First off … thanks! 2020 is over (lastly) and we're grateful to all our Advisors, Brokers, and comp

First off … thanks! 2020 is over (lastly) and we’re grateful to all our Advisors, Brokers, and companions who belief us with your small business. We love having the ability to do that day by day and look ahead to the long run—and on this subject of Markets in Movement ™ we need to give attention to two main developments that can improve our skill to create portfolios that extra carefully monitor our long-term funding themes in addition to present for threat administration. For these of you who need to compensate for our 2020 assessment, right here’s a hyperlink to our December GT Webinar that can present shade on what absolutely will go down in investing historical past as a really distinctive yr.

Now for the New–Donohue Forlines, in partnership with TrimTabs Asset Administration (TTAM), has launched two new proprietary ETFs. Be taught extra about our ETF growth right here.

Innovation as an Asset Class

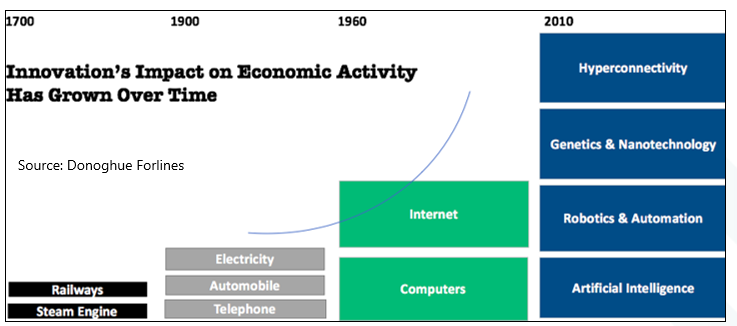

Right now, we’re witnessing the real-time disruption of a bunch of incumbent corporations by opponents who’ve used new applied sciences to higher serve clients. The accelerated tempo of innovation is giving rise to the fourth industrial revolution and constructing a brand new financial system – reworking conventional sectors and industries whereas creating new ones. Each side of our lives will probably be impacted, creating monumental potential progress alternatives. (Chart 1)

[wce_code id=192]

With the financial panorama quickly altering, traders require a special and forward-looking strategy to seize the structural developments which are simply getting underway. In our view, not solely will conventional “style-box” and market capitalization indexes fail to seize this progress alternative, however additionally they will compound the danger of underperformance by having giant allocations to “victims” of disruption. Subsequently, we consider innovation has grow to be its personal asset class and deserves a strategic allocation in shopper portfolios. (chart 2).

Exponential applied sciences and innovation have been a strategic allocation to the World Tactical suite for over a decade. Nevertheless, we felt the present product choices in innovation had been insufficient in precisely capturing our understanding of main developments—both they had been too specialised, specializing in new applied sciences and never the influence on broad markets or they weren’t diversified, topic to each upside and draw back volatility.

Study our latest allocation to innovation in our GT Suite.

A New World for Bonds

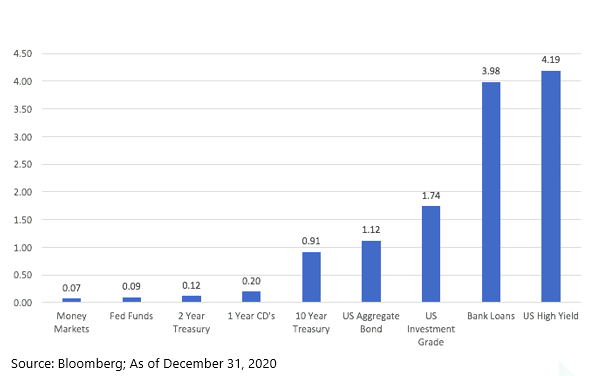

Merely put, Curiosity Charges are in a long-term secular Bear Market. At 0.9%, yields on 10-year US notes are close to the bottom in fashionable historical past, and adjusted for inflation, bond traders are locking in a assured lack of about 0.8% per yr for the privilege of getting their a refund. Moreover, authorities bonds have reached valuation ranges that basically change the traits they create to a portfolio. With actual yields destructive and rates of interest up towards their decrease bounds, bonds diversification and risk-reduction advantages have weakened.

Within the final three years, with the ultimate acceleration brought on by the virus-induced huge world financial disruption, Bonds have reworked from “risk-free return” to “return-free threat.”

