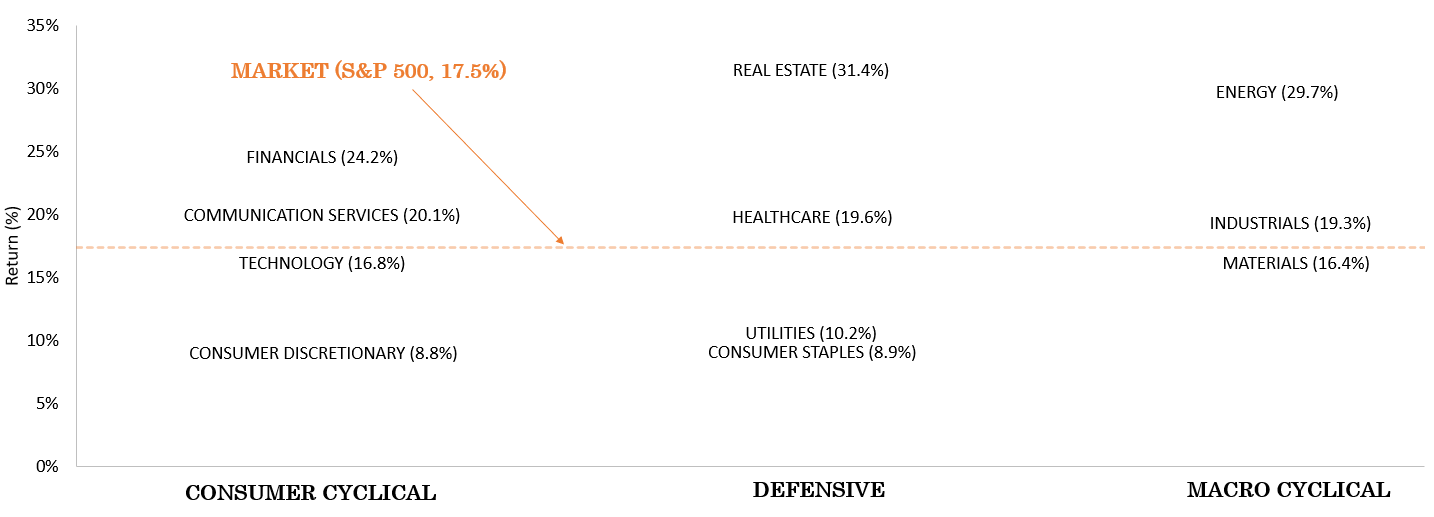

Heading into 2021, many prognosticators recommended macro-cyclical sectors have been poised to profit from the accommodative financial, accommodative fiscal coverage, and client returning to pre-COVID-19 behaviors. Many of those developments existed throughout the second half of 2020 and have been projected into 2021. Determine 1 reveals the year-to-date efficiency of all eleven sectors organized by supersector. The supersector elements replicate our view of how behavioral and macroeconomic information influence sector efficiency. In line with the expectations at the beginning of 2021, the macro-cyclical supersector has outperformed different supersectors on common. But given the return dispersion inside every supersector, we needed to evaluate three behavioral information factors – momentum, flows, and quick curiosity – for indicators of whether or not the efficiency developments would proceed.

[wce_code id=192]

Determine 1. Yr-to-Date U.S. Sector Efficiency

Supply: Innealta Capital. Timeframe 12/31/2020 to 07/31/2021.

Relative efficiency (i.e., cross-sectional momentum) is a generally used conduct that measures the overall returns of a basket of securities or markets on a relative foundation. Though many variants of this method exist, the core logic is that the top-performing securities or markets inside the basket usually tend to hold outperforming on a relative foundation. Determine 2 reveals the common return of every supersector over the previous 3,6, 9, and 12 months. The illustration reveals that the macro-cyclical group has, on common, outperformed the opposite two teams and the market in three of the 4 intervals analyzed. Whereas the newest three-month underperformance of the macro-cyclical group is regarding, we consider that the sturdy relative efficiency throughout the opposite intervals helps the notion for continued sturdy relative efficiency.

Determine 2 Relative Power

Supply: Innealta Capital. Timeframe 07/31/2020 to 07/31/2021. “Shopper Cyclical” refers back to the weighted common returns of the Data Expertise, Communication Providers, Shopper Discretionary, and Financials sectors. “Defensive” refers back to the weighted common returns of the Utilities, Shopper Staples, Healthcare, and Actual Property sectors. “Macro Cyclical” refers back to the Power, Industrials, and Supplies sectors.” Market” refers back to the S&P 500.

