By Rebecca Felton, Senior Market Strategist

SUMMARY

- Fairness markets had a robust quarter led by the US with no clear fashion dominating.

- We count on taxes and inflation to dominate the headlines this summer time.

- Safety choice is more and more necessary as we select which ‘restoration’ and ‘progress’ sectors to personal, therefore our ‘barbell method.’

Most Fairness Asset Lessons and Sectors Profit Throughout the Quarter

Anybody who has used a GPS for navigational help is aware of there’s hardly ever just one approach to attain our vacation spot. There are normally a number of routes, and every has trade-offs. Some might contain tolls, typically there’s a scenic route, and detours typically pop-up unexpectedly. Utilizing the GPS analogy appears becoming when eager about the twists and turns skilled throughout the second quarter of 2021 as we proceed on the trail to normalcy. Paved with employment tendencies which might be trending positively, shopper and company confidence returning to pre-pandemic ranges, and a ‘V-shaped’ restoration for company earnings, the muse seems stable. Nonetheless, detours attributable to inflation fears and threats of upper taxes acted as velocity bumps alongside the best way.

[wce_code id=192]

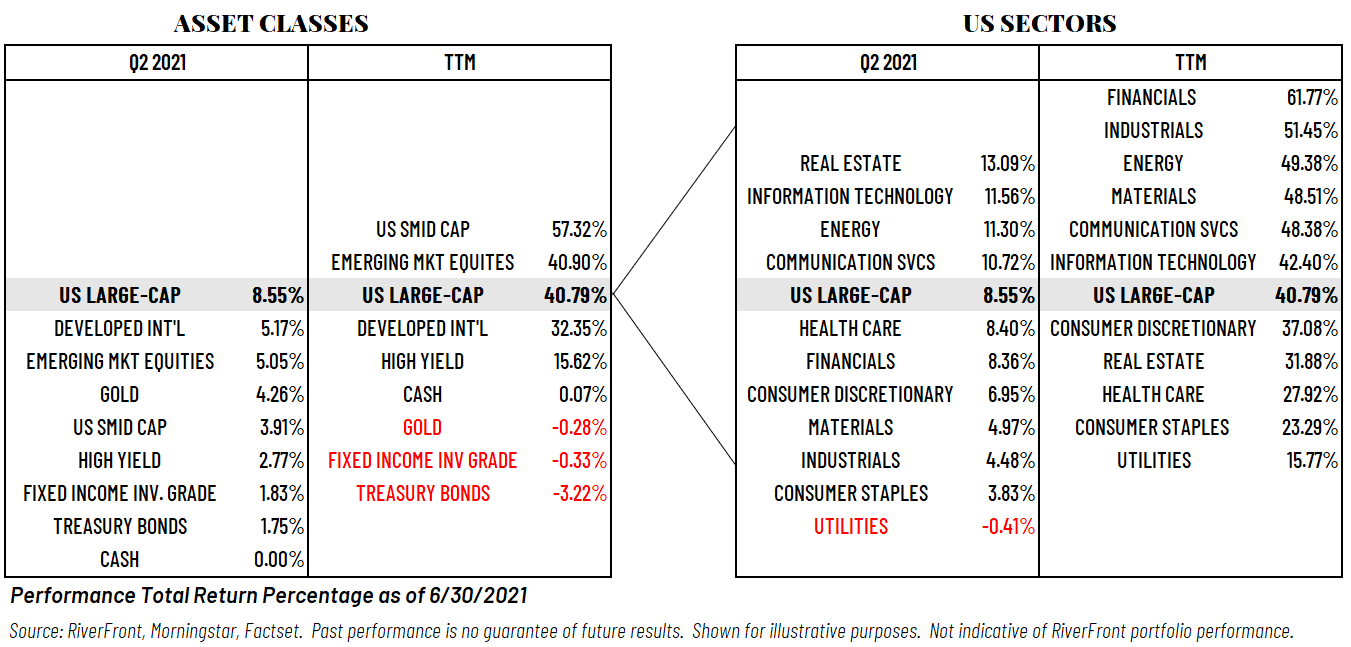

The sturdy returns for each the quarter and the trailing twelve months (TTM) illustrate to us that buyers proceed to look past COVID-19, anticipating a continued restoration in earnings. Early within the quarter, restoration momentum in Europe boosted efficiency for developed worldwide equities, however that relative momentum light attributable to rising COVID-19 instances ensuing within the S&P 500 (US Giant-Cap) turning within the strongest efficiency within the quarter at almost 8.6%. Paradoxically, regardless of a detrimental return over the trailing twelve-month interval, gold elevated to over 4% throughout the second quarter reflecting heightened inflation worries. US Small and Mid-cap equities retained the lead because the strongest performing asset class over the trailing twelve months rising 57.3%.

