This article initially appeared at TheETFEducator.com. You'll be able to comply with the writer on

This article initially appeared at TheETFEducator.com. You’ll be able to comply with the writer on Twitter @NateGeraci.

I’ve spent the higher a part of 12 years debunking ridiculous ETF myths. It’s exhausting swatting down the identical drained arguments and tropes again and again…

“ETFs are inflicting a bubble”

“ETFs are the tail wagging the canine”

“ETF demise spirals”

Nonetheless, I not too long ago got here throughout an attention-grabbing principle which has me questioning the influence of ETFs on asset valuations. The concept was put forth by the pseudonymous author and tweeter Jesse Livermore, one of many brightest and most original thinkers on the monetary markets. Right here is Jesse by way of Patrick O’Shaughnessy’s Make investments Just like the Greatest podcast:

“Clearly, we all know that we’re in a market the place another person goes to be keen to pay one thing close to the value that you just pay… In case you’re assured that you just’re going to have the ability to take your cash out everytime you need to, you’re not going to demand as excessive of a return, as excessive of an earnings yield, as excessive of a dividend yield. You’re going to be keen to pay a lot larger costs.”

Jesse is suggesting that if market contributors have excessive confidence in plentiful liquidity – that they will simply purchase and promote investments with out meaningfully impacting costs – they may not require as excessive of a return. Why? As a result of there may be much less threat. Again to Jesse:

“I name the value that you’d pay if you happen to couldn’t promote the intrinsic worth of a safety. And that’s the value that you’d demand when it comes to yield and revenue and earnings and development, if you happen to had to surrender all of the liquidity and needed to maintain the safety perpetually after which bequeath to your heirs.

Clearly in a contemporary market, you don’t have to cost issues at that value since you’re not going to lose your liquidity, you’re going to have the ability to promote to any individual else. You’re keen to just accept decrease yields, decrease revenue, decrease returns in alternate for the chance as a result of the liquidity shouldn’t be being taken away. There’s intrinsic worth, after which what will get you all the best way as much as the market worth is the liquidity worth which is that this latter level. It’s the premium that you just’re keen to pay on the asset as a result of you understand you’ll be able to promote it to any individual else.”

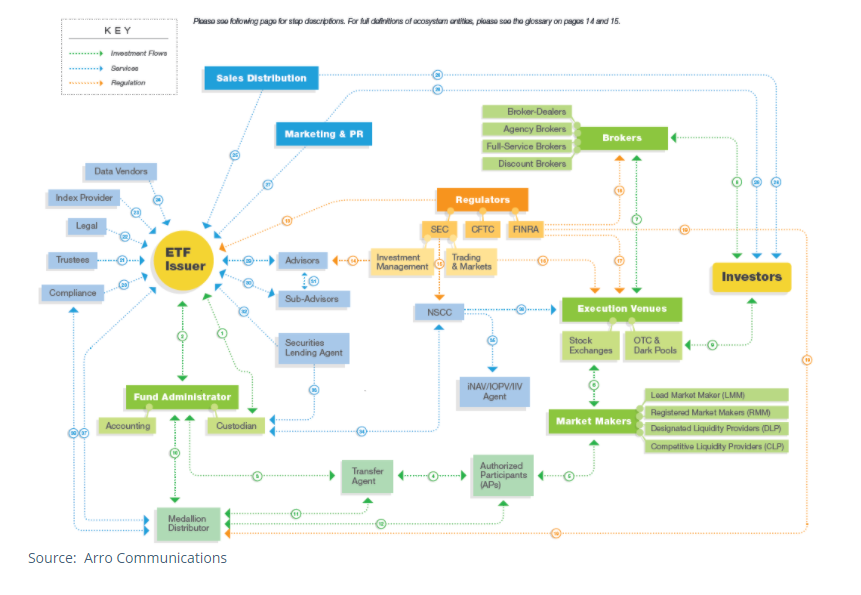

What does this must do with ETFs? A key characteristic of ETFs is their capacity to facilitate liquidity. Buyers can effortlessly purchase or promote complete swaths of asset courses – shares, bonds, commodities, currencies – all on the push of a button and with excessive confidence in pricing. As a matter of truth, ETFs have been born out of the 1987 inventory market crash to function liquidity buffers. The Securities and Trade Fee (SEC) believed an absence of liquidity was a significant contributor to what was infamously dubbed “Black Monday”. One of many concepts the SEC floated as a possible answer to assist reduce future crashes was a safety that represented a basket of shares, however may very well be traded similar to a person inventory. The concept was that such a safety may change palms with out impacting the underlying shares, offering further liquidity to the markets. Quick ahead to in the present day and there’s almost $5 trillion invested in ETFs, which characterize some 30% of secondary alternate buying and selling quantity.

If ETFs assist facilitate market liquidity, then they’re doubtlessly driving asset valuations larger. Curiously, improved liquidity could also be solely one in every of a number of elements at play. Jesse penned a weblog a number of years in the past describing how lowered frictions of investing – suppose decrease prices, the power to simply diversify, no commissions – may be impacting valuations:

“Because the market builds and popularizes more and more cost-effective mechanisms and methodologies for diversifying away the idiosyncratic dangers in dangerous investments, the value reductions and extra returns that these investments want to supply, in an effort to compensate for the prices and dangers, comes down.

Within the 12 months 1950, the typical entrance load on a mutual fund was 8%, with one other 1% annual advisory price added in. At present, given the choice of simple indexing, traders can get handy, well-diversified publicity to many extra shares than would have been in a mutual fund in 1950, all for 0%. This important discount in the price of diversification warrants a discount within the extra return that shares are priced to ship, notably over secure property like authorities securities that don’t must be diversified. Let’s suppose with all elements included, the elimination of historic diversification prices finally ends up being value 2% per 12 months in annual return. Parity would then recommend that shares ought to provide a 2% extra return over authorities bonds, not the historic 4%. Their valuations would have a foundation to rise accordingly.”

To summarize, Jesse is postulating that the power to simply purchase and promote property with minimal market value influence, together with a capability to cost-effectively diversify investments, could cut back extra returns required by traders, thus resulting in elevated valuations. A less complicated method to consider this: prior to now, traders required larger market returns to compensate them for the numerous prices related to shopping for investments (liquidity prices, fund charges, commissions, and so on). With these prices lowered, traders don’t require as excessive of a gross return in an effort to earn the identical internet return. Valuations alter (rise) accordingly.

All the ETF ecosystem has continued evolving over the previous almost 30 years, with information and expertise advancing such that liquidity has frequently improved, bid-ask spreads have narrowed, and expense ratios have declined.

So, what’s the takeaway? Since ETFs present traders with liquidity, diversification, and decrease prices, then it’s cheap to imagine they have pushed valuations larger! Simply not in the best way worry mongers recommend. ETFs aren’t some bogeyman irrationally driving market costs larger. There’s nothing inherently flawed or damaged with the ETF construction. As a substitute, a spread of ETF advantages are doubtlessly leading to elevated valuations – probably on the margins, however attention-grabbing nonetheless. Sadly, that doesn’t make for salacious headlines.

One closing word: I feel we will say with certainty that ETF prices will proceed shrinking. We are able to additionally say Silicon Valley-like ETF innovation means traders will have the ability to additional diversify funding portfolios, if desired. Nonetheless, there isn’t a assure that ETF liquidity (or any funding’s liquidity) will stay strong in periods of market turmoil. I extremely advocate studying Corey Hoffstein’s Liquidity Cascades for a deep-dive, however it’s truthful to invest that if ample liquidity can drive valuations larger, then an absence of liquidity can push valuations down. From Corey:

“If that liquidity disappears in periods of stress, it may result in cascades that ship markets spiraling uncontrolled… Variable liquidity, in and of itself, shouldn’t be inherently an issue. When considerably thinning liquidity meets excessive liquidity taking wants, nevertheless, there generally is a catastrophic mis-match out there.”

ETFs once more proved their mettle throughout the latest interval of stress, the Coronavirus crash. That gained’t cease scrutiny over the rising affect of ETFs on the monetary markets. That’s wholesome and productive. It’s additionally essential to keep in mind that no person needs to return to the times of much less liquidity, larger prices, and fewer alternatives to diversify a portfolio. Markets evolve over time in pursuit of higher investor outcomes. ETFs are a part of that evolution. Our understanding of the influence of ETFs on markets can also be nonetheless evolving.

Initially printed by The ETF Educator, 10/22/20

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.