May’s financial knowledge captu

May’s financial knowledge captured a few of the re-opening difficulties going through the financial system as we speak, with labor shortages, wage and worth inflation, and ever-changing guidelines and laws making a difficult setting for enterprise of all sorts.

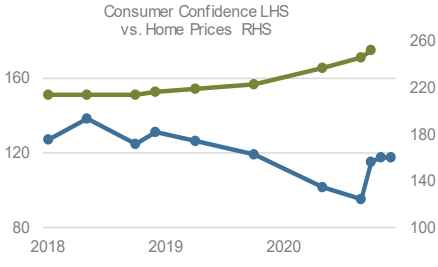

Labor continues to be cited as a key restraint on the financial system proper now. Expanded federal and state unemployment advantages have inspired many lower-wage employees to go for the sidelines, forcing many journey and leisure enterprise to chop again on capability and repair. The JOLTS (US Job Openings by Business) quantity for March hit it’s highest degree on report, indicating extra the 8.1 million job openings right here within the US. Anecdotally, almost each enterprise proprietor we converse with cites the shortcoming to rent employees as the most important problem they’re going through. The Unemployment Fee for April got here in at +6.1% and the Underemployment Fee held at a stubbornly excessive +10.4%.

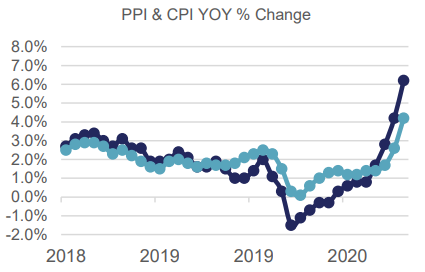

Compounding labor shortages is the dramatic rise in enter prices, which was highlighted on one earnings name after one other throughout the current quarter-end bulletins. CPI for April was up +4.2% YoY whereas PPI surged +6.2% YoY. The Fed’s favored metric, the PCE Deflator rose +3.6% YoY. Regardless of these rises, the Fed insists that current inflationary pressures are “transitory”, which means they’re unlikely to persist over the long term (at any time when that’s).

US GDP rose at a 6.4% SAAR within the first quarter of 2021, with Private Consumption rising by 11.3%. This was considerably anticipated given the broad shutdowns a 12 months in the past, however this degree of development ought to proceed over the approaching quarters with increasingly more states totally re-opening as vaccination efforts take maintain. This could put elevated strain on the Federal Reserve to at the very least start to “take into consideration serious about” elevating short-term rates of interest, and paring again the present $120 billion monthly of bond purchases. Markets might want to alter, nonetheless, ought to we get to that time.

Home Fairness

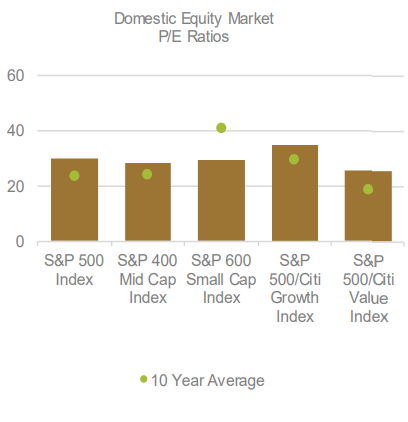

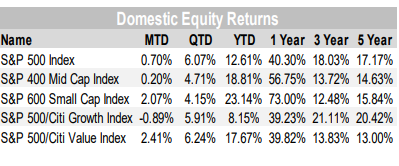

U.S. equities posted one other month of optimistic returns in Might, because the benchmark S&P 500 Index gained +0.70% to shut at 4,204. Small-Caps, as measured by the S&P SmallCap 600 Index have been one of the best performing section of the U.S. fairness market, up +2.08% throughout the interval, whereas MidCaps, as measured by the S&P MidCap 400 Index trailed, returning a scant +0.20% on the month.

Threat-On sentiment reigned supreme, because the S&P 500 Excessive Beta Index posted a +5.30% achieve on the month, adopted carefully by the S&P 500 Enhanced Worth and Pure Worth Indices, which returned +4.95% and +4.84%,

respectively. Notably Enhanced and Pure Worth proceed to outperform the normal Worth Index. Moreover, Worth as an element continued to outperform Development, with the S&P 500 Worth Index posting a +2.41% achieve, in comparison with the S&P 500 Development’s -0.89% loss. Efficiency amongst Worth and Development oriented sectors stays combined, with pockets of energy and weak point in each camps. From a Worth standpoint, Vitality, Supplies, Financials, and Industrials have been all robust performers, returning +5.77%, +5.22%, +4.79%, and +3.14%, respectively – all handily outpacing the S&P 500 Worth Index (+2.41%). From a Development standpoint, Communication Providers (Fb, Google), Info Know-how (Apple, Microsoft), and Client Discretionary (Amazon, Tesla) all posted losses on the month, returning -0.06%, -0.91%, and -3.81%, respectively. Development oriented sectors proceed to be directionally levered to their market cap weighted constituents highlighted in parenthesis above. Regardless of rates of interest remaining vary certain for the prior few months, the rotation out of Development and into Worth is instantly obvious.