The desk beneath reveals the efficiency of asset courses on the left and US fairness sectors on the correct. Returns for each the second quarter and the previous 12 months (TTM) are proven. The desk is anchored by US Giant-Cap equities, that are shaded, and permits for simpler comparability to see greater and decrease relative efficiency by every asset class and sector.

Efficiency: A Nearer Look

Whereas the perfect performing sectors over the trailing twelve-month interval are these most delicate to the financial restoration, the returns for the second quarter inform a unique story in our opinion. Our GPS analogy about completely different routes is well-illustrated as the highest three performing sectors throughout the second quarter are every related to a unique theme – inflation, progress, and worth. Inflation considerations resulted within the Actual Property sector handing over the perfect efficiency, rising to over 13%. The Info Expertise sector is the bellwether for progress and was the second-best performing sector throughout the quarter as buyers responded to optimistic earnings steering. This sector had the best variety of corporations issuing optimistic earnings and income steering of all eleven S&P 500 sectors throughout the second quarter. Lastly, the value-oriented Vitality sector additionally rose over 11% throughout the quarter because it continued to learn from greater oil costs. Oil costs rose to two-year highs in June as a result of rising energy in demand.

We consider the uneven nature of the restoration makes the case for diversification and will increase the significance of choice as we navigate via the rest of 2021.

Our present home fairness choice is characterised by what we check with as a ‘barbell’ method, which provides us publicity to each progress and value-oriented equities. Our methods at present maintain a mixture of industries that proceed to learn from the work-from-home setting in addition to people who stand to learn from the excessive ranges of presidency stimulus. We favor industries corresponding to software program, information warehousing, financials, and medical gadgets inside our US fairness portion of the portfolios. Our outlook for worldwide shares stays blended within the near-term as we watch the rise in COVID-19 instances that might hinder financial restoration in Europe and Japan. COVID-19 containment points have additionally brought on us to regulate our rising markets publicity decrease. We stay underweight mounted earnings in our balanced methods and maintain US Treasuries as an fairness shock absorber.

Course of over Prediction:

For a lot of the previous yr, market momentum has been tied to 1 theme: COVID-19 restoration. Now investor consideration is topic to a number of detours within the type of headlines creating concern over points corresponding to greater inflation or greater taxes. At RiverFront, we stay targeted on our course of reasonably than the headlines. We’re constructive as we glance out via the rest of the yr attributable to our perception that the elemental underpinnings for a sustainable financial restoration are in place. Nonetheless, as we famous within the June 14, 2021, version of the Weekly View (Three Tactical Guidelines: Flying with the ‘Fasten Seatbelt’ Signal On), we consider markets may face headwinds this summer time. Chief amongst them could also be a downturn in investor sentiment as earnings or financial information disappointments serve to dampen investor enthusiasm within the near-term.

Necessary Disclosure Info

The feedback above refer typically to monetary markets and never RiverFront portfolios or any associated efficiency. Opinions expressed are present as of the date proven and are topic to alter. Previous efficiency just isn’t indicative of future outcomes and diversification doesn’t guarantee a revenue or shield towards loss. All investments carry some stage of threat, together with lack of principal. An funding can’t be made straight in an index.

Chartered Monetary Analyst is knowledgeable designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of monetary analysts. Candidates are required to cross three ranges of exams protecting areas corresponding to accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can develop into a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Info or information proven or used on this materials was obtained from sources believed to be dependable, however accuracy just isn’t assured.

This report doesn’t present recipients with data or recommendation that’s enough on which to base an funding choice. This report doesn’t keep in mind the precise funding aims, monetary scenario or want of any specific shopper and will not be appropriate for all sorts of buyers. Recipients ought to think about the contents of this report as a single consider investing choice. Extra elementary and different analyses could be required to make an funding choice about any particular person safety recognized on this report.

The Benefit portfolios could also be invested in shares, bonds and exchange-traded merchandise (exchange-traded funds (ETFs) and exchange-traded notes (ETNs)). Benefit is obtainable via individually managed accounts or on mannequin supply platforms, relying on the Sponsor Agency.

In a rising rate of interest setting, the worth of fixed-income securities typically declines.

Excessive-yield securities (together with junk bonds) are topic to higher threat of lack of principal and curiosity, together with default threat, than higher-rated securities.

Small-, mid- and micro-cap corporations could also be hindered on account of restricted assets or much less various services or products and have due to this fact traditionally been extra risky than the shares of bigger, extra established corporations.

Expertise and Web-related shares, particularly of smaller, less-seasoned corporations, are usually extra risky than the general market.

