Blockchain, hashish, and dividend yield

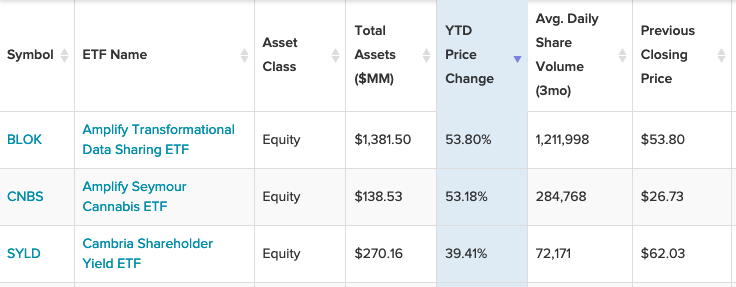

Blockchain, hashish, and dividend yields are a couple of of the top-performing sectors within the actively-managed area from ETF suppliers Amplify and Cambria.

Blockchain Tops the Record

As cryptocurrencies proceed to see curiosity from traders massive and small, institutional and non-institutional, so are their underlying applied sciences: blockchain. That is serving to energetic funds just like the Amplify Transformational Information Sharing ETF (BLOK).

BLOK seeks to offer complete return by investing not less than 80% of its internet property (together with funding borrowings) within the fairness securities of firms actively concerned within the growth and utilization of transformational knowledge sharing applied sciences. It could spend money on non-U.S. fairness securities, together with depositary receipts.

“As an alternative of investing immediately in unstable digital currencies, BLOK appears for firms which can be concerned within the growth and utilization of blockchain expertise,” an ETF Database evaluation mentioned. “BLOK’s portfolio consists of well-known U.S. shares like Microsoft, Google-parent Alphabet, and IBM, alongside Japanese web agency GMO Web and Chinese language on-line retailer JD.com.”

Hashish and Dividend Yields

Hashish will not be too far behind blockchain with the Amplify Seymour Hashish ETF (CNBS). CNBS seeks to offer funding publicity to international firms principally engaged within the rising hashish and hemp ecosystem throughout one among three classifications.

CNBS capitalizes on:

- Client Demand: Worldwide shopper spending on authorized hashish was $21.three billion in 2020, up 48% (from $14.four billion) in 2019.

- Legalization: At present authorized in some type in 47 US states and 21 nations, with extra anticipated to return.

- Medical Use: Over 100 naturally occurring compounds – cannabinoids – are discovered within the hashish plant. At present three FDA-approved medicine exist that incorporate hashish compounds; nonetheless, analysis into different use and software instances is dramatically rising.

Lastly, the Cambria Shareholder Yield ETF (SYLD) seeks to realize its funding goal by investing, underneath regular market situations, not less than 80% of its complete property in fairness securities, together with widespread inventory, issued by U.S.-based publicly listed firms that present excessive “shareholder yield.” Its funding adviser, Cambria Funding Administration, L.P., defines “shareholder yield” because the totality of returns realized by an investor from an organization’s money funds for dividends, buybacks, and debt paydowns.

SYLD makes use of a quantitative method to spend money on U.S. equities with excessive money distribution traits. The preliminary screening universe consists of shares in america with advertising capitalizations over $200 million.

The ETF is comprised of the 100 firms with the very best mixed rank of dividend funds and internet inventory buybacks, that are the important thing parts of shareholder yield. The ETF additionally screens for worth and high quality elements, together with low monetary leverage.

For extra information and data, go to the Good Beta Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.