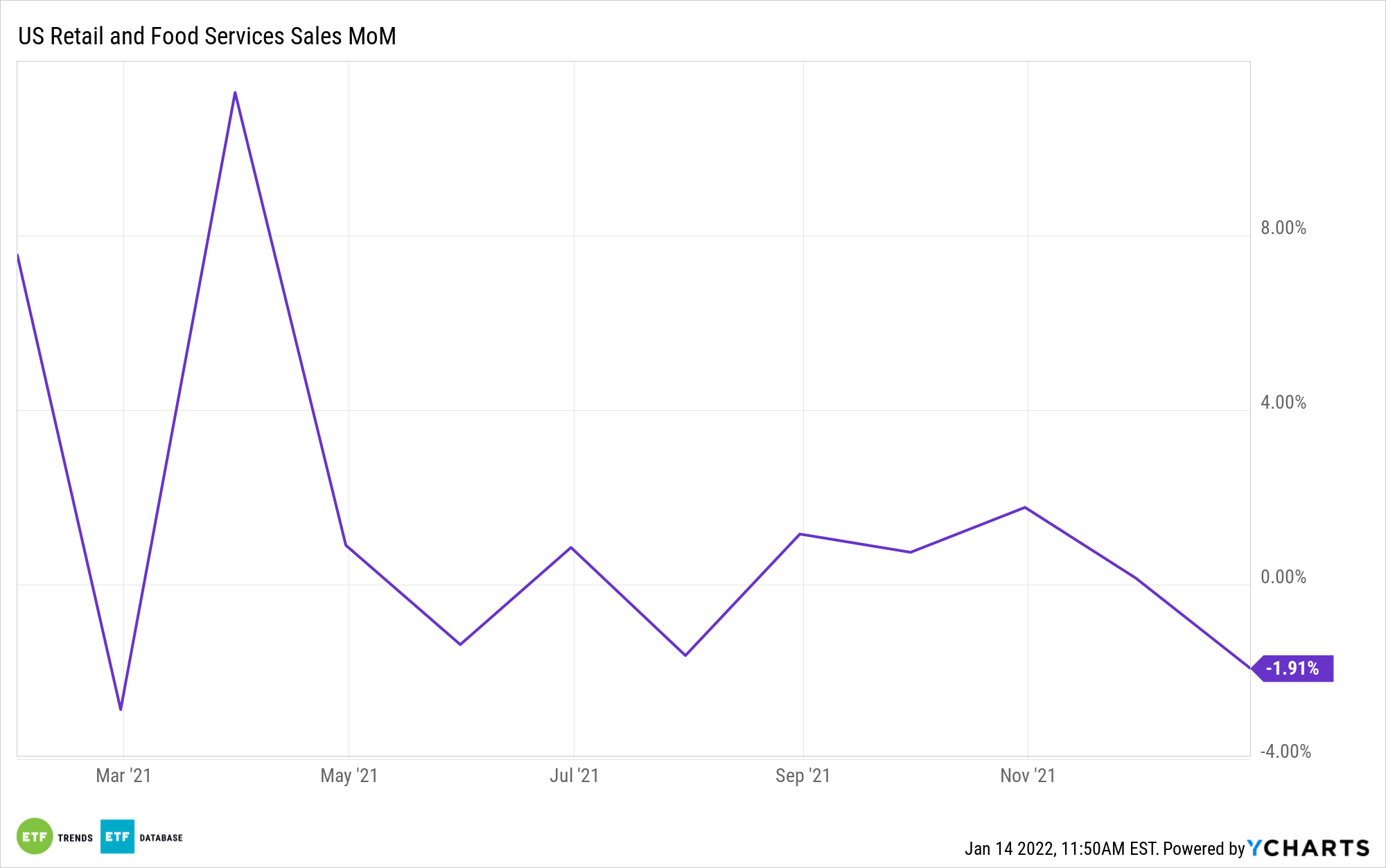

At a time when cases of the Omicron variant of COVID-19 are surging and inflation is rising at a rapid rate, the Commerce Department on Friday reported that retail sales dropped to $626.8 billion in December, down 1.9% from the previous month. This marks the first decline after four consecutive months of sales increases.

But while this is far below the 0.1% decline estimated by Dow Jones, some economists are saying that it’s premature to declare that the sky is falling. Ian Shepherdson of Pantheon Macroeconomics told TheStreet.com that while “the overall numbers are terrible … it’s just not possible to make a judgement like that on the basis of one month’s report.”

Meanwhile, Beth Ann Bovino, chief U.S. economist at S&P Global, told the New York Times that while December figures are weak, retail sales have been strong over the past few months. “This is not a sign of consumer weakness,” Bovino told the news outlet. “Given that households have relatively strong balance sheets with high savings levels and a strong job market with wages climbing higher, it seems that consumers are not necessarily closing their pocketbooks. They’re taking a brief pause.”

So, if the long-term retail figures suggest that the industry is still going strong, investors looking for exposure while prices are down could check out the First Trust Nasdaq Retail ETF (FTXD). Launched in 2016, FTXD follows a liquidity-selected, multi-factor-weighted index of more than 50 U.S. retail companies.

Top holdings include Kroger Co. (KR), at 7.03%; CVS Health Corporation (CVS), at 6.88%; and Costco Wholesale Corporation (COST), at 5.52%. Its long-term returns are well above its peers. Its one-, three-, and five-year returns are 13.94%, 67.32%, and 88.13%, respectively, above ETF Database’s respective category averages of 2.13%, 51.41%, and 62.7%.

In a supplement to the summary prospectus, Issuer First Trust disclosed in November that the fund expects to switch from the Nasdaq US Smart Retail Index to a new, expanded index including more e-commerce-themed companies before the end of January. The S-Network Global E-Commerce Index will be composed of approximately 60 securities issued by companies that are materially engaged in the global e-commerce industry, including the online retail, online marketplace, content navigation, and e-commerce infrastructure business segments. The new index includes companies that operate online stores, help potential customers find online stores, and enable e-commerce business activities, from payment processing to delivery to the consumer’s front door.

For more news, information, and strategy, visit the Nasdaq Investment Intelligence Channel.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com