By Scott Welch, CIMA ®, Chief Funding Officer – Mannequin Portfolios

I am making an attempt to make a dwelling

I can not save a cent

It takes all of my cash

Simply to eat and pay my hire

I obtained the blues

Acquired these inflation blues

(From “Inflation Blues” by BB King, 1983)

I can not assist however marvel what a person suppose to do

I obtained these laborious breaking escalatin’ excessive inflation blues

(From “Excessive Inflation Blues” by Moe Bandy, 1977)

On this weblog put up we proceed with our deeper dives into totally different financial indicators, what we are able to study by trying past the headline numbers and what these indicators would possibly inform us about future financial and market situations. In earlier posts we mentioned client sentiment and investor conduct and employment.

This time we talk about a subject that appears to be top-of-mind for a lot of economists, advisors and traders: inflation. When Messrs. King and Bandy recorded their songs within the late-1970s/early-1980s, the U.S. was in one of many worst inflationary durations in its historical past, topping out at 14.6% in April 1980. We doubt both of these gents would view immediately’s surroundings as “inflationary” as they knew it.

However is has been absent for therefore lengthy that even a whiff of inflationary stress raises questions and considerations, particularly contemplating the recovering world financial system, world easy-money insurance policies and continued large stimulus right here in the US. So, let’s dive in.

The Headline Numbers

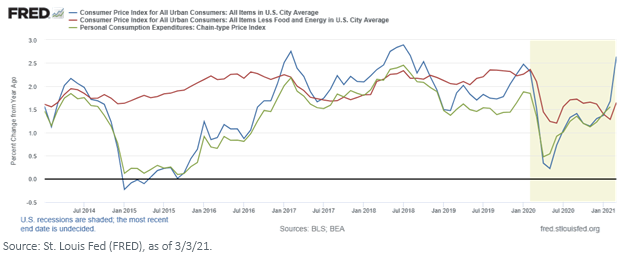

Definitionally, inflation is just an increase in costs and a corresponding decline within the buying energy of cash. Right here within the U.S., the “headline” measures of inflation are the Client Value Index (CPI), a measure of the common worth of a basket of products and companies, CPI ex-Meals & Power, which removes these two sectors as a result of they are usually unstable (these could appear ridiculous issues to exclude to somebody paying extra for his or her fuel and groceries), and the Private Consumption Expenditures Index (PCE), which measures the change in family expenditures over a time period. The Federal Reserve (Fed) tends to choose the PCE when evaluating inflation as a result of it accounts for modifications in client conduct (e.g., substituting hamburger for steak) as costs change.

Right here is how these three indicators at present look.

On condition that the Fed’s historic goal price for inflation is 2%, these headline numbers don’t give a lot trigger for alarm, particularly because the Fed has signaled it believes any near-term enhance is probably going transitory. The Fed has additionally indicated that it’ll enable inflation to run scorching earlier than stepping in, with the intention to pursue continued financial restoration.

The Numbers Behind the Numbers

Let’s now have a look at a few of the “numbers behind the numbers.” We’ll deal with the 2 major drivers of inflation – wages and enter costs. Wages, as a result of as staff earn extra, they have a tendency to devour extra, and the legal guidelines of provide and demand counsel that tends to drive costs up. Enter costs as a result of, as the price of “inputs” (e.g., uncooked supplies, delivery prices, and many others.) go up, corporations will move these elevated costs by (as a lot as they’ll) to the top client with the intention to sustain their earnings.

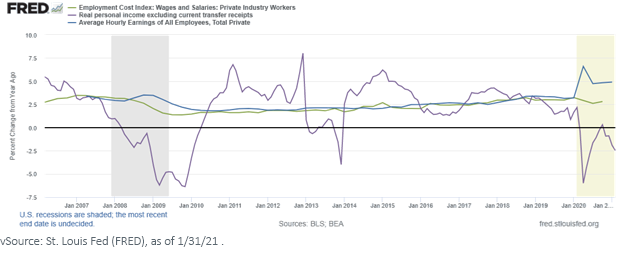

Three helpful measures of wage inflation are: (1) the Employment Value Index (ECI), revealed by the Bureau of Labor Statistics, which measures each wages and advantages in any respect ranges of an organization (and so it’s most likely probably the most complete metric), (2) the Common Hourly Earnings of Staff, Complete Non-public (since authorities staff are paid by the taxes on these earnings) and (3) Actual Private Revenue, Excluding Switch Receipts (once more, since switch funds – social safety, Medicare, Covid-19 aid, and many others., are paid for by taxes on personal sector earnings).

The present ranges of those measures counsel we have now not but begun to see vital wage inflation. Common hourly earnings are rising as individuals return to work from the pandemic lockdown, however the ECI is secure and Actual Private Revenue is definitely declining.

