By: BCM Funding Staff

By: BCM Funding Staff

Pricing pressures proceed to plague producers as provide chain points persist and exercise eases off highs, although the Richmond Fed Manufacturing Index stays firmly in development territory. Economists proceed to invest about if/when these worth will increase will filter by way of to shoppers, and forex developments have us questioning how a lot of that client base might be worldwide. And as many traders chase high performers—typically to their very own detriment—inflation nervousness continues to make its presence felt within the markets, although it does seem like easing considerably. Are you conscious of how totally different asset courses sometimes behave in various inflationary environments? And as volatility continues within the crypto market amid speak of elevated regulation out of China—Bitcoin climbed again above $40,000 after dramatic weekend losses—what regulatory method are different main governments taking?

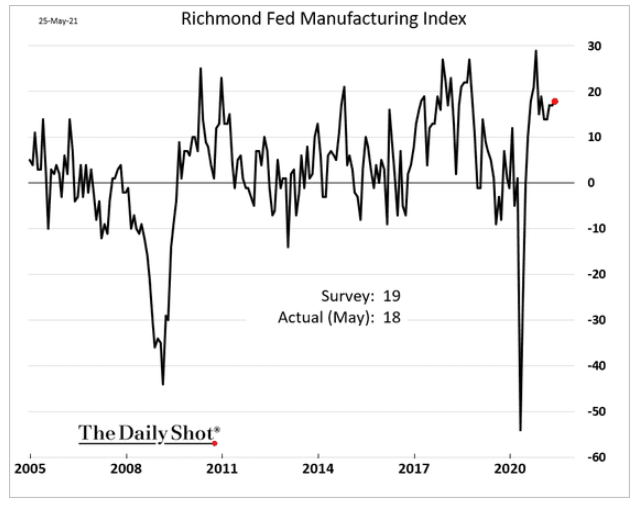

- The regional Fed surveys, whereas off their pandemic-bounce highs, proceed to point sturdy manufacturing exercise:

[wce_code id=192]

Supply: The Each day Shot, from 5/26/21

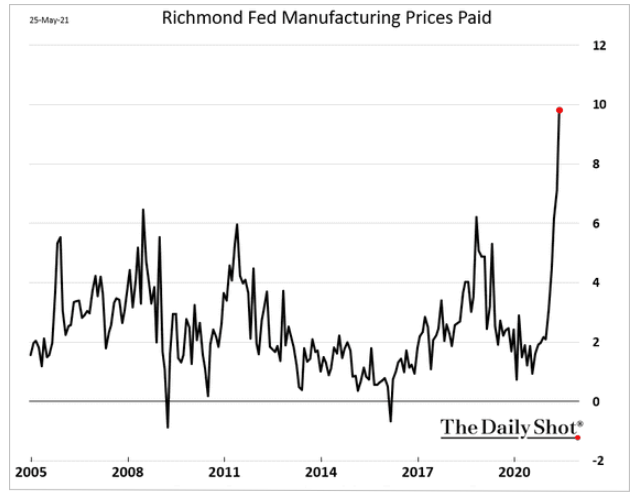

- Prices of products offered proceed to rise as a consequence of pent-up demand and provide shortages. Will these worth will increase get handed by way of to shoppers?

Supply: The Each day Shot, from 5/26/21

- Chinese language forex energy ought to be serving to with the commerce deficit…

Supply: The Each day Shot, from 5/26/21

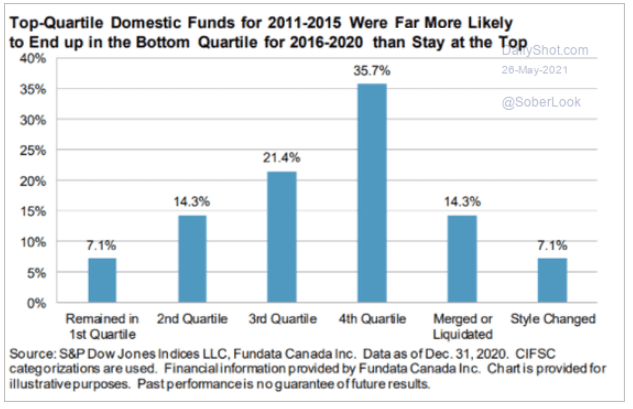

- Driving by utilizing the rear-view mirror doesn’t make sense, why make investments this fashion? Sluggish and regular can get traders to achieve their objectives…

