By VanEck Hope Springs Everlasting

By VanEck

Hope Springs Everlasting

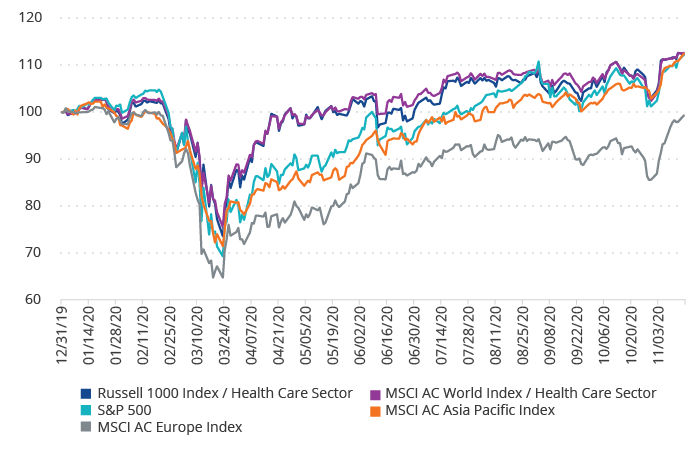

Hopes of a return to normality are growing after a 12 months of pandemic-induced tumult. Information that COVID-19 vaccines developed by Pfizer and BioNTech, and Moderna had been greater than 90% efficient in scientific trials lifted international inventory markets, with well being care shares outpacing the beneficial properties within the U.S., Asia and Europe over the week (see Determine 1). The extent of efficacy was a lot larger than the 70% that many had hoped for, elevating expectations that vaccinations may assist increase the sluggish international economic system, and supply a method out of the pandemic.

Determine 1: Market performances (Complete returns, rebased)

Supply: Factset. As of 16 November 2020. The above chart represents previous efficiency of assorted indices and never the fund. Index efficiency just isn’t illustrative of the fund’s efficiency. You can’t make investments instantly in an index. Index returns assume dividends are instantly reinvested and exclude administration charges and prices incurred when investing within the fund. Previous efficiency of the indices just isn’t a dependable indicator of assure of future efficiency of the fund.

Brilliant prospects

The vaccines current an enormous alternative for pharmaceutical companies resembling Pfizer, one of many prime 10 holdings within the VanEck Vectors® Pharmaceutical ETF (PPH®). The U.S. pharmaceutical large, which is growing the vaccine in partnership with Germany’s BioNTech, expects to provide globally as much as 50 million doses this 12 months and over one billion doses in 2021,[1] topic to scientific success and regulatory authorization. Gross sales for the vaccine are estimated at US$3.5 billion subsequent 12 months earlier than steadying at US$1.Four billion yearly.

The potential for a divided U.S. Congress might additional propel the pharmaceutical sector, benefiting pharmaceutical ETFs. Though each Democrats and Republicans are supportive of drug pricing and reimbursement reform, the prospects of huge modifications to authorities well being plans are decrease if there’s a coverage gridlock.

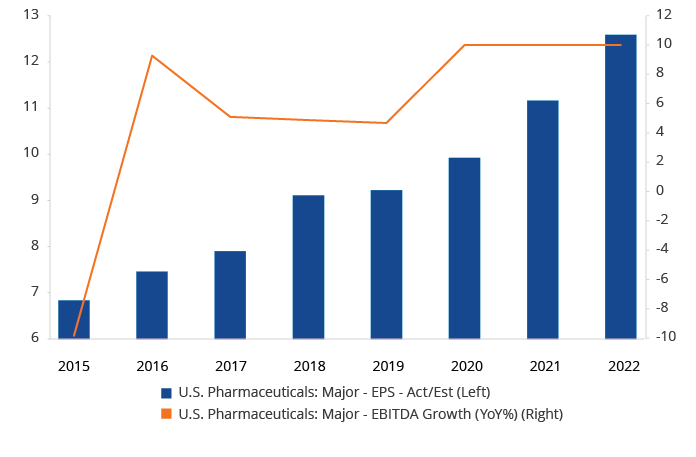

In the meantime, third-quarter outcomes from the pharmaceutical sector has been upbeat thus far, with nearly 90% of the businesses reporting better-than-expected revenues and earnings. Analysts count on the momentum to proceed, with trade estimates from Factset (see Determine 2) projecting earnings progress over the subsequent couple of years.

A rising, ageing and richer international inhabitants will additional increase demand for improved biotechnology and healthcare. Technological developments such because the elevated use of synthetic intelligence and on-line docs, and evolving care fashions may guarantee an extended tailwind for the sector.

Determine 2: Healthcare earnings outlook

Supply: Factset. Knowledge as of 18 November 2020.

VanEck Vectors Pharmaceutical ETF (NASDAQ: PPH)

As an alternative of investing in particular person firms, one of many best methods to spend money on the healthcare sector is through the VanEck Vectors Pharmaceutical ETF (NASDAQ: PPH). PPH gives publicity to 25 of the biggest pharmaceutical and distribution firms on this planet by monitoring the MVIS US Listed Pharmaceutical 25 Index. U.S. drugmakers make up barely greater than 65% of the portfolio, whereas the rest of the publicity (~35%) is in different healthcare firms in Europe, Israel and Japan. When it comes to fees, the fund’s expense ratio of 0.36%[2] is way decrease than a few of the charges levied by its friends for comparable funds.[3]

Key factors about PPH:

- An ETF to play on the potential progress of the pharmaceutical sector.

- Supplies publicity to a few of the world’s largest pharmaceutical firms which can be properly positioned to learn from long-term progress within the trade.

- Acquiring entry to those main firms doesn’t come at a excessive value. PPH’s expense ratio is among the many lowest in comparison with the costs levied by its friends for comparable funds.[4]

Initially revealed by VanEck, 11/20/20

DISCLOSURES

1 Supply: Pfizer, as of 11 November 2020.

2 Bills for PPH are capped contractually at 0.35% till February 1, 2021. Cap excludes acquired fund charges and bills, curiosity expense, buying and selling bills, taxes and extraordinary bills.

3 Supply: Morningstar.

4 Supply: Morningstar.

This materials is for informational functions solely. The data introduced doesn’t contain the rendering of customized funding, monetary, authorized, or tax recommendation. Sure statements contained herein might represent projections, forecasts and different ahead trying statements, which don’t replicate precise outcomes, are legitimate as of the date of this communication and are topic to vary with out discover. Data supplied by third get together sources are believed to be dependable and haven’t been independently verified for accuracy or completeness and can’t be assured. The data herein represents the opinion of the writer(s), however not essentially these of VanEck.

This isn’t a suggestion to purchase or promote, or a solicitation of any supply to purchase or promote any of the businesses talked about herein. Fund holdings will differ. For a whole listing of holdings within the ETF, please click on right here: https://www.vaneck.com/etf/fairness/pph/holdings/.

Earnings per share (EPS) is the financial worth of earnings per excellent share of widespread inventory for an organization. Earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) is an accounting measure calculated utilizing an organization’s earnings, earlier than curiosity bills, taxes, depreciation, and amortization are subtracted, as a proxy for an organization’s present working profitability.

An funding in VanEck Vectors Pharmaceutical ETF (PPH) could also be topic to dangers which embody, amongst others, investing within the pharmaceutical trade, fairness securities, well being care sector, depositary receipts, particular danger issues of investing in European issuers, international securities, international forex, small- and medium-capitalization firms, issuer-specific modifications, market, operational, index monitoring, approved participant focus, no assure of lively buying and selling market, buying and selling points, passive administration, fund shares buying and selling, premium/low cost danger and liquidity of fund shares, non-diversified, and focus dangers, all of which can adversely have an effect on the Fund. Overseas investments are topic to dangers, which embody modifications in financial and political circumstances, international forex fluctuations, modifications in international rules, and modifications in forex alternate charges which can negatively impression the Fund’s returns. Small- and medium-capitalization firms could also be topic to elevated dangers.

MVIS US Listed Pharmaceutical 25 Index is the unique property of MV Index Options GmbH (an entirely owned subsidiary of the Adviser), which has contracted with Solactive AG to keep up and calculate the Index. Solactive AG makes use of its greatest efforts to make sure that the Index is calculated accurately. Regardless of its obligations in direction of MV Index Options GmbH, Solactive AG has no obligation to level out errors within the Index to 3rd events. The VanEck Vectors Pharmaceutical ETF just isn’t sponsored, endorsed, offered or promoted by MV Index Options GmbH and MV Index Options GmbH makes no illustration concerning the advisability of investing within the Fund.

Investing entails substantial danger and excessive volatility, together with potential lack of principal. An investor ought to think about the funding goal, dangers, fees and bills of a Fund rigorously earlier than investing. To acquire a prospectus and abstract prospectus, which comprise this and different info, name 800.826.2333 or go to vaneck.com. Please learn the prospectus and abstract prospectus rigorously earlier than investing.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.