When referring to being “obese” or “underweight” relative to a market or asset class, RiverFront is referring to our present portfolios’ weightings in comparison with the composite benchmarks for every portfolio. Asset class weighting dialogue refers to our Benefit portfolios. For extra data on our different portfolios, please go to www.riverfrontig.com or contact your Monetary Advisor.

Investing in international corporations poses extra dangers since political and financial occasions distinctive to a rustic or area might have an effect on these markets and their issuers. Along with such normal worldwide dangers, the portfolio may be uncovered to foreign money fluctuation dangers and rising markets dangers as described additional beneath.

Adjustments within the worth of foreign currency in comparison with the U.S. greenback might have an effect on (positively or negatively) the worth of the portfolio’s investments. Such foreign money actions might happen individually from, and/or in response to, occasions that don’t in any other case have an effect on the worth of the safety within the issuer’s residence nation. Additionally, the worth of the portfolio could also be influenced by foreign money trade management rules. The currencies of rising market international locations might expertise important declines towards the U.S. greenback, and devaluation might happen subsequent to investments in these currencies by the portfolio.

Overseas investments, particularly investments in rising markets, might be riskier and extra risky than investments within the U.S. and are thought of speculative and topic to heightened dangers along with the final dangers of investing in non-U.S. securities. Additionally, inflation and speedy fluctuations in inflation charges have had, and will proceed to have, detrimental results on the economies and securities markets of sure rising market international locations.

Shares symbolize partial possession of an organization. If the company does effectively, its worth will increase, and buyers share within the appreciation. Nonetheless, if it goes bankrupt, or performs poorly, buyers can lose their total preliminary funding (i.e., the inventory worth can go to zero). Bonds symbolize a mortgage made by an investor to an organization or authorities. As such, the investor will get a assured rate of interest for a particular time frame and expects to get their unique funding again on the finish of that point interval, together with the curiosity earned. Funding threat is reimbursement of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Traders ought to concentrate on these variations previous to investing.

Sectors primarily based on World Trade Classification Commonplace (GICS) a standardized classification system for equities developed collectively by Morgan Stanley Capital Worldwide (MSCI) and

Commonplace & Poor’s. The GICS hierarchy begins with 11 sectors and is adopted by 24 business teams, 67 industries, and 147 sub-industries.

Commonplace & Poor’s (S&P) 500 Index TR USD (US Giant Cap) measures the efficiency of 500 giant cap shares, which collectively symbolize about 80% of the entire US equities market.

Asset Class Definitions:

S&P 1000 Index TR USD (US SMID Cap) is a mix of the S&P Mid Cap 400 Index TR USD & S&P Small Cap 600 Index TR USD.

MSCI EAFE Index TR USD (Developed Worldwide Equities) is an fairness index that captures giant and mid cap illustration throughout developed market international locations around the globe, excluding the US and Canada.

MSCI Rising Markets Index NR USD (Rising Market Equities) is an fairness index that captures giant and mid cap illustration throughout 23 rising markets (EM) international locations.

Bloomberg Barclays Capital US Treasury Index TR USD (Treasury Bonds) measures the efficiency of the US Treasury bond market.

Bloomberg Barclays US Combination Bond Index TR USD (Mounted Revenue Funding Grade) is an unmanaged index that covers the funding grade mounted fee bond market with index elements for presidency and company securities, mortgage pass-through securities, and asset-backed securities. The problems should be rated funding grade, be publicly traded, and meet sure maturity and subject measurement necessities.

ICE BofA Merrill Lynch Excessive Yield Index TR USD (Excessive Yield) which tracks the efficiency of US greenback denominated beneath funding grade rated company debt publicly issued within the US home market. Index constituents are capitalization-weighted primarily based on their present quantity excellent instances the market worth plus accrued curiosity.

Bloomberg Barclays Capital 1–Three Month US Treasury Invoice Index TR USD (Money) contains all publicly issued zero-coupon US Treasury Payments with a remaining maturity between 1 and three months, are rated investment-grade, and have an impressive face worth of $250 million or extra.

LBMA Gold Worth PM ($/OZt) (GOLD) – the London gold worth per troy ounce of gold for supply in London via a member of the LBMA approved to impact such supply, acknowledged in U.S. {Dollars}, as calculated and administered by impartial service supplier (S) and revealed by the LBMA on its web site at www.lbma.org.uk

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Alternate Fee. Registration as an funding adviser doesn’t suggest any stage of talent or experience. Any dialogue of particular securities is supplied for informational functions solely and shouldn’t be deemed as funding recommendation or a advice to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Integrated (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its workers via RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and due to this fact an oblique proprietor of RiverFront. BFC is the father or mother firm of Robert W. Baird & Co. Integrated, a registered dealer/vendor and funding adviser.

To evaluate different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Kind ADV, Half 2A. Copyright ©2021 RiverFront Funding Group. All Rights Reserved. ID 1710528

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.