By Doug Sandler, CFA

Abstract

- The financial re-opening has led to produce constraints which threaten development.

- Traditionally, a mix of technological positive factors, human ingenuity, and labor and blend shifts have alleviated provide constraints.

- We view provide constraints as extra of a speedbump and fewer of a roadblock.

Provide constraints extra seemingly a speedbump than a roadblock

Undoubtedly, we consider higher financial instances are coming because of pent-up demand and excessive shopper financial savings charges. Nevertheless, for the primary time shortly, our view is that the most important risk to future development might not be an absence of demand however slightly constraints on provide.

Final week, we highlighted a few of these supply-related challenges dealing with the economic system together with labor provide and manufacturing and providers capability. This week our focus is on the potential fixes to those provide shortages and challenges to our thesis.

Potential Fixes:

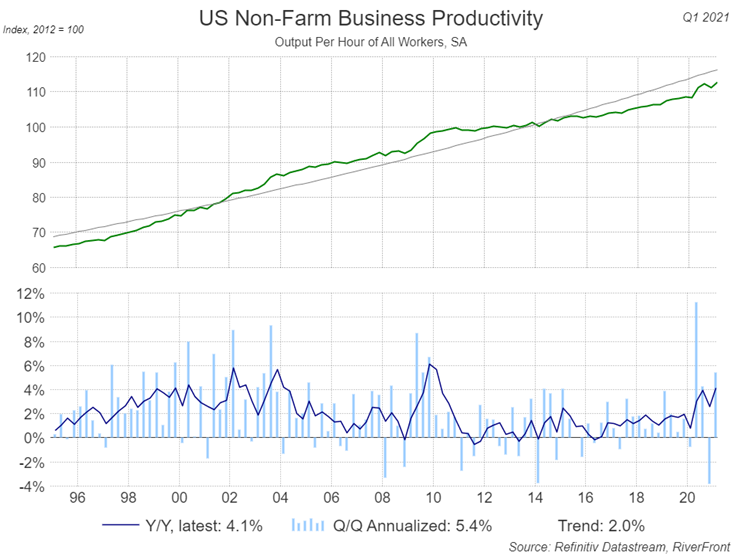

- Expertise: From the steam-engine to synthetic intelligence, expertise has all the time performed a pivotal function in narrowing the divide between demand and provide. In our view, the speedy adoption of expertise by many firms to function successfully throughout the COVID-19 pandemic, will turbo-charge productiveness positive factors in coming years. As could be seen within the chart under, productiveness development has picked up since COVID-19 registering 4.1% year-over-year and 5.4% quarter-over-quarter will increase. This charge of development is considerably greater than the two% development pattern that has existed for the reason that mid-1990s.

In impact, we consider nearly all firms are tech firms whether or not they provide it or use it. Expertise will proceed to remodel firms’ means to deal with change.

[wce_code id=192]

Productiveness Beginning to Rise

- Human ingenuity: Utilizing historical past as a information, provide shortages sometimes get rectified. Larger costs deliver extra opponents, employees, and capability to an trade. Finally, we consider it will get discovered. In any case, we developed a vaccine for COVID-19, a never-before-seen illness, in lower than one yr…. constructing a brand new sawmill or auto plant needs to be kid’s play compared.

- Onshoring: ‘Onshoring’ happens when a job that was ‘offshored’ to a decrease wage nation comes again to the US. This pattern towards onshoring began as the associated fee/productiveness benefits of offshoring began to say no. President Donald Trump’s commerce conflict and extra vehement public opposition to outsourcing accelerated the pattern. At this time, any further disruptions to the worldwide provide chain, like COVID-19 or transport challenges, will solely speed up the pattern additional, in our view.

- Combine Shifts: The pandemic was all about items because the service a part of the economic system was shut down. Nevertheless, reopening might scale back demand for items, as customers reallocate spending extra in direction of providers underutilized throughout the pandemic, corresponding to leisure and journey. We consider this might additionally probably alleviate a number of the inflation pressures which have arisen because of constraints on provide. Not too long ago the costs of various commodities (lumber, copper, agricultural merchandise, and many others.) seem to have began to chill off barely, for example.

- Service charges: Service wages want to extend, in our view. The federal government’s enhanced unemployment advantages are partly in charge however different components additionally contribute. For a lot of service employees that depend upon suggestions, the economics of working at a restaurant or hair salon working at half capability with restricted hours shouldn’t be tenable. Lengthy-term components like an absence of advantages and disruptions to public transportation can also be contributing components. One resolution can be to boost service employee wages and advantages funded by means of a compulsory service cost in lieu of suggestions. Such fashions are commonplace all through Europe and could also be prepared for prime time within the US, particularly as COVID-19 has highlighted the worth of those professions.

Challenges to our thesis:

- Considerably greater charges and/or considerably decrease US greenback: As the general public worries about greater costs and inflation, the bond and foreign money markets have been signaling that long-term inflation shouldn’t be but a priority. A spike in long-term rates of interest, presently under 3%, can be trigger for concern, as would a major and sustained drop within the worth of the US greenback.

