By Holly Framstad, CFA, U.S. Head of Issue ETFs, iShares Ke

By Holly Framstad, CFA, U.S. Head of Issue ETFs, iShares

Key takeaways

- The prospect of middling financial progress and low charges makes income-generation difficult for a lot of traders.

- A possible rise in inflation could result in decrease actual yields, highlighting the higher significance of equities as a approach to entry portfolio revenue.

- Excessive-yield and dividend-growth methods every provide fairness revenue with an emphasis on “high quality” firms, and the 2 methods can be utilized collectively in the identical portfolio.

Investing for normal revenue looks like it must be a simple proposition.

And but, there may be extra to revenue investing than many admire. Revenue funding methods are available in all totally different sizes and shapes, together with shares, bonds, bond-like shares, and stock-like bonds. And the effectiveness of every technique at delivering revenue can range with market circumstances.

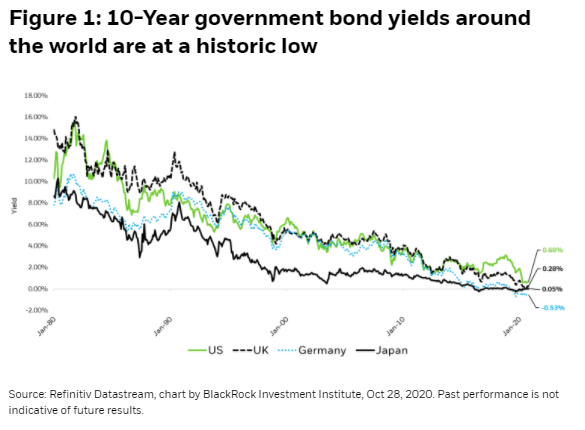

One of the crucial well-known income-producing property is the 10-year U.S. authorities bond. In October of 1987, this asset boasted a yield over 10%. By 2007 the yield had reached 5%, a perform of rising after reaching lows in the course of the early 2000’s recession. This 12 months, its yield hit a report low close to 0.5%.[1] The present outlook for tepid financial progress and current feedback from Federal Reserve Chairman Jerome Powell point out low charges could also be right here to remain (although an efficient COVID-19 vaccine quickly could have an effect on this view). On this atmosphere, purchasers I communicate with are on the lookout for methods to reinvigorate the standard method to looking for revenue.

The dividend method to looking for revenue

Fairness dividends could provide the next yield on this traditionally low-rate atmosphere. A possible benefit of the dividend method vis-à-vis bonds is that, apart from present revenue, equities might also develop their dividends and notice capital appreciation over time. The mix may also help ship returns that preserve tempo with or exceed inflation. Whereas inflation has been subdued lately, the BlackRock Funding Institute (BII) lately forecasted increased inflation within the medium time period, that means that the inflation-adjusted actual yield for traders may very well be even decrease.

Notably, traders who make the most of a 60/40 portfolio could already be uncovered to equities as a supply of revenue. Because the chart beneath reveals, fairness dividends could comprise a higher portion of a 60/40 portfolio as bond yields have fallen.

Fairness revenue instruments are sharper than ever earlier than

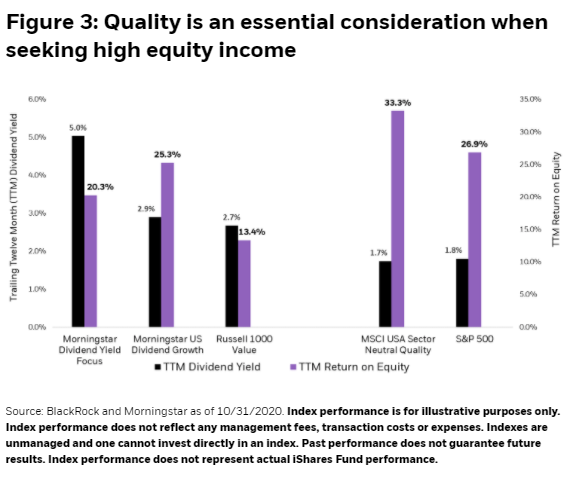

In 2020, revenue traders face a distinct panorama than in many years previous. Because the markets have advanced, so too have the index-based options which now provide direct and considerate publicity to fairness revenue. For instance, the Morningstar Dividend Yield Focus Index explicitly seeks publicity to U.S. firms with excessive dividend yield, whereas additionally screening for dividend sustainability and different parts of high quality. This index posts a dividend yield of 5.0% whereas the Russell 1000 Worth and S&P 500 provide yields of two.7% and 1.8% respectively.[2]

Dividend-growth methods are one other approach to consider fairness revenue. Dividend-growth indexes such because the Morningstar US Dividend Development Index present entry to firms which have persistently grown their dividends for 5 years or longer and have the monetary means to proceed to take action. Whereas its methodology doesn’t explicitly search to maximise yield, it has captured an above-market dividend yield of two.9% by together with solely dividend-growing firms.[3]

High quality issues when pondering dividends

Notably, each high-yield and dividend-growth indexes mentioned above incorporate “high quality” screens. Since yield is a perform of dividend funds divided by worth (D/P), higher-yielding shares could not all the time characterize firms with sturdy enterprise fashions that may assist the distribution of excessive present revenue to traders. Often a inventory’s excessive yield can sign a “yield entice,” that means that the yield is excessive largely as a result of its inventory worth had fallen sharply. High quality screens in indexes may also help decrease publicity to the dangers of yield traps.