Supply: S&P World Market Intelligence, from 5/26/21

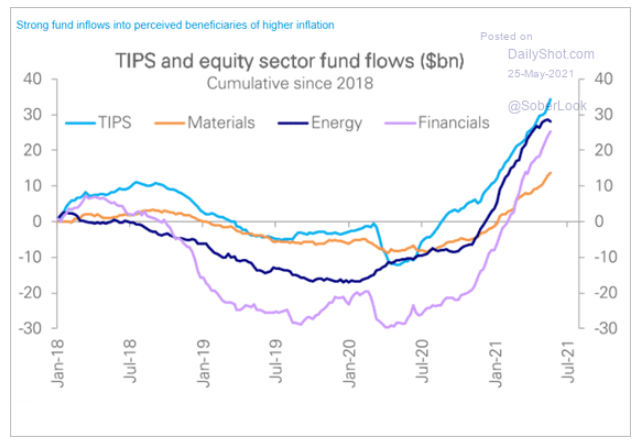

- These apprehensive about inflation have been investing accordingly:

Supply: Deutsche Financial institution Analysis, from 5/25/21

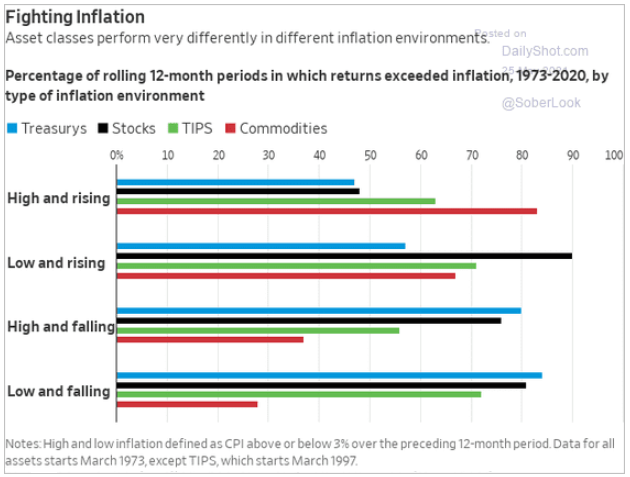

- Historic inflation and its impact on some main asset courses:

Supply: Wall Avenue Journal, from 5/25/21

- Attention-grabbing. As inflation fears grew, gold retreated. Now that inflation fears are subsiding, gold is rising once more…

Supply: The Each day Shot, from 5/26/21

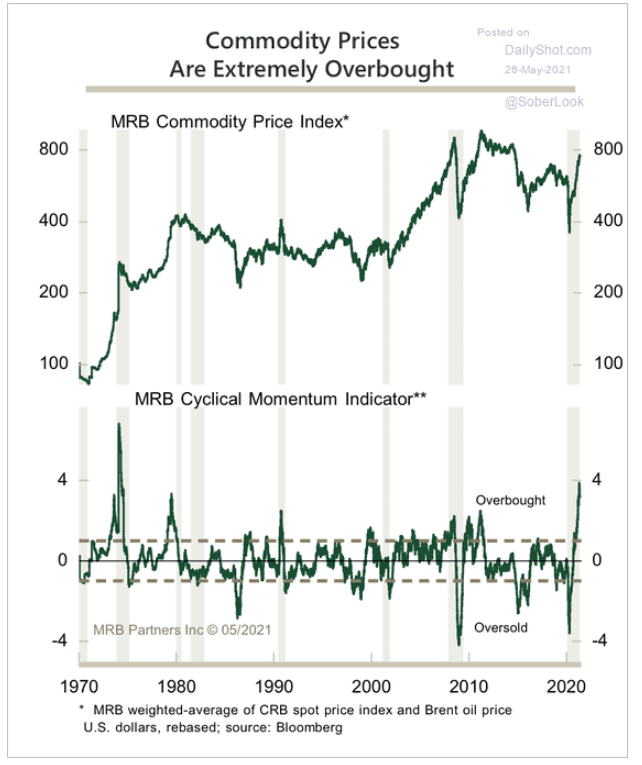

- Whereas this information is as of Could, it’s a good historic gauge. We notice many commodity costs have retreated since…

Supply: The Each day Shot, from 5/26/21

- An replace on how governments view crypto:

Supply: BCA Analysis, from 5/25/21

This text was contributed by Beaumont Capital Administration Funding Staff, a participant within the ETF Strategist Channel.

For extra insights like these, go to BCM’s weblog at weblog.investbcm.com.

Disclosure: The charts and info-graphics contained on this weblog are sometimes primarily based on information obtained from third events and are believed to be correct. The commentary included is the opinion of the writer and topic to alter at any time. Any reference to particular securities or investments are for illustrative functions solely and usually are not supposed as funding recommendation nor are they a suggestion to take any motion. Particular person securities talked about could also be held in consumer accounts. Previous efficiency isn’t any assure of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.