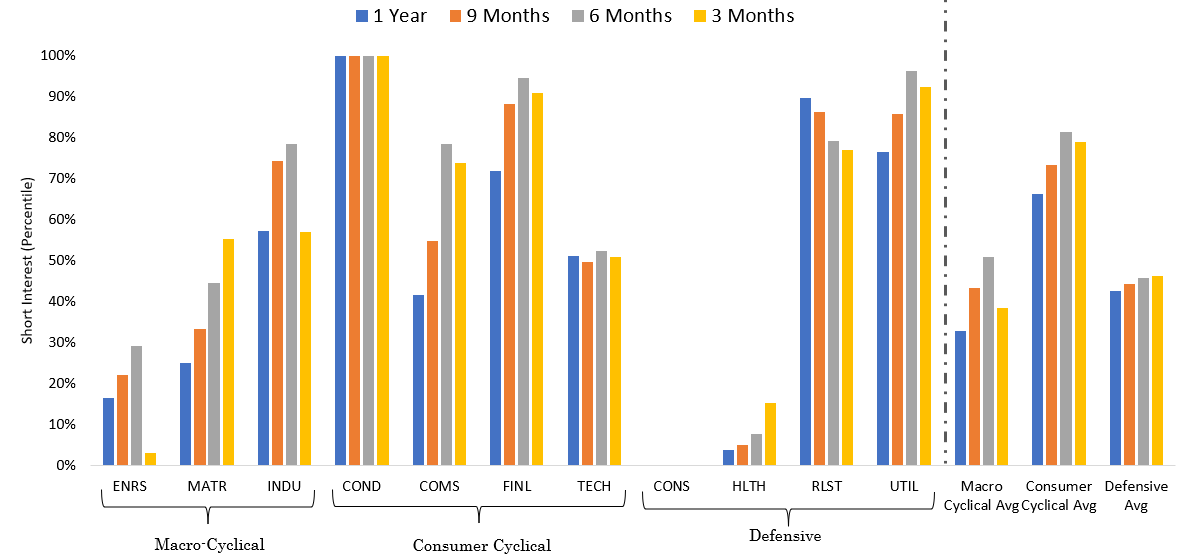

Whereas relative power (i.e., momentum) is a helpful behavioral indicator, one other we consider is beneficial is brief curiosity. We might anticipate that securities, trade teams, or sectors which have a excessive relative quantity of quick curiosity underperform on a relative foundation. Determine 3. reveals our quick curiosity indicator for every sector throughout a number of intervals. We in contrast the newest quick curiosity as a share of shares excellent relative to all values noticed for a given safety over 4 totally different time frames. Thus our quick curiosity indicator is bounded between 0% and 100%, and the next worth is indicative of extra shorting stress relative to every sector’s historical past. The graph reveals that the macro-cyclical group reveals the bottom quick curiosity whereas the buyer discretionary sector reveals the very best. Inside these teams, numerous dispersion exists. Quick curiosity may be very low within the defensive group’s client staples and healthcare sectors, whereas very excessive in the actual property and utility sectors. In our opinion, the quick curiosity information offers an analogous view because the momentum information and helps the view of the continued reflation commerce.

Determine 3. Quick Curiosity Indicator

Supply: Innealta Capital. Timeframe 07/31/2020 to 07/31/2021. Quick Curiosity Indicator calculated because the quick curiosity as a share of shares excellent after which scaled inside every market’s distinctive historical past. Percentile calculated as the newest worth relative of all values noticed throughout the pattern set. Please see disclosures for class descriptions.

