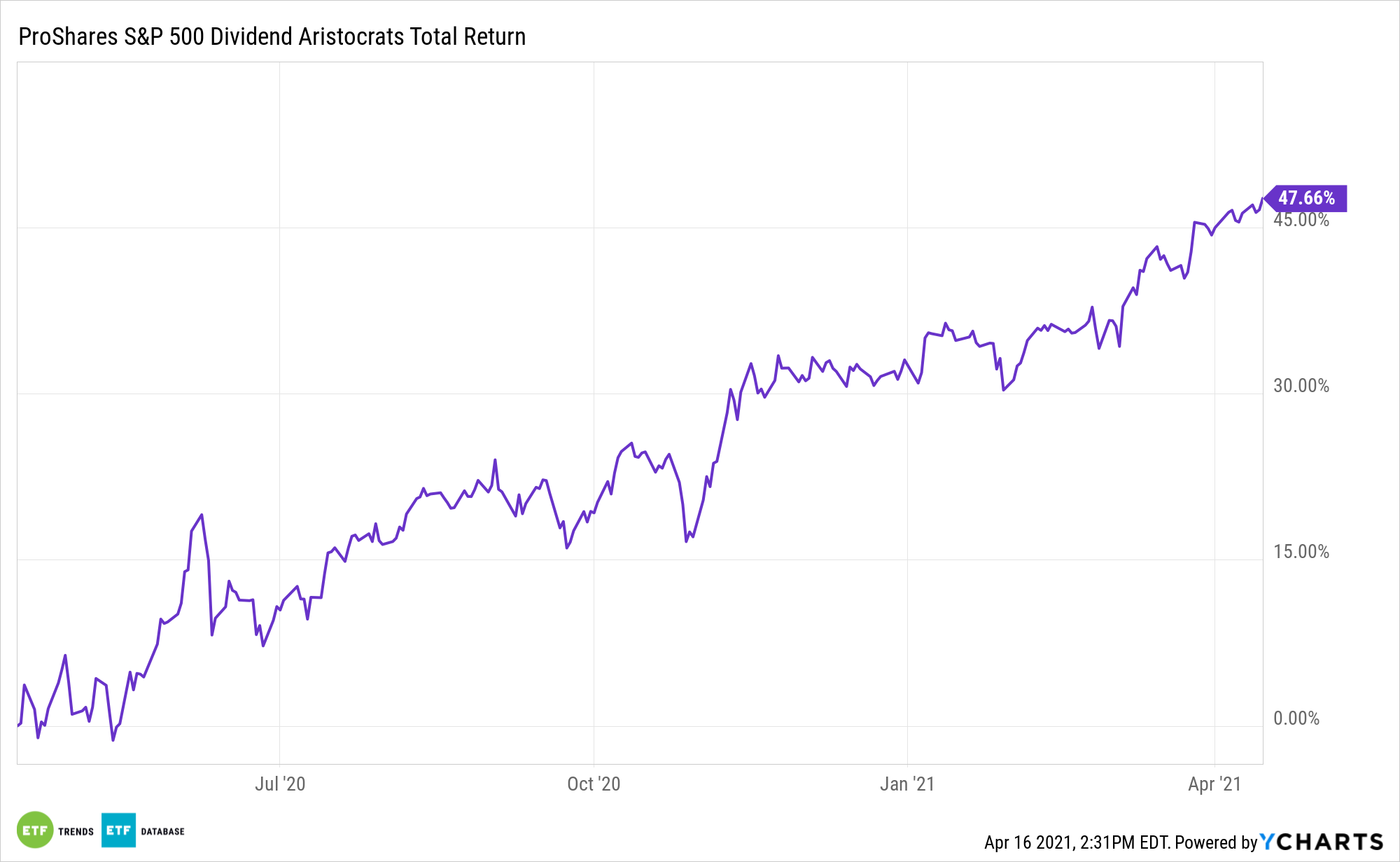

Tright here have been some bumps within the street final yr, however dividend progress is returning, highlighting the advantages of alternate traded funds just like the ProShares S&P 500 Aristocrats ETF (CBOE: NOBL).

NOBL tracks the S&P 500 Dividend Aristocrats Index and targets the cream of the crop, solely choosing elements which have elevated their dividends for at the very least 25 consecutive years. Consequently, buyers are left with a portfolio of high-quality, sustainable dividend payers.

“When the pandemic started, many buyers feared widespread dividend cuts,” in response to S&P Dow Jones Indices. “Nonetheless, whereas some corporations did lower or suspended their dividends, the injury was largely confined to the pandemic’s early phases. As soon as the financial system started to stabilize, so did dividends. By the tip of 2020, roughly thrice as many corporations within the S&P 500 raised their dividends as lower them.”

Final yr’s dividend reducing and the current return of dividend progress underscore the attract of NOBL right now.

When Reliability Issues, Faucet ‘NOBL’

Dividend progress can also be significant right now as a result of payout growers sometimes climate rising charges. That’s one thing to think about with Treasury yields climbing.

“Throughout the market-cap spectrum, dividend growers outperformed dividend cutters by roughly 20%. Dividend methods centered on excessive yield (represented by the Dow Jones U.S. Choose Dividend Index) held proportionately extra dividend cutters and noticed their efficiency battle. Dividend progress methods (represented by the S&P 500 Dividend Aristocrats Index) fared significantly better,” notes S&P Dow Jones.

Importantly, and extremely related right now, NOBL will not be a excessive dividend technique. When sorting by dividend yield, corporations within the highest quintile of dividend yield – these whose means to pay could change into stretched in difficult markets – account for greater than double the variety of dividend cuts and eliminations versus these within the backside quintile with extra modest dividend yields

“One apparent place to search for sustainable and growing earnings is dividend progress methods. Whereas dividends for the broad-market indexes have been flat or down, S&P Dividend Aristocrat methods delivered strong charges of dividend progress,” finishes S&P Dow Jones.

For extra on earnings methods, go to our Retirement Revenue Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.