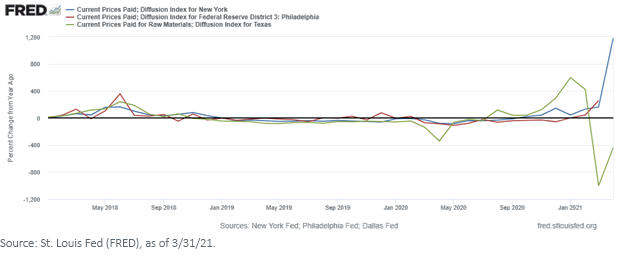

Lastly, let’s have a look at enter costs. Once more, there are a handful of helpful metrics. One is Present Costs Paid, which is calculated by a few of the regional Federal Reserve Banks and measures how a lot corporations are paying for his or her inputs. Right here we maybe see the primary indicators of true inflationary stress.

One other helpful metric is to measure the altering costs of commodities, which is a vital enter price for a lot of corporations. A generally reported metric is the Commodity Analysis Board (CRB) Index, which measures the altering costs of an outlined basket of commodities. We choose, nevertheless, to take a look at the altering costs of indexes monitoring these particular person commodity sectors. What we see is a gradual rise over the previous 12 months.

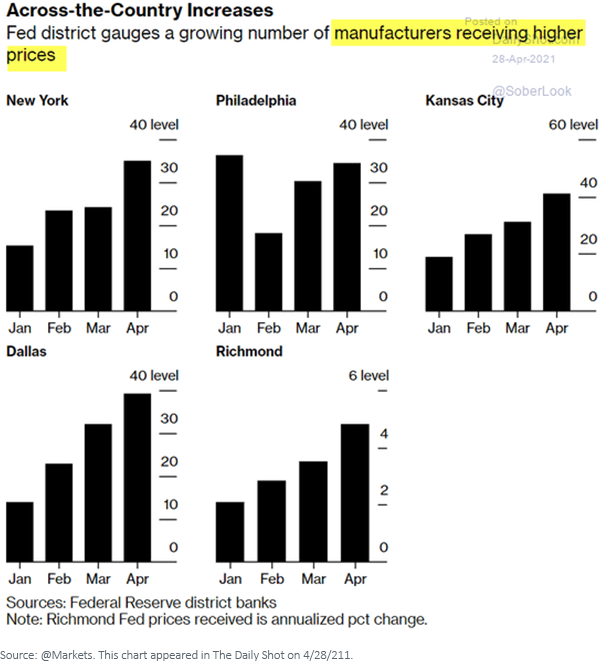

As famous above, corporations more and more are passing these elevated enter costs by to their finish shoppers – an actual instance of enter worth inflation.

Conclusion

Based mostly on the metrics we comply with, it may be untimely to be singing the “inflation blues.” However many of those metrics will nearly actually rise over the approaching months as the worldwide financial system recovers, staff return to work and pent-up consumption demand is launched.

The market likes somewhat inflation – it traditionally has been good for shares. We is not going to be involved till inflation rose to roughly 5% or above. However reflation is one among our major funding themes for 2021 – we completely imagine inflation is coming, and we recommend advisors and traders plan accordingly.

Initially revealed by WisomTree, 5/10/21

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which accommodates funding goals, dangers, prices, bills, and different info; learn and contemplate rigorously earlier than investing.

There are dangers concerned with investing, together with attainable lack of principal. Overseas investing includes foreign money, political and financial danger. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller corporations might expertise larger worth volatility. Investments in rising markets, foreign money, mounted earnings and different investments embody extra dangers. Please see prospectus for dialogue of dangers.

Previous efficiency is just not indicative of future outcomes. This materials accommodates the opinions of the creator, that are topic to alter, and may to not be thought-about or interpreted as a advice to take part in any explicit buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There is no such thing as a assure that any methods mentioned will work beneath all market situations. This materials represents an evaluation of the market surroundings at a particular time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation relating to any safety specifically. The consumer of this info assumes the whole danger of any use manufactured from the data supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Providers, LLC, or its associates present tax or authorized recommendation. Traders looking for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Until expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially characterize the views of WisdomTree or any of its associates.

The MSCI info might solely be used in your inner use, might not be reproduced or re-disseminated in any kind and might not be used as a foundation for or element of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a advice to make (or chorus from making) any type of funding determination and might not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the consumer of this info assumes the whole danger of any use manufactured from this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Get together have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss earnings) or another damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Providers, LLC.

WisdomTree Funds are distributed by Foreside Fund Providers, LLC, within the U.S. solely.

You can not make investments instantly in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.