Curiously, defensive and yield oriented sectors proceed to stay out of favor, with Utilities shedding -2.38% on the month, and solely up +4.65% on the 12 months. Maybe Utilities are additionally affected by top-heaviness, with

NextEra Vitality commanding a lofty premium to the sector whereas investor sentiment in direction of Clear Vitality themes has soured. Client Staples fared higher on the month, gaining +1.77%, but additionally stays out of favor on the 12 months, up solely +5.22%. For the trailing 12-month interval, Staples have additionally lagged badly, retuning +23.1% in comparison with +40.32% for the S&P 500.

[wce_code id=192]

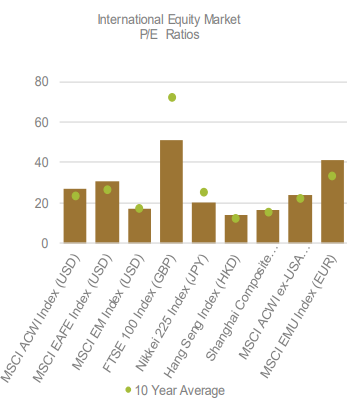

Worldwide Fairness

Worldwide equities posted robust returns on the month, with each Developed Markets (DM), as measured by the MSCI EAFE Index, and Rising Markets (EM), as measured by the MSCI EM Index, outperforming the S&P 500. DM equities posted a +3.34% achieve in Might helped by a weak US Greenback serving to fairness inflows into the worldwide area, coupled with enhancing earnings sentiment and optimistic vaccine associated exercise. EM additionally carried out effectively, posting a +2.36% achieve on the month as a continued shift in direction of Worth and Cyclically oriented components of the market have continued.

From a regional standpoint, the MSCI EMU Index gained +2.70% in EUR phrases, and +4.41% in USD phrases because of a weaker Greenback. Continued stimulus packages and elevated vaccine distribution, along with a choose reopening, skew positively for the Eurozone, as their re-opening has barely begun. The UK, as measured by the FTSE 100 Index, gained +1.08% in GBP phrases in Might, and paired with the Eurozone, has additionally been a beneficiary of elevated worldwide allocations. In Japan, the Nikkei 225 Index posted a +0.16% return in JPY phrases throughout the interval because the nation’s sluggish vaccine rollout has prompted elevated pushback in direction of the upcoming Olympic Video games.

In Rising Markets, the Chinese language Yuan continues to strengthen in opposition to the US Greenback, serving to the Shanghai Composite, which returned +5.02% in CNY phrases on the month. The extra Know-how centered MSCI China Index has additionally begun to stabilize on the again of optimistic earnings associated information from behemoths such

as Tencent, Alibaba, Pinduoduo, and most just lately supply large Meituan.

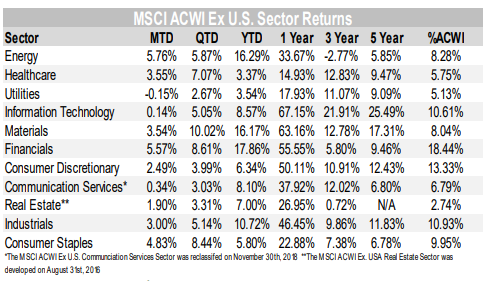

From a sector standpoint, MSCI ex USA sector returns favored Worth oriented sectors, with Vitality, Financials, Supplies, and Industrials posting returns of +5.76%, +5.57%, +3.54%, and +3.00%, respectively, mirroring the highest sectors within the US.

Globally, Worth oriented sectors proceed to outperform, and will stand to profit from a continued re-opening, uptick in financial exercise, and rise in inflation expectations. Comparatively, these themes and tendencies could proceed to favor Developed and Rising Markets as their sector compositions closely skew in direction of Worth and Cyclical sectors, whereas the S&P 500 stays closely tilted in direction of Development associated sectors and industries. Keep tuned.

Fastened Revenue

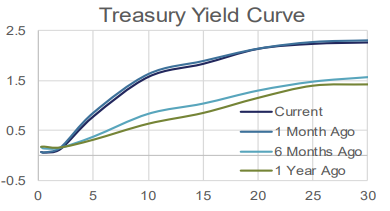

On Might 12th, the Bureau of Labor Statistics (BLS) launched the Client Worth Index (CPI) for April 2021. That is the gauge that’s generally used to characterize the quantity of inflation being skilled within the U.S. The headline quantity got here in at 4.2%, increased than expectations. Rates of interest haven’t proven any vital concern, seemingly satisfied that the Fed is appropriate of their assumption that the rise in costs is transitory.

