One ETF that is up over 60% up to now this yr might see extra of the identical within the subsequen

One ETF that is up over 60% up to now this yr might see extra of the identical within the subsequent: the International X Cloud Computing ETF (Nasdaq: CLOU).

The fund seeks to trace the Indxx International Cloud Computing Index, the fund holds a basket of corporations that doubtlessly stand to learn from the persevering with proliferation of cloud computing know-how and providers. CLOUD offers ETF buyers:

- Excessive Progress Potential: CLOU allows buyers to entry excessive progress potential by corporations which are positioned to learn from the elevated adoption of cloud computing know-how.

- An Unconstrained Method: CLOU’s composition transcends basic sector, business, and geographic classifications by monitoring an rising theme.

- ETF Effectivity: In a single commerce, CLOU delivers entry to dozens of corporations with excessive publicity to the cloud computing theme.

The cloud computing business refers to corporations that (i) license and ship software program over the web on a subscription foundation (SaaS), (ii) present a platform for creating software program purposes that are delivered over the web (PaaS), (iii) present virtualized computing infrastructure over the web (IaaS), (iv) personal and handle amenities prospects use to retailer information and servers, together with information heart Actual Property Funding Trusts (REITs), and/or (v) manufacture or distribute infrastructure and/or {hardware} parts utilized in cloud and edge computing actions.

Taking a look at its YTD chart, it is easy to see why CLOU could be a first-rate possibility.

As extra enterprise fashions look to make the most of know-how amid social distancing, cloud computing will solely develop to larger heights. Previous to the pandemic, companies have been already transitioning to rising utilization of cloud computing to streamline their processes.

CLOU Positioning for Future Progress

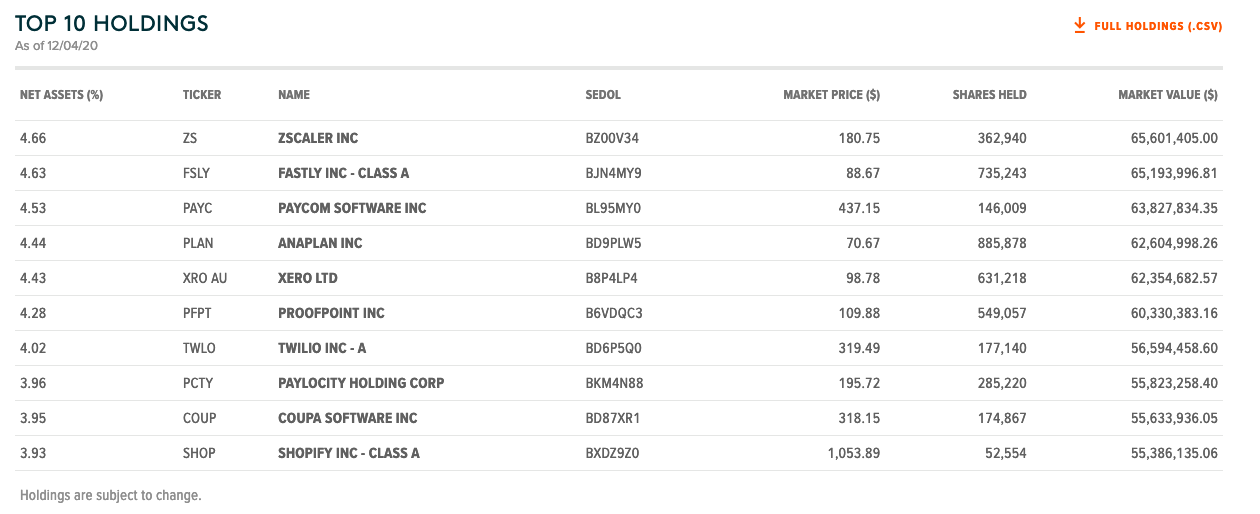

CLOU does not have typical tech names like Apple, Google, and Amazon in its high ten holdings.

As a substitute, you may see shares like cloud-based safety firm Zscaler. It is not a family title, however one which you have to be accustomed to in relation to the long run progress of cloud computing.

The corporate’s lately income “rose 52.3% to $142.58 million, beating consensus estimates by $10.16 million, and non-GAAP earnings reached 14 cents per share, beating consensus estimates by eight cents per share. The most important shock was non-GAAP working margins coming in at 14%, which was considerably larger than the two.9% consensus estimate,” based on an Investopedia article.

Holdings like Zscaler is simply one of many causes CLOU buyers are protecting their heads within the clouds.

For extra information and data, go to the Thematic Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.