invented machines pharma firms use to make life-saving medication.

And America’s largest chipmaker, Nvidia, is the “brains” behind a very powerful synthetic intelligence (AI) tasks on the earth as we speak.

Our job at RiskHedge is to get you into these disruptive megawinners.

We spend money on firms pioneering entire new industries and reworking previous ones.

The above record exhibits companies that obtain these feats routinely become megawinners… and may hand you 1,000%+ beneficial properties, or typically much more, over the course of a decade.

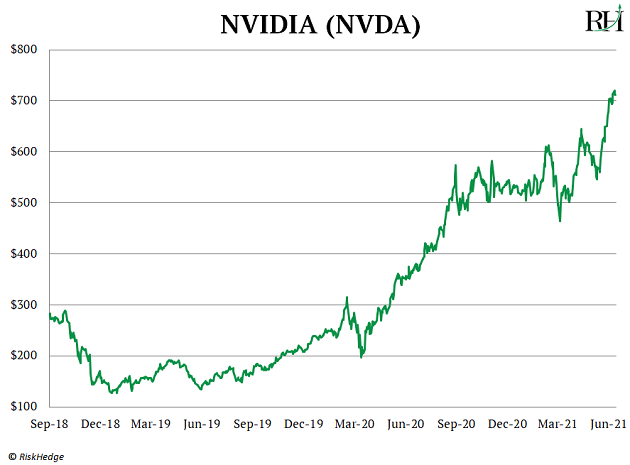

For instance, I made an enormous name again in 2018.

I stated if I may solely purchase one inventory for the subsequent 5 years… it could be Nvidia (NVDA). The inventory has greater than doubled since then:

Why did I select Nvidia?

It ticked all of the packing containers to be a megawinner. The disruptive chipmaker nearly single handedly revived the dream of making synthetic intelligence (AI) with its revolutionary chip known as the GPU.

Not solely are these chips chargeable for the real-life online game graphics now we have as we speak…

These gaming chips are good for coaching machines to “suppose” like people.

This breakthrough has helped Nvidia develop its AI-related information middle gross sales 1,850% over the previous 5 years.

Keep in mind, disruptive megawinners routinely pioneer entire new industries. This enables them to develop uninterrupted yr after yr.

Nvidia’s inventory has handed out 14x beneficial properties over the previous 5 years.

So subsequent time you concentrate on shopping for a inventory, bear in mind the reality:

Most shares suck.

If you wish to get wealthy investing, you need to personal the “megawinners.”

Right here at RiskHedge, we’re dedicated to discovering them for you… and serving to you revenue off them for years to come back.

Initially revealed by Mauldin Economics, 6/21/21

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.