Due to this, traders are pressured to maneuver up the danger spectrum for returns. The very best risk-adjusted alternatives stay in credit score (particularly excessive yield company bonds) to cut back rate of interest threat and generate significant yield. Nevertheless, credit score poses its personal dangers, so traders are additionally pressured to handle volatility with tactical administration.

Study our latest Excessive Yield allocation in our GT Suite.

Time For an Asset Allocation Re-Suppose

Our two new proprietary merchandise are a part of a broader effort to enhance the worldwide tactical suite for the evolving macro atmosphere over the following decade. And it’s why standard indexes in each equities and bonds could require a re-think.

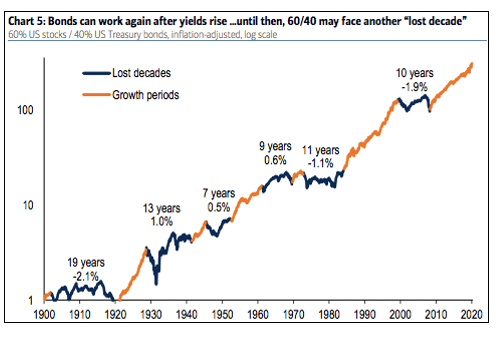

Particularly, the period of passive index dominance could also be ending. For monetary advisors, the “core portfolio” has historically consisted of a mixture of shares and bonds – generally known as the “60/40.” And lately, the 60/40 portfolio has delivered superior risk-adjusted returns.

However previous efficiency will not be indicative of future outcomes and we consider 60/40 portfolio outperformance is over.

The yield on a 60/40 portfolio has reached an all-time low … and as we’ve demonstrated above, there’s a sea-change taking place in fairness markets components. primarily based on a various set of capital market assumptions, the 60/40 portfolio may face a possible “misplaced decade”.

The 40% in bonds offers much less reward and extra threat with yields close to their decrease bounds. And the 60% many traders have in large-cap shares in conventional types (e.g. Worth, Development) could also be simply as perilous over an extended timeframe. Indexes initially constructed to supply diversification at the moment are weighted closely to only a handful of corporations… and have giant allocations to industries in danger to disruption.

Buyers have to adapt their portfolio for at this time’s low return atmosphere or settle for low (or destructive) anticipated returns. Advisors are challenged to rethink foundational portfolio components of investor portfolios – which implies looking for out methods that bolster the “core” going ahead. With no low cost belongings, tactical and unconstrained administration is now extra necessary than ever. As a way to produce optimistic returns over the following 5-10 years, traders might want to actively handle progress cycles. Donoghue Forlines World Tactical suite is a superb different for advisors making an attempt to navigate this new atmosphere for his or her purchasers. By exploiting a bigger alternative set and tactically adjusting threat publicity, our world macro technique can have a significant edge over the normal 60/40 portfolio. In at this time’s markets, world macro is the long run and the 60/40 retirement rule is caught up to now.

2021: Quick Time period Macro Perspective and Present Positioning

- The worldwide financial system will strengthen in 2021, however will stay fragmented because the pandemic winds down (see: BREXIT, EU woes; China resetting to new US Administration; extra adjustments in power markets as local weather considerations regularly grow to be extra mainstream).

- Financial/fiscal coverage will stay accommodative, however there will probably be shocks brought on by legislators and central bankers who usually mistime home windows of lodging and tightening

- TINA (There IS No Different to Equities) will proceed to dominate investor habits Shares will proceed to outperform bonds; we want a barbell of progressive & high quality corporations with a cautious collection of cyclical worth corporations that can profit from the virus receding. This contains worldwide alternatives, particularly in rising markets.

- Bond yields will rise modestly; we want credit score over authorities bonds for yield and threat aversion

- The USD will weaken, however there will probably be extra foreign money volatility (a possibility); we favor Gold as long-term debt/foreign money/inflation hedge

- Investor euphoria will result in short-term corrections in 2021; however threat gained’t be systemic until Fiscal & Financial Coverage errors derail post-Virus restoration.

We invite you to study extra about our 2021 World Markets Outlook in our upcoming webinar and please don’t hesitate to contact our group with any questions. You will get extra data by calling (800) 642-4276 or by emailing [email protected]. Additionally, go to our Gross sales Workforce Web page to study extra about your territory protection.

