The labor market is setting new

The labor market is setting new—and regarding—information within the U.S. as Covid restrictions ease, life will get a bit extra regular, and “return-to-office” efforts start in earnest; job openings have hit their highest degree on document, layoffs hit a document low, and employees are quitting at a document tempo. Costs are additionally climbing, spurred at the least partially by the necessity to accommodate greater wages, although the pandemic-induced hire crash might stop the climb from totally reflecting in CPI… for so long as it lasts. The fairness markets in the meantime are revisiting a sample from the ’90s and worth shares have continued their outperformance. And it’s been a busy week for Bitcoin after tumbling on the again of the Colonial Pipeline random seizure after which being adopted as authorized tender for the primary time in a landmark transfer by the El Salvadorian authorities—does such a combined bag of headlines imply extra but volatility could possibly be in retailer?

[wce_code id=192]

1. The weird continues as job openings hit a document excessive. Companies wish to rent, however the low finish of the pay spectrum continues to be competing with the pandemic-based unemployment advantages.

Supply: The Day by day Shot, from 6/9/21

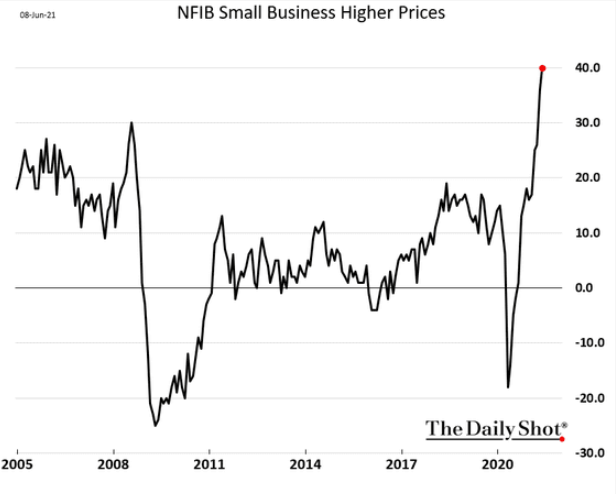

2. After over a decade with restricted capacity to cross on worth will increase, companies now can and are passing on greater costs:

Supply: The Day by day Shot, from 6/9/21

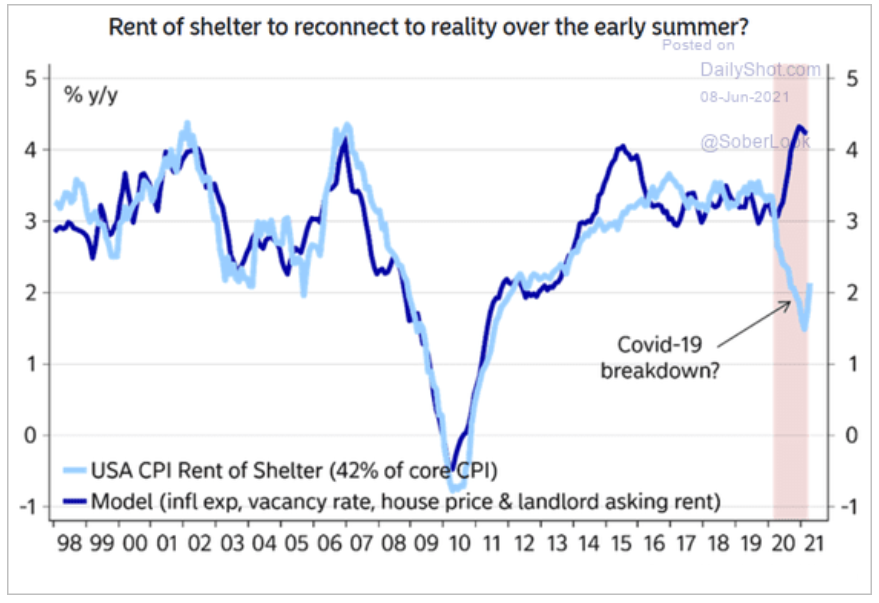

3. Many have argued that CPI has been understated in the course of the pandemic. 42% of the CPI is the housing part, and whereas “equal rents” have plummeted, shopping for a home has grow to be far more costly:

Supply: The Day by day Shot, from 6/8/21

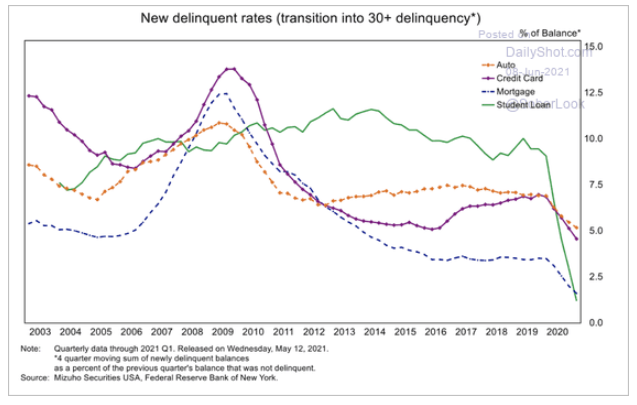

4. The U.S. shopper, on common, is in nice form. How a lot of this is because of authorities moratoriums on funds and defaults?