- Absence of productiveness positive factors: The very best antidote to supply-side inflation is productiveness positive factors. Productiveness positive factors signify the economic system’s means to provide extra for a similar price. If productiveness positive factors start to subside, a number of the ‘transitory inflation’ now being skilled could show to be ‘structural’ and trigger for extra concern.

- Poor administration choice making: ‘Transitory or structural’ is the query many enterprise executives are grappling with. If the provision scarcity is seen as transitory, introduced on by pent-up demand and stimulus, then large adjustments to produce chains are pointless. Nevertheless, if the shortages are seen as structural, i.e., a operate of de-globalization and the millennials reaching their ‘prime spending’ years, then additional motion is required. The results to answering this query incorrectly might be vital. The boom-and-bust cycles of the 50s, 60s, 70s, and 80s had been introduced on by enterprise leaders misinterpreting demand surges. Again then it was frequent for companies to provide further stock, aggressively rent employees and increase their manufacturing capability; typically financed by means of large quantities of debt. Inevitably, the economic system would hit an impediment deeming their demand forecasts too rosy and far of their efforts must be reversed: fire-selling stock, shedding employees, and shutting factories. Since a lot of the enlargement was funded with debt, the financial penalties of misjudging demand had been typically whole (chapter). If firms had been elevating the danger profiles of their companies by overspending, we consider it might be first mirrored of their credit score scores. A fabric decline in general credit score scores can be one thing that might fear us.

Conclusion:

We consider {that a} mixture of American ingenuity and a decreasing of investor expectations will prevail, and the bull market will stay intact. To get there it could take 1 / 4 or two of lower-than-average fairness returns. Our portfolios stay barely obese shares relative to bonds, in keeping with our constructive long-term outlook.

Necessary Disclosure Info

The feedback above refer usually to monetary markets and never RiverFront portfolios or any associated efficiency. Opinions expressed are present as of the date proven and are topic to alter. Previous efficiency shouldn’t be indicative of future outcomes and diversification doesn’t guarantee a revenue or shield in opposition to loss. All investments carry some stage of threat, together with lack of principal. An funding can’t be made immediately in an index.

Chartered Monetary Analyst is knowledgeable designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of monetary analysts. Candidates are required to go three ranges of exams protecting areas corresponding to accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can turn into a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Info or knowledge proven or used on this materials was acquired from sources believed to be dependable, however accuracy shouldn’t be assured.

This report doesn’t present recipients with data or recommendation that’s enough on which to base an funding choice. This report doesn’t have in mind the precise funding aims, monetary scenario or want of any explicit shopper and might not be appropriate for every type of traders. Recipients ought to contemplate the contents of this report as a single consider investing choice. Further elementary and different analyses can be required to make an funding choice about any particular person safety recognized on this report.

In a rising rate of interest surroundings, the worth of fixed-income securities usually declines.

When referring to being “obese” or “underweight” relative to a market or asset class, RiverFront is referring to our present portfolios’ weightings in comparison with the composite benchmarks for every portfolio. Asset class weighting dialogue refers to our Benefit portfolios. For extra data on our different portfolios, please go to www.riverfrontig.com or contact your Monetary Advisor.

Investing in overseas firms poses further dangers since political and financial occasions distinctive to a rustic or area could have an effect on these markets and their issuers. Along with such normal worldwide dangers, the portfolio can also be uncovered to foreign money fluctuation dangers and rising markets dangers as described additional under.

Adjustments within the worth of foreign currency echange in comparison with the U.S. greenback could have an effect on (positively or negatively) the worth of the portfolio’s investments. Such foreign money actions could happen individually from, and/or in response to, occasions that don’t in any other case have an effect on the worth of the safety within the issuer’s house nation. Additionally, the worth of the portfolio could also be influenced by foreign money change management rules. The currencies of rising market nations could expertise vital declines in opposition to the U.S. greenback, and devaluation could happen subsequent to investments in these currencies by the portfolio.

Overseas investments, particularly investments in rising markets, could be riskier and extra unstable than investments within the U.S. and are thought of speculative and topic to heightened dangers along with the final dangers of investing in non-U.S. securities. Additionally, inflation and speedy fluctuations in inflation charges have had, and should proceed to have, unfavourable results on the economies and securities markets of sure rising market nations.

Shares signify partial possession of a company. If the company does nicely, its worth will increase, and traders share within the appreciation. Nevertheless, if it goes bankrupt, or performs poorly, traders can lose their total preliminary funding (i.e., the inventory value can go to zero). Bonds signify a mortgage made by an investor to a company or authorities. As such, the investor will get a assured rate of interest for a particular time period and expects to get their authentic funding again on the finish of that point interval, together with the curiosity earned. Funding threat is reimbursement of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Buyers ought to concentrate on these variations previous to investing.

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Change Fee. Registration as an funding adviser doesn’t suggest any stage of ability or experience. Any dialogue of particular securities is offered for informational functions solely and shouldn’t be deemed as funding recommendation or a suggestion to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Integrated (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its staff by means of RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and due to this fact an oblique proprietor of RiverFront. BFC is the mum or dad firm of Robert W. Baird & Co. Integrated, a registered dealer/vendor and funding adviser.

To overview different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Kind ADV, Half 2A. Copyright ©2021 RiverFront Funding Group. All Rights Reserved. ID 1669154

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.