Buyers might also think about managing danger with revenue methods on the portfolio degree. This may be executed with complementary fund holdings. For instance, a top quality issue technique could also be an excellent complement to an income-focused funding as a result of it counterbalances danger associated to shares which may have a excessive yield however weaker fundamentals. Think about as a illustration of high quality the MSCI USA Sector Impartial High quality Index, which focuses on discovering firms with excessive profitability and powerful steadiness sheets. The beneath chart reveals dividend yields and return on fairness (ROE) as a easy proxy for high quality. Each high-yield and dividend-growth methods present a extra favorable trade-off between yield and high quality than the Russell 1000 Worth Index. Whereas the devoted high quality index doesn’t explicitly search increased yield, its considerably increased ROE versus each the Russell 1000 Worth Index, however extra importantly the S&P 500, demonstrates the advantages high quality screens can present on the portfolio degree to income-seeking traders.

Fairness revenue would be the lacking portfolio hyperlink

Shares with excessive dividend yields could look totally different from shares with excessive dividend progress charges; nonetheless, each are probably helpful to revenue traders. Excessive-dividend methods are usually concentrated in additional mature sectors, fall predominantly within the massive worth “model field,” and might exhibit increased rate of interest sensitivity. In distinction, dividend-growth methods sometimes seize a mixture of mature and growth-oriented sectors, maintain a mix of each worth and growth-oriented securities, and exhibit much less rate of interest sensitivity than excessive yield targeted methods. These very totally different approaches to the fairness revenue section of the market generate solely 30% publicity overlap, permitting them for use collectively inside portfolios.[4] In a low-rate world, dividend fairness methods would be the lacking hyperlink to supply traders with the revenue they’re now not getting from bonds, whereas nonetheless providing fairness market publicity to supply upside in an inflationary atmosphere.

Associated iShares Funds:

Initially printed by iShares, 11/23/20

1 Historic yield figures from the Federal Reserve Financial institution of St. Louis web site.

2 Supply: BlackRock as of 10/31/2020. Trailing twelve month (TTM) dividend yield is used, which divides TTM dividends by present worth.

3 Supply: BlackRock as of 10/31/2020. Trailing twelve month dividend yield is used, which divides TTM dividends by present worth.

4 Morningstar as of 10/31/2020. This represents the publicity overlap of the Morningstar Dividend Yield Focus Index and the Morningstar US Dividend Development Index. Topic to alter.

Fastidiously think about the Funds’ funding aims, danger elements, and fees and bills earlier than investing. This and different data may be discovered within the Funds’ prospectuses or, if obtainable, the abstract prospectuses, which can be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Learn the prospectus rigorously earlier than investing.

Investing entails danger, together with doable lack of principal.

There is no such thing as a assure that dividends will likely be paid.

There may be no assurance that efficiency will likely be enhanced or danger will likely be diminished for funds that search to supply publicity to sure quantitative funding traits (“elements”). Publicity to such funding elements could detract from efficiency in some market environments, maybe for prolonged intervals. In such circumstances, a fund could search to keep up publicity to the focused funding elements and never modify to focus on various factors, which may end in losses.

Index efficiency is for illustrative functions solely. Index efficiency doesn’t mirror any administration charges, transaction prices or bills. Indexes are unmanaged and one can’t make investments instantly in an index. Previous efficiency doesn’t assure future outcomes.

This materials represents an evaluation of the market atmosphere as of the date indicated; is topic to alter; and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This data shouldn’t be relied upon by the reader as analysis or funding recommendation relating to the funds or any issuer or safety specifically.

The methods mentioned are strictly for illustrative and academic functions and usually are not a advice, provide or solicitation to purchase or promote any securities or to undertake any funding technique. There is no such thing as a assure that any methods mentioned will likely be efficient.

The data introduced doesn’t take into accounts commissions, tax implications, or different transactions prices, which can considerably have an effect on the financial penalties of a given technique or funding choice.

This materials comprises normal data solely and doesn’t take note of a person’s monetary circumstances. This data shouldn’t be relied upon as a major foundation for an funding choice. Somewhat, an evaluation must be made as as to if the data is suitable in particular person circumstances and consideration must be given to speaking to a monetary skilled earlier than investing choice.

The Funds are distributed by BlackRock Investments, LLC (along with its associates, “BlackRock”).

The iShares Funds usually are not sponsored, endorsed, issued, offered or promoted by Barclays, Bloomberg Finance L.P., BlackRock Index Companies, LLC, Cohen & Steers Capital Administration, Inc., European Public Actual Property Affiliation (“EPRA® ”), FTSE Worldwide Restricted (“FTSE”), ICE Knowledge Companies, LLC, India Index Companies & Merchandise Restricted, JPMorgan Chase & Co., Japan Trade Group, MSCI Inc., Markit Indices Restricted, Morningstar, Inc., The NASDAQ OMX Group, Inc., Nationwide Affiliation of Actual Property Funding Trusts (“NAREIT”), New York Inventory Trade, Inc., Russell or S&P Dow Jones Indices LLC. None of those firms make any illustration relating to the advisability of investing within the Funds. Excluding BlackRock Index Companies, LLC, who’s an affiliate, BlackRock Investments, LLC is just not affiliated with the businesses listed above.

Neither FTSE nor NAREIT makes any guarantee relating to the FTSE NAREIT Fairness REITS Index, FTSE NAREIT All Residential Capped Index or FTSE NAREIT All Mortgage Capped Index; all rights vest in NAREIT. Neither FTSE nor NAREIT makes any guarantee relating to the FTSE EPRA/NAREIT Developed Actual Property ex-U.S. Index, FTSE EPRA/NAREIT Developed Europe Index or FTSE EPRA/NAREIT International REIT Index; all rights vest in FTSE, NAREIT and EPRA.“FTSE®” is a trademark of London Inventory Trade Group firms and is utilized by FTSE below license.

© 2020 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI brand are emblems of BlackRock, Inc., or its subsidiaries in america and elsewhere. All different marks are the property of their respective house owners.

iCRMH1220U/S-1431702-1/7

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.