Supply: Macro Securities USA, from 6/8/21

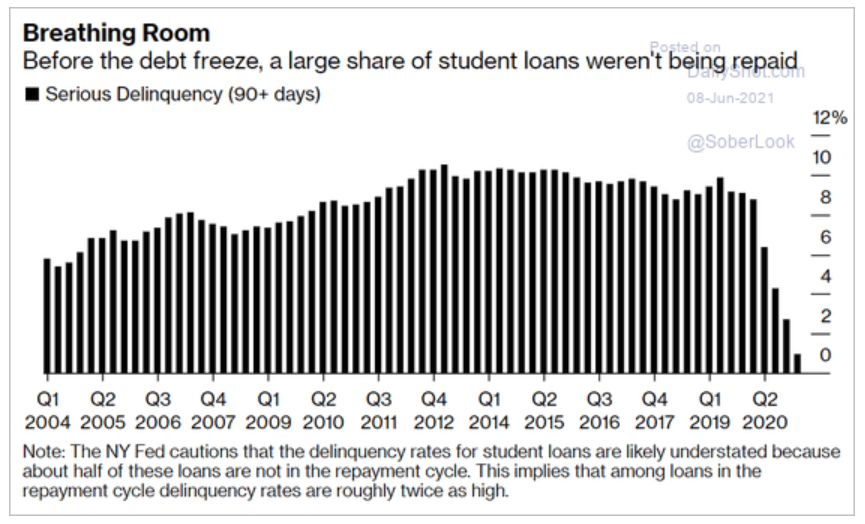

5. Scholar mortgage debt is as soon as once more a looming macro concern. The moratorium on funds ends in October and plenty of have merely stopped paying. The default fee is greater than junk bonds!

There’s an alternate: Lower the rate of interest to 1% above the 10-year Treasury yield (for servicing prices). This fashion, compensation is far more inexpensive for all who’ve loans however can also be truthful to those that have already paid off their loans.

Supply: Bloomberg, from 6/8/21

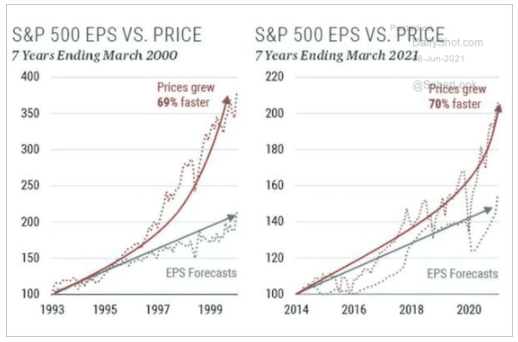

6. “Historical past doesn’t repeat nevertheless it typically rhymes.” Whereas the writer is underneath debate, this outstanding comparability to the late 1990s will not be:

Supply: The Day by day Shot, from 6/8/21

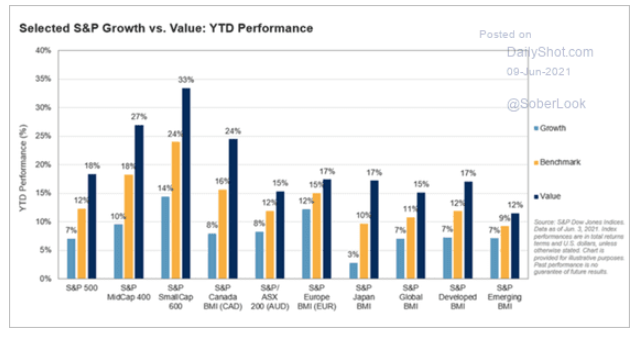

7. The shift from development to worth has been a worldwide phenomenon…

Supply: S&P World Market Intelligence, from 6/9/21

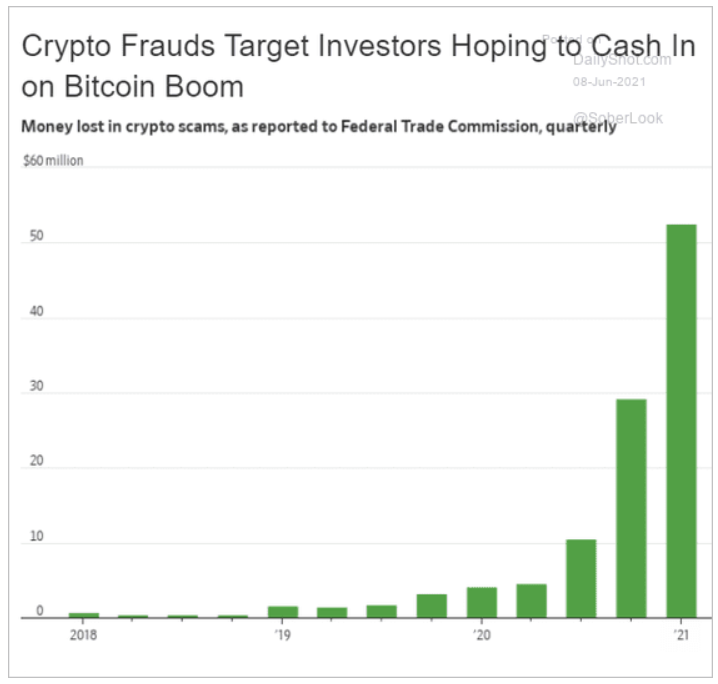

8. Wait, so a supposed forex, designed largely for legal enterprise, is open to fraud? Are cryptos underneath stress as a result of the U.S. authorities was capable of recuperate a lot of the Colonial Pipeline’s ransom?

Supply: Wall Road Journal, from 6/8/21

9. As we talked about Monday, when the Fed stops shopping for new bonds, who will purchase them, and at what worth/yield?

Supply: BofA World Analysis, from 6/8/21

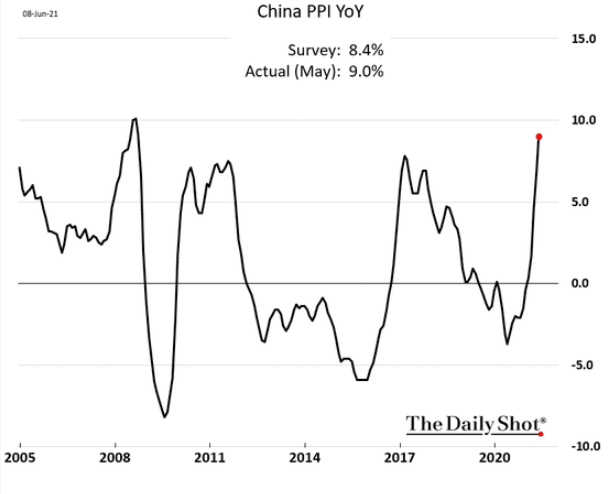

10. China, just like the U.S. and Europe, is seeing benign CPI however rising PPI. One thing should give quickly…

Supply: The Day by day Shot, from 6/9/21

11. After a parabolic rise, many commodities are returning to earth. Right here is lumber:

Supply: The Day by day Shot, from 6/8/21

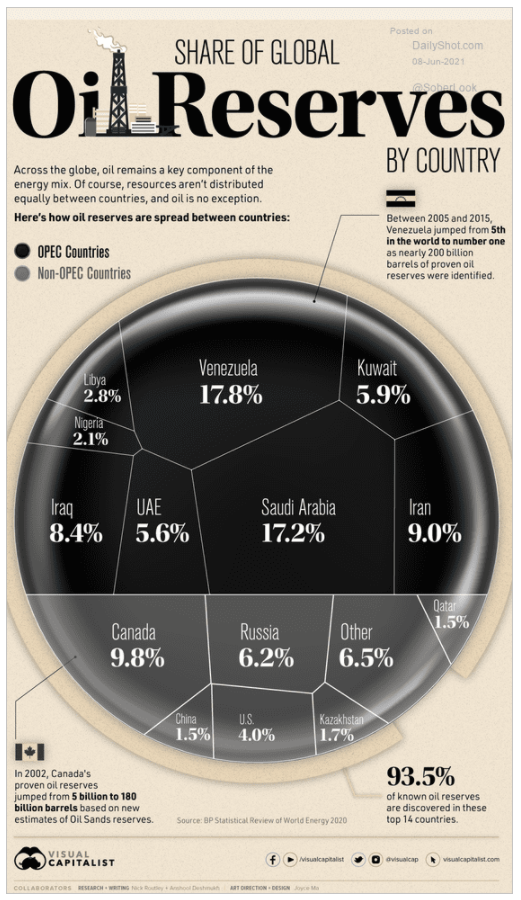

12. Are you able to identify the three nations with essentially the most oil reserves?

Supply: Visible Capitalist, from 6/8/21

This text was contributed by the Beaumont Capital Administration (BCM) Funding Workforce, a participant within the ETF Strategist Channel.

For extra insights like these, go to BCM’s weblog at weblog.investbcm.com.

Disclosure: The charts and info-graphics contained on this weblog are sometimes primarily based on knowledge obtained from third events and are believed to be correct. The commentary included is the opinion of the writer and topic to alter at any time. Any reference to particular securities or investments are for illustrative functions solely and should not meant as funding recommendation nor are they a suggestion to take any motion. Particular person securities talked about could also be held in shopper accounts. Previous efficiency is not any assure of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.