Treasury yields are marginally decrease than they have been final month. The transfer was concentrated within the intermediate and longer maturities.

Funding Grade corporates have been the highest home performer. BBB spreads have held their floor whereas single

A noticed unfold tightening, permitting IG to clip their coupons and supply a powerful month-to-month return.

Excessive Yield spreads widened barely, however appear to be settling down. The widening offset a few of their increased earnings, leaving them with a median return for the month, proper in step with Governments, the U.S. Agg, and the Municipal benchmarks.

Rising Market bond publicity supplied the very best return total in Might. This got here from a mixture of a excessive beginning yield and a comparatively lengthy period, which advantages when charges decline.

Municipal bond yields are barely extra engaging in comparison with Treasury bond yields, however stay dear on a

long run foundation. Demand stays excessive as we’ve seen a big pick-up in Tax & Property Planning. With marginal tax brackets for people and companies anticipated to rise, and the potential for the Property Tax exemption ranges to fall (by way of laws or sunsetting of the present provision), this demand is unlikely to wane near-term.

Various Investments

Various Investments have been largely optimistic in Might, benefitting from a wide range of components together with a weaker U.S. Greenback. The US Greenback, as measured by the DXY Index, fell -1.59% throughout the month and is roughly flat for the 12 months.

Commodities, as measured by the Bloomberg Commodity Index, gained +2.73% in Might and are up a formidable +18.92% YTD. The re-opening of worldwide economies and pent-up shopper demand has result in a provide bottleneck that has brought on inflationary pressures on varied commodities that operate as manufacturing inputs. The costs of iron ore, copper, and timber all hit report ranges over the previous month.

Gold was among the best performing asset lessons in Might, ending the month up +7.79%. Gold continues to be helpful as a portfolio diversifier and potential inflation hedge. Though the mainstream media likes to give attention to extra glamorous different investments in a digital financial system, gold vastly outperformed lots of the fashionable cryptocurrencies which completed down 30% or extra for the month. As well as, Gold Miners, as measured by

the NYSE Arca Gold Miners Index, have been up +14.28% for the month.

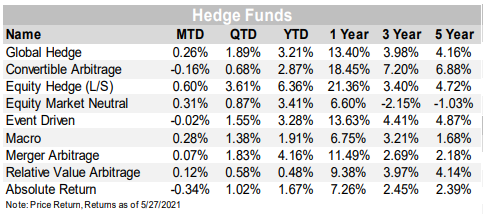

Hedge Fund methods have been largely optimistic throughout the month, with six out of 9 methods tracked posting optimistic returns on common. Fairness Hedge (Lengthy/Quick) methods have been the highest performer, up +3.25% on the month, and stay the highest performer for the 12 months up +6.36%. Absolute Return methods have been the worst performer, down -0.34% for the month.

ESG

In Might, the ESG aligned U.S. index acquired again on monitor, outperforming its non-ESG built-in counterpart. Whereas the 12 months to Date return nonetheless trails barely, all different time durations mirror robust outperformance.

ESG built-in EAFE returns have been roughly on par with the nonESG involved index exposures. YTD it continues to path, however one and three 12 months time durations present outperformance. Time, and additional implementation of the EU Taxonomy and Sustainable Finance Disclosure Regulation (SFDR), could present a tailwind for this publicity.

Rising Market ESG built-in returns have been a optimistic performer vs the benchmark within the month, the quarter, YTD, and all longer time durations. This allocation continues to face out as a shining instance of how ESG concerns can result in higher outcomes over time.

Funding Grade company bonds have continued to profit from ESG integration, offering a further 15 to 20 foundation factors of return over longer time durations. This could proceed, because the monitoring of firm exposures to ESG-related dangers can permit for riskier holdings to be screened out previous to the danger being realized and inflicting unfold widening/underperformance.

Whereas ESG concerns are nonetheless within the early innings, steerage continues to develop and evolve each domestically and internationally. John Coates, performing director of the SEC’s Division of Company Finance, has argued that the SEC has an obligation to offer tangible steerage to public corporations about what they

ought to disclose about ESG dangers, both by counting on a world ESG framework or establishing certainly one of its personal. The European Union’s Sustainable Finance Motion Plan draft Taxonomy was initially launched in December 2020, modified after receiving essential suggestions, and re-released on Might seventh, to little fanfare up to now.

Initially printed by Nottingham Advisors, 6/1/21

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.