Initially printed by Donoghue Forlines

Previous efficiency is not any assure of future outcomes. The fabric contained herein in addition to any attachments will not be a proposal or solicitation for the acquisition or sale of any monetary instrument. It’s offered solely to offer data on funding methods, alternatives and, from time to time, abstract opinions on numerous portfolio performances. The funding descriptions and different data contained on this Markets in Movement are primarily based on information calculated by Donoghue Forlines LLC (previously W.E. Donoghue, LLC) and different sources together with Morningstar Direct. This abstract doesn’t represent a proposal to promote or a solicitation of a proposal to purchase any securities and will not be relied upon in reference to any supply or sale of securities.

The views expressed are present as of the date of publication and are topic to alter with out discover. There may be no assurance that markets, sectors or areas will carry out as anticipated. These views aren’t meant as funding, authorized or tax recommendation. Funding recommendation ought to be personalized to particular person traders aims and circumstances. Authorized and tax recommendation ought to be sought from certified attorneys and tax advisers as applicable.

The Donoghue Forlines World Tactical Allocation Portfolio composite was created July 1, 2009. The Donoghue Forlines World Tactical Revenue Portfolio composite was created August 1, 2014. The Donoghue Forlines World Tactical Development Portfolio composite was created April 1, 2016. The Donoghue Forlines World Tactical Conservative Portfolio composite was created January 1, 2018.

Outcomes are primarily based on absolutely discretionary accounts beneath administration, together with these accounts not with the agency. Particular person portfolio returns are calculated month-to-month in U.S. {dollars}. Insurance policies for valuing portfolios and calculating efficiency can be found upon request. These returns characterize traders domiciled primarily in america. Previous efficiency will not be indicative of future outcomes. Efficiency displays to re-investment of dividends and different earnings.

Internet returns are offered internet of administration charges and embrace the reinvestment of all revenue. Internet of charge efficiency was calculated utilizing a mannequin charge of 1% representing an relevant wrap charge. The funding administration charge schedule for the composite is: Shopper Belongings = All Belongings; Annual Price % = 1.00%. Precise funding advisory charges incurred by purchasers could fluctuate.

The Benchmark Reasonable is the HFRU Hedge Fund Composite. The HFRU Hedge Fund Composite USD Index is designed to be consultant of the general composition of the UCITS-Compliant hedge fund universe. It’s comprised of all eligible hedge fund methods; together with, however not restricted to fairness hedge, occasion pushed, macro, and relative worth arbitrage.

The Blended Benchmark Conservative is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% Bloomberg Barclays World Mixture, rebalanced month-to-month.

The Blended Benchmark Development is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% MSCI ACWI, rebalanced month-to-month.

The Blended Benchmark Revenue is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% Bloomberg Barclays World Mixture, rebalanced month-to-month.

The MSCI ACWI Index is a free float adjusted market capitalization weighted index that’s designed to measure the fairness market efficiency of developed and rising markets. The HFRU Hedge Fund Composite USD Index is designed to be consultant of the general composition of the UCITS-Compliant hedge fund universe. It’s comprised of all eligible hedge fund methods; together with, however not restricted to fairness hedge, occasion pushed, macro, and relative worth arbitrage. The underlying constituents are equally weighted. The Bloomberg Barclays World Mixture Index is a flagship measure of worldwide funding grade debt from twenty-four native foreign money markets. This multi-currency benchmark contains treasury, government-related, company and securitized fixed-rate bonds from each developed and rising markets issuers.

Index efficiency outcomes are unmanaged, don’t replicate the deduction of transaction and custodial costs or a administration charge, the incurrence of which might have the impact of reducing indicated historic efficiency outcomes. You can not make investments straight in an Index. Financial components, market circumstances and funding methods will have an effect on the efficiency of any portfolio, and there aren’t any assurances that it’ll match or outperform any specific benchmark.

Insurance policies for valuing portfolios, calculating efficiency, and making ready compliant shows can be found upon request. For a compliant presentation and/or the agency’s checklist of composite descriptions, please contact 800‐642‐4276 or [email protected].

Donoghue Forlines is a registered funding adviser with United States Securities and Trade Fee in accordance with the Funding Advisers Act of 1940. Registration doesn’t indicate a sure stage of talent or coaching.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.