As america faces a divided authorities, buyers ought to really feel comforted by supportive insuran

As america faces a divided authorities, buyers ought to really feel comforted by supportive insurance policies that can hold the inventory markets going.

“The confluence of things at present supporting fairness and credit score markets — enhancing financial circumstances, shares buying and selling low-cost in comparison with bonds, and accommodative financial coverage — holds true no matter the final word consequence of the presidential election. Paradoxically, divided authorities may set the stage for more-protracted market and enterprise cycles. I consider the restoration will nonetheless doubtless play out within the coming years, however at a extra modest tempo than had there been further fiscal help,” Kristina Hooper, Chief World Market Strategist at Invesco, and Brian Levitt, World Market Strategist, specializing in North America, Invesco, stated in a analysis be aware.

“I consider that buyers, at a minimal, can relaxation straightforward understanding that significant change might be not forthcoming. And bear in mind, as Gracie Allen stated, ‘The president of as we speak is simply the postage stamp of tomorrow,'” they added.

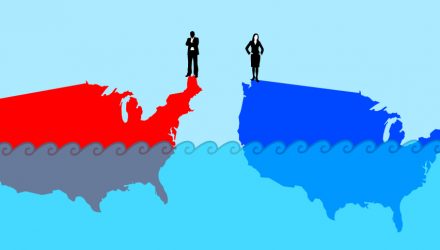

It’s all however sure that the Senate will preserve its Republican majority whereas the Home of Representatives will hold its Democrat lead, albeit barely smaller than earlier than, resulting in a divided Congress, which can be good for markets. The inventory market has traditionally reacted positively to divided authorities. This has supplied some aid from many firms fearing a Democratic sweep that will pave the way in which for elevated company taxes and the next minimal wage.

However, the U.S. will not doubtless obtain a strong fiscal stimulus package deal, which can contribute to a slower financial restoration.

Underneath a Joe Biden presidency, Hooper argued that we’ll see a brand new period of fiscal conservatism regardless of our fragile post-coronavirus financial restoration. This state of affairs could be just like what occurred beneath the Obama administration with sequestration whereas the U.S. financial system was nonetheless recovering from the worldwide monetary disaster. Consequently, we could expertise a slower, much less strong financial restoration, with decrease authorities spending and borrowing.

Moreover, Levitt added that the president subsequent 12 months will face elevated balances on his energy as a result of partisan management of Congress.

For extra information, info, and technique, go to the Revolutionary ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.