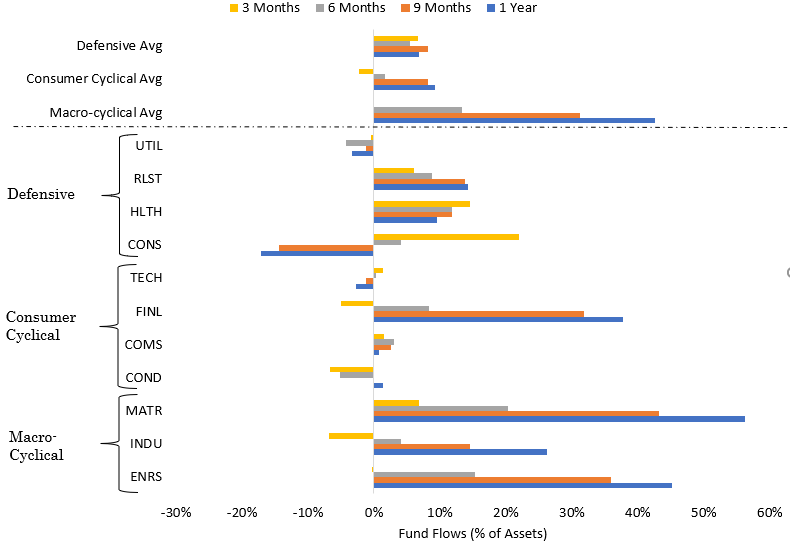

Lastly, fund flows. On this case, we search for securities, trade teams, or sectors experiencing sturdy inflows relative to different securities, trade teams, or sectors. Whereas this method is calculated equally to relative power, intervals have existed when relative fund flows present a distinct perception. Determine Four reveals exchange-traded fund flows over the identical intervals used for relative power and quick curiosity. The flows information reveals that, on common, the macro-cyclical sectors acquired giant inflows as a share of property, then client cyclical or defensive sectors over the previous 6, 9, and 12 months. Nevertheless, over the previous three months, defensive and consumer-cyclical sectors have seen extra relative inflows. The flows information offers a 3rd behavioral information level that helps the reflation commerce.

Determine 4. U.S. Sector Fund Flows

Supply: Innealta Capital. As of 07/31/2021. Fund Flows are calculated because the sum of fund flows over the pattern interval divided by the common property over the interval. Please see disclosures for class descriptions and reference exchange-traded funds used.

After reviewing the behavioral information factors above, the behavioral information would seem to make a case for Power and Supplies sectors to proceed to outperform over the subsequent two to 3 months. The Healthcare sector is one other attention-grabbing sector given its sturdy fund flows and low quick curiosity. The Shopper Discretionary sector screens week primarily based on relative power, quick curiosity, and flows on the opposite facet of the spectrum. We might warning anybody from extrapolating the behavioral information, reminiscent of the information represented on this doc, alone. Somewhat we desire and would counsel utilizing the behavioral information at the side of company elementary and macroeconomic information to type a sturdy view of monetary markets.

Essential Data

“UTIL” refers back to the Utilities sector and was proxied utilizing the SPRD Choose Utilities exchange-traded fund. “RLST” refers back to the Actual Property sector and was proxied utilizing the Vanguard Actual Property exchange-traded fund (“VNQ”). “HLTH” refers back to the healthcare sector and was proxied utilizing the SPDR Choose Healthcare exchange-traded fund. “CONS” refers back to the Shopper Staples sector and was proxied utilizing the SPDR Choose Shopper Staples exchange-traded fund (“XLP”). “TECH” refers back to the data know-how sector and was proxied utilizing the SPDR Choose Data Expertise exchange-traded fund. “FINL” refers back to the monetary companies sector and was proxied utilizing the SPDR Choose Financials exchange-traded fund (“XLF”). “COMS” refers back to the communication companies sector and was proxied utilizing the SPDR Communication Providers exchange-traded fund. “COND” refers back to the client discretionary sector and was proxied utilizing the SPDR Choose Shopper Discretionary exchange-traded fund (“XLY”). “MATR” refers back to the supplies sector and was proxied utilizing the SPDR Choose Supplies exchange-traded fund (“XLB”). “INDU” refers back to the industrials sector was proxied utilizing the SPDR Industrials exchange-traded fund (“XLI”). “ENRS” refers back to the vitality sector and was proxied utilizing the SPDR Power exchange-traded fund (“XLE”).

This materials is for informational functions and is meant for use for instructional and illustrative functions solely. It isn’t designed to cowl each side of the related markets and isn’t meant for use as a normal information to investing or as a supply of any particular funding suggestion. It isn’t meant as a proposal or solicitation for the acquisition or sale of any monetary instrument, funding services or products. This materials doesn’t represent funding recommendation, neither is it an alternative to such skilled recommendation or companies, nor ought to or not it’s used as a foundation for any determination or motion which will have an effect on your enterprise. Earlier than making any determination or taking any motion which will have an effect on your enterprise, it’s best to seek the advice of a certified skilled adviser. In getting ready this materials now we have relied upon information equipped to us by third events. The knowledge has been compiled from sources believed to be dependable, however no illustration or guarantee, specific or implied, is made by Innealta Capital, LLC as to its accuracy, completeness or correctness. Innealta Capital, LLC doesn’t assure that the knowledge equipped is correct, full, or well timed, or make any warranties with regard to the outcomes obtained from its use. Innealta Capital, LLC has no obligations to replace any such data.

839-INN